The PDF editor makes it easy to create the pa w3r form file. It will be easy to make the form efficiently by simply following these simple actions.

Step 1: Choose the "Get Form Now" button to get going.

Step 2: Now, you can modify the pa w3r form. The multifunctional toolbar helps you include, eliminate, customize, highlight, as well as do similar commands to the words and phrases and fields within the document.

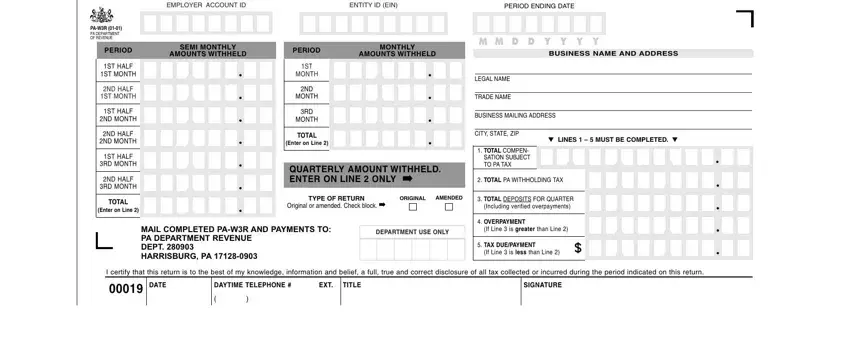

These particular parts will make up the PDF document:

Step 3: When you hit the Done button, the ready file is simply exportable to any kind of of your devices. Alternatively, it is possible to send it through email.

Step 4: It will be simpler to have duplicates of the file. There is no doubt that we are not going to disclose or read your data.

▲

▲ ▲

▲ ▲

▲ ▲

▲ ▲

▲