You could fill out pa w 2 effortlessly by using our PDFinity® online tool. FormsPal expert team is continuously endeavoring to enhance the editor and enable it to be much easier for people with its many functions. Take your experience to a higher level with constantly developing and amazing opportunities we provide! With a few basic steps, you are able to begin your PDF journey:

Step 1: Click on the "Get Form" button in the top area of this webpage to access our PDF editor.

Step 2: As soon as you start the tool, you will notice the form prepared to be filled out. Besides filling in different fields, you might also do several other actions with the PDF, such as writing any textual content, changing the original textual content, adding illustrations or photos, signing the document, and much more.

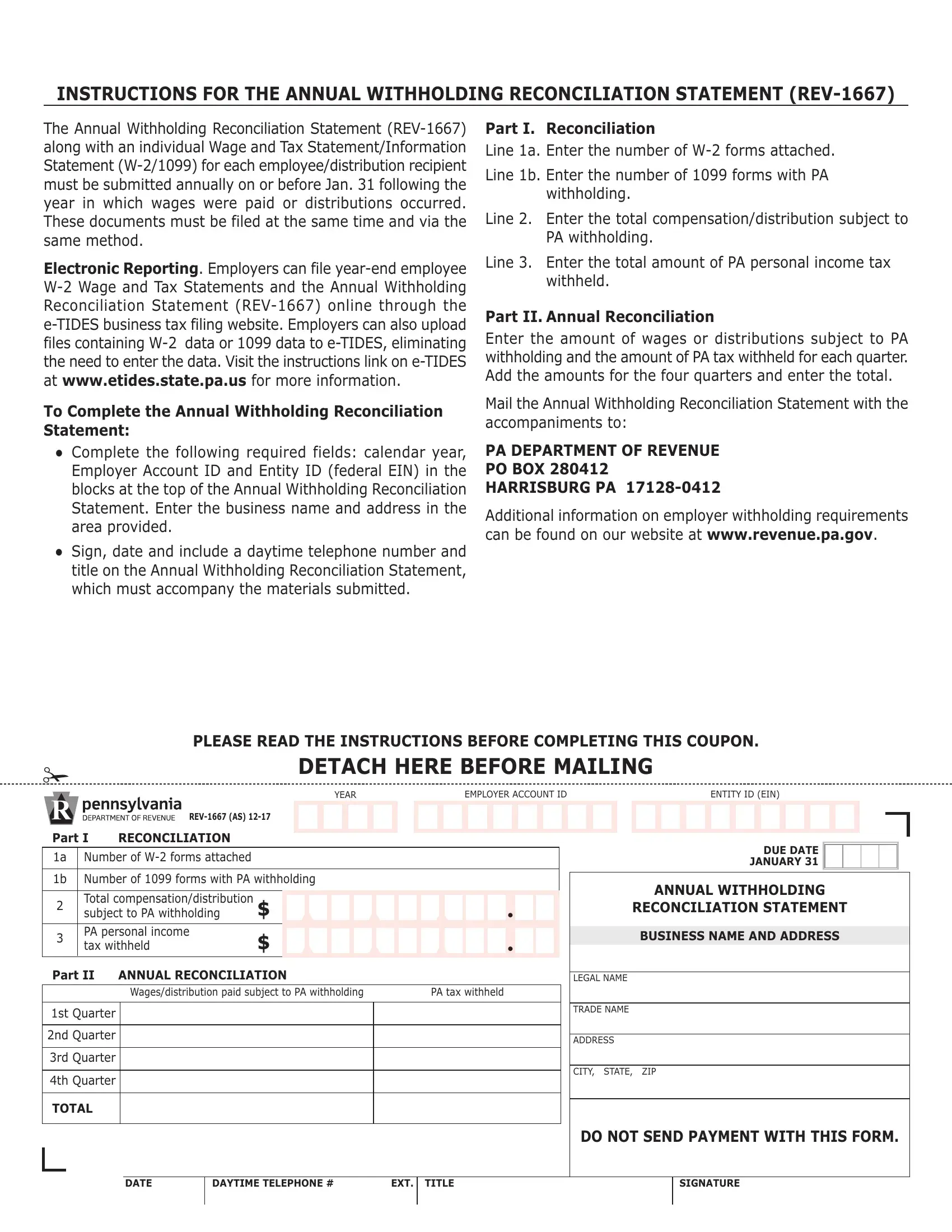

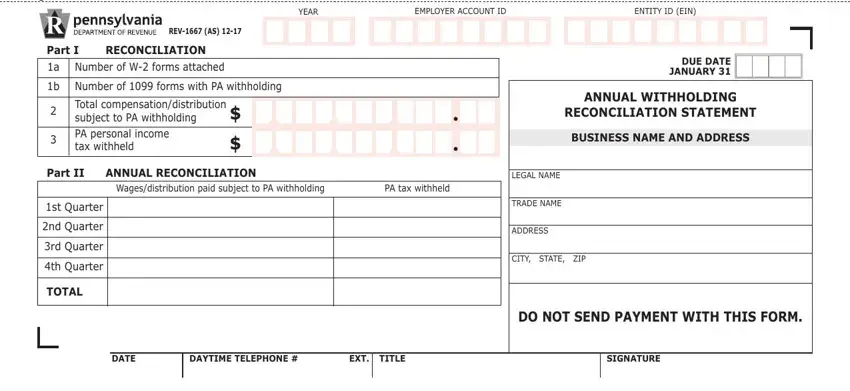

This PDF will need particular details to be typed in, therefore make sure you take some time to type in what is expected:

1. The pa w 2 necessitates specific details to be entered. Ensure that the subsequent blanks are completed:

Step 3: Spell-check all the details you've entered into the form fields and then click on the "Done" button. Sign up with FormsPal now and immediately access pa w 2, prepared for download. All changes made by you are kept , letting you edit the file further anytime. At FormsPal, we do our utmost to make certain that all of your details are stored protected.