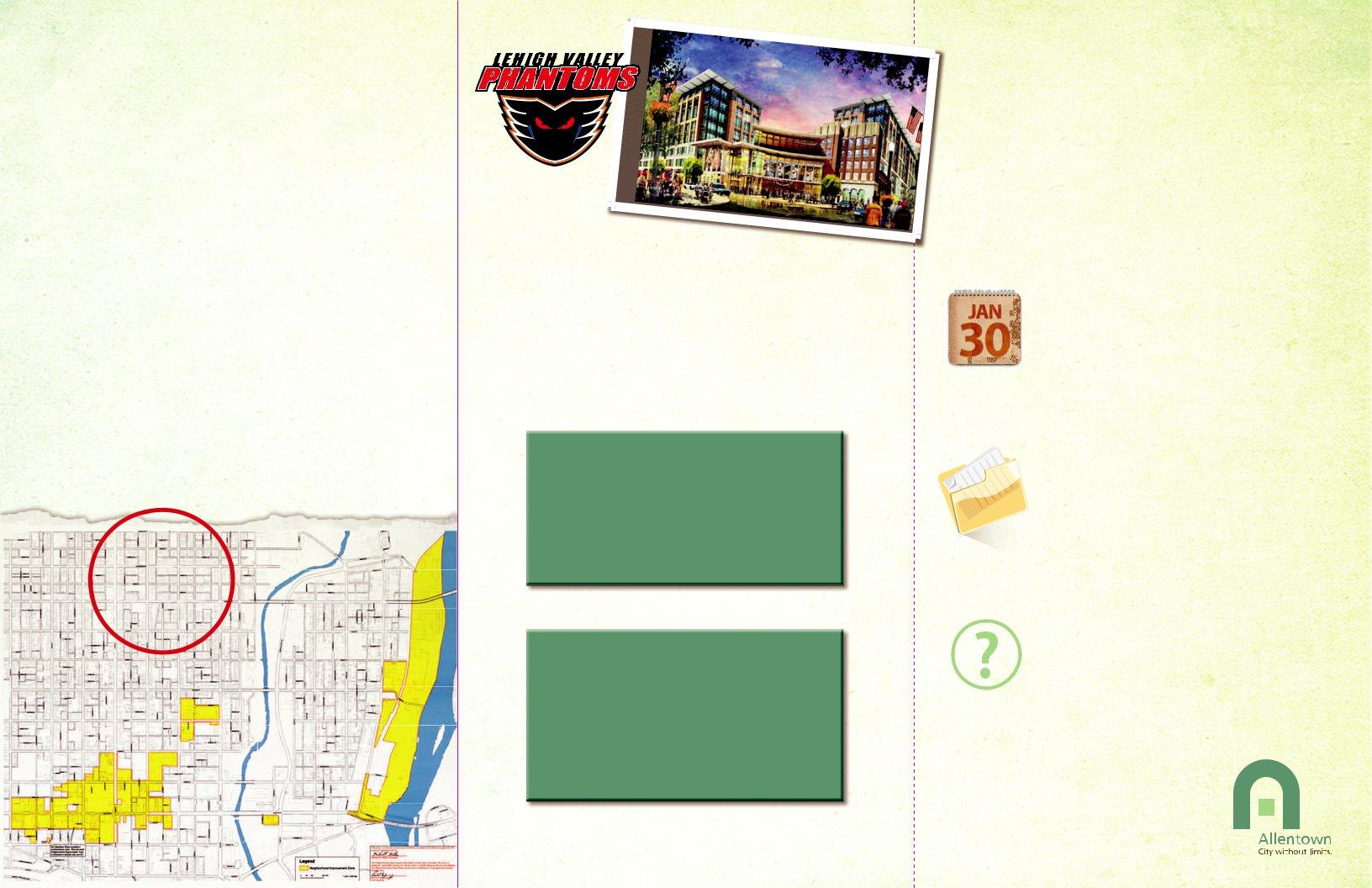

The establishment and operationalization of the Neighborhood Improvement Zone (NIZ) in Allentown reflects a strategic initiative to foster economic development and urban revitalization. Enacted by state law in 2011, the NIZ covers approximately 128 acres across downtown Allentown and along the western banks of the Lehigh River. This special taxing district aims to catalyze development through the unique use of certain state and local tax revenues. These revenues are instrumental in financing qualifying capital improvements within the zone, including the iconic public-private arena complex and other vital commercial, retail, residential, and hospitality projects. Overseen by the Allentown Neighborhood Improvement Zone Development Authority (ANIZDA), the NIZ promises significant benefits not only to the city by propelling new commerce, tourism, and job creation but also to the individual business owners through anticipated property value increases, enhanced safety, and improved accessibility. To facilitate compliance and leverage these advantages, the NIZ mandates annual reporting from businesses by January 30, offering guidance and personalized support through designated consulting firms. This strategic approach underscores a collaborative effort to transform Allentown into a vibrant, attractive destination for commerce, entertainment, and culture, whilst ensuring businesses thrive in a supportive, enhanced urban environment.

| Question | Answer |

|---|---|

| Form Name | Pa Niz Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | niz improvement online, pennsylvania business niz improvement, pa niz, pa doing neighborhood |

Dear Business Owner,

As mayor of the City of Allentown, I’m honored that you’ve chosen the city’s downtown or waterfront as the home for your business.

As you may know, your business is located within Allentown’s Neighborhood Improvement Zone, or NIZ. Created by state law in 2011, the NIZ is a special taxing district that encourages development and

Under the NIZ law, your business is required to le NIZ reporting forms every year by January 30.

e city is here to help you with the process, beginning with this brochure. ese pages will introduce you

to the NIZ, summarize your requirements and point you toward additional information. Beyond that, the Allentown Neighborhood Improvement

Zone Development Authority, ANIZDA, has hired professionals to personally help you understand and comply with this new reporting. We’ve listed how to get in touch with them in these pages.

As always, we are here to assist you in doing business within Allentown. We look forward to partnering with you to create a brighter tomorrow for our promising city.

Mayor Ed Pawlowski

For more information contact:

NIZ@concannonmiller.com

Doing Business

in Allentown’s

Neighborhood

Improvement Zone

A Guide to Your Benets & Reporting Requirements

What is the

Neighborhood Improvement Zone (NIZ)?

Created by a state law in 2011, the Neighborhood Improvement Zone (NIZ) is a special taxing district that encourages development and revitalization in Allentown. The NIZ consists of approximately 128 acres in center city Allentown and along the western side of the Lehigh River.

Under the law, certain state and local tax revenues generated by new and existing businesses within the NIZ can be used to pay debt on bonds and loans that are issued for qualifying capital improvements in the zone. Those improvements include the

The NIZ is overseen and managed by the Allentown Neighborhood Improvement Zone Development Authority (ANIZDA).

YOU |

||

ARE |

IN |

THE |

|

||

|

|

|

NEIGHBORHOOD |

||

IMPROVEMENT |

||

|

ZONE |

|

Why was the NIZ Created?

The NIZ was created as an economic development tool to spur the transformation of downtown Allentown, beginning with the construction of an event arena that will be home to the Lehigh Valley Phantoms, the professional

NIZ Benets to Allentown

•New commerce, increased tourism, new companies

•Thousands of new jobs

•A strengthened, more collaborative community

•A range of housing options

•A distinctive, attractive, vibrant downtown

•Smart growth that encourages multiple land uses while preserving open space and historic buildings

NIZ Benets to Your Business

•Expected property value increase

•Improved cleanliness, safety & streetscapes

•More parking and better access to your business

•Increased foot traffic with:

–New housing, hotels, restaurants & retail

–

–Arena events 1 of every 3 nights

–4 million new visitors to Allentown each year

Your NIZ Reporting Requirements

Business owners within the NIZ will not incur any additional taxes as a result of the NIZ. However, under the NIZ law, you are required to report the taxes your business already pays and reports to state and local agencies. Please begin completing your NIZ reporting forms well in advance of the deadline.

Timeline

All NIZ reporting forms must be completed and received by the Pennsylvania Department of Revenue and the City of Allentown on or before January 30 to

avoid a penalty.

NIZ Reporting Forms

A detailed NIZ Business Information &

Reporting Packet will be provided to all qualied businesses within the NIZ.

For Help Filing

ANIZDA has arranged for you to have personal help with any NIZ reporting questions at no cost to you. Please don’t hesitate to contact these professionals right away for assistance:

Compass Point Business Management Consulting

NIZ@concannonmiller.com or

dzosky@compasspt.com

Allentown will be a destination city for commerce,

entertainment, culture and more!