This PDF editor makes it simple to fill out documents. You won't need to undertake much to change pc 583 michigan forms. Basically stick to all of these actions.

Step 1: The first thing will be to select the orange "Get Form Now" button.

Step 2: You can find all of the options which you can take on the document after you've entered the account of fiduciary form editing page.

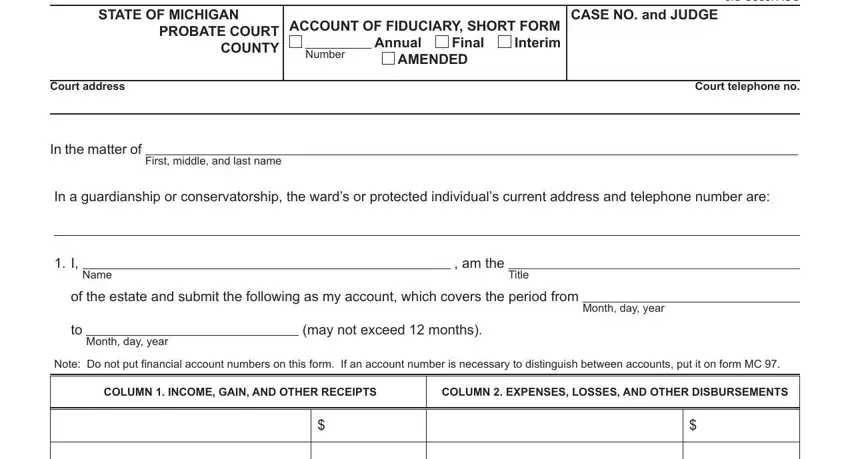

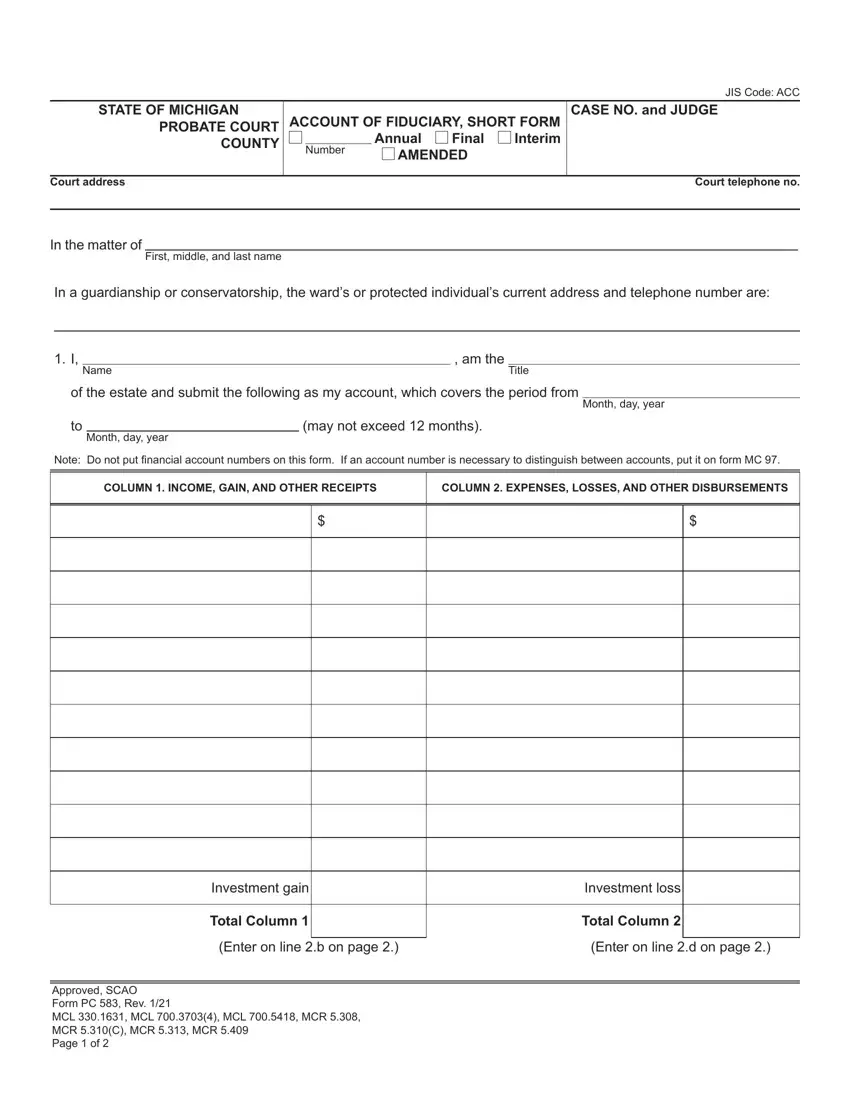

Fill out the account of fiduciary form PDF and provide the content for every area:

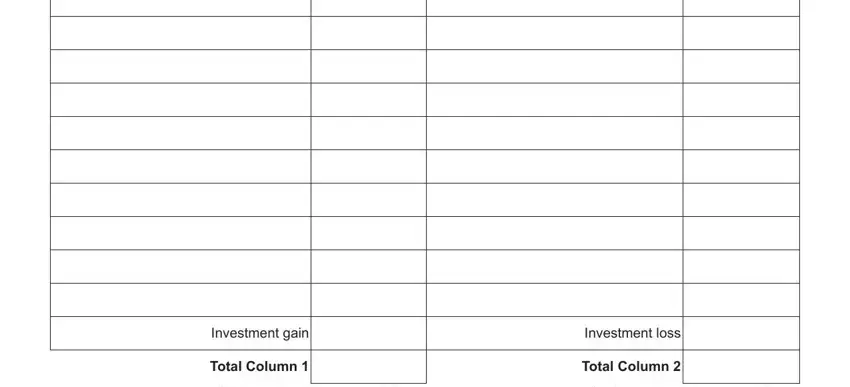

Type in the required particulars in the space Investment gain, Total Column, Investment loss, and Total Column.

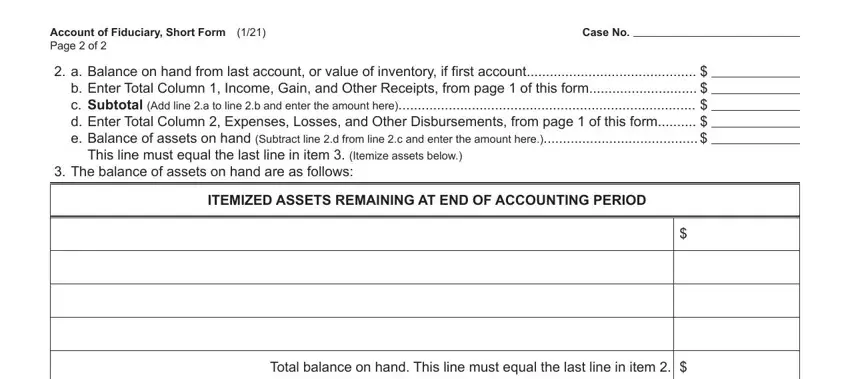

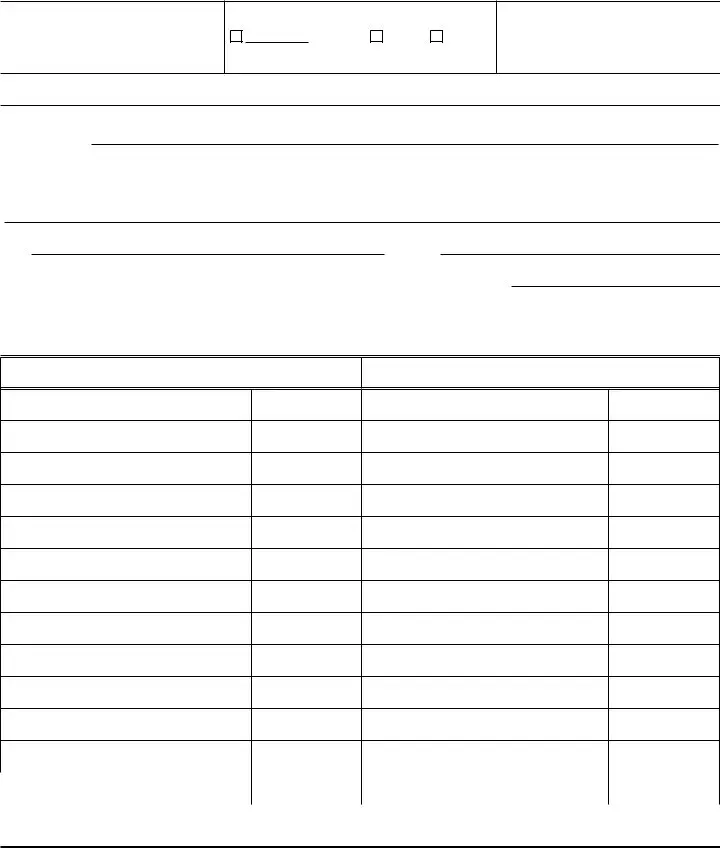

The application will ask you to give some key info to easily fill out the area Account of Fiduciary Short Form, Case No, a Balance on hand from last, This line must equal the last line, The balance of assets on hand are, ITEMIZED ASSETS REMAINING AT END, and Total balance on hand This line.

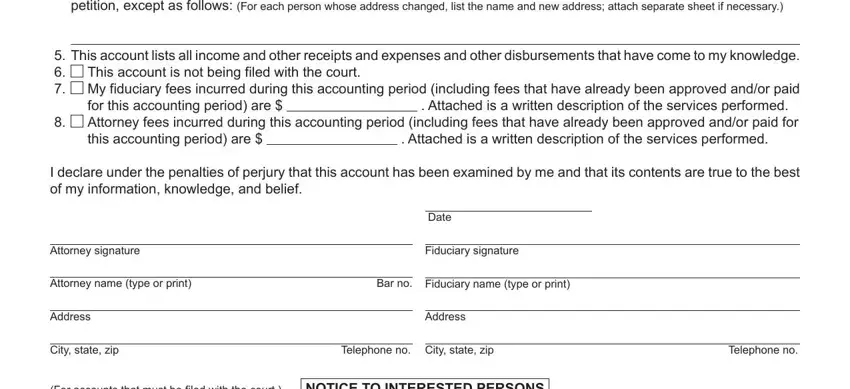

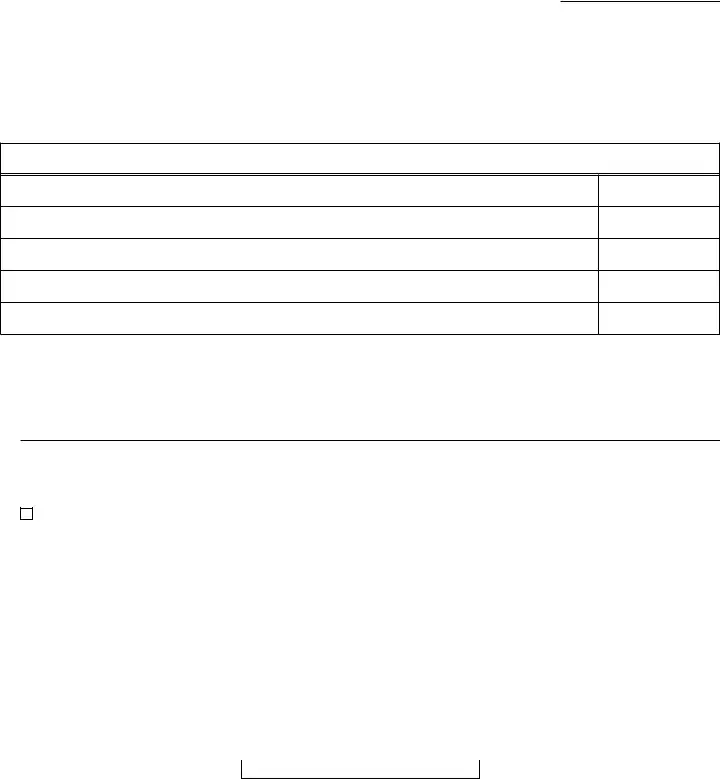

The NOTE In guardianships and, This account lists all income and, This account is not being filed, for this accounting period are, Attached is a written description, Attorney fees incurred during this, this accounting period are, Attached is a written description, I declare under the penalties of, Attorney signature, Date, Fiduciary signature, Attorney name type or print Bar no, Fiduciary name type or print, and Address space is the place where all sides can indicate their rights and responsibilities.

Step 3: After you choose the Done button, your ready form can be easily transferred to any of your devices or to email chosen by you.

Step 4: To prevent any sort of risks in the long run, be sure to have as much as several duplicates of your file.

AMENDED

AMENDED

This account is not being filed with the court.

This account is not being filed with the court. My fiduciary fees incurred during this accounting period (including fees that have already been approved and/or paid

My fiduciary fees incurred during this accounting period (including fees that have already been approved and/or paid