When you would like to fill out ohio tax form, there's no need to download any sort of software - simply try using our PDF editor. We at FormsPal are focused on providing you the best possible experience with our tool by regularly presenting new functions and upgrades. Our editor is now much more user-friendly with the most recent updates! At this point, editing PDF forms is easier and faster than before. With a few easy steps, you are able to begin your PDF editing:

Step 1: Press the "Get Form" button at the top of this webpage to get into our tool.

Step 2: With this state-of-the-art PDF editing tool, you are able to accomplish more than simply complete blank fields. Try all the features and make your forms seem sublime with custom textual content incorporated, or modify the original content to perfection - all that comes along with the capability to incorporate any graphics and sign the file off.

It will be an easy task to fill out the pdf using out detailed tutorial! This is what you need to do:

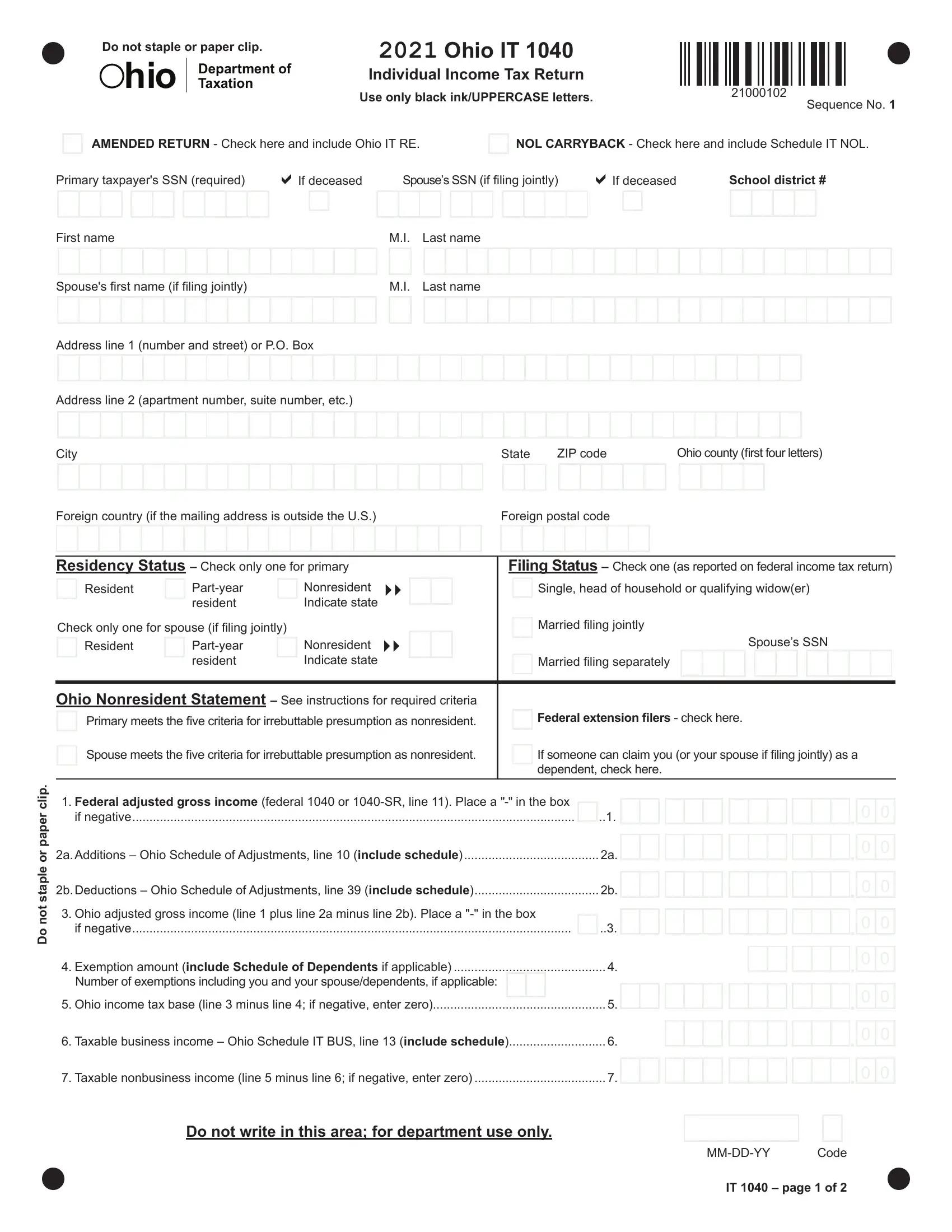

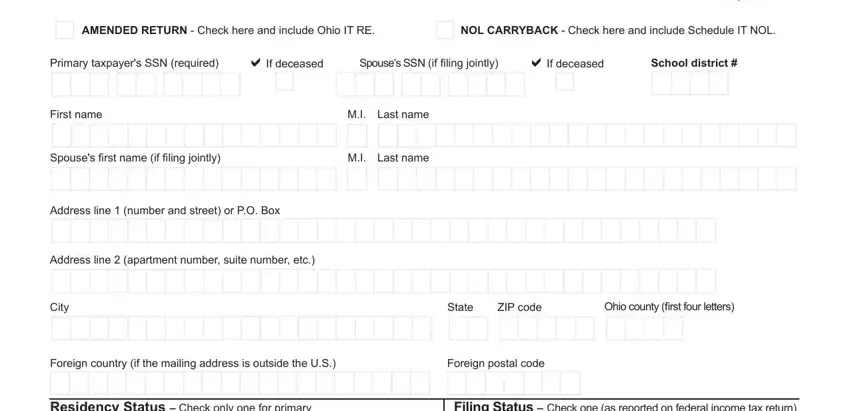

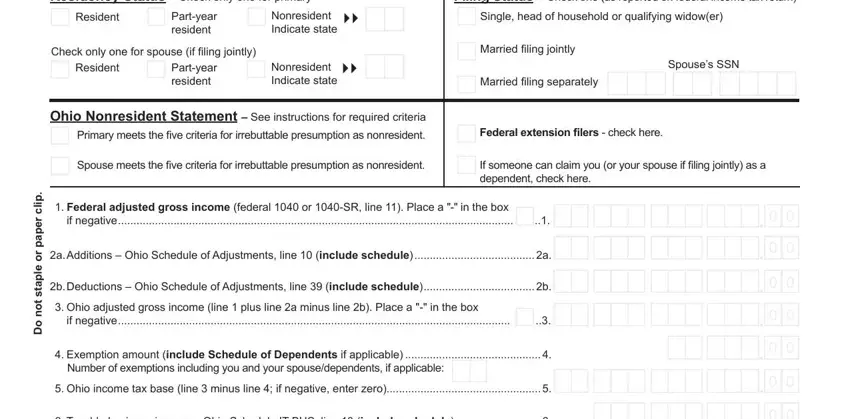

1. Firstly, when completing the ohio tax form, beging with the section that features the next blank fields:

2. When the previous array of fields is done, you're ready to include the needed details in Residency Status Check only one, Filing Status Check one as, Resident, Partyear resident, Nonresident Indicate state, Check only one for spouse if, Resident, Partyear resident, Nonresident Indicate state, Single head of household or, Married filing jointly, Married filing separately, Spouses SSN, Ohio Nonresident Statement See, and Federal extension filers check so you can progress further.

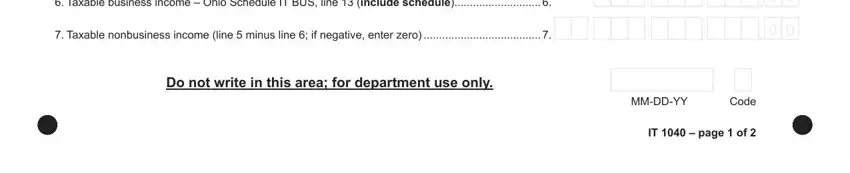

3. Completing Taxable business income Ohio, Taxable nonbusiness income line, Do not write in this area for, MMDDYY, Code, and IT page of is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

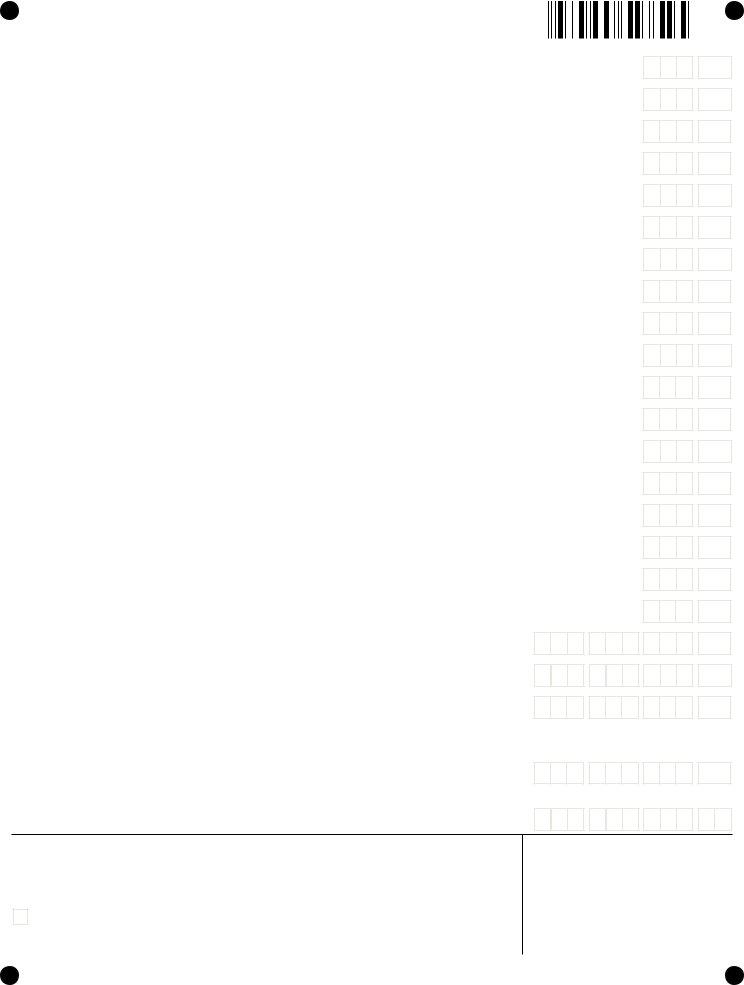

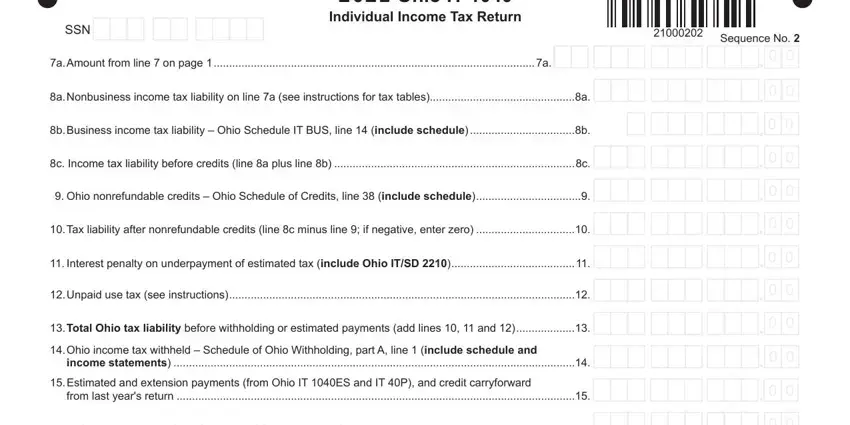

4. This next section requires some additional information. Ensure you complete all the necessary fields - SSN, Ohio IT Individual Income Tax, a Amount from line on page a, a Nonbusiness income tax liability, b Business income tax liability, c Income tax liability before, Ohio nonrefundable credits Ohio, Tax liability after nonrefundable, Interest penalty on underpayment, Unpaid use tax see instructions, Total Ohio tax liability before, income statements, Estimated and extension payments, from last years return, and Refundable credits Ohio Schedule - to proceed further in your process!

As to income statements and Tax liability after nonrefundable, ensure you double-check them here. Both of these are surely the most significant fields in the document.

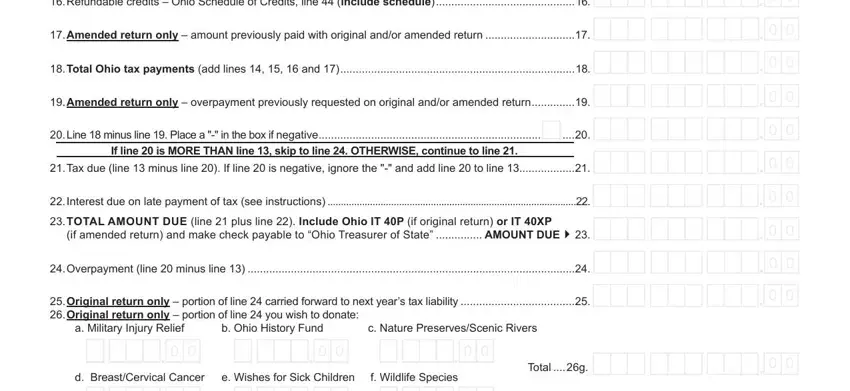

5. To wrap up your form, the last part involves some extra blank fields. Typing in Refundable credits Ohio Schedule, Amended return only amount, Total Ohio tax payments add lines, Amended return only overpayment, Line minus line Place a in the, If line is MORE THAN line skip, Tax due line minus line If line, Interest due on late payment of, if amended return and make check, Overpayment line minus line, Original return only portion of, a Military Injury Relief, b Ohio History Fund, c Nature PreservesScenic Rivers, and d BreastCervical Cancer is going to finalize everything and you'll be done before you know it!

Step 3: Prior to finalizing this form, make sure that all blank fields have been filled out correctly. As soon as you confirm that it is good, press “Done." Create a 7-day free trial subscription at FormsPal and get direct access to ohio tax form - download or edit from your FormsPal account page. We don't sell or share the details that you use when working with forms at our website.