Any time you need to fill out Ota Form 1, you won't need to download and install any kind of programs - simply give a try to our online tool. In order to make our tool better and easier to work with, we consistently come up with new features, with our users' suggestions in mind. To get the ball rolling, consider these simple steps:

Step 1: Open the PDF form in our tool by clicking on the "Get Form Button" above on this page.

Step 2: As soon as you access the tool, you will see the form all set to be filled in. Other than filling in various fields, you may also do other sorts of actions with the Document, including putting on your own words, editing the initial textual content, adding illustrations or photos, signing the document, and much more.

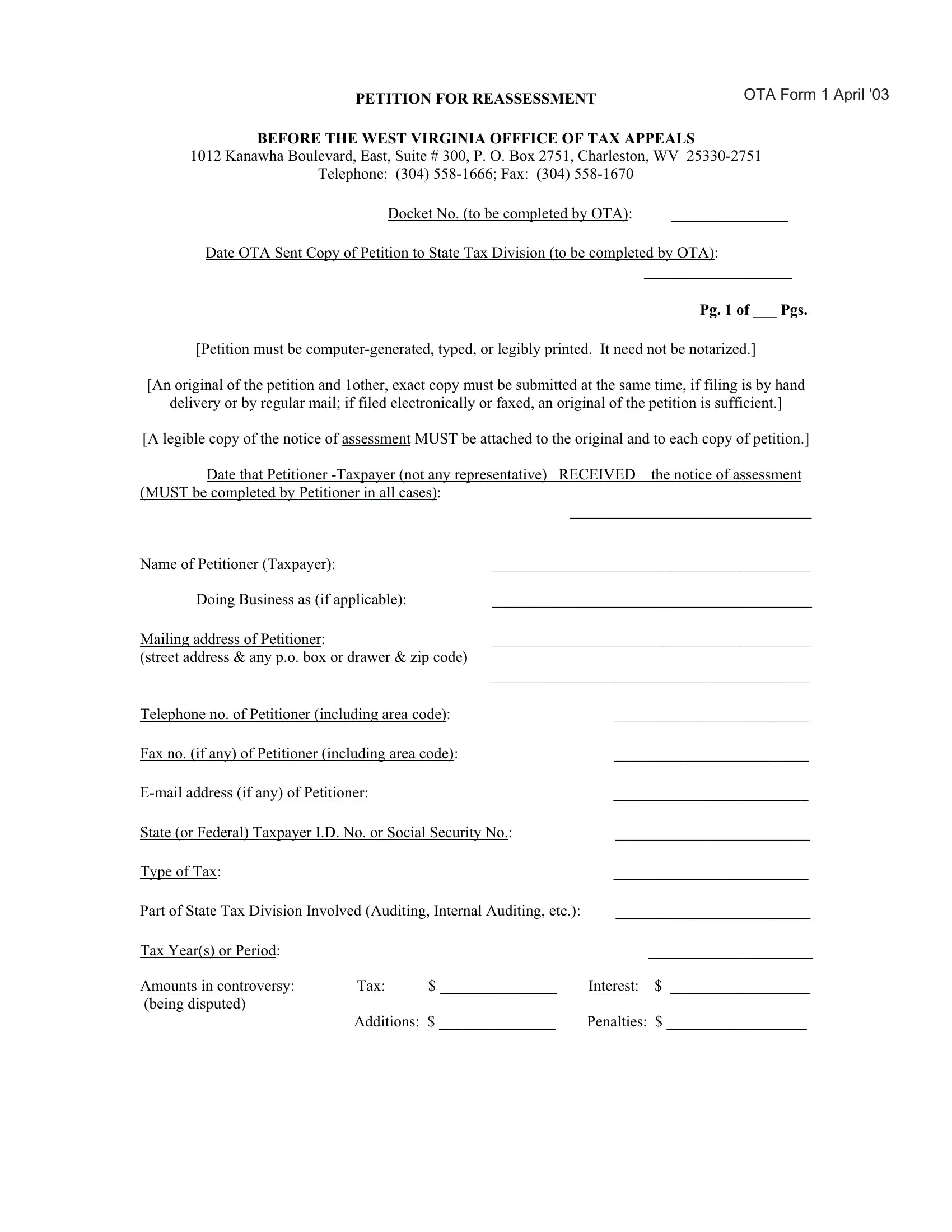

With regards to the blank fields of this specific PDF, here's what you need to know:

1. It's vital to fill out the Ota Form 1 accurately, so pay close attention when filling in the segments comprising all of these blank fields:

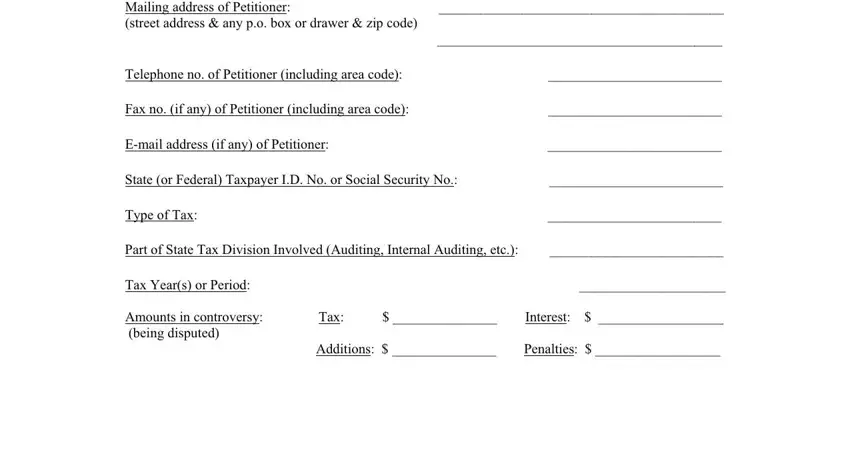

2. The next stage is to fill in these particular blanks: Mailing address of Petitioner, and Interest.

As for Interest and Mailing address of Petitioner, be sure you review things in this current part. Both of these are surely the most important ones in this PDF.

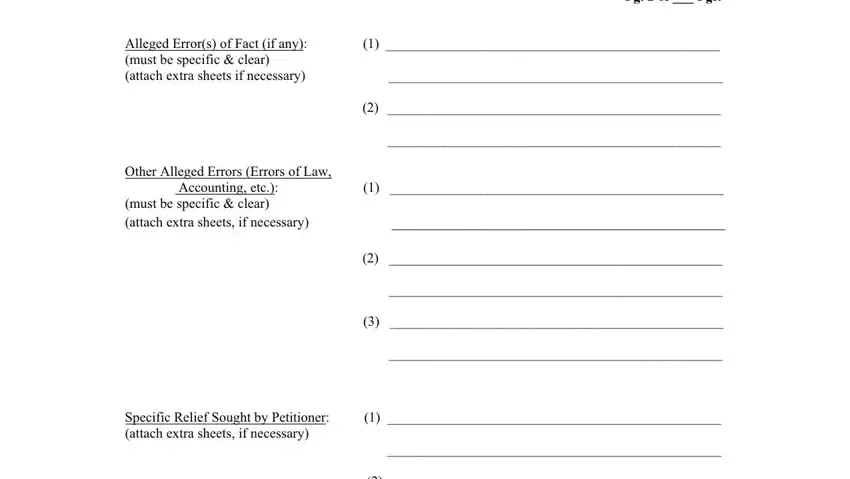

3. The following segment is related to PETITION FOR REASSESSMENT, Alleged Errors of Fact if any, Pg of Pgs, Other Alleged Errors Errors of Law, Accounting etc, and must be specific clear attach - complete every one of these empty form fields.

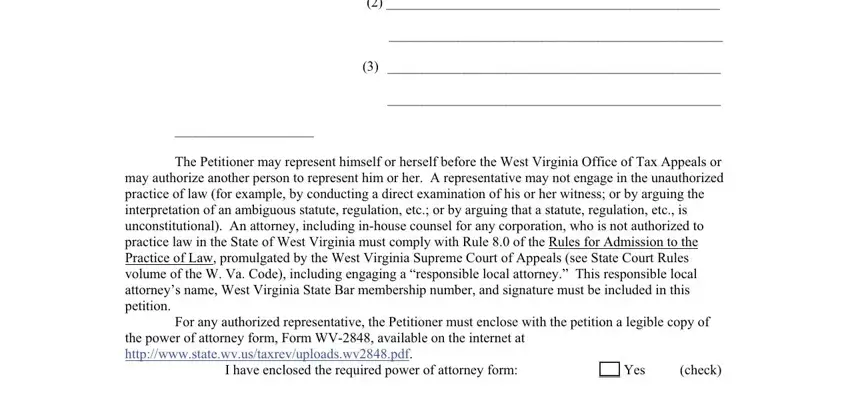

4. The following part will require your input in the subsequent places: The Petitioner may represent, I have enclosed the required power, For any authorized representative, and Yes check. Ensure you fill out all of the needed information to go onward.

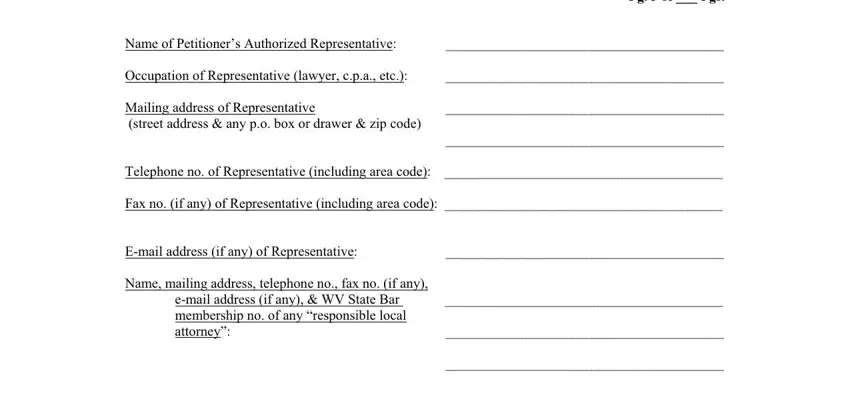

5. As you approach the completion of this form, there are actually a few more points to complete. In particular, Pg of Pgs, Name of Petitioners Authorized, and email address if any WV State Bar must be done.

Step 3: Ensure your information is accurate and then simply click "Done" to proceed further. After starting afree trial account at FormsPal, it will be possible to download Ota Form 1 or email it directly. The PDF will also be easily accessible through your personal account page with all of your changes. FormsPal guarantees your data confidentiality via a protected system that never saves or shares any private data involved in the process. Be assured knowing your docs are kept protected each time you use our tools!