With the help of the online PDF editor by FormsPal, you'll be able to fill in or edit Oregon Form Tm 230 here and now. FormsPal expert team is continuously endeavoring to improve the editor and make it even better for clients with its cutting-edge features. Bring your experience to the next level with continuously improving and exceptional possibilities we provide! With some simple steps, you may start your PDF editing:

Step 1: Hit the "Get Form" button at the top of this webpage to access our tool.

Step 2: With the help of this online PDF editor, you can accomplish more than just complete blanks. Edit away and make your docs seem faultless with custom text put in, or adjust the file's original content to perfection - all that accompanied by an ability to insert any pictures and sign the PDF off.

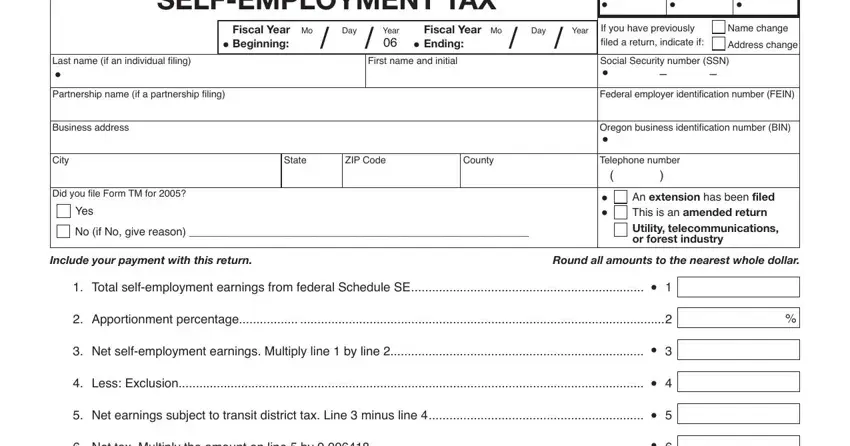

As a way to fill out this PDF form, be certain to type in the information you need in each and every blank field:

1. The Oregon Form Tm 230 involves certain information to be inserted. Ensure the following blank fields are complete:

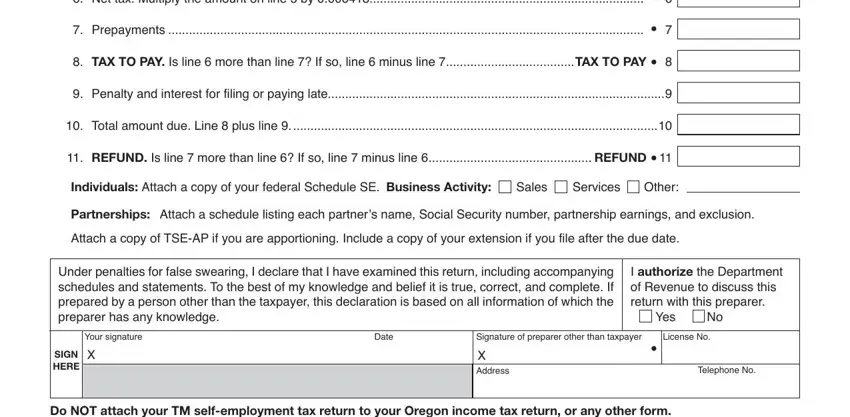

2. The subsequent step is to submit all of the following blanks: Net tax Multiply the amount on, cid cid, cid Prepayments, TAX TO PAY Is line more than, cid, Penalty and interest for filing, Total amount due Line plus line, REFUND Is line more than line, cid, Individuals Attach a copy of your, Sales, Services, Other, Partnerships Attach a schedule, and Attach a copy of TSEAP if you are.

You can potentially make a mistake when completing your Individuals Attach a copy of your, for that reason be sure you reread it before you finalize the form.

Step 3: Immediately after proofreading the entries, click "Done" and you are done and dusted! Right after setting up a7-day free trial account here, you will be able to download Oregon Form Tm 230 or email it directly. The PDF file will also be accessible via your personal account page with all your edits. FormsPal is devoted to the personal privacy of our users; we ensure that all information entered into our editor is secure.