When working in the online tool for PDF editing by FormsPal, you may fill in or alter 17b right here. Our team is continuously working to develop the editor and help it become even faster for users with its many features. Enjoy an ever-improving experience now! By taking several simple steps, you'll be able to start your PDF journey:

Step 1: First, access the tool by pressing the "Get Form Button" in the top section of this site.

Step 2: With this handy PDF editor, you may do more than simply complete blanks. Edit away and make your forms look professional with custom text added, or fine-tune the file's original content to perfection - all that comes along with an ability to insert your personal pictures and sign the PDF off.

This PDF form requires specific details; to guarantee accuracy and reliability, don't hesitate to bear in mind the guidelines below:

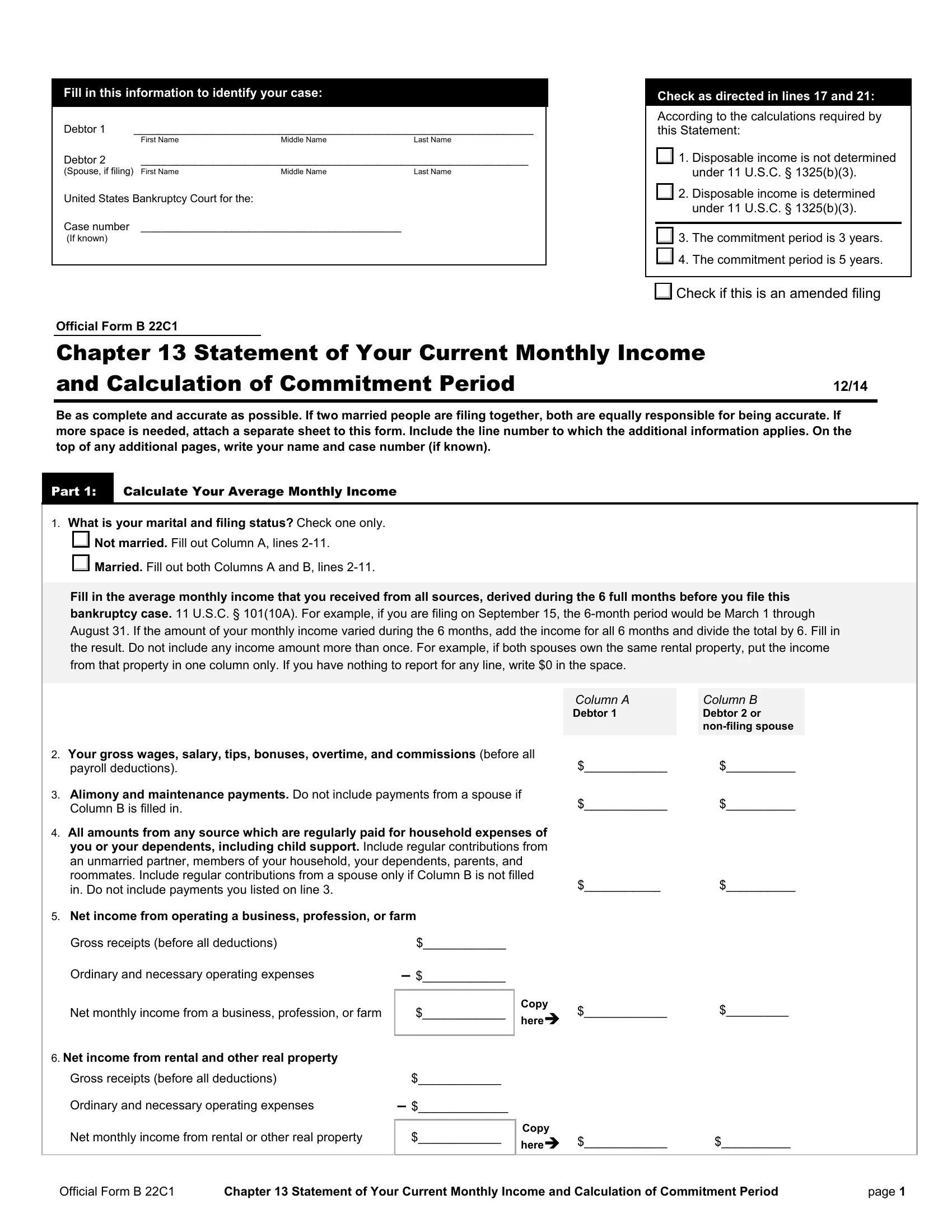

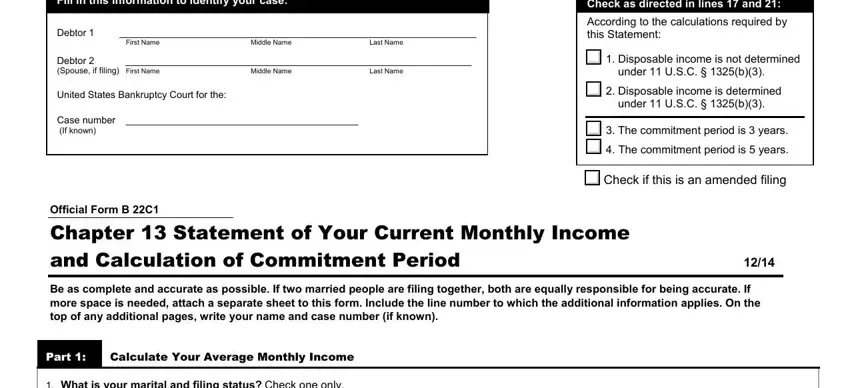

1. To start off, while filling out the 17b, start in the area that includes the next blanks:

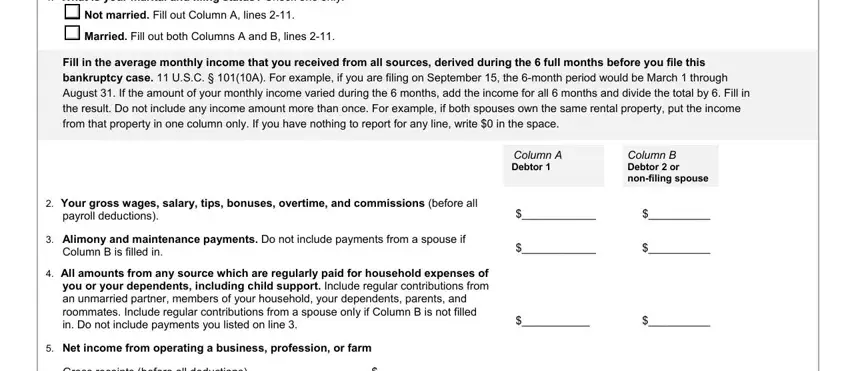

2. Now that the last array of fields is done, you have to insert the essential specifics in What is your marital and filing, Not married Fill out Column A, Married Fill out both Columns A, Fill in the average monthly income, Your gross wages salary tips, payroll deductions, Alimony and maintenance payments, Column B is filled in, All amounts from any source which, Net income from operating a, Gross receipts before all, Column A Debtor, and Column B Debtor or nonfiling so you can proceed further.

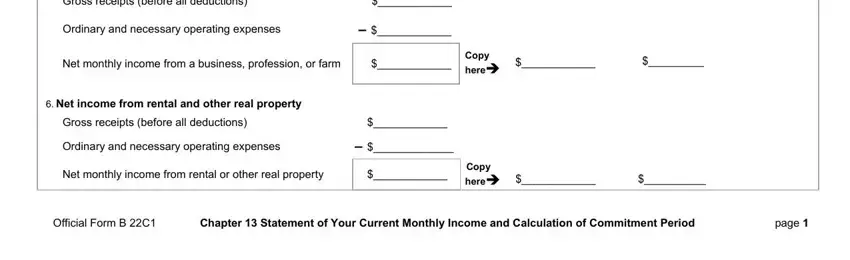

3. Through this part, examine Gross receipts before all, Ordinary and necessary operating, Net monthly income from a business, Copy, here, Net income from rental and other, Gross receipts before all, Ordinary and necessary operating, Net monthly income from rental or, Copy here, Official Form B C, Chapter Statement of Your Current, and page. Every one of these will need to be filled out with utmost accuracy.

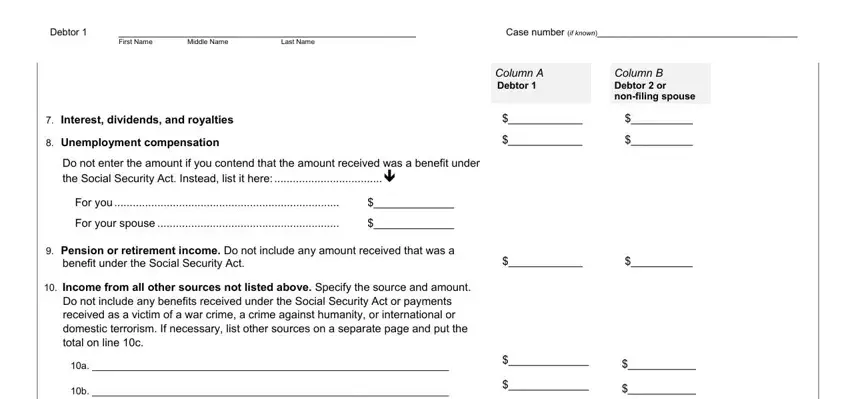

4. It is time to complete this fourth segment! Here you'll have all these First Name, Middle Name, Last Name, Case number if known, Debtor, Interest dividends and royalties, Unemployment compensation, Column A Debtor, Column B Debtor or nonfiling, Do not enter the amount if you, For you, For your spouse, Pension or retirement income Do, benefit under the Social Security, and Income from all other sources not fields to complete.

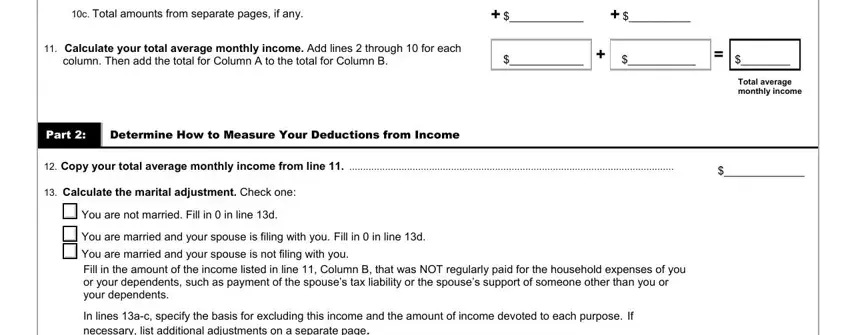

5. As a final point, the following last portion is what you'll want to finish before closing the form. The blanks in question include the following: c Total amounts from separate, Calculate your total average, column Then add the total for, Total average monthly income, Part Determine How to Measure, Copy your total average monthly, Calculate the marital adjustment, and Fill in the amount of the income.

It's easy to make a mistake while filling out the Fill in the amount of the income, so make sure that you reread it prior to deciding to submit it.

Step 3: Make sure that your information is accurate and then just click "Done" to conclude the process. Sign up with FormsPal today and immediately gain access to 17b, all set for downloading. All adjustments made by you are saved , which means you can customize the file at a later point anytime. FormsPal is invested in the privacy of all our users; we ensure that all information put into our tool remains confidential.