When you desire to fill out Otc 901 Oklahoma Tax Form, you don't need to download and install any applications - simply make use of our PDF tool. The tool is consistently upgraded by us, getting handy features and becoming better. If you're looking to get going, here is what it's going to take:

Step 1: First of all, access the editor by clicking the "Get Form Button" at the top of this webpage.

Step 2: When you open the file editor, you'll notice the document all set to be completed. Other than filling in various fields, you could also perform other sorts of actions with the file, such as putting on custom text, modifying the initial textual content, adding images, affixing your signature to the form, and more.

It is actually easy to finish the document with our detailed guide! This is what you should do:

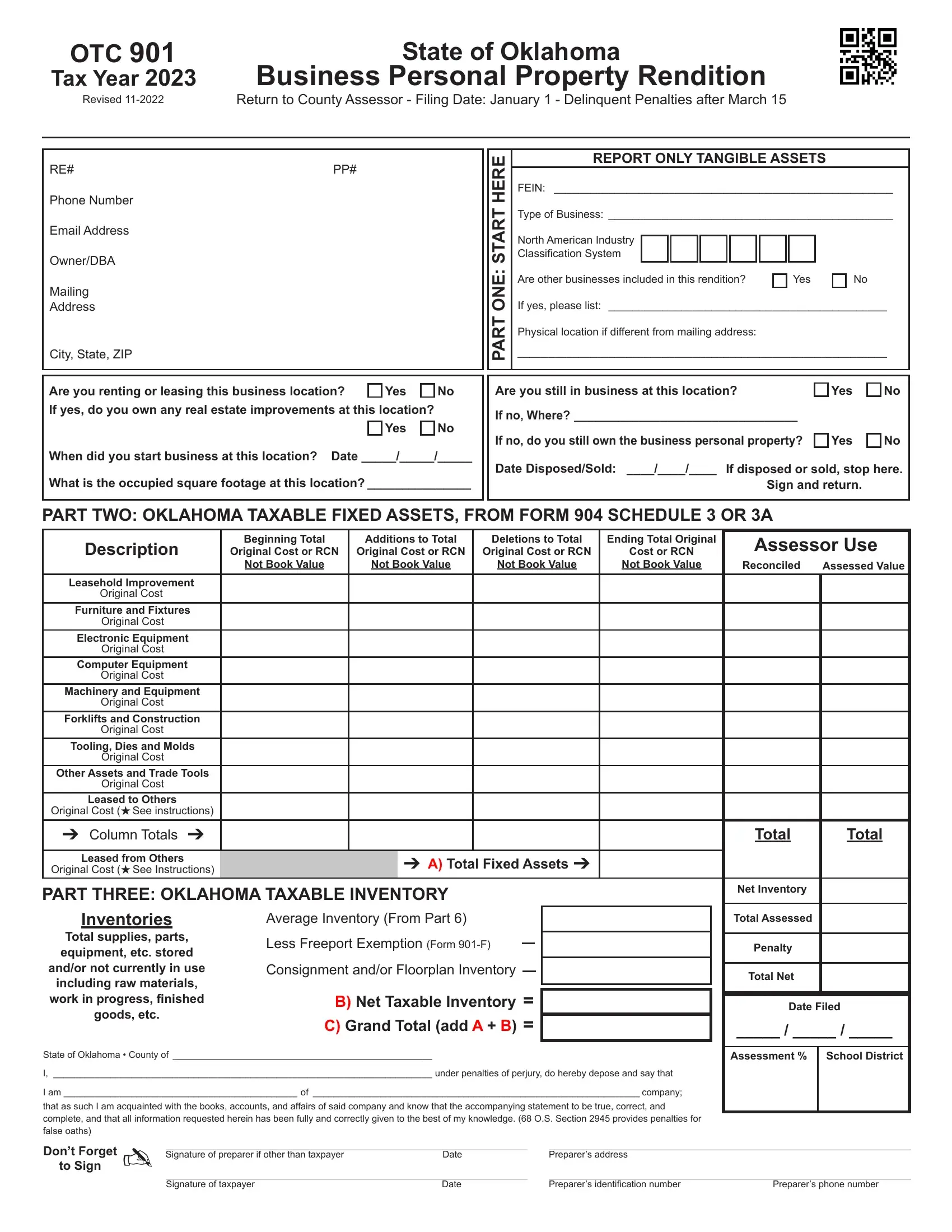

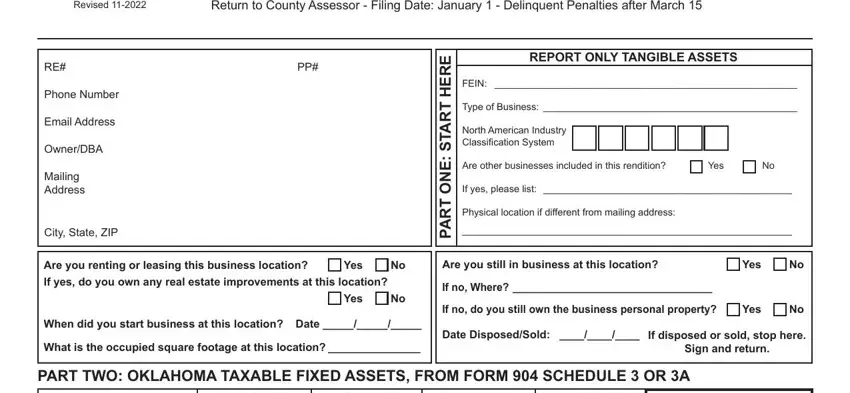

1. Begin filling out the Otc 901 Oklahoma Tax Form with a number of major blanks. Gather all the important information and ensure there is nothing missed!

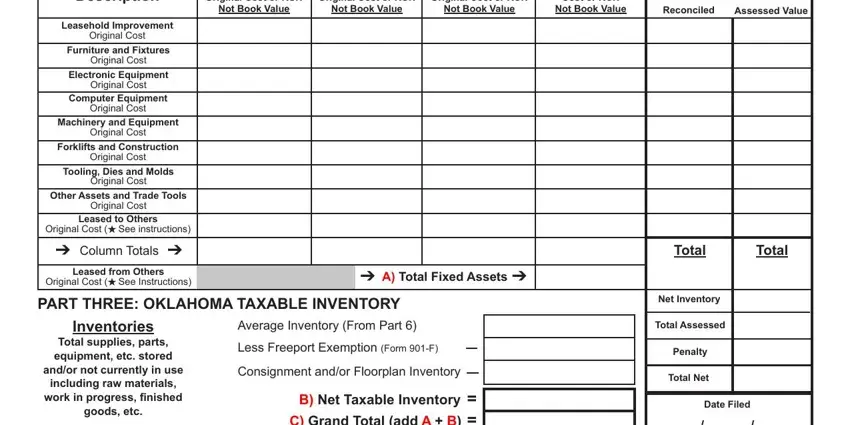

2. Once the previous segment is complete, you're ready add the essential particulars in Original Cost or RCN, Original Cost or RCN, Original Cost or RCN, Not Book Value, Not Book Value, Not Book Value, Cost or RCN, Not Book Value, Assessor Use, Reconciled, Assessed Value, Description, Leasehold Improvement, Original Cost, and Furniture and Fixtures allowing you to go further.

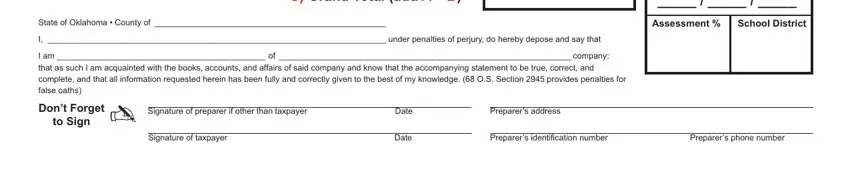

3. The next section is rather uncomplicated, C Grand Total add A B, State of Oklahoma County of, I under penalties of perjury do, I am of company, that as such I am acquainted with, Dont Forget, to Sign, Signature of preparer if other, Preparers address, Assessment School District, Signature of taxpayer, Date, Preparers identification number, and Preparers phone number - each one of these form fields will need to be filled out here.

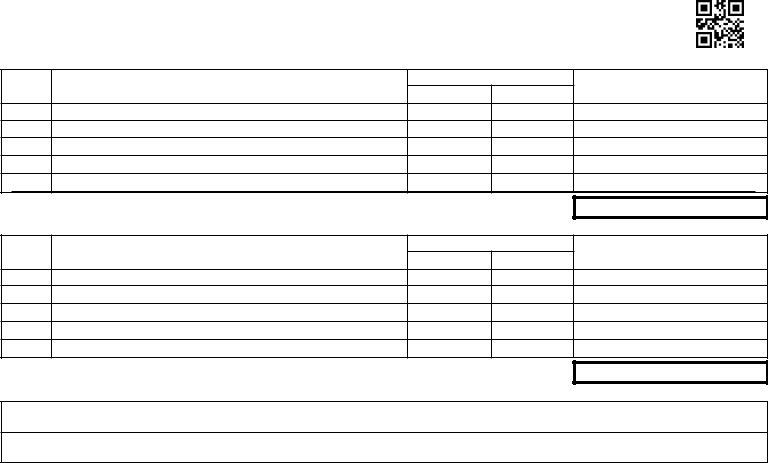

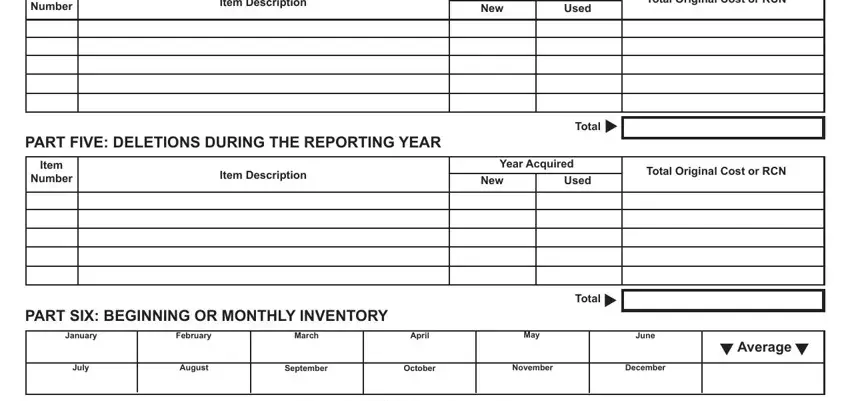

4. To move forward, this section requires filling in a few blanks. Included in these are Number, Item Description, New, Used, Total Original Cost or RCN, PART FIVE DELETIONS DURING THE, Item, Number, Item Description, Year Acquired, New, Used, Total Original Cost or RCN, Total, and PART SIX BEGINNING OR MONTHLY, which are integral to carrying on with this form.

Always be really attentive while filling out Used and Item Description, as this is the section where many people make a few mistakes.

Step 3: Before moving forward, check that all form fields have been filled in properly. Once you establish that it's correct, click “Done." Try a free trial option with us and acquire direct access to Otc 901 Oklahoma Tax Form - download, email, or edit in your FormsPal cabinet. We do not share any details that you use while filling out documents at FormsPal.