The Ohio DTE 24 form, revised as of April 2005, serves as a crucial document within the realm of property taxation, specifically focusing on the application process for real property tax exemptions and remissions in the state of Ohio. This form, utilized extensively by property owners and representatives, is fundamentally designed to facilitate the request for property to be placed on the tax-exempt list, adhering to specific authorizing agreements, ordinances, or resolutions in line with the Ohio Revised Code's limitations. Applicants are required to submit three copies of this meticulously detailed form to the county auditor's office where the property is located, with a strict final filing deadline set for December 31 of the year for which the exemption is sought. The form compels applicants to provide comprehensive property details, including parcel number(s), school district location, property title information, and the precise section(s) of the Ohio Revised Code under which exemption is sought, amongst other pertinent details. Detailed instructions also guide applicants on how to complete both the county auditor's finding and the treasurer’s certificate sections, ensuring all tax, penalty, and interest statuses are accurately reflected. Notably, the form accommodates applications under various sections of the Ohio Revised Code, including tax increment financing exemptions, with specific instructions for cases involving service payments in lieu of taxes. This document embodies the complex interplay between legislative requirements, fiscal obligations, and property owners' rights, underscoring its significance in the broader context of Ohio's tax incentive programs.

| Question | Answer |

|---|---|

| Form Name | Ohio Form Dte 24 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | CAUV, dog tags champaign county ohio, dog licence champaign co ohio, champaign county ohio auditor |

Champaign

County name

DTE 24

Rev. 4/05

Tax Incentive Program – Application for

Real Property Tax Exemption and Remission

Date received by county auditor

Date received by DTE

Offi ce Use Only

County application number

DTE application number

General Instructions

Submit three copies of this application to the auditor’s office in the county where the property is located (make a copy for your records). The final deadline for filing with the county auditor is Dec. 31 of the year for which exemption is sought. If you need assistance in completing this form, contact your county auditor.

Both the county auditor’s finding (page 3) and the treasurer’s certificate (page 4) of this application must be completed. Ask your county auditor for the procedure to follow to obtain the treasurer’s certificate. When presented with this application, the county treasurer should promptly complete the certificate and return the application to you so it may be filed with the county auditor. The county treasurer should make certain that the treasurer’s certificate is complete and accurately reflects the pay- ment status of taxes, special assessments penalties and interest, by tax year. Obtain a copy of the property record card from the county auditor and enclose it with this application. It is the applicant’s responsibility to make sure the information supplied by the county auditor and county treasurer is complete and accurate.

Answer all questions on the form. If you need more room for any question, use additional sheets of paper to explain details. Please indicate which question each additional sheet is answering. This application must be signed by the property owner or the property owner’s representative.

Special Instructions for Tax Increment Financing Exemptions

If the applicant requests an exemption under Ohio Revised Code (R.C.) 725.02, 1728.10, 5709.40, 5709.41, 5709.73 or 5709.78, the application can be signed by the property owner, the property owner’s representative, the political subdivi- sion without the property owner’s consent, or the political subdivision with the property owner’s consent acting under a power of attorney (attach DTE form 24P). If the application is signed by the political subdivision without the property owner’s consent, such exemption shall be subordinate to an exemption granted under any other section of the Revised Code and service payments shall not be required for the portion of the property exempt under that other section. If the exemption requested involves service payments in lieu of taxes and the application is signed by the property owner, the property owner’s representative, or the political subdivision with the property owner’s consent acting under a power of attorney, those payments will remain in effect for the term of the exemption even if the property is used later for another exempt purpose, unless the political subdivision consents in writing to the subsequent exemption. These service pay- ments are also binding on future owners if the political subdivision or the property owner files a notice with the county recorder after the tax commissioner approves the application, unless the political subdivision consents in writing to the subsequent exemption. Failure to file such notice relieves only future owners from the obligation to make service pay- ments if the property becomes exempt under any other provision of the Revised Code. Consent by a property owner filed with the tax commissioner after the commissioner has approved an application for exemption originally filed by the political subdivision without the property owner’s consent will trigger the same procedures mentioned above for an application fi led by or with the property owner’s consent.

Please Type or Print Clearly

Applicant name

Name

Notices concerning

this application Name (if different from applicant) should be sent to

Address

City |

State |

ZIP |

Telephone number |

Application is hereby made to have the following property placed on the

Karen T. Bailey, Champaign County Auditor

DTE 24

Rev. 4/05

Page 2

1. Parcel number(s).(If more than |

a) |

|

four, continue on an attached |

b) |

|

sheet.) All parcels must be in |

c) |

|

the same school district. |

||

|

||

|

d) |

2.School district where located

3.Street address or location of property

4.a) Title to this property is in the name of b) Address of owner

5.Date title was acquired

6.If title holder is different from applicant, please explain

7.Under what section(s) of the Ohio Revised Code is exemption sought?

§725.02 |

§1728.10 |

§5709.40(B) |

§5709.40(C) |

§5709.41 |

|

|

|

|

|

§5709.62 |

§5709.63 |

§5709.71 |

§5709.73(B) |

§5709.73(C) |

§5709.78(A) |

§5709.78(B) |

§5709.88 |

|

|

|

|

|

|

|

Other incentive program, specify R.C. section

8.Explain terms and details of incentive (real property included, percentage exempted, number of years, etc.).

9.a) Attach a copy of the resolution or ordinance of the subdivision granting the incentive and/or the applicant’s incentive agreement with the subdivision.

b) Attach a copy of school district approval (if required).

10.If this application requests exemption under a tax increment financing provision (see special instructions), please indicate whether the application is being filed.

By the property owner |

By the political subdivision without owner consent |

By the political subdivision with owner consent (attach copies of DTE form 24P)

I declare under penalty of perjury that I have examined this application and, to the best of my knowledge and belief, it is true, correct and complete.

Applicant or representative signature

Print name and title

Address

City |

State |

ZIP code |

Telephone number |

Date |

DTE 24

Rev. 4/05

Page 3

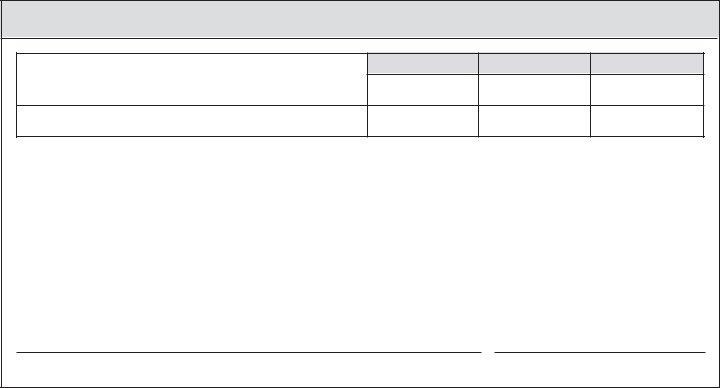

County Auditor’s Finding

Taxable value in year of application |

|

(tax year) |

Land

Building

Total

Taxable value in prior year |

|

(tax year) |

|

This application covers property that is (check all that apply):

Currently exempt* |

|

New construction on previously exempted parcel |

Currently on CAUV |

||

Previously exempt |

|

Previously on CAUV |

|

|

|

Auditor’s recommendation Grant |

Partial grant |

Deny |

None |

||

Comments: |

|

|

|

|

|

County auditor (signature) |

Date |

Forward two copies of the completed application to the Ohio Department of Taxation, Tax Equalization Division, P.O. Box 530, Columbus, OH

*If the property or any portion of the property is currently exempt, please indicate below the type of exemption, the portion of property exempted and the tax years to which the current exemption applies.

DTE 24

Rev. 4/05

Page 4

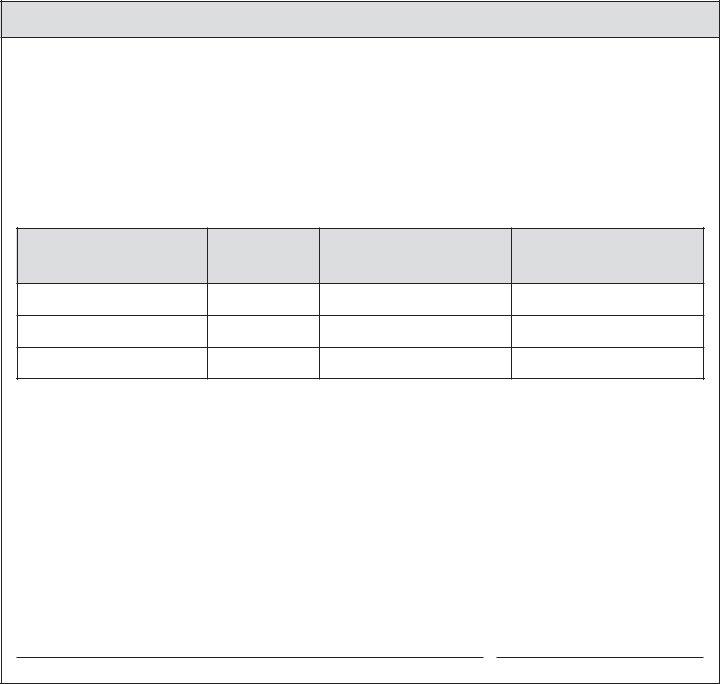

Treasurer’s Certificate

If the treasurer’s certifi cate is not properly fi lled out and signed, the tax commissioner will have no jurisdiction to act on the application and it will be subject to dismissal.

(Notice to treasurer: The fi rst paragraph of this certifi cate must always be complete.)

I hereby certify that all taxes, special assessments, penalties and interest levied and assessed against the above

described property have been paid in full to up and including the tax year |

|

|

. The most recent year for which |

|

|

|

|||

taxes and special assessments have been charged is tax year |

|

|

. |

|

|

|

|

||

I further certify that the only unpaid taxes, special assessments, penalties and interest that have been charged against this property are as follows:

Parcel Number

Tax Year

Taxes

(including penalties

and interest)

Special Assessments (including penalties and interest)

If additional years are unpaid, please list on an attached sheet.

Have tax certifi cates been sold under R.C. 5721.32 or 5721.33 for any of the property |

Yes |

No |

|

subject to this application? |

|

|

|

Are any unpaid taxes listed on this certifi cate subject to a valid delinquent tax contract |

Yes |

No |

|

under R.C. 323.31(A)? If unpaid taxes are subject to a valid delinquent tax contract, |

|

|

|

please indicate which tax years’ charges are included in the contract. |

|

|

|

If yes, list tax years |

|

|

|

Comments: |

|

|

|

County treasurer (signature) |

Date |