In case you want to fill out oregon estimated tax vouchers, there's no need to download and install any sort of software - just try using our PDF tool. In order to make our tool better and more convenient to work with, we constantly implement new features, with our users' feedback in mind. Getting underway is simple! Everything you need to do is follow the next basic steps below:

Step 1: Simply hit the "Get Form Button" at the top of this site to launch our form editing tool. This way, you will find everything that is necessary to work with your document.

Step 2: This editor lets you work with PDF forms in a range of ways. Change it by writing personalized text, correct what is already in the file, and put in a signature - all readily available!

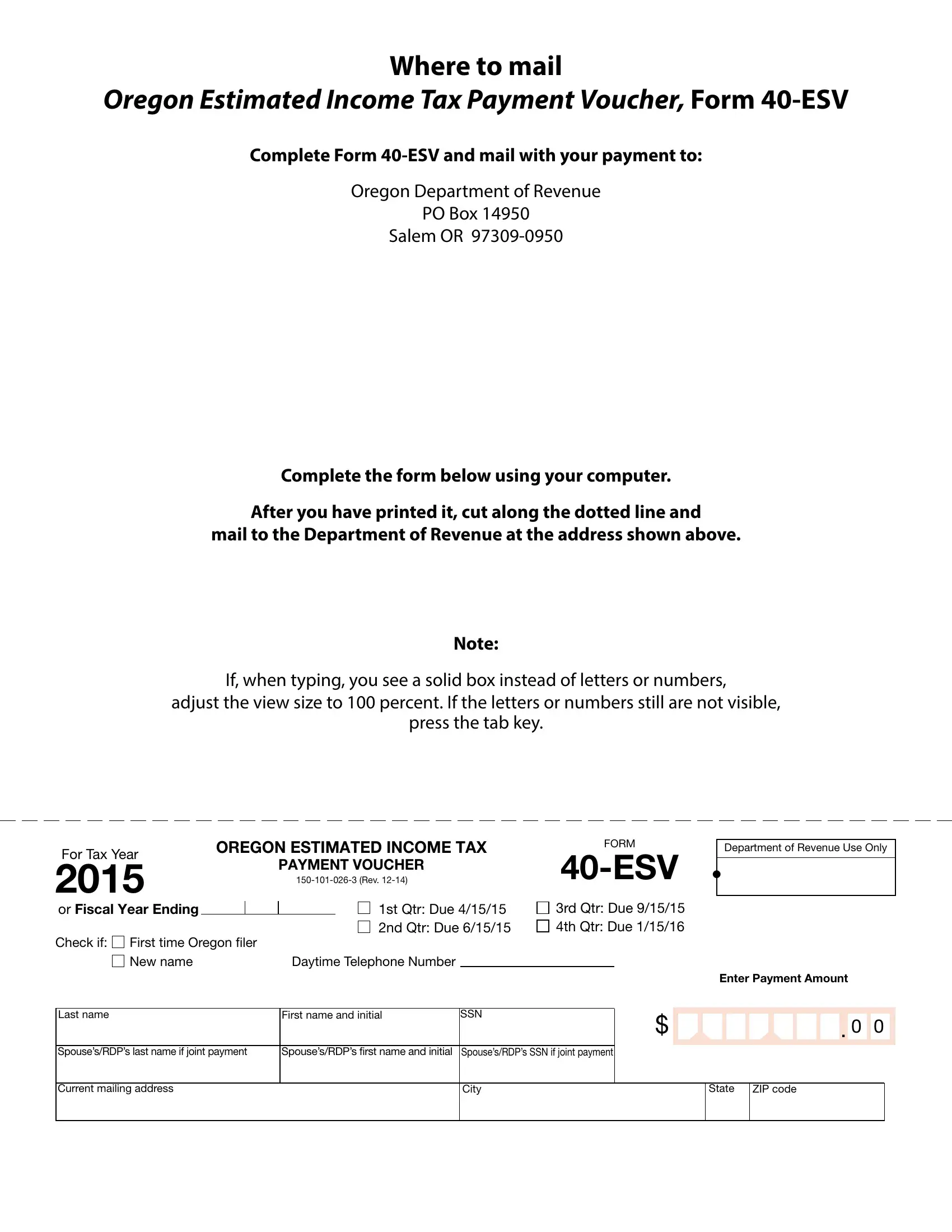

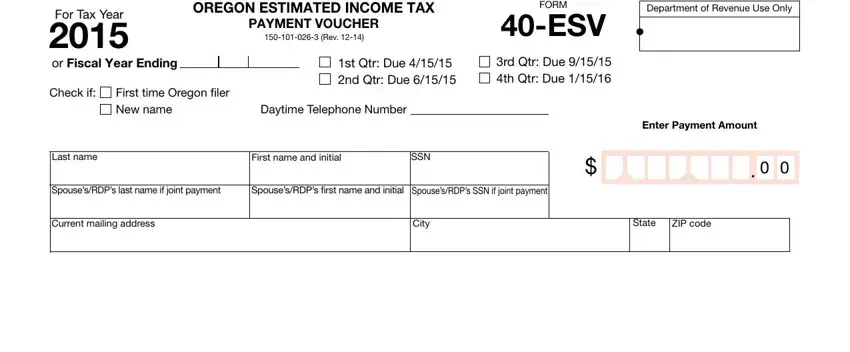

If you want to fill out this form, be sure you type in the required information in each and every area:

1. The oregon estimated tax vouchers usually requires specific details to be inserted. Make certain the next blanks are complete:

Step 3: Right after you have reviewed the details you given, simply click "Done" to conclude your form. Sign up with FormsPal today and easily access oregon estimated tax vouchers, prepared for downloading. Each modification you make is conveniently saved , which enables you to edit the file at a later point when necessary. At FormsPal.com, we endeavor to guarantee that your information is stored protected.