Once you open the online PDF tool by FormsPal, you can easily complete or edit p11d b form 2019 20 template right here. Our tool is continually evolving to grant the best user experience attainable, and that is thanks to our resolve for continual enhancement and listening closely to customer opinions. For anyone who is seeking to start, this is what it takes:

Step 1: Just press the "Get Form Button" in the top section of this page to access our pdf form editor. There you will find everything that is necessary to work with your file.

Step 2: This tool will let you customize the majority of PDF documents in a range of ways. Modify it by adding customized text, correct existing content, and put in a signature - all doable in no time!

It's straightforward to finish the pdf with our practical guide! Here is what you should do:

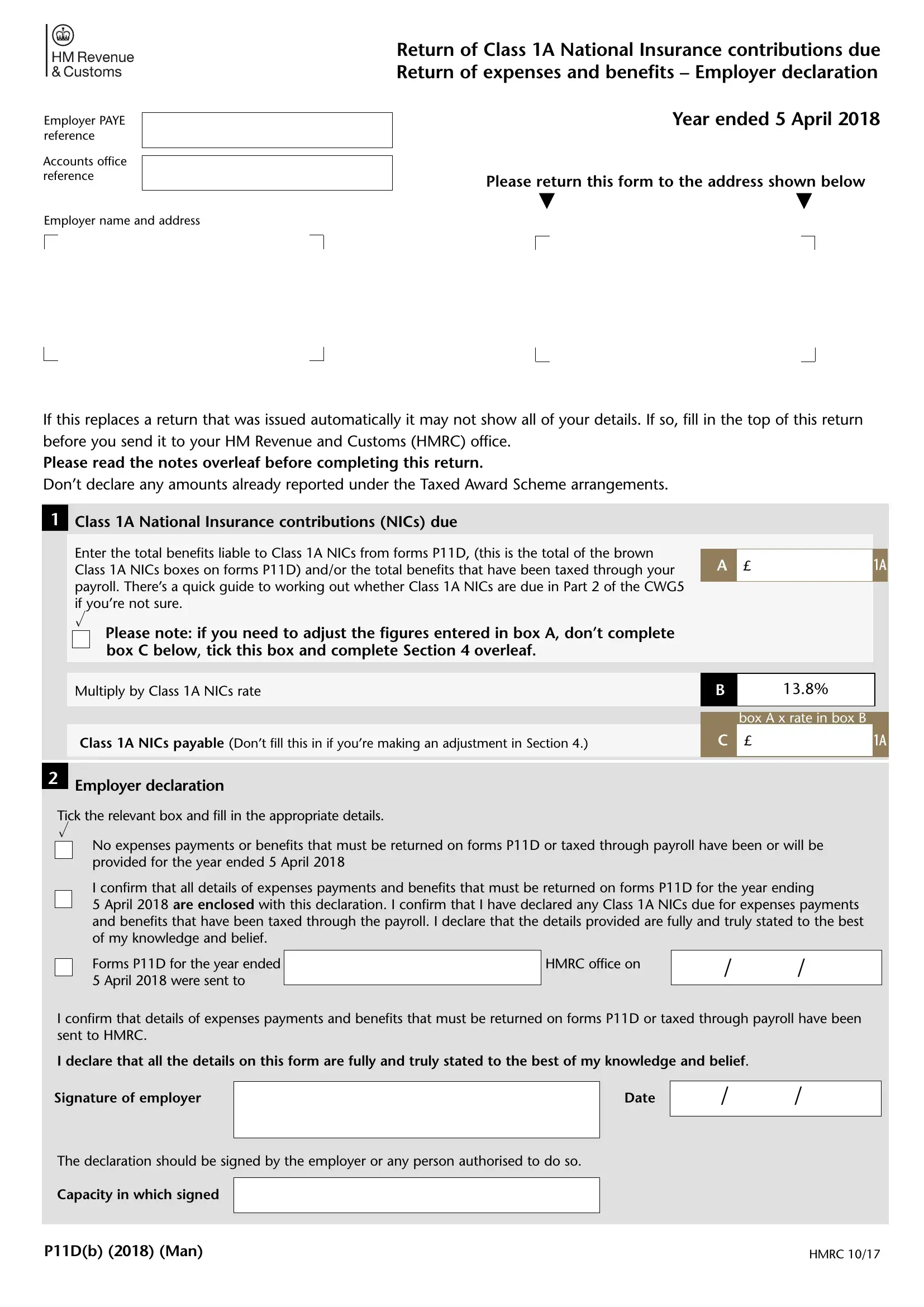

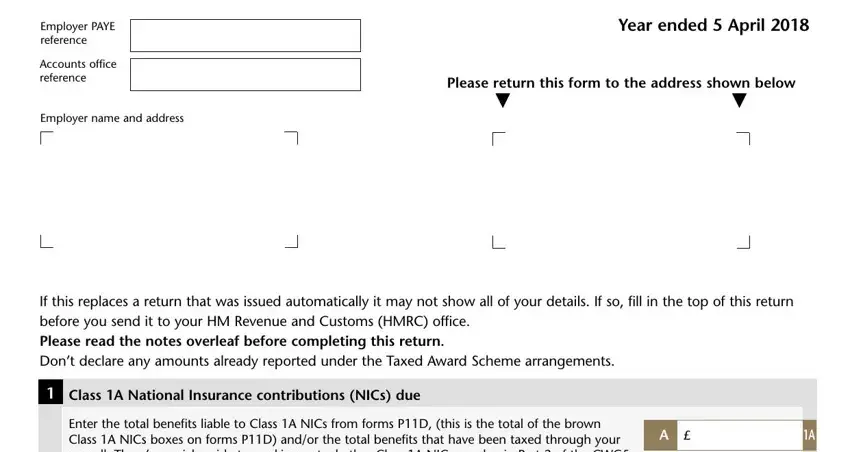

1. To begin with, when completing the p11d b form 2019 20 template, begin with the area with the following blank fields:

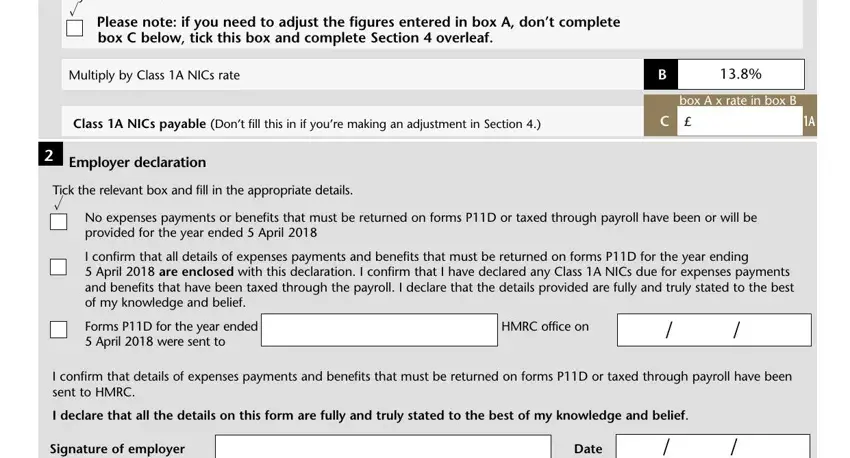

2. The next stage would be to fill in the following fields: Enter the total benefits liable to, Please note if you need to adjust, Multiply by Class A NICs rate, Class A NICs payable Dont fill, Employer declaration, box A x rate in box B, Tick the relevant box and fill in, I confirm that all details of, Forms PD for the year ended HMRC, I confirm that details of expenses, I declare that all the details on, Signature of employer, and Date.

In terms of Signature of employer and Multiply by Class A NICs rate, be certain you get them right here. Both of these are the key ones in this form.

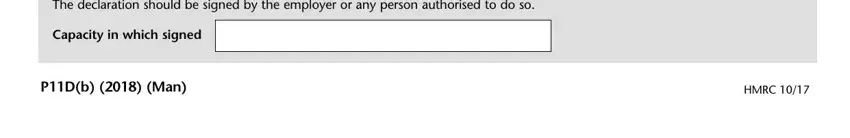

3. Completing The declaration should be signed, Capacity in which signed, PDb Man, and HMRC is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

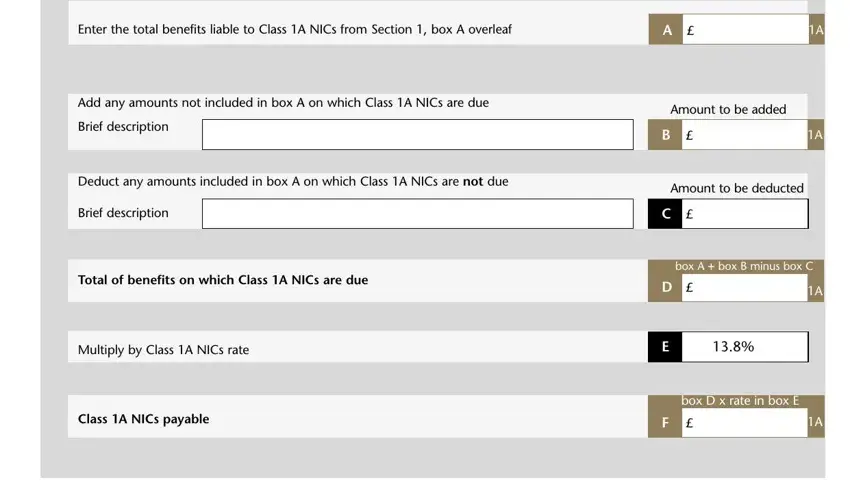

4. The next paragraph needs your information in the subsequent places: Enter the total benefits liable to, Add any amounts not included in, Brief description, Deduct any amounts included in box, Brief description, Amount to be added, Amount to be deducted, Total of benefits on which Class A, Multiply by Class A NICs rate, Class A NICs payable, box A box B minus box C, and box D x rate in box E. Ensure you fill out all of the requested details to move forward.

Step 3: Make sure that the information is right and then click on "Done" to progress further. Find the p11d b form 2019 20 template once you subscribe to a free trial. Readily access the pdf document from your personal account page, along with any modifications and adjustments automatically kept! Here at FormsPal, we aim to guarantee that all your information is kept private.