With the online PDF tool by FormsPal, it is possible to fill in or edit form 122c official form here. In order to make our tool better and less complicated to use, we constantly develop new features, considering feedback coming from our users. By taking several basic steps, you can begin your PDF journey:

Step 1: Press the "Get Form" button in the top section of this webpage to get into our tool.

Step 2: When you launch the file editor, you'll see the form made ready to be filled in. In addition to filling in different blank fields, you may as well perform other sorts of actions with the Document, namely putting on any text, modifying the initial textual content, inserting images, putting your signature on the PDF, and much more.

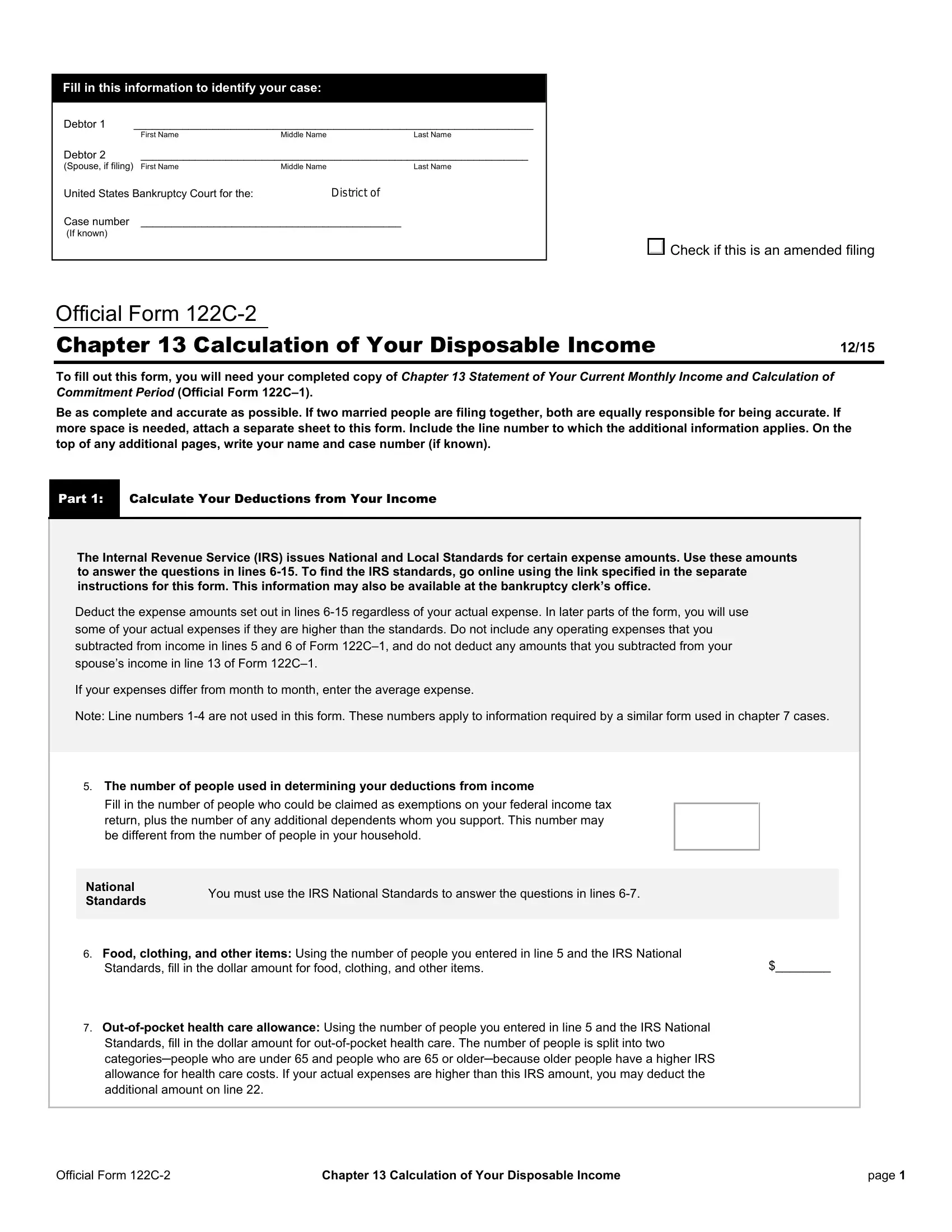

As for the fields of this specific form, this is what you need to know:

1. First, while filling out the form 122c official form, start out with the page containing following blank fields:

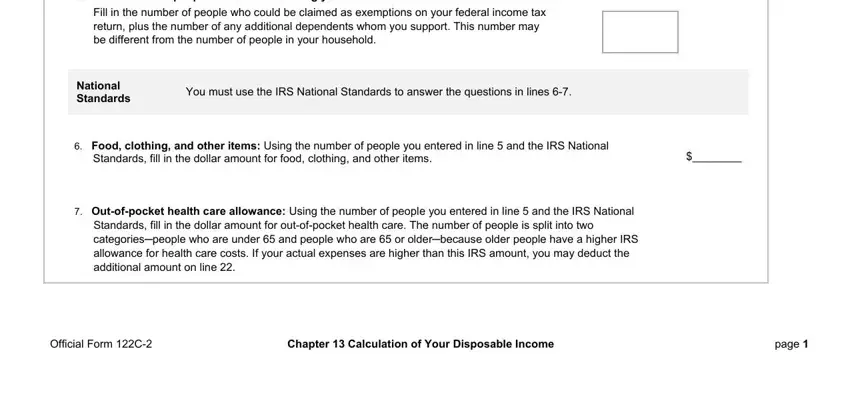

2. After this array of fields is filled out, proceed to enter the suitable information in all these - The number of people used in, Fill in the number of people who, National Standards, You must use the IRS National, Food clothing and other items, Standards fill in the dollar, Outofpocket health care allowance, Standards fill in the dollar, Official Form C, Chapter Calculation of Your, and page.

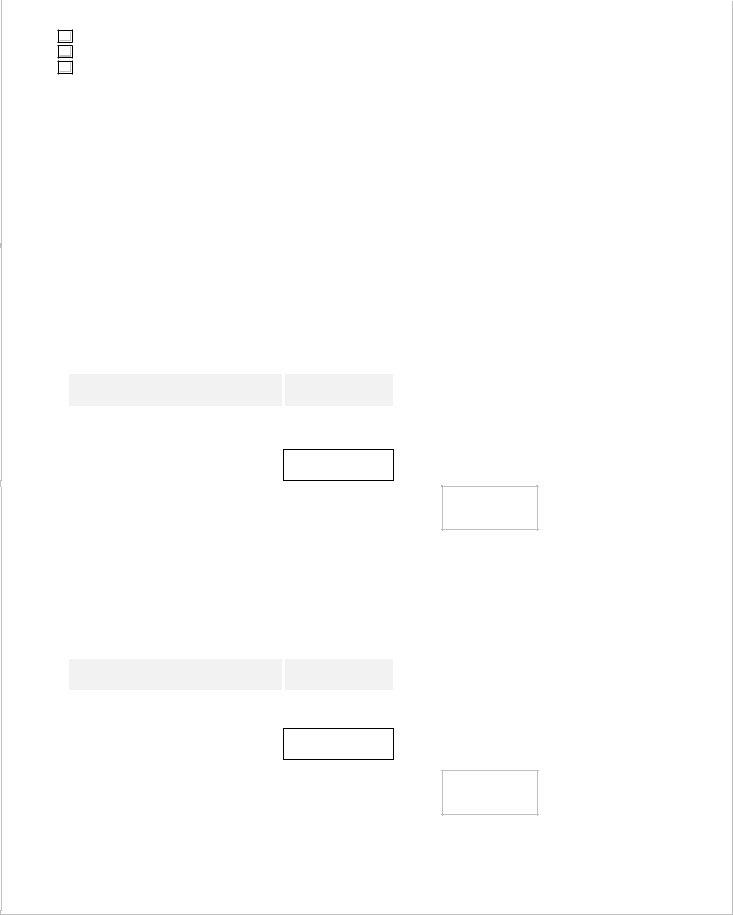

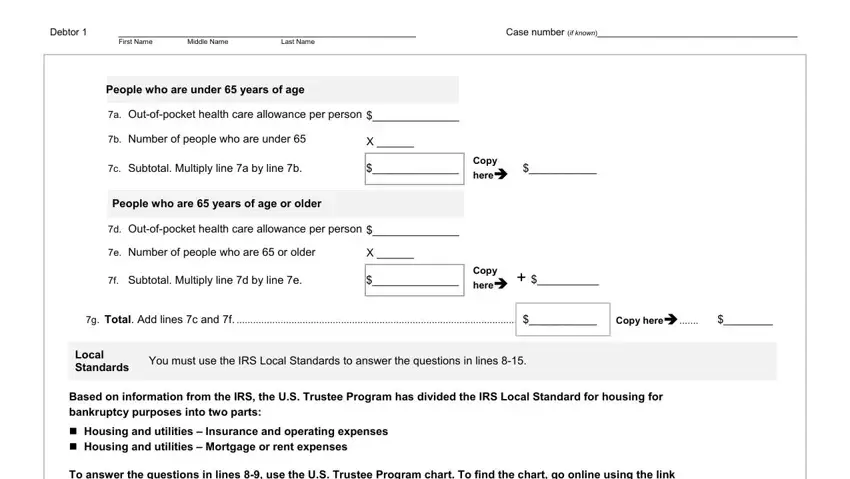

3. This next part is going to be straightforward - fill in every one of the form fields in Debtor, First Name, Middle Name, Last Name, Case number if known, People who are under years of age, a Outofpocket health care, b Number of people who are under, c Subtotal Multiply line a by line, Copy here, People who are years of age or, d Outofpocket health care, e Number of people who are or, f Subtotal Multiply line d by line, and Copy to conclude this segment.

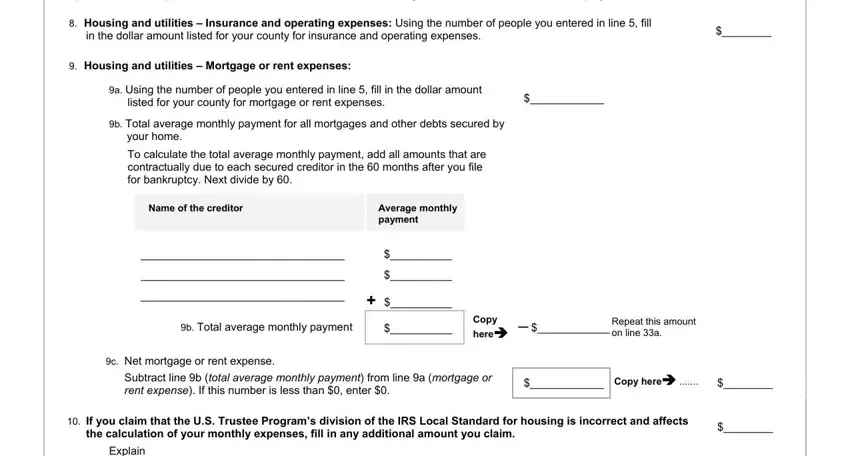

4. To move onward, your next step will require typing in a couple of blank fields. Included in these are To answer the questions in lines, Housing and utilities Insurance, in the dollar amount listed for, Housing and utilities Mortgage, a Using the number of people you, listed for your county for, b Total average monthly payment, your home, To calculate the total average, Name of the creditor, Average monthly payment, b Total average monthly payment, Copy, here, and Repeat this amount on line a, which you'll find fundamental to moving forward with this particular PDF.

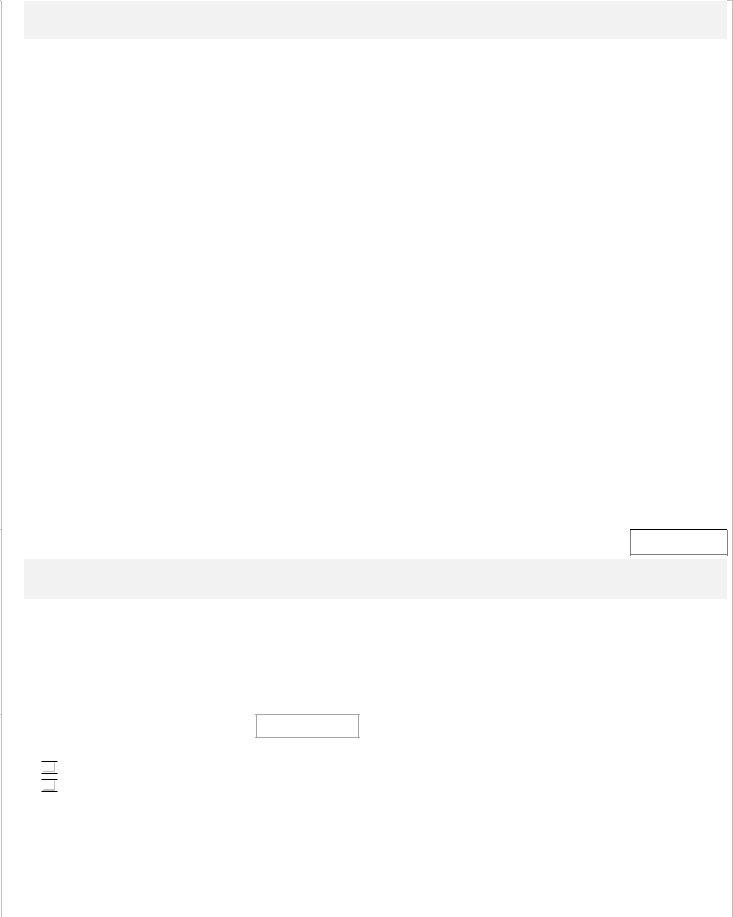

5. Last of all, this last portion is precisely what you will need to complete prior to using the PDF. The fields in this instance are the following: Explain why, Official Form C, Chapter Calculation of Your, and page.

It is possible to make a mistake when completing the Chapter Calculation of Your, and so make sure you take a second look prior to deciding to finalize the form.

Step 3: After you've looked once again at the details you given, click "Done" to complete your FormsPal process. Get hold of the form 122c official form the instant you register here for a free trial. Instantly view the document from your personal account page, along with any modifications and changes automatically preserved! FormsPal offers protected form editing without personal information record-keeping or distributing. Be assured that your information is in good hands here!