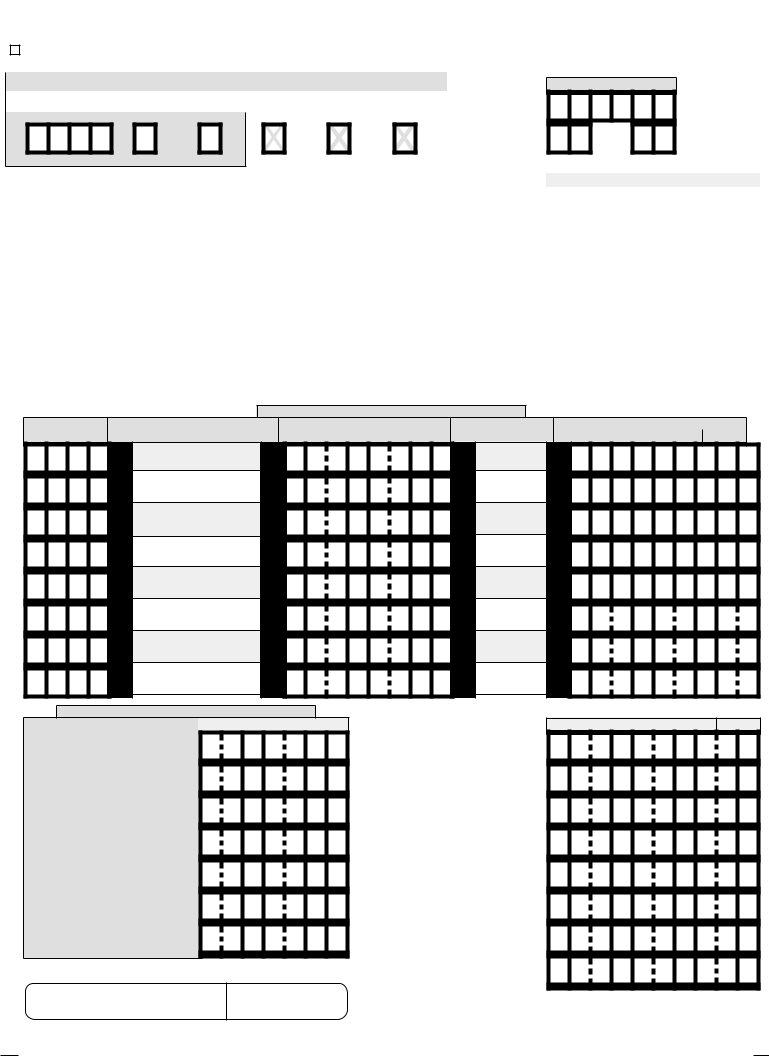

The Oklahoma Sales Tax Report form, designated as STS 4100200 rev. 10-2003, stands as a pivotal document for businesses operating within the state, necessitating meticulous completion and timely submission to remain in compliance with state taxation laws. It requires businesses to delineate their total sales, any merchandise removed from inventory for use or sale, alongside a thorough accounting of sales tax exemptions, which might include transactions not subject to sales tax due to various reasons such as sales to holders of specific permits or sales exempt under federal law. The form further breaks down the reporting of net taxable sales, calculation of the state tax owed, and details city and county tax computations based on the business location. Essential to the process is ensuring accuracy in reporting taxpayer identification, the pertinent reporting period, and due dates, with a specific section addressing changes in business mailing or location addresses. The form not only facilitates the calculation of taxes due, including interest and penalties if applicable, but also provides a mechanism for claiming any eligible discounts for timely filings or approved credits against amounts owed. Businesses are urged to utilize the provided instructions carefully to ensure all taxable sales are accurately reported and the correct tax rate applied, with additional support available through the Oklahoma Tax Commission for any challenges encountered during the filing process. Ensuring the completeness and accuracy of this form is critical for businesses to fulfill their sales tax obligations and avoid potential penalties for non-compliance.

| Question | Answer |

|---|---|

| Form Name | Oklahoma Sales Tax Report Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Sales Tax Reporting Form 13.23 oklahoma form sts0002 |

STS |

|

4100200 |

222 |

222 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||

IF REPORT IS TYPED P. |

|

|

|

|

|

||||||

OR MACHINE PRINTED |

OKLAHOMA SALES |

TAX |

|||||||||

Revision |

|||||||||||

SEE INSTRUCTIONS |

|||||||||||

|

|

|

|

|

|

|

|

|

|||

|

A. Taxpayer FEIN/SSN |

|

B. Reporting Period |

C. Due Date |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- OFFICE USE ONLY - |

F.C. |

P.T. |

Mailing |

Business |

G. Out of Business |

REPORT |

|

|

|

|

|

D. Permit Number |

|

H. Page |

0 |

I |

of |

Page(s)

F. Address Change

E.MAILING ADDRESS

1. Total Sales (Whole dollars only)

|

|

|

2. |

Removed from inventory and |

Name |

|

|

||

|

|

|

consumed or used or purchases |

|

|

|

|

|

for which direct payment is due |

|

|

|

3. |

Total exemptions |

Address |

|

|

||

|

|

|

|

(Total from Schedule N. below) |

|

|

|

|

|

City |

State |

Zip |

4. |

Net Taxable Sales |

|

|

|

5. STATE TAX

+

-

=

=

|

|

CENTS |

|||||||

|

|

||||||||

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY AND COUNTY TAX COMPUTATION

I. City/County |

J. City/County Name |

K. Net Sales Subject To Tax |

L. Tax Rate |

M. Amount of Tax Due (multiply item K. by item L.) |

||

Code |

(%) |

CENTS |

||||

|

||||||

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

N. SALES TAX EXEMPTION SCHEDULE

3a. Sales To Those Holding Sales Tax Permits or direct pay permits

3b. Gasoline Sales With State

Gasoline Tax Paid .....................

3c. Motor Vehicle Sales On Which

Excise Tax Has Been Paid ..........

3d. Agricultural Sales ......................

3e. Sales Subject To Federal Food

Stamp Exemption ......................

3f. Returned Merchandise ...............

3g. Other Legal sales tax exemptions

(explain on reverse) ...................

Ideclare that the information in this document and any attachments is true and correct to the best of my knowledge and belief.

SIGN |

|

HERE: |

DATE |

14.Total Lines 6 through 13 .....

15.Total from Supplement pages

16.Tax Due

(Add Lines 5, 14 and 15) ....

17.Discount .............................

See Instructions

18.Interest ...............................

19.Penalty ................................

20.Less Approved Credit (Attach Credit Voucher) ......

21.TOTAL DUE

(if No Total Due put '0') .......

-

+

+

-

=

CENTS

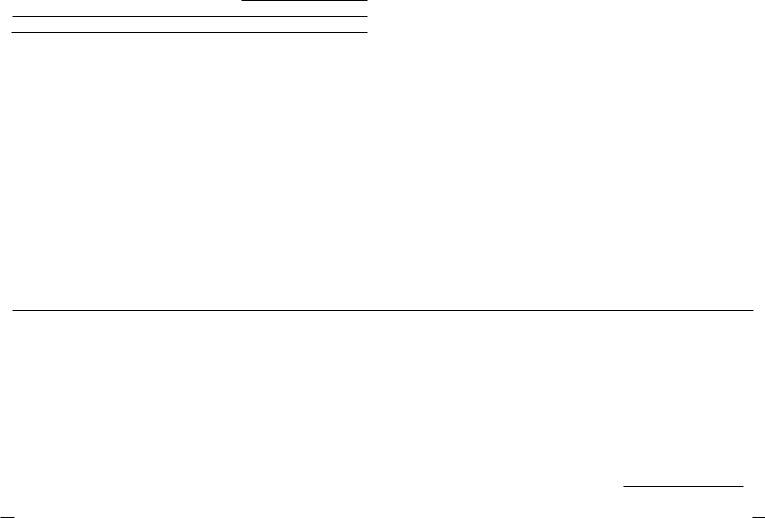

GENERAL INSTRUCTIONS

Please use a #2 pencil or pen with black ink to make your entries on this form. If you type your report, please type "XXX" over "222" in box P. at the top of the form. If your mailing address or your business address has changed place an "X" in the proper Box F and enter the correct information in space provided below. If you are not required to file this form, call the Oklahoma Tax Commission at

|

SPECIFIC INSTRUCTIONS |

ITEM A. - |

Enter your taxpayer identification number. |

ITEM B. - |

Enter the month(s) and year for the sales being reported.(Begin with |

|

the month when you made your first sale) |

ITEM C. - |

Enter the date the report is due. |

ITEM D. - |

Enter your Sales Tax Permit Number. |

ITEM E. - |

Provide your name and mailing address. |

ITEM H. - |

Enter the total number of pages enclosed in the boxes to the right of |

|

the word "of." |

If you are closing your business and this will be your last sales tax return, mark over the "X" in block "G." and return your permit card with this report to the Oklahoma Tax Commission for cancellation.

LINE 1 (TOTAL SALES)- Enter the total amount of gross receipts of all sales, including taxable and

LINE 2 (REMOVED FROM INVENTORY)- Enter the sales value of tangible personal property purchased for resale and consumed or used in this reporting period. Any merchandise purchased tax exempt with your sales tax permit and withdrawn for use by you or your business is to be included in this line. Also include amounts for purchases for which you are paying the sales tax directly to the Oklahoma Tax Commission.

LINE 3 (TOTAL SALES TAX EXEMPTIONS)- Use the Exemption Schedule, Item N, to compute the authorized exemptions from gross receipts for this reporting period. (Use Lines 3a. thru 3g.). Enter the amount of total sales tax exemptions on Line 3, at top.

3g. Explanation of 'Other Sales tax exemptions':

LINE 4 (NET TAXABLE SALES)- Subtract line 3 from the total of lines 1 and 2 to arrive at net taxable sales. If you have no amount subject to tax, leave blank.

LINE 5 (STATE TAX)- Multiply Line 4 by the applicable tax rate. If there is no tax due, leave blank.

LINES 6 THROUGH LINE 13 - We are aware the computer printed information is subject to change: therefore, we have provided blank lines for you to add cities/counties as needed. If any computer printed information is incorrect line through the incorrect information and write in the correct data. If no taxable sales were made for a computer printed City/County, leave the line blank.

Column I. - Enter the code for each city or county for which you are

If additional space is needed to report more cities/counties, call our office at

LINE 14 (TOTAL LINES 6 THROUGH 13)- Add the City/County tax due from lines 6 through 13, Column M.

LINE 15 (TOTAL FROM SUPPLEMENT PAGES)- Total the tax due amounts from Line 39 of all supplement pages of city/county taxes.

LINE 16 (TAX DUE)- Add the amounts on Line 5, 14 and 15. This will be the total state, city, county tax due before any discount, interest, or penalty is applied.

LINE 17 (DISCOUNT)- If this report and remittance is not filed electronically by the due date shown in Item C, you are only eligible for a 1.25% discount for timely payment. Multiply Line 16 (tax) by .0125. The maximum discount allowed is $3,300.00. Make no entry if this report is late. No discount allowed for Direct Pay.

LINE 18 (INTEREST)- If this report and remittance is postmarked after the due date shown in Item C, the tax is subject to interest from the due date (Item C) until it is paid. Multiply the amount on Line 16 by .0125 the applicable rate for each month or part thereof that the report is late.

LINE 19 (PENALTY)- If this tax report and remittance is not postmarked within 15 calendar days of the due date, a 10% penalty is due. Multiply the tax amount on Line 16 by .10 to determine the penalty.

LINE 20 (LESS APPROVED CREDIT)- Enter the amount of credit taken. Use any OTC credit voucher(s) issued for a previous over payment of taxes. Attach the credit voucher(s) to this report.

LINE 21 (TOTAL DUE)- Total the report: Line 16, minus Line 17 and 20, plus line 18 and Line 19.

Sign and date the report and mail it with your payment in the enclosed return envelope to:

OKLAHOMA TAX COMMISSION

P.O. BOX 26850

OKLAHOMA CITY, OK

WHO MUST FILE

Every vendor who is responsible for collecting/remitting payment of Oklahoma sales tax must file a Sales Tax Report. Reports must be filed for every period even though there is no amount subject to tax nor any tax due.

WHEN TO FILE

Reports must be postmarked on or before the 20th day of the month following each reporting period. The due date for filing this report is printed in Item C.

PAYMENT

Please send a separate check with each report submitted and put your Taxpayer No. (Item A.) on your check.

WHO TO CONTACT FOR ASSISTANCE

For assistance, call (405)

Mandatory inclusion of Social Security and/or Federal identification numbers is required on forms filed with the Oklahoma Tax Commission pursuant to Title 68 of the Oklahoma Statutes and regulations thereunder, for identification purposes, and are deemed part of the confidential files and records of the Oklahoma Tax Commission.

Column J. -

Column K. -

Column L. -

Column M.

-

remitting tax that has not been computer printed.

Print the name of the city or county for which you are remitting tax that has not been computer printed.

Enter the "taxable sales" for each city or county. If no "taxable sales" were made, leave blank.

Enter the current sales tax rate for each city/county for which you are remitting tax that has not been computer printed. Multiply the amounts in Col. K times the rates in Col. L and enter the sales tax due for each city/county.

The Oklahoma Tax Commission is not required to give actual notice of changes in any state tax law.

Changes in Business Mailing Address: |

Changes in Business Location Address: |

||||||||

FEIN/SSN |

|

|

FEIN/SSN |

|

|

||||

|

|

|

|

||||||

NAME |

|

|

NAME |

|

|

||||

|

|

|

|

||||||

ADDRESS |

|

ADDRESS |

|

||||||

|

|

||||||||

CITY |

|

CITY |

|

||||||

|

|

||||||||

STATE |

|

|

ZIP |

STATE |

|

|

ZIP |

|

|

|

|