Osla Forbearance Request Form can be filled out with ease. Just open FormsPal PDF tool to finish the job quickly. Our tool is consistently evolving to present the very best user experience possible, and that is due to our dedication to continual development and listening closely to user feedback. To get the ball rolling, go through these easy steps:

Step 1: Simply click the "Get Form Button" in the top section of this site to open our form editor. Here you'll find all that is required to fill out your document.

Step 2: With our handy PDF file editor, you're able to do more than simply complete forms. Edit away and make your documents look great with customized text added in, or modify the original content to excellence - all that comes with an ability to incorporate stunning images and sign the file off.

It will be an easy task to complete the document with our helpful tutorial! Here's what you need to do:

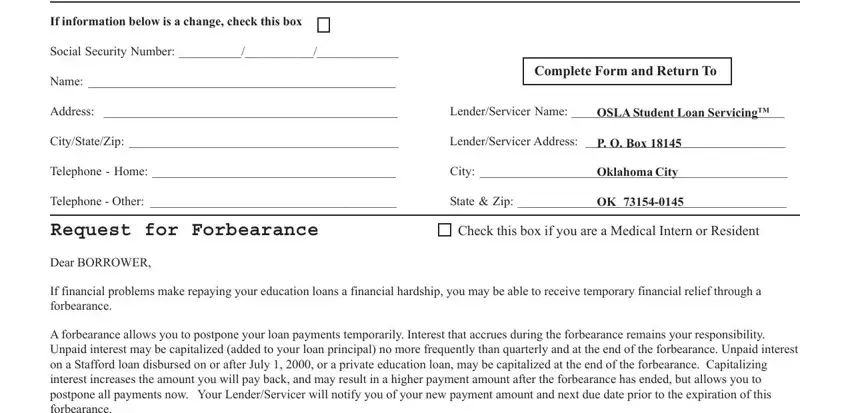

1. You will want to fill out the Osla Forbearance Request Form properly, thus pay close attention while filling in the segments including these specific blanks:

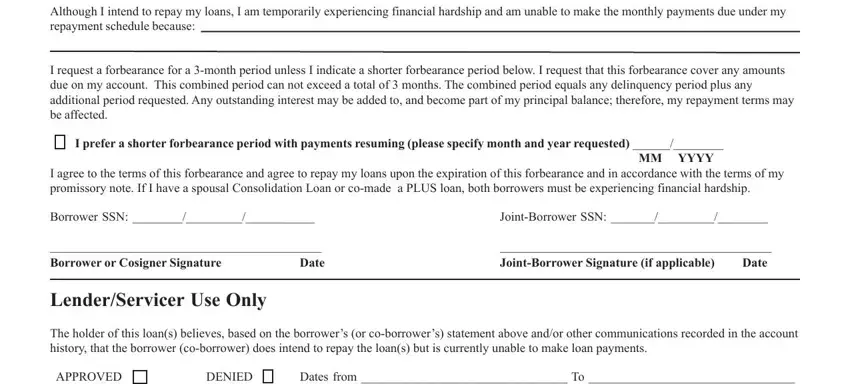

2. Soon after performing the previous part, head on to the subsequent step and fill out all required details in these blanks - Although I intend to repay my, I request a forbearance for a, I prefer a shorter forbearance, MM YYYY, I agree to the terms of this, Borrower SSN, JointBorrower SSN, Borrower or Cosigner Signature, JointBorrower Signature if, LenderServicer Use Only, The holder of this loans believes, APPROVED, DENIED, and Dates from To.

People frequently make mistakes when completing JointBorrower Signature if in this part. You should definitely review what you enter here.

Step 3: Before moving on, make sure that all blanks have been filled out right. When you believe it is all good, click on “Done." Acquire the Osla Forbearance Request Form once you register here for a free trial. Conveniently access the pdf inside your personal cabinet, with any edits and adjustments being all preserved! FormsPal provides safe document editing without data recording or sharing. Feel at ease knowing that your details are safe here!