Working with PDF documents online is actually very easy with this PDF editor. You can fill in from r0902c here painlessly. We are focused on providing you with the ideal experience with our tool by regularly releasing new functions and upgrades. With these improvements, working with our tool gets better than ever! It just takes several simple steps:

Step 1: Simply hit the "Get Form Button" above on this page to start up our pdf form editing tool. This way, you will find all that is required to fill out your document.

Step 2: Once you access the editor, you will get the form made ready to be completed. Other than filling in different fields, you could also do other things with the file, such as putting on any text, editing the initial text, inserting images, signing the PDF, and much more.

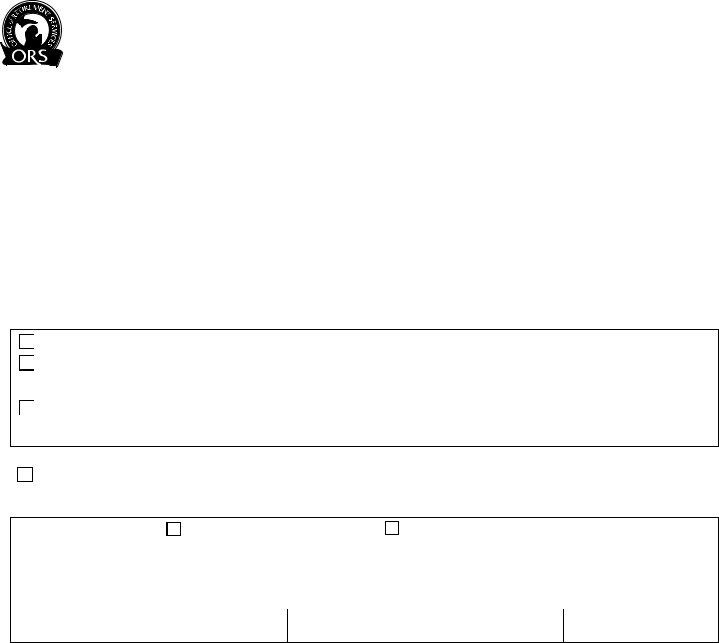

So as to complete this PDF document, be sure you type in the information you need in each and every blank field:

1. The from r0902c necessitates specific information to be inserted. Make sure the subsequent blanks are filled out:

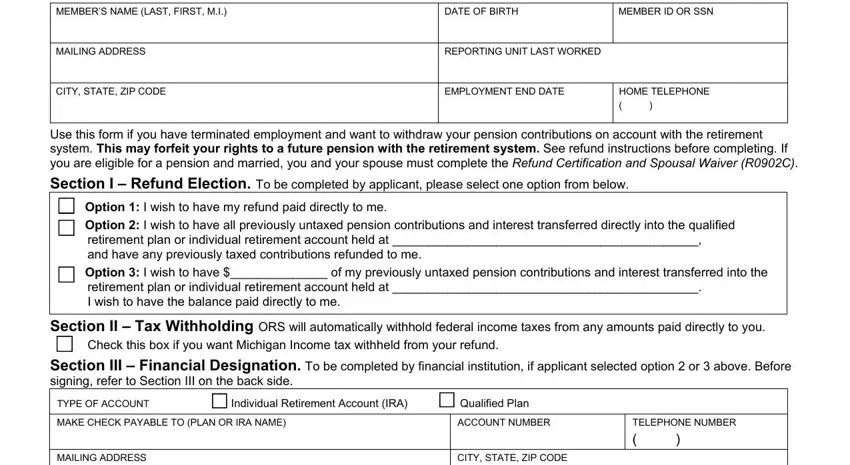

2. Immediately after the last part is filled out, go on to type in the relevant information in these: TRUSTEE OR PLAN ADMINISTRATOR, TRUSTEE NAME OR PLAN ADMINISTRATOR, DATE, Section IV Employer Certification, NAME OF REPORTING UNIT, REPORTING UNIT, TELEPHONE NUMBER, PAYROLL OFFICIALS NAME PRINT, DATE CONTRIBUTIONS LAST WITHELD, PAYROLL OFFICIAL SIGNATURE, TITLE, DATE, Section V Applicant Certification, DATE, and Notary Public Subscribed and sworn.

Be really attentive when completing TELEPHONE NUMBER and PAYROLL OFFICIAL SIGNATURE, as this is where most people make errors.

Step 3: Soon after going through your fields, press "Done" and you're good to go! Try a free trial plan with us and get direct access to from r0902c - download or edit inside your personal account. FormsPal ensures your data privacy by having a secure method that in no way records or shares any sort of private information provided. Rest assured knowing your files are kept confidential each time you work with our services!