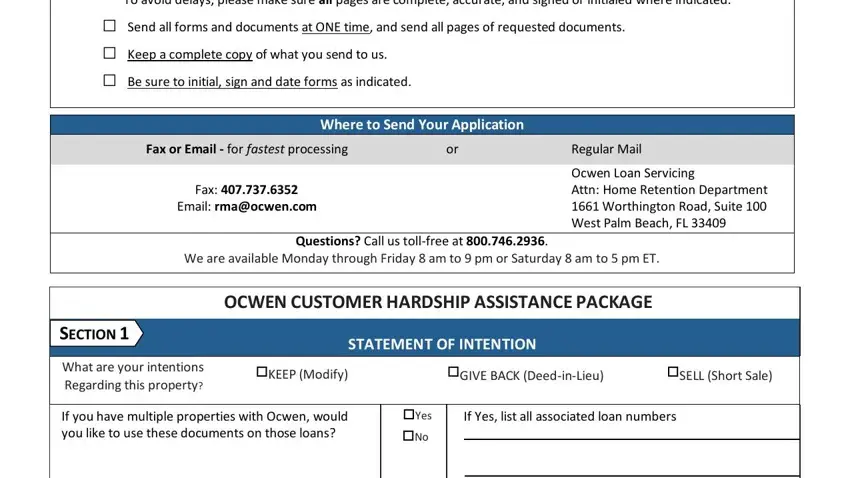

It is easy to fill out forms applying our PDF editor. Modifying the ocwen form file is straightforward for those who consider the next actions:

Step 1: On the page, click the orange "Get form now" button.

Step 2: Now, you are on the document editing page. You can add information, edit present details, highlight particular words or phrases, place crosses or checks, insert images, sign the form, erase needless fields, etc.

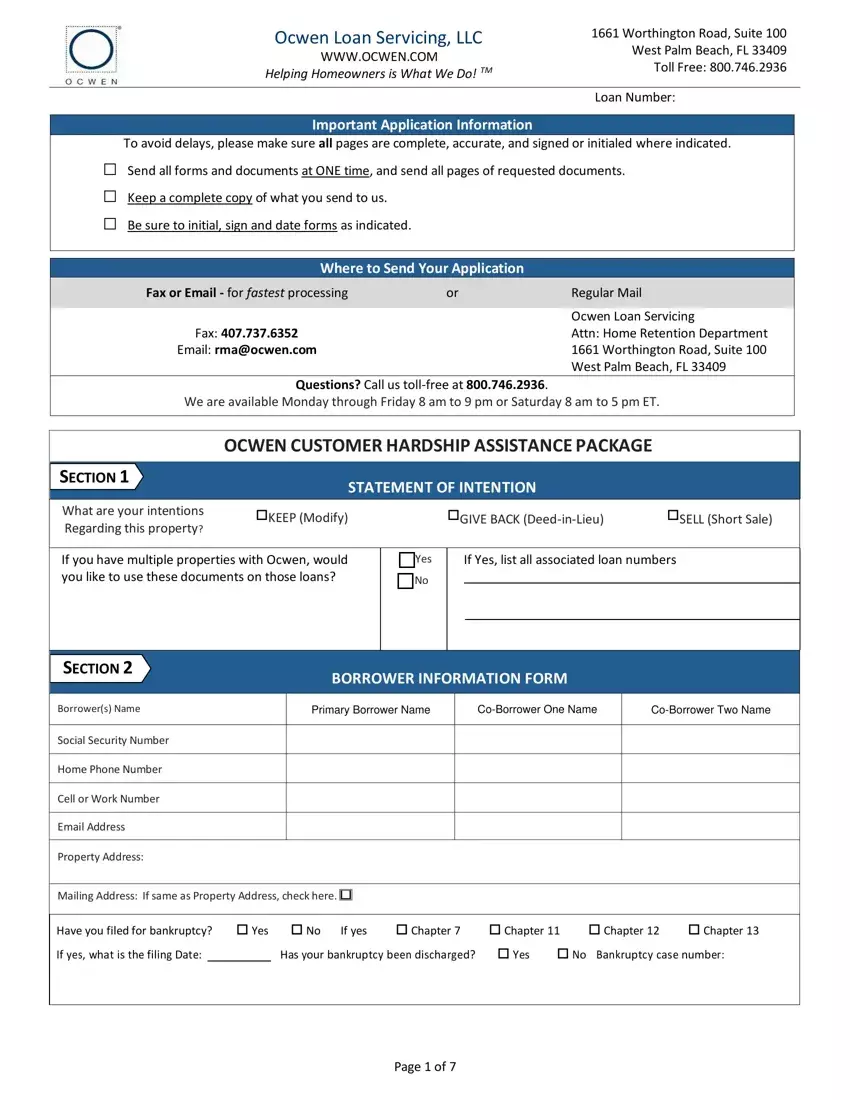

It is essential to enter the following details to be able to create the template:

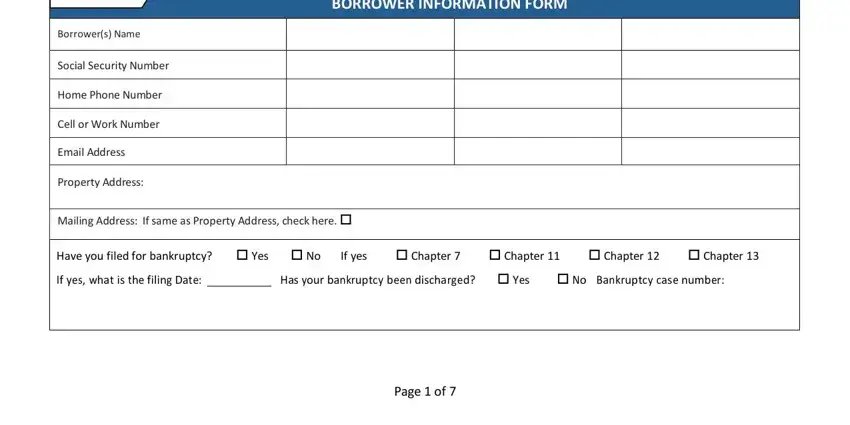

Provide the necessary particulars in the space BORROWER INFORMATION FORM, SECTION, Borrowers Name, Social Security Number, Home Phone Number, Cell or Work Number, Email Address, Property Address, Mailing Address If same as, Have you filed for bankruptcy Yes, If yes, Chapter, Chapter, Chapter, and Chapter.

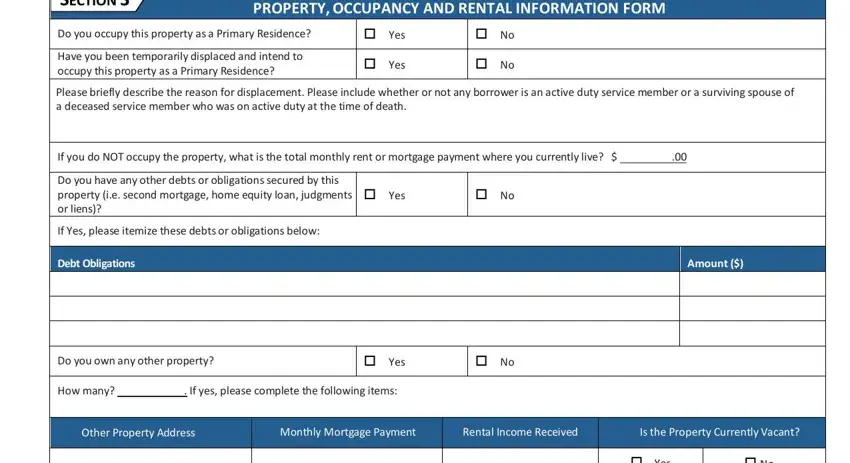

You're going to be expected to provide the information to help the system complete the area SECTION, PROPERTY OCCUPANCY AND RENTAL, Do you occupy this property as a, Have you been temporarily, Yes, Yes, Please briefly describe the reason, If you do NOT occupy the property, Do you have any other debts or, If Yes please itemize these debts, Yes, Debt Obligations, Amount, Do you own any other property, and Yes.

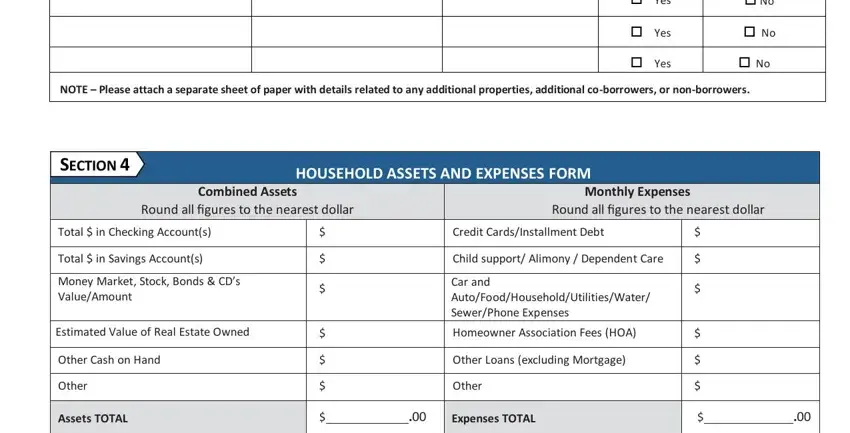

You will have to identify the rights and obligations of both parties in section Yes, Yes, Yes, NOTE Please attach a separate, SECTION, HOUSEHOLD ASSETS AND EXPENSES FORM, Combined Assets Round all figures, Monthly Expenses, Round all figures to the nearest, Total in Checking Accounts, Total in Savings Accounts, Money Market Stock Bonds CDs, Estimated Value of Real Estate, Other Cash on Hand, and Other.

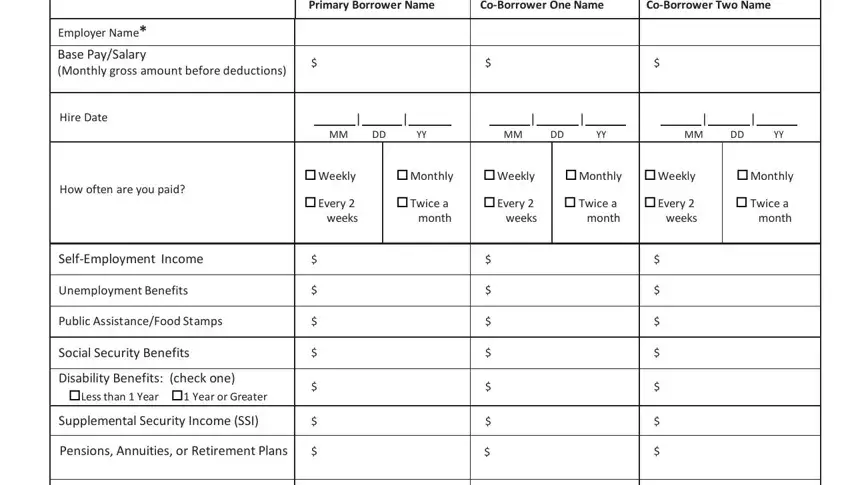

End up by reading the next areas and filling them in accordingly: Primary Borrower Name, CoBorrower One Name, CoBorrower Two Name, Employer Name Base PaySalary, Hire Date, How often are you paid, SelfEmployment Income, Unemployment Benefits, Public AssistanceFood Stamps, Social Security Benefits, Disability Benefits check one, Less than Year Year or Greater, Supplemental Security Income SSI, Pensions Annuities or Retirement, and Weekly.

Step 3: Select the button "Done". Your PDF file is available to be transferred. You will be able obtain it to your pc or send it by email.

Step 4: To prevent different concerns in the foreseeable future, try to create up to several copies of the form.