|

DISTRIBUTIONS FROM PARTNERSHIPS |

For Pennsylvania personal income tax purposes guaranteed |

|

Non-corporate shareholders and partners should use |

|

payments are classified as follows: |

|

|

|

amounts from PA-20S/PA-65 Schedule RK-1, Section IV |

|

|

|

● If services are rendered directly in the production of in- |

|

through Section VII to determine or calculate owner’s basis. |

|

come from a business, profession, or farm, the guaran- |

|

Partners include Line 12 in net classified income on their |

|

teed payments are gross income from that income class. |

|

Pennsylvania tax returns. |

|

● If services are rendered directly in the production of |

|

|

|

|

|

|

|

|

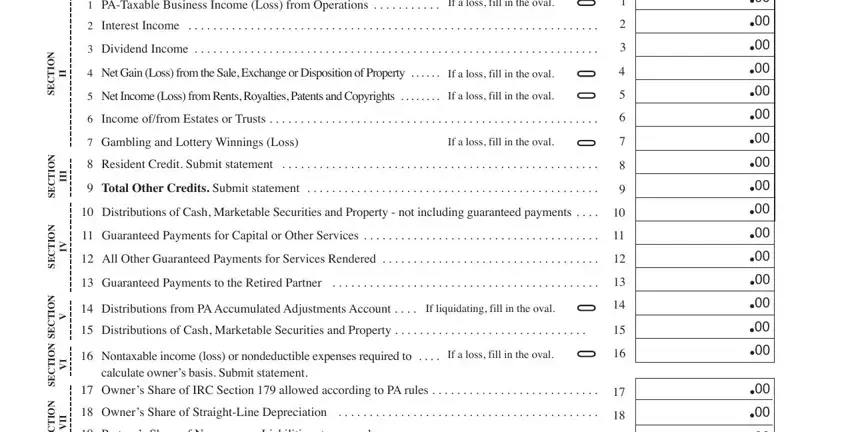

LINE 10 |

|

|

|

|

|

rental or royalty income, the guaranteed payments are |

|

DISTRIBUTION OF CASH, MARKETABLE SECURITIES |

gross income from that in-come class. |

|

|

|

|

|

|

|

AND PROPERTY NOT INCLUDING GUARANTEED |

HEALTH SAVINGS ACCOUNTS (HSA) |

|

|

|

PAYMENTS |

Contributions by a partnership to a bona fide partner’s HSA |

|

|

|

|

|

|

Enter the partner’s share of distribution of cash, marketable |

are not contributions by an employer. The contributions are |

|

securities and property, other than guaranteed payments. |

treated as a distribution of money and are not included in |

|

With respect to liquidating property distributions, this line will |

the partner’s income. |

|

|

|

|

|

|

|

include the total of cash and the fair market value of mar- |

Contributions by a partnership to a partner’s HSA for serv- |

|

ketable securities and property distributed to the Pennsylva- |

|

ices rendered, however, are treated as guaranteed pay- |

|

nia resident partner. |

|

ments that are deducted by the partnership and included in |

|

|

|

|

|

|

The partner reduces his basis in the partnership by amount |

the partner’s income. In both situations, the partnership can |

|

of distributions. If the distribution amount is in excess of |

deduct the contribution made to the partner’s HSA. |

|

|

|

basis, it must be reported on the resident partner’s return as |

Contributions to a nonresident partner’s HSA for services |

|

taxable gain on PA-20S/PA-65 Schedule D. |

|

|

|

|

|

must be apportioned. |

|

|

|

|

|

LINE 11 |

|

|

|

|

|

|

|

Contributions by an S corporation to a 2 percent share- |

|

GUARANTEED PAYMENTS FOR CAPITAL |

|

holder-employee’s HSA for services rendered are deducted |

|

OR OTHER SERVICES |

by the S corporation as wage or salary expense and in- |

|

Enter the partner’s share of guaranteed payments for capital |

cluded in the shareholder-employee’s gross compensation. |

|

or other services. |

The shareholder-employee can deduct the contribution |

|

|

|

|

|

|

Pennsylvania does not follow federal treatment for guaran- |

made to the shareholder-employee’s HSA. |

|

|

|

teed payments for services. Under Pennsylvania tax law, to |

|

|

|

|

LINE 13 |

|

|

|

the extent paid for other services or for the use of capital, a |

|

|

|

guaranteed payment is: |

GUARANTEED PAYMENTS TO RETIRED PARTNER |

|

|

|

|

● A withdrawal proportionately from the capital of all |

|

|

|

|

Guaranteed payments to a retired partner must meet the ex- |

|

|

partners; |

|

|

ception described in IRC §1402(a)(10). |

|

|

|

|

● A gain from the disposition of the recipient’s partnership |

|

|

|

|

|

|

|

|

|

interest and a loss from the disposition of the other part- |

Generally, retirement payments received by a retired partner |

|

|

ners’ partnership interests, to the extent derived from the |

from a partnership (of which he or she is a member or former |

|

|

capital of the other partners; and |

member) are counted as net earnings from self-employment. |

|

|

● A return of capital by the recipients to the extent derived |

|

|

Certain periodic payments by a partnership to a retired part- |

|

|

from their own capital. |

ner made on account of retirement under a written plan of |

|

Pennsylvania allows the deduction. |

partnership are excluded from the tax. To be effective, the |

|

plan must meet such requirements as are prescribed by Reg |

|

|

|

|

|

|

|

|

LINE 12 |

|

|

|

|

|

§1.1402(a)-17. It must apply to partners generally or to a |

|

ALL OTHER GUARANTEED PAYMENTS |

class or classes of partners, and provide such payments at |

|

least until the retired partner's death. |

|

|

|

FOR SERVICES RENDERED |

|

|

|

|

|

|

|

Enter the partner’s share of such payments. Typically, guar- |

The exclusion applies to retirement payments received by a |

|

anteed payments to partners are paid to the extent the serv- |

retired partner only if he or she renders no services in any |

|

ices are rendered directly in the production of income from |

business conducted by the partnership during the taxable |

|

a business, profession or farm, and/or from rental or royalty |

|

year of such partnership, ending within or with his or her tax- |

|

income. |

|

able year in which amounts were received. At the end of |

|

|

|

|

|

|

|

|

NOTE: The partner must know the class of income |

such partnership's taxable year: (1) there must be no obli- |

|

|

|

|

|

|

from which the partnership made the guaranteed pay- |

gation from other partners to the retired partner, other than |

|

|

|

|

ments. The partner must then properly classify the payments |

to make retirement payments under the plan; and (2) the re- |

|

on his/her PA-40 Individual Income Tax Return. |

|

tired partner's share in the capital of the partnership had |

|

|

|

|

|

|

|

|

IMPORTANT: If the total guaranteed payment includes |

been paid to him or her in full. Code Sec. 1402(a)(10) Reg |

|

|

|

more than one of the income classes described below, |

§1.1402(a)-17. |

|

|

|

|

|

|

|

|

|

|

|

|

www.revenue.pa.gov |

PA-20S/PA-65 RK-1 |

5 |