Our top rated computer programmers have worked collectively to develop the PDF editor that you could apply. The following app makes it easy to complete laundering files quickly and without problems. This is certainly all you have to undertake.

Step 1: Hit the orange button "Get Form Here" on this webpage.

Step 2: So, you're on the file editing page. You can add information, edit existing details, highlight specific words or phrases, place crosses or checks, add images, sign the form, erase unwanted fields, etc.

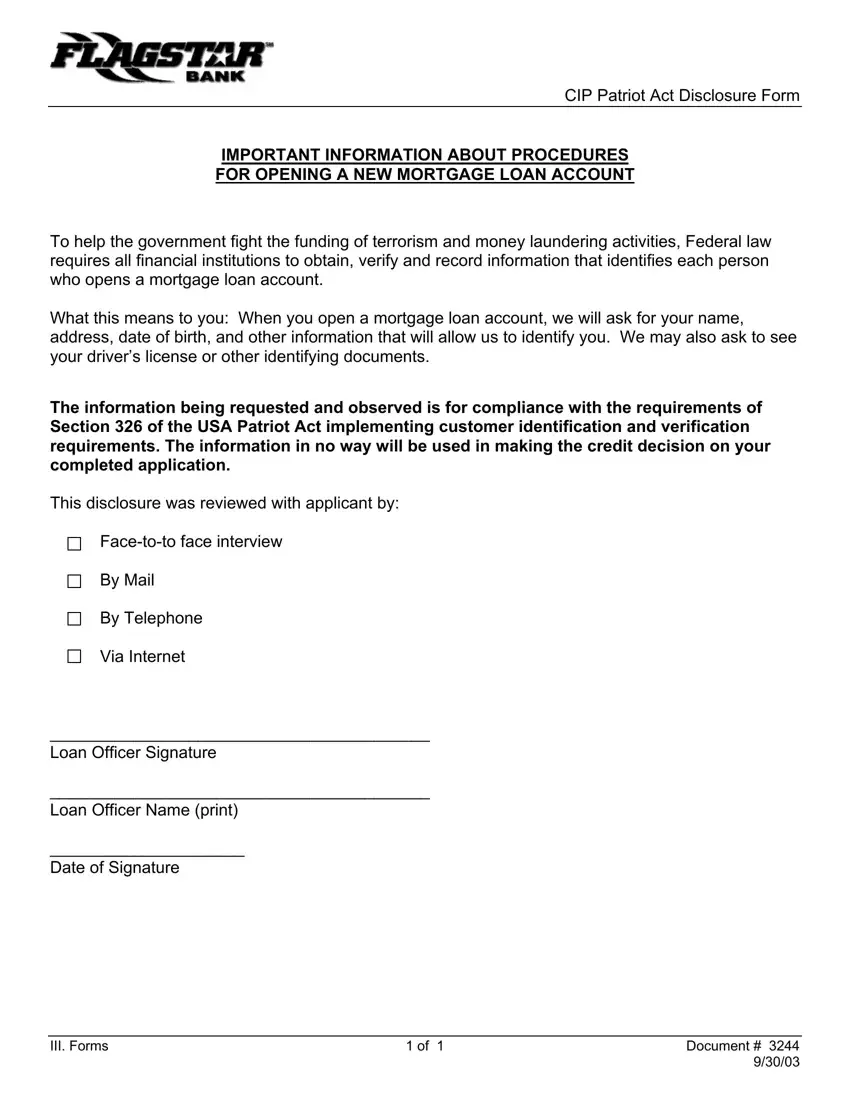

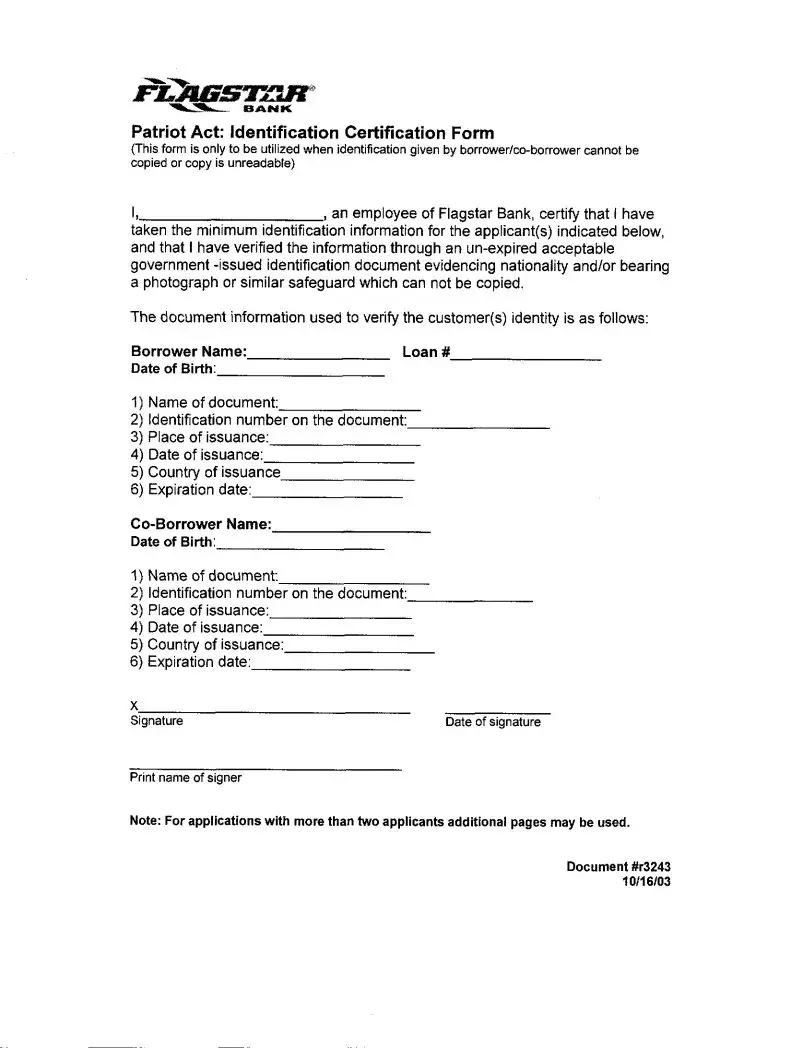

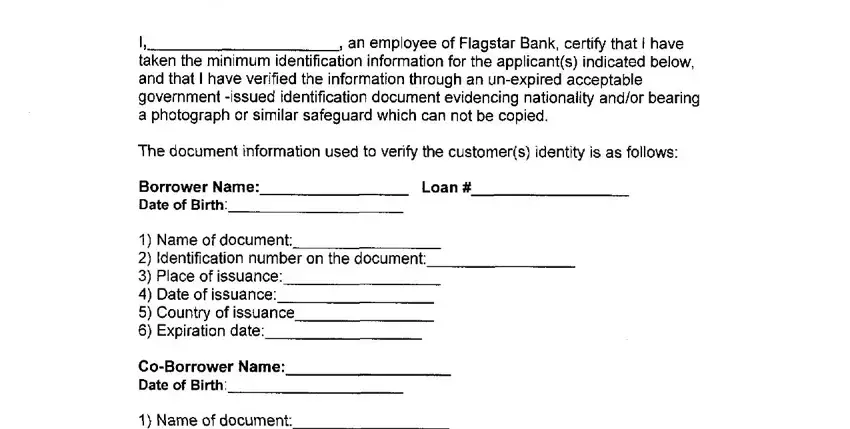

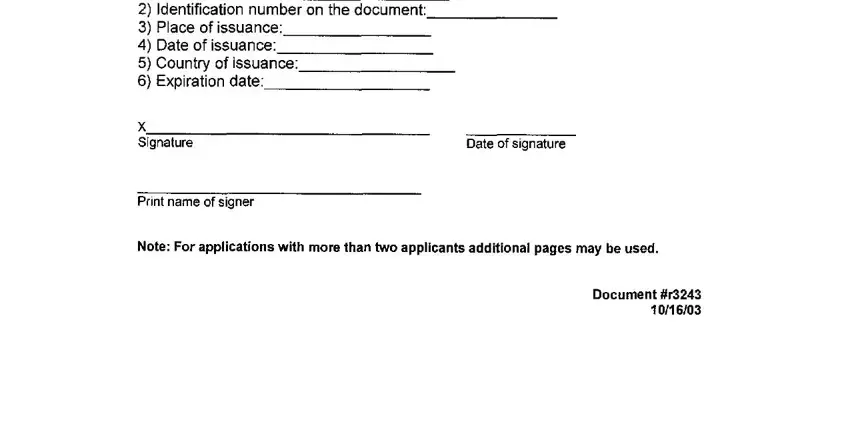

Fill in the following segments to prepare the file:

Please enter the crucial details in the area.

The program will demand for more information in order to automatically complete the field .

Step 3: Hit "Done". Now you may transfer your PDF document.

Step 4: To prevent any specific challenges in the long run, you will need to get as much as a couple of duplicates of your document.