taxpayer oklahoma sales can be filled in online very easily. Simply open FormsPal PDF tool to do the job promptly. In order to make our tool better and more convenient to use, we consistently work on new features, considering feedback coming from our users. To get the ball rolling, consider these simple steps:

Step 1: Click the orange "Get Form" button above. It will open up our editor so you can begin filling in your form.

Step 2: After you open the online editor, you'll see the document made ready to be completed. Aside from filling out various blank fields, it's also possible to perform several other things with the file, particularly adding custom text, modifying the original text, adding graphics, placing your signature to the PDF, and a lot more.

Completing this document will require thoroughness. Ensure that all necessary areas are filled out accurately.

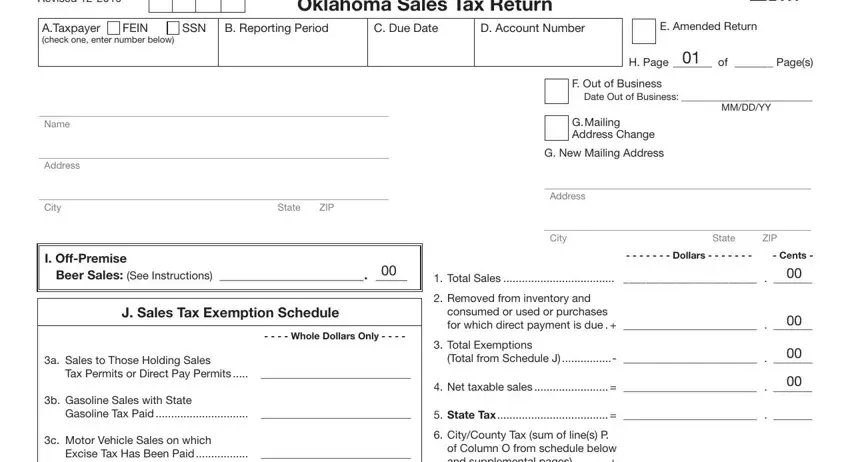

1. Begin filling out your taxpayer oklahoma sales with a number of necessary blanks. Note all of the important information and be sure not a single thing overlooked!

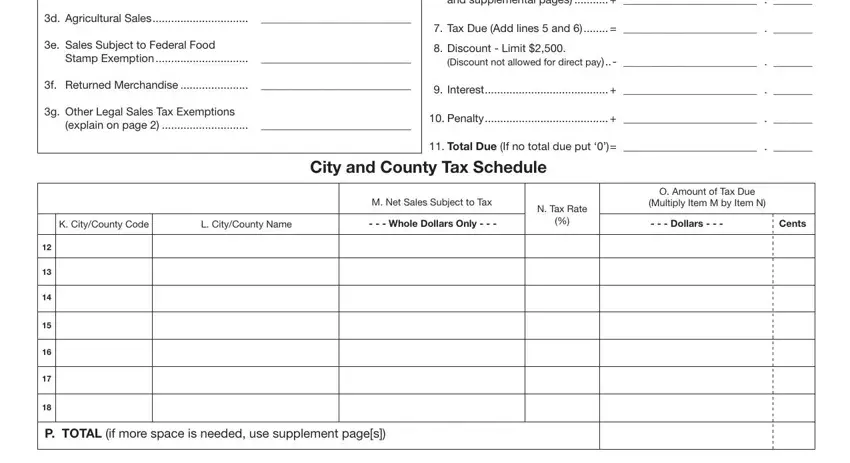

2. When this segment is complete, it is time to include the essential details in CityCounty Tax sum of lines P, of Column O from schedule below, d Agricultural Sales, Tax Due Add lines and, e Sales Subject to Federal Food, Stamp Exemption, Discount Limit, Discount not allowed for direct, f Returned Merchandise, Interest, g Other Legal Sales Tax Exemptions, explain on page, Penalty, Total Due If no total due put, and City and County Tax Schedule so you're able to proceed further.

3. In this specific step, take a look at Signature, Date, and The information contained in this. These will need to be completed with utmost precision.

Lots of people generally make errors when filling in The information contained in this in this area. You need to read again whatever you enter right here.

4. The fourth part comes next with the next few fields to enter your information in: g Explanation of Other Sales tax, Line Net Taxable Sales Subtract, Line State Tax Multiply Line by, Line Total from CityCounty Tax, Need Assistance, For assistance contact the, Mandatory inclusion of Social, and The Oklahoma Tax Commission is not.

Step 3: Ensure your information is accurate and click "Done" to proceed further. Create a free trial account at FormsPal and acquire instant access to taxpayer oklahoma sales - downloadable, emailable, and editable inside your FormsPal account page. If you use FormsPal, you can certainly complete forms without having to be concerned about information breaches or data entries being shared. Our secure software ensures that your personal data is stored safely.