Any time you wish to fill out Official Form 122A 2, you don't need to download any kind of software - just try using our PDF tool. Our editor is constantly developing to provide the best user experience attainable, and that is thanks to our resolve for continual improvement and listening closely to user opinions. By taking some simple steps, you may start your PDF editing:

Step 1: First, access the pdf editor by clicking the "Get Form Button" in the top section of this site.

Step 2: Once you access the online editor, you will find the form prepared to be filled out. Apart from filling out different blank fields, you may as well perform various other things with the form, that is putting on any text, modifying the initial text, inserting illustrations or photos, signing the document, and a lot more.

This PDF form will need some specific details; in order to guarantee correctness, you need to take note of the recommendations further on:

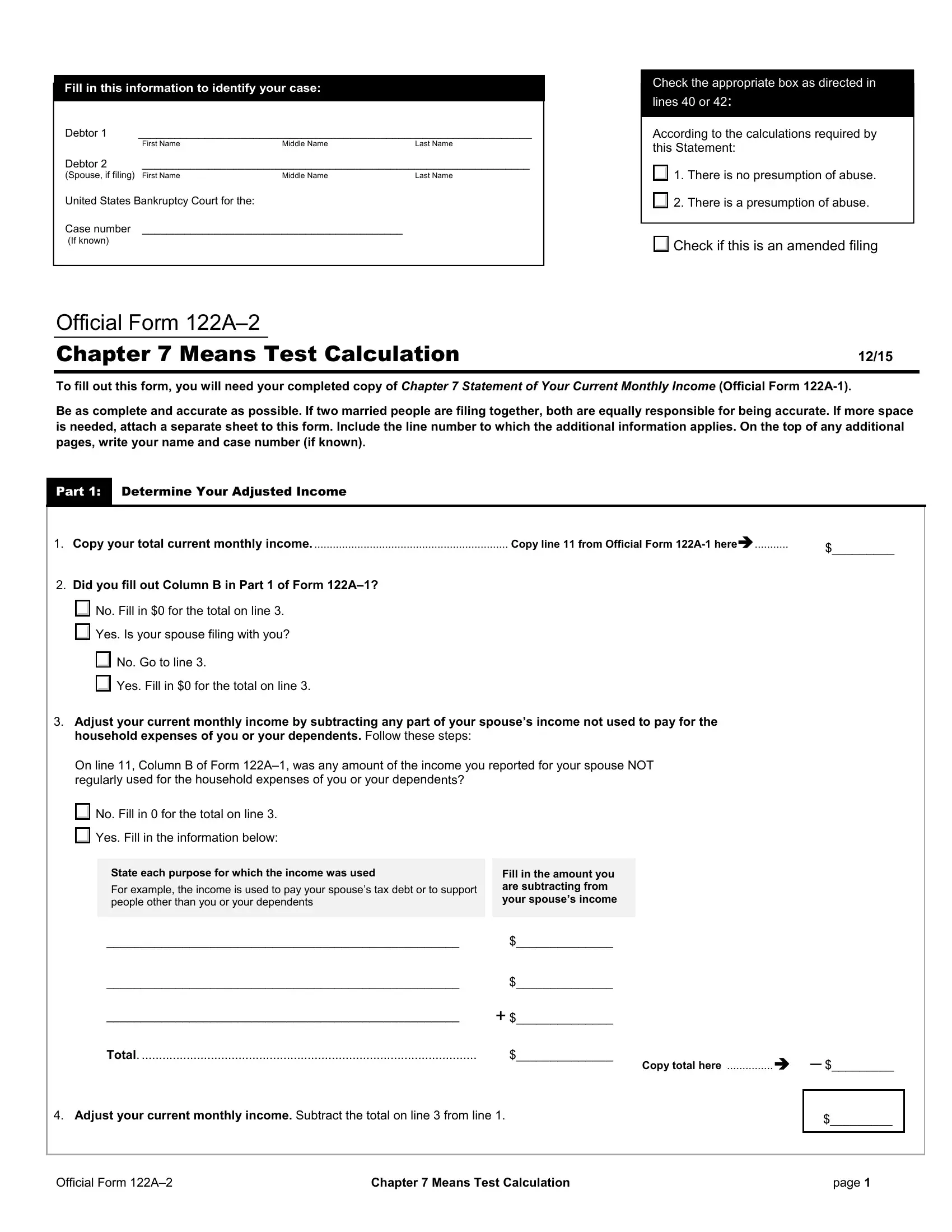

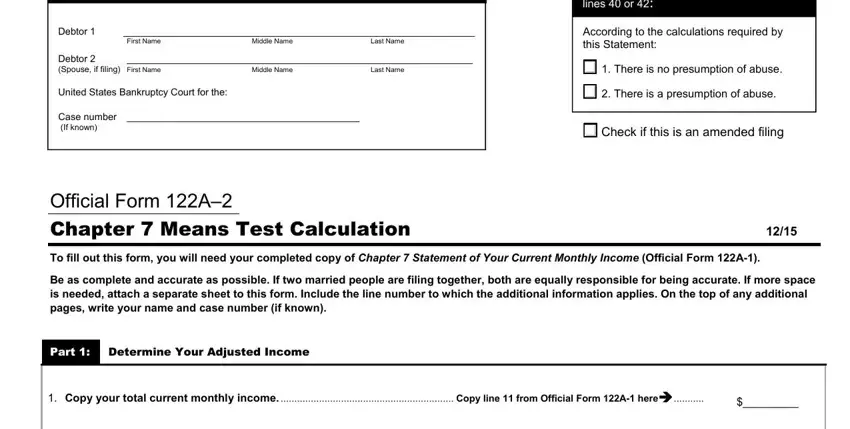

1. You will want to fill out the Official Form 122A 2 properly, therefore pay close attention while filling in the areas including these fields:

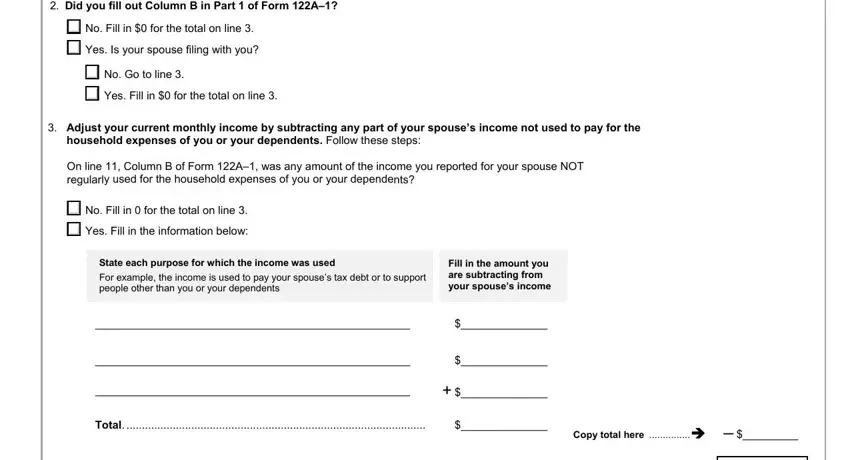

2. Just after filling out the last step, head on to the subsequent stage and enter all required particulars in all these blank fields - Did you fill out Column B in Part, No Fill in for the total on line, No Go to line Yes Fill in for, Adjust your current monthly, household expenses of you or your, On line Column B of Form A was, No Fill in for the total on line, State each purpose for which the, For example the income is used to, Fill in the amount you are, Total, and Copy total here.

3. Completing Adjust your current monthly income, Official Form A, Chapter Means Test Calculation, and page is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

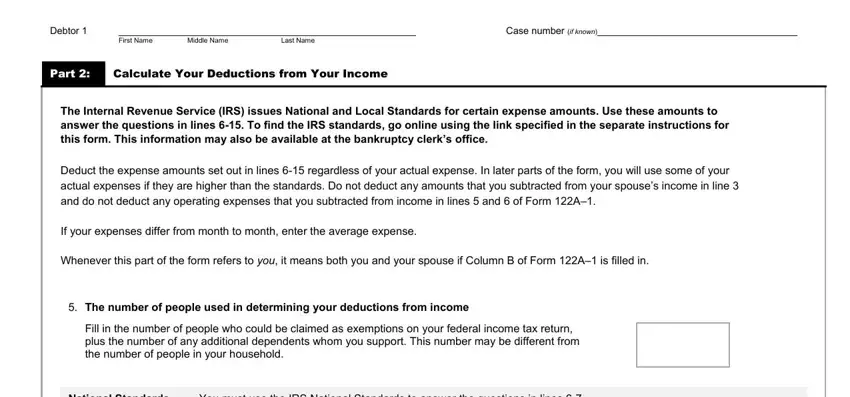

4. Filling out Debtor, First Name, Middle Name, Last Name, Case number if known, Part, Calculate Your Deductions from, The Internal Revenue Service IRS, Deduct the expense amounts set out, If your expenses differ from month, Whenever this part of the form, The number of people used in, Fill in the number of people who, National Standards, and You must use the IRS National is paramount in the next form section - don't forget to don't hurry and fill in every single blank area!

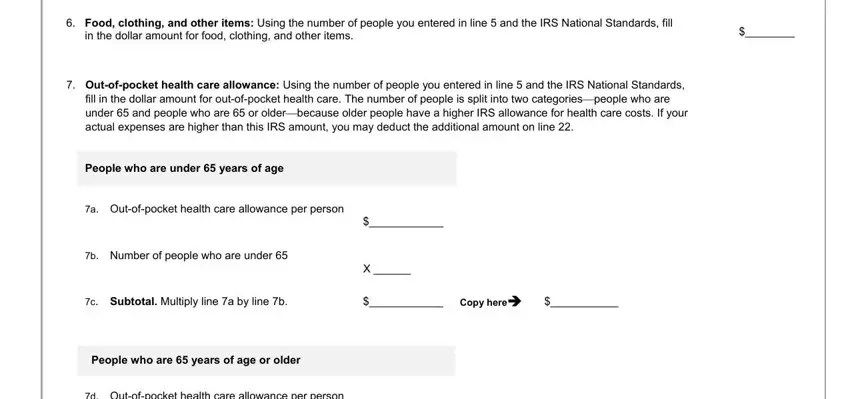

5. The form has to be finalized with this particular part. Below one can find a full list of form fields that require correct details for your document usage to be accomplished: Food clothing and other items, in the dollar amount for food, Outofpocket health care allowance, fill in the dollar amount for, People who are under years of age, a Outofpocket health care, b Number of people who are under, c Subtotal Multiply line a by line, Copy here, People who are years of age or, and d Outofpocket health care.

People who work with this PDF often get some points wrong when filling in b Number of people who are under in this section. You need to re-examine everything you enter here.

Step 3: Before moving on, ensure that form fields have been filled in as intended. As soon as you determine that it's correct, click on “Done." Right after setting up afree trial account at FormsPal, you'll be able to download Official Form 122A 2 or email it directly. The form will also be available via your personal account menu with your every single edit. Whenever you work with FormsPal, you can fill out documents without stressing about information leaks or entries being distributed. Our protected system helps to ensure that your private details are maintained safely.