|

For official use only: |

|

|

|

|

Customer Name |

|

Customer No. |

|

|

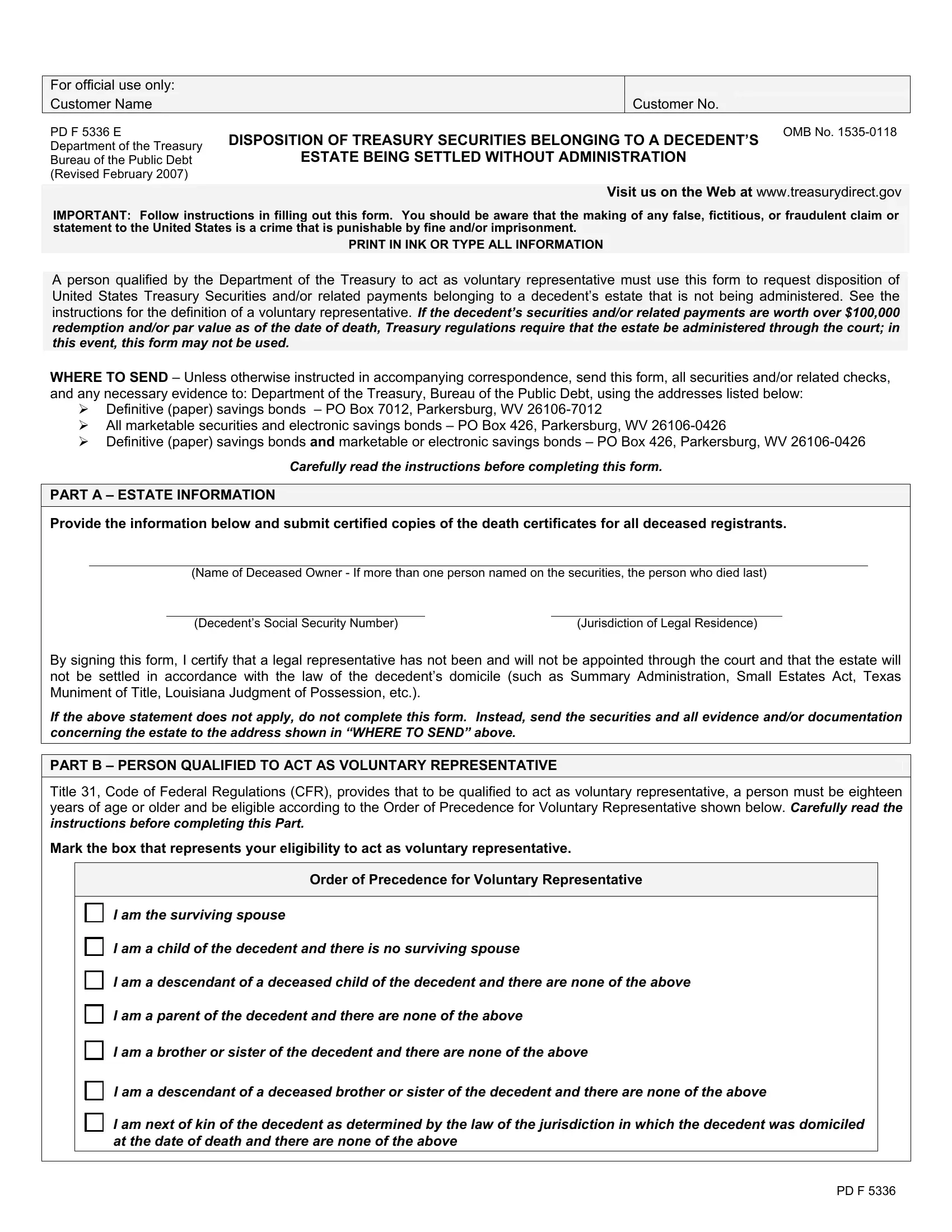

PD F 5336 E |

DISPOSITION OF TREASURY SECURITIES BELONGING TO A DECEDENT’S |

OMB No. 1535-0118 |

|

Department of the Treasury |

|

|

ESTATE BEING SETTLED WITHOUT ADMINISTRATION |

|

|

Bureau of the Public Debt |

|

(Revised February 2007)

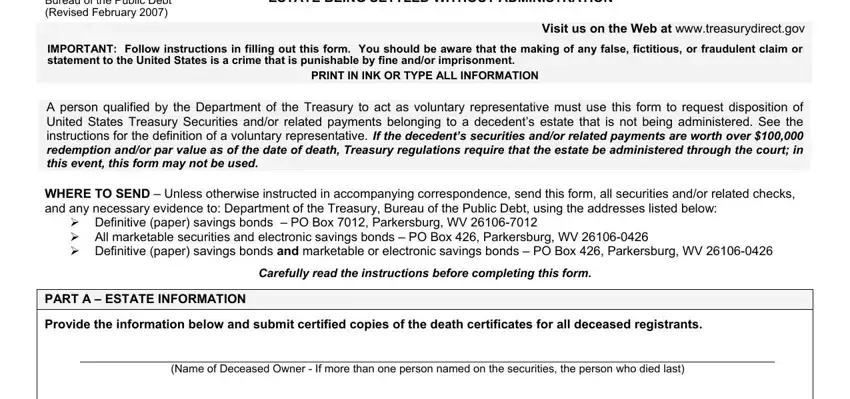

Visit us on the Web at www.treasurydirect.gov

IMPORTANT: Follow instructions in filling out this form. You should be aware that the making of any false, fictitious, or fraudulent claim or statement to the United States is a crime that is punishable by fine and/or imprisonment.

PRINT IN INK OR TYPE ALL INFORMATION

A person qualified by the Department of the Treasury to act as voluntary representative must use this form to request disposition of United States Treasury Securities and/or related payments belonging to a decedent’s estate that is not being administered. See the instructions for the definition of a voluntary representative. If the decedent’s securities and/or related payments are worth over $100,000 redemption and/or par value as of the date of death, Treasury regulations require that the estate be administered through the court; in this event, this form may not be used.

WHERE TO SEND – Unless otherwise instructed in accompanying correspondence, send this form, all securities and/or related checks, and any necessary evidence to: Department of the Treasury, Bureau of the Public Debt, using the addresses listed below:

Definitive (paper) savings bonds – PO Box 7012, Parkersburg, WV 26106-7012

All marketable securities and electronic savings bonds – PO Box 426, Parkersburg, WV 26106-0426

Definitive (paper) savings bonds and marketable or electronic savings bonds – PO Box 426, Parkersburg, WV 26106-0426

Carefully read the instructions before completing this form.

PART A – ESTATE INFORMATION

Provide the information below and submit certified copies of the death certificates for all deceased registrants.

(Name of Deceased Owner - If more than one person named on the securities, the person who died last)

(Decedent’s Social Security Number) |

(Jurisdiction of Legal Residence) |

By signing this form, I certify that a legal representative has not been and will not be appointed through the court and that the estate will not be settled in accordance with the law of the decedent’s domicile (such as Summary Administration, Small Estates Act, Texas Muniment of Title, Louisiana Judgment of Possession, etc.).

If the above statement does not apply, do not complete this form. Instead, send the securities and all evidence and/or documentation concerning the estate to the address shown in “WHERE TO SEND” above.

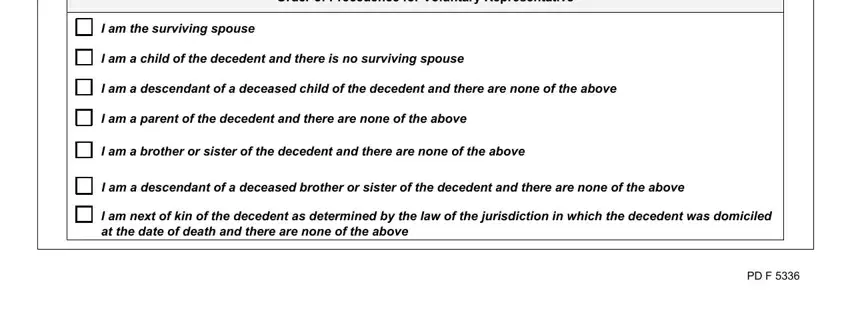

PART B – PERSON QUALIFIED TO ACT AS VOLUNTARY REPRESENTATIVE

Title 31, Code of Federal Regulations (CFR), provides that to be qualified to act as voluntary representative, a person must be eighteen years of age or older and be eligible according to the Order of Precedence for Voluntary Representative shown below. Carefully read the instructions before completing this Part.

Mark the box that represents your eligibility to act as voluntary representative.

Order of Precedence for Voluntary Representative

I am the surviving spouse

I am a child of the decedent and there is no surviving spouse

I am a descendant of a deceased child of the decedent and there are none of the above

I am a parent of the decedent and there are none of the above

I am a brother or sister of the decedent and there are none of the above

I am a descendant of a deceased brother or sister of the decedent and there are none of the above

I am next of kin of the decedent as determined by the law of the jurisdiction in which the decedent was domiciled at the date of death and there are none of the above

PD F 5336

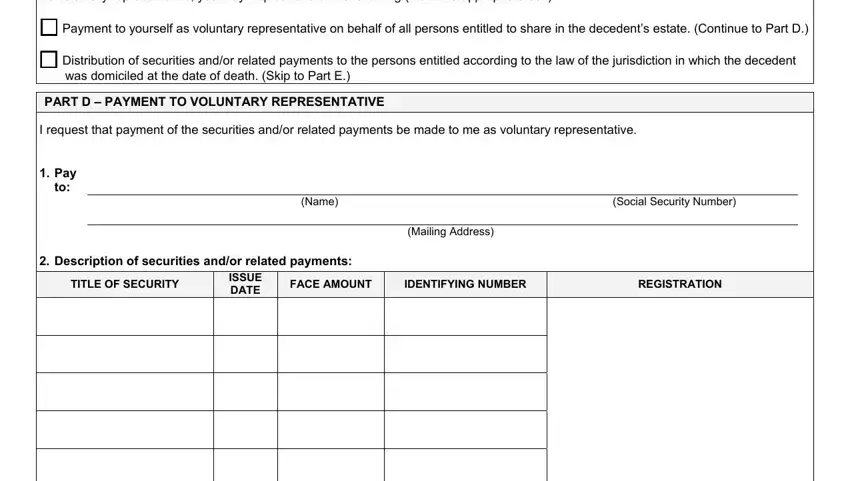

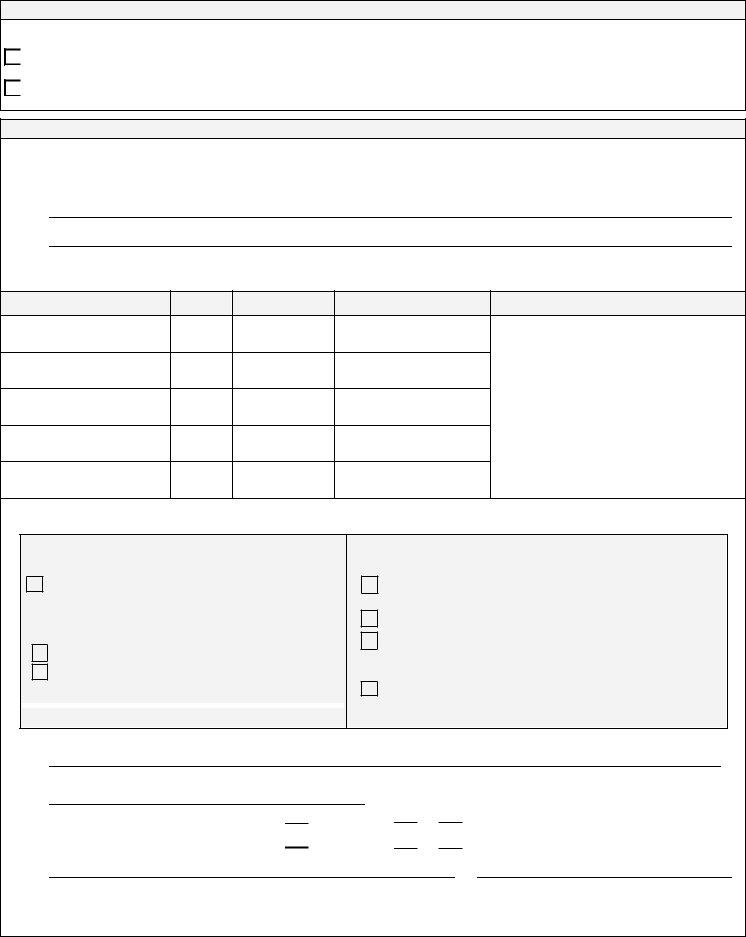

PART C – TYPE OF DISPOSITION

As voluntary representative, you may request one of the following (mark the appropriate box):

Payment to yourself as voluntary representative on behalf of all persons entitled to share in the decedent’s estate. (Continue to Part D.)

Distribution of securities and/or related payments to the persons entitled according to the law of the jurisdiction in which the decedent was domiciled at the date of death. (Skip to Part E.)

PART D – PAYMENT TO VOLUNTARY REPRESENTATIVE

I request that payment of the securities and/or related payments be made to me as voluntary representative.

1.Pay to:

(Name) |

(Social Security Number) |

(Mailing Address)

2. Description of securities and/or related payments:

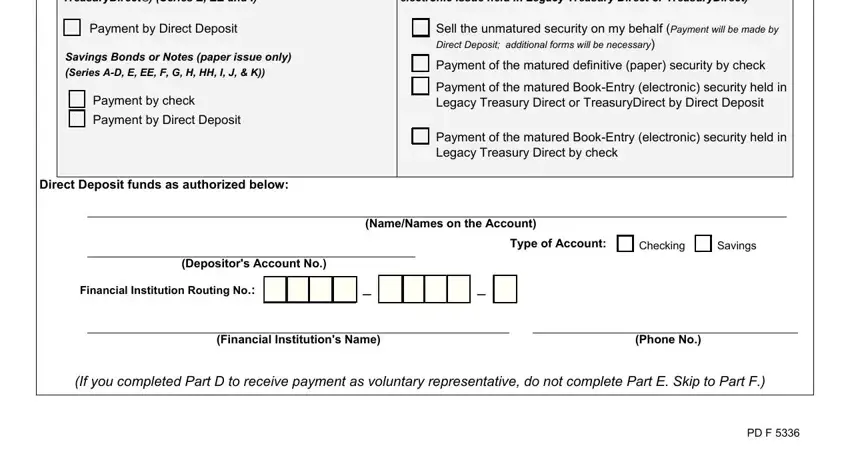

3. Mark the box for the particular type of security involved:

Book-Entry Savings Bonds (electronic issue held in TreasuryDirect®) (Series E, EE and I)

Payment by Direct Deposit

Savings Bonds or Notes (paper issue only)

(Series A-D, E, EE, F, G, H, HH, I, J, & K))

Payment by check

Payment by Direct Deposit

Marketable Treasury Bills, Notes, Bonds, and TIPS (paper issue or electronic issue held in Legacy Treasury Direct or TreasuryDirect)

Sell the unmatured security on my behalf (Payment will be made by Direct Deposit; additional forms will be necessary)

Payment of the matured definitive (paper) security by check

Payment of the matured Book-Entry (electronic) security held in Legacy Treasury Direct or TreasuryDirect by Direct Deposit

Payment of the matured Book-Entry (electronic) security held in Legacy Treasury Direct by check

Direct Deposit funds as authorized below:

(Name/Names on the Account)

Type of Account: |

|

Checking |

|

Savings |

(Depositor's Account No.)

Financial Institution Routing No.:

(Financial Institution's Name) |

(Phone No.) |

(If you completed Part D to receive payment as voluntary representative, do not complete Part E. Skip to Part F.)

PD F 5336

PART E – DISTRIBUTION OF SECURITIES AND/OR RELATED PAYMENTS TO PERSON ENTITLED

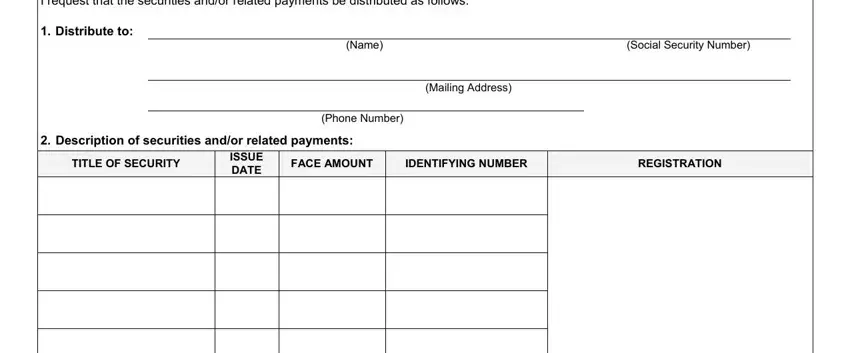

I request that the securities and/or related payments be distributed as follows:

1. Distribute to:

(Name) |

(Social Security Number) |

(Mailing Address)

(Phone Number)

2. Description of securities and/or related payments:

3.Extent of distribution:

Amount, Fractional Share, or Percentage

PART E – DISTRIBUTION OF SECURITIES AND/OR RELATED PAYMENTS TO PERSON ENTITLED

I request that the securities and/or related payments be distributed as follows:

1. Distribute to:

(Name) |

(Social Security Number) |

(Mailing Address)

(Phone Number)

2. Description of securities and/or related payments:

3.Extent of distribution:

Amount, Fractional Share, or Percentage

PD F 5336

PART F - SIGNATURE AND CERTIFICATION

I certify under penalty of perjury that the information provided herein is true and correct to the best of my knowledge and belief and that I am eligible to act as voluntary representative. I further certify that I will distribute payment made to me as voluntary representative or that I am distributing the securities and/or related payments to the persons entitled by the law of the jurisdiction in which the decedent was domiciled at the date of death. The United States is not liable to any person for the improper distribution of payments or securities. Upon payment or distribution of the securities at my request as voluntary representative, the United States is released to the same extent as if it had paid or delivered to a representative of the estate appointed pursuant to the law of the jurisdiction in which the decedent was domiciled at the date of death.

I bind myself, my heirs, legatees, successors and assigns, jointly and severally, to hold the United States harmless on account of the transaction requested, to indemnify unconditionally and promptly repay the United States in the event of any loss which results from this request, including interest, administrative costs, and penalties. I consent to the release of any information regarding this transaction, including information contained in this application, to any party having an ownership or entitlement interest in the securities or payments.

You must wait until you are in the presence of a certifying officer to sign this form.

Sign Here: ⇒

(Applicant's Signature, As Voluntary Representative of the |

(Daytime Telephone Number) |

Decedent’s Estate) |

|

Address:

(Number and Street or Rural Route) |

(City) |

(State) |

(ZIP Code) |

E-Mail Address:

Certifying Officer - The individual must sign in your presence. You must complete the certification and affix your stamp or seal.

I CERTIFY that |

|

|

|

|

|

, whose identity is known or was |

proven to me, personally appeared before me this |

|

|

day of |

|

, |

|

, |

|

|

|

|

|

|

(Month) |

(Year) |

at |

|

|

, and signed this form. |

|

|

|

|

|

|

|

(City) |

(State) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Signature and Title of Certifying Officer) |

|

|

|

|

|

(OFFICIAL STAMP |

|

|

|

|

|

|

|

|

|

|

|

OR SEAL) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Number and Street or Rural Route) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(City) |

|

(State) |

(ZIP Code) |

PRIVACY ACT AND PAPERWORK REDUCTION ACT NOTICE

We’re asking for the information on this form to assist us in processing your securities transaction requests. Our authority comes from 31 U.S.C. Ch. 31 which authorizes the Treasury Department to borrow money to pay the public debt of the United States. Also, 26 U.S.C. 6109 requires us to use your SSN on certain forms when we report taxable income to IRS. It’s voluntary that you provide the requested information, but without it, we may not be able to process your transaction requests. Information concerning your securities holdings and transactions is considered confidential under Treasury regulations (31 CFR Part 323) and the Privacy Act. However, the following routine uses of this information may include disclosure to the following persons or entities: agents and contractors who help us manage the public debt; others entitled to the securities or payment; agencies (including disclosure through approved computer matches) determining eligibility for benefits, finding persons we’ve lost contact with, or helping us collect debts; agencies for investigations or prosecutions; courts, counsel, and others for litigation and other proceedings; a Congressional office asking on your behalf; and as otherwise authorized by law.

We estimate it will take you about 30 minutes to complete this form. However, you are not required to provide information requested unless a valid OMB control number is displayed on the form. Any comments or suggestions regarding this form should be sent to the Bureau of the Public Debt, Forms Management Officer, Parkersburg, WV 26106-1328. DO NOT SEND completed form to the above address; send to the address shown in the instructions.

PD F 5336

INSTRUCTIONS

USE OF FORM – A voluntary representative is a person qualified by the Department of the Treasury to request disposition of United States Treasury Securities (Treasury Bills, Notes, Bonds, TIPS, Savings Bonds and Savings Notes) and/or related payments (not exceeding $100,000) that belong to a decedent’s estate if the estate is not being administered through the court. A voluntary representative of the decedent’s estate must complete this form to request:

Payment on behalf of persons entitled to the estate according to the law of the jurisdiction in which the decedent was domiciled at the date of death, or

Distribution of the securities to the persons entitled to the estate according to the law of the jurisdiction in which the decedent was domiciled at the date of death.

If more space is needed for any item, use a plain sheet of paper or make photocopies, as necessary, and attach to the form.

All securities belonging to the decedent’s estate must be included in this transaction. If the redemption and/or par value of all securities and/or related payments owned by the decedent as of the date of death exceeds $100,000, Treasury regulations require that the estate be administered through the court; in this event, this form may not be used.

PART A – ESTATE INFORMATION

Provide the requested information regarding the decedent. If more than one deceased person is named on the securities, provide the information for the person who died last. Submit certified copies of the death certificates for all deceased

registrants.

Insert the following information:

Decedent’s name

Decedent’s social security number

Jurisdiction (state, district, or territory) of decedent’s last legal residence

By signing this form you certify that the decedent’s estate has not been and will not be administered through a court or settled in accordance with the law of the decedent’s domicile (such as Summary Administration, Small Estates Act, Texas Muniment of Title, Louisiana Judgment of Possession, etc.). If a legal representative has been appointed by the court, if the estate has been administered and is now closed, or if you have a document establishing entitlement to the estate (other than an unprobated will), do not complete this form. Instead, send the securities and all evidence and/or documentation concerning the estate to the address shown in “WHERE TO SEND” on the last page of these instructions. Upon review of the submission, we will provide additional instructions, if necessary.

PART B – PERSON QUALIFIED TO ACT AS VOLUNTARY REPRESENTATIVE

Title 31, Code of Federal Regulations (CFR), provides that disposition of a decedent’s estate that is not being administered through the court will be made upon the request of a person qualified to act as voluntary representative. To act as voluntary representative, you must be eighteen years of age or older and be eligible according to the Order of Precedence for Voluntary Representative.

Starting at the top, read down the Order of Precedence until you find the situation that applies to you. Mark the box that represents your eligibility to act as voluntary representative. For example, if the decedent leaves a surviving spouse and children (over the age of eighteen), the surviving spouse must complete this form. If there is no surviving spouse, one of the children (over the age of eighteen) must complete this form.

PART C – TYPE OF DISPOSITION

Title 31, Code of Federal Regulations (CFR), provides that a voluntary representative may request one of the following: Payment to the voluntary representative on behalf of all persons entitled to share in the decedent’s estate.

Distribution of securities and/or related payments to the persons entitled according to the law of the jurisdiction in which the decedent was domiciled at the date of death.

Mark the appropriate box. If you are requesting payment, continue to Part D. If you are requesting distribution, skip Part D and continue to Part E.

PD F 5336

PART D – PAYMENT TO VOLUNTARY REPRESENTATIVE

Complete this part to receive payment as voluntary representative.

A person acting as voluntary representative who receives payment of securities and/or related payments warrants, certifies, and unconditionally guarantees that he/she will make distribution of the proceeds to the persons entitled by the law of the decedent's domicile at the date of death. Payment to a voluntary representative is for the convenience of the United States and does not determine ownership of the securities or their proceeds.

1.Provide your name, social security number, and mailing address.

Note: Your social security number may be used to report all of the interest earned to the Internal Revenue Service for Federal income tax purposes. For Federal income tax information, see IRS Publication 550 or contact the IRS or your tax advisor.

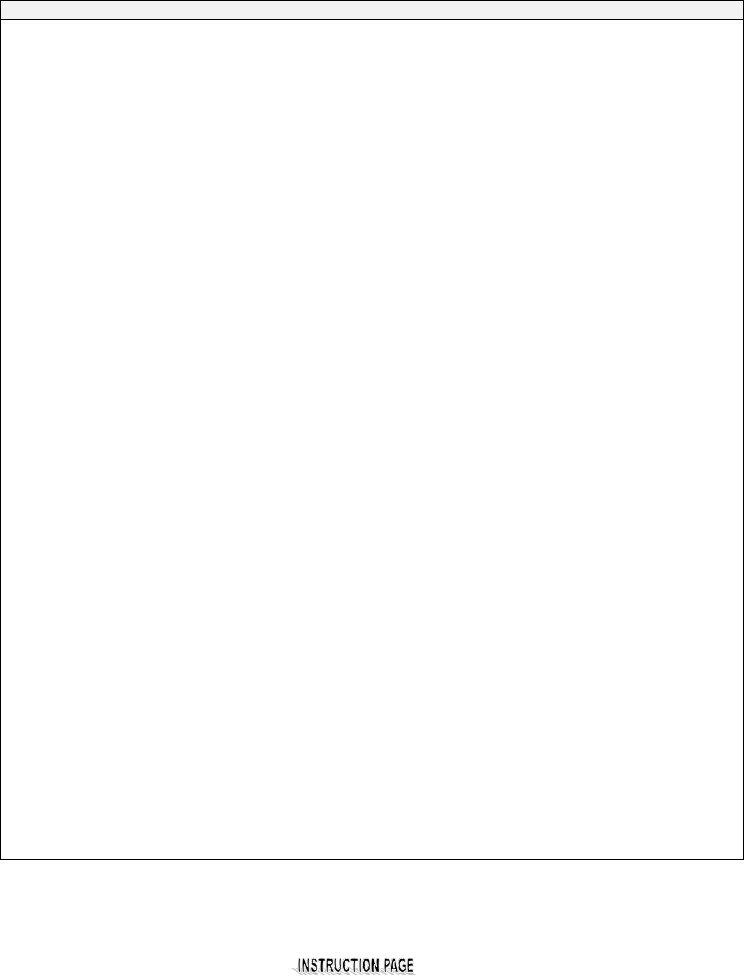

2.Describe the securities and/or checks:

TITLE OF SECURITY – Identify each security by series, interest rate, type, CUSIP, and call and maturity date, as appropriate. If describing a check, insert the word “check.”

ISSUE DATE – Provide the issue date of each security or check.

FACE AMOUNT – Provide the face amount (par or denomination) of each security or check.

IDENTIFYING NUMBER (if applicable) – Provide the serial number of each security, the confirmation number, or the check number.

REGISTRATION – Provide the registration of each security, check, or account; also provide the account number, if any. Note: If the taxpayer identification number is included in the registration but is masked (i.e. ***-**-1234), please be sure to provide the entire number.

EXAMPLES:

|

TITLE OF SECURITY |

|

|

ISSUE |

|

|

FACE AMOUNT |

|

|

IDENTIFYING NUMBER |

|

|

REGISTRATION |

|

|

|

|

DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paper Marketable Security |

|

|

|

|

|

|

|

|

Serial # |

|

|

|

|

|

9 1/8 % TREASURY BOND OF |

|

|

|

|

|

|

|

|

|

|

JOHN DOE AND JANE DOE |

|

|

|

5/15/79 |

|

$5,000 |

|

123 |

|

|

|

|

2004-2009 MATURES 5/15/09 |

|

|

|

|

|

SSN 222-22-2222 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSIP 912810CG1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCT # 4800-123-1234 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Marketable Security |

|

2/5/04 |

|

$1,000 |

|

|

|

|

|

JOHN DOE |

|

|

CUSIP 912795QW4 |

|

|

|

|

|

|

|

SSN 222-22-2222 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Series I Savings Bond |

|

1/1/02 |

|

$100 |

|

|

Confirmation # |

|

|

ACCT # N-111-11-1111 |

|

|

SERIES I |

|

|

|

|

IAAAB |

|

|

JOHN DOE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN 222-22-2222 |

|

|

Paper Series EE Savings Bond |

|

|

|

|

|

|

|

|

Serial # |

|

|

|

|

|

7/99 |

|

$100 |

|

|

|

JOHN DOE |

|

|

SERIES EE |

|

|

|

C-123,456,789-EE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OR JANE DOE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check |

|

|

|

|

|

|

|

|

Check # |

|

|

|

|

|

|

7/26/04 |

|

$351.02 |

|

502123456 |

|

|

JOHN DOE |

|

|

CHECK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If unsure what to provide in each of the areas, furnish all identifying information in the space for REGISTRATION.

3.Mark the appropriate box indicating the method of payment for the particular type of security involved. Note: If securities are held in a TreasuryDirect account, payment must be made by Direct Deposit. Payment for matured electronic securities held in a Legacy Treasury Direct account may be made by check or Direct Deposit. The only payment option for matured definitive (paper) marketable securities is by check.

For payment by Direct Deposit, furnish the name(s) on the account, the account number, the type of account, and the financial institution's name, the routing/transit number that identifies the institution, and the institution's phone number. You may need to contact the financial institution to obtain the routing number.

(If you completed Part D to receive payment as voluntary representative, do not complete Part E. Skip to Part F.)

PD F 5336

PART E – DISTRIBUTION OF SECURITIES AND/OR RELATED PAYMENTS TO PERSON ENTITLED

Complete this part to distribute the securities and/or related payments to the persons entitled.

A person acting as voluntary representative who distributes securities and/or related payments warrants, certifies, and unconditionally guarantees that he/she is making distribution to the persons entitled by the law of the decedent's domicile at the date of death.

1.Enter the name, social security number, address, and phone number of only one distributee in each Part E, Item 1. (A separate Part E must be completed for each distributee.)

2.Describe only the securities and/or checks that the person shown in Item 1 is to receive, in whole or in part. See Item 2 in Part D for information on how to describe securities and/or checks.

3.Mark the box “In full” if the person listed in Item 1 is to receive the entire value of the securities and/or checks described in Item 2; or if the person listed in Item 1 is not to receive the entire value, mark the second box and provide the appropriate amount, fractional share, or percentage he/she is to receive.

In most cases, we will need additional forms and/or information from the distributee. If so, we may contact the distributee directly. If the transaction can be processed without additional forms or information from the distributee, we will send the securities and/or payments directly to the distributee.

Note: If the distributee wants payment of eligible paper:

Savings bonds or notes, he/she must complete the request on the reverse of the bond.

Marketable securities, the voluntary representative must complete the assignment on the reverse of the security and the distributee must complete IRS Form W-9.

Any interest that is or becomes due on securities belonging to the estate of the decedent will be paid to the person to whom the securities are distributed, unless otherwise requested.

PART F – SIGNATURES AND CERTIFICATIONS

SIGNATURES – The application must be signed in ink.

CERTIFICATION – You must appear before and establish identification to the satisfaction of an authorized certifying officer. The form must be signed in the officer’s presence. The certifying officer must affix the seal or stamp that is used when certifying requests for payment. Authorized certifying officers are available at most financial institutions, including credit unions.

ADDITIONAL REQUIREMENTS – The Commissioner of the Public Debt, as designee of the Secretary of the Treasury, reserves the right in any particular case to require the submission of additional evidence and/or the formal administration of the estate.

RETURN OF EVIDENCE – If you want the evidence submitted with this form returned to you, please provide a written request when you submit the form and evidence.

WHERE TO SEND – Unless otherwise instructed in accompanying correspondence, send this form, all securities and/or related checks, and any necessary evidence to: Department of the Treasury, Bureau of the Public Debt, using the addresses listed below:

Definitive (paper) savings bonds – PO Box 7012, Parkersburg, WV 26106-7012

All marketable securities and electronic savings bonds – PO Box 426, Parkersburg, WV 26106-0426

Definitive (paper) savings bonds and marketable or electronic savings bonds – PO Box 426, Parkersburg, WV 26106-0426

Note: You must use only one form and describe all of the securities.

PD F 5336