Oklahoma Form Ow 11 can be filled in online with ease. Just make use of FormsPal PDF tool to finish the job in a timely fashion. We at FormsPal are devoted to making sure you have the ideal experience with our editor by constantly adding new capabilities and enhancements. Our tool has become much more useful as the result of the newest updates! Currently, working with PDF forms is simpler and faster than ever. Here is what you will want to do to get going:

Step 1: Hit the "Get Form" button above on this webpage to get into our PDF tool.

Step 2: When you launch the tool, you'll notice the form ready to be filled in. Besides filling out various fields, you can also do some other actions with the form, namely adding your own text, editing the original textual content, adding illustrations or photos, signing the document, and a lot more.

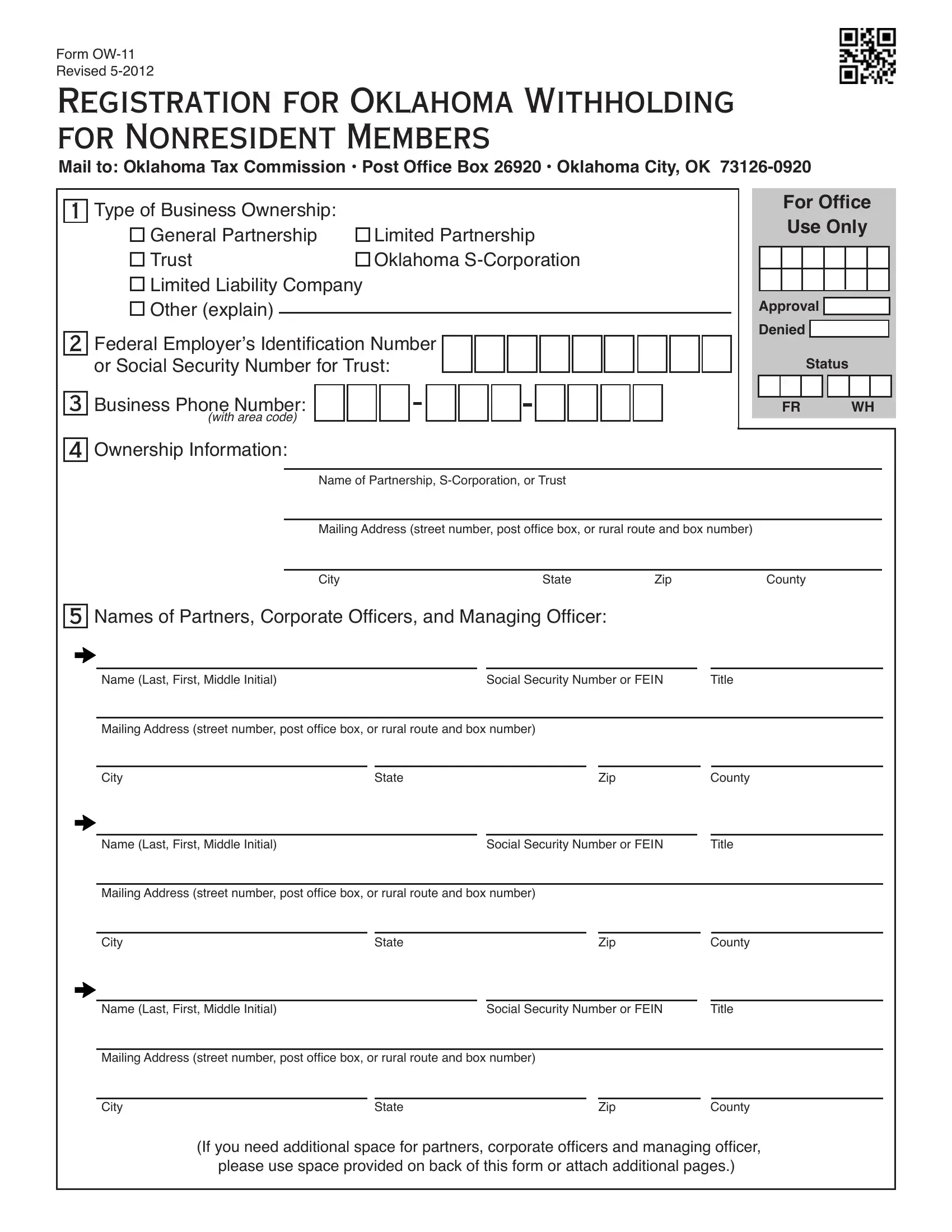

With regards to the blank fields of this specific document, this is what you want to do:

1. To begin with, when completing the Oklahoma Form Ow 11, start in the section that features the subsequent blanks:

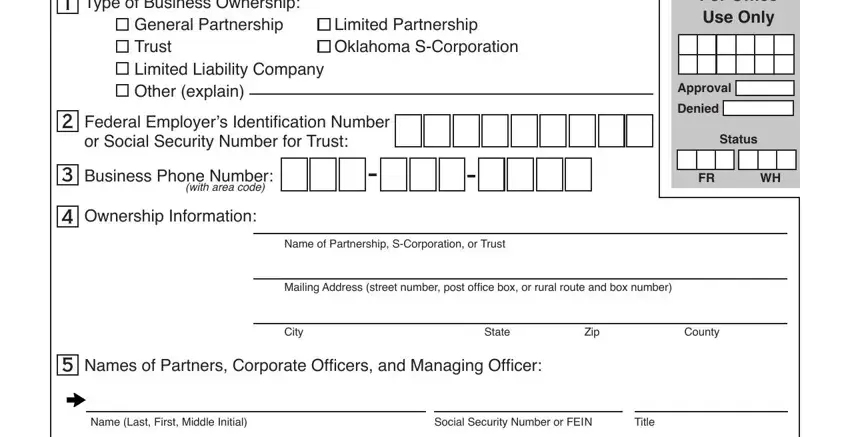

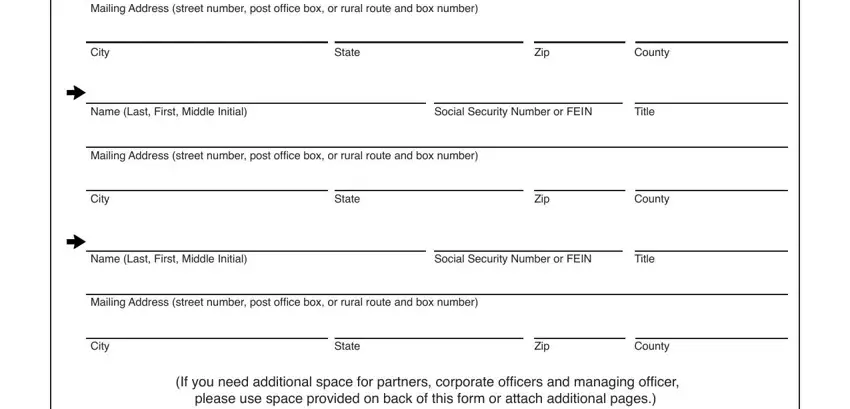

2. When the last part is complete, you'll want to add the needed particulars in Mailing Address street number post, City, Name Last First Middle Initial, State, Zip, County, Social Security Number or FEI N, Title, Mailing Address street number post, City, Name Last First Middle Initial, State, Zip, County, and Social Security Number or FEIN allowing you to proceed to the 3rd step.

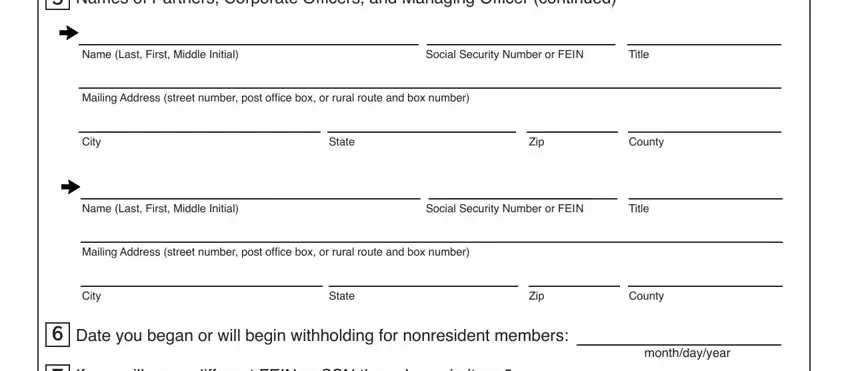

3. The following part should be fairly straightforward, Names of Partners Corporate, Name Last First Middle Initial, Social Security Number or FEI N, Title, Mailing Address street number post, City, Name Last First Middle Initial, State, Zip, County, Social Security Number or FEI N, Title, Mailing Address street number post, City, and State - all of these fields has to be completed here.

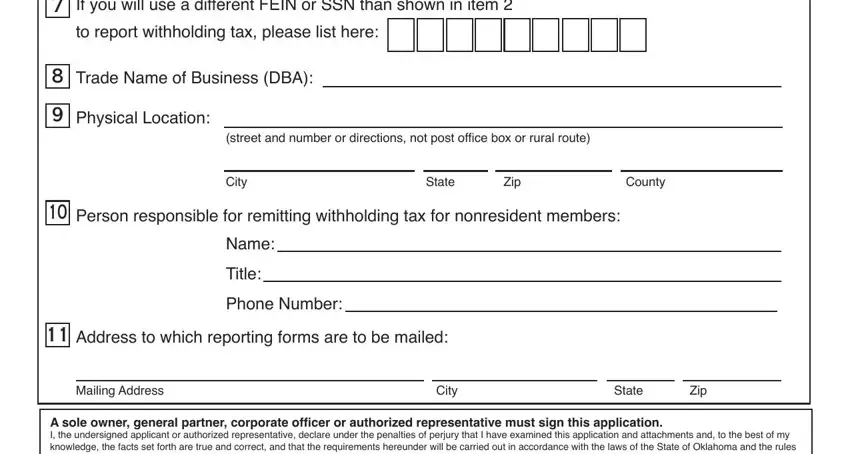

4. Filling out If you will use a different FEIN, Trade Name of Business DBA, street and number or directions, City, State, Zip, County, Person responsible for remitting, Name Title Phone Number, Mailing Address, City, State, Zip, and A sole owner general partner is paramount in the next part - you'll want to spend some time and take a close look at every field!

People generally make mistakes while filling out Person responsible for remitting in this area. You should definitely reread whatever you enter right here.

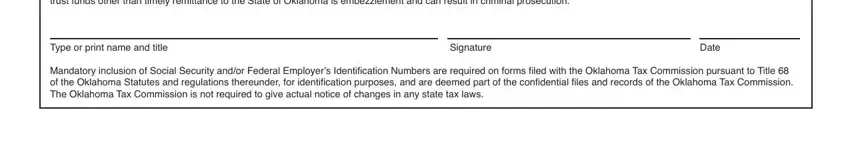

5. The form must be concluded by dealing with this area. Below you'll find an extensive list of form fields that require accurate information in order for your form usage to be complete: A sole owner general partner, Type or print name and title, Signature, Date, and Mandatory inclusion of Social.

Step 3: Always make sure that your information is correct and then simply click "Done" to progress further. Right after starting a7-day free trial account here, you will be able to download Oklahoma Form Ow 11 or email it right off. The PDF will also be readily available from your personal account with your each and every change. When using FormsPal, you can fill out forms without the need to worry about personal information leaks or records being distributed. Our protected platform makes sure that your personal details are stored safe.