Navigating the complexities of financial disclosure in the public sphere brings us to the essential PDC Form F-1, also known as the Personal Financial Affairs Statement. Housed under the vigilant watch of the Public Disclosure Commission in Olympia, Washington, this form serves as a cornerstone for maintaining transparency and trust in the public sector. The crux of this document lies in its detailed compilation of an individual's personal finances, requiring a thorough declaration from incumbent elected officials, candidates, and appointed officials among others. By stipulating deadlines for different statuses—April 15 for incumbents and within two weeks for new candidates or appointees—it emphasizes timely accountability. From income sources and real estate interests to assets, investments, and debts, the form encompasses a comprehensive overview, ensuring that any potential conflicts of interest can be identified and addressed. Instructions within the form guide filers through the labyrinth of disclosure requirements, including the mandatory identification of immediate family members who play a significant part in the financial landscape of the filer. Additionally, the form prods into the filer’s engagement with entities by requiring disclosure of significant ownerships or positions held. Not just a formality, the F-1 mandates a reflection on the participation in proposing or challenging state legislation for personal compensation, capturing any outside influence on policy-making. Concluding with a certification of the veracity of the information provided, under the stern warning of perjury, the form underlines the gravity and legal implications of the submission process. This exhaustive approach not only fosters an environment of integrity within Washington's public offices but also fortifies the public's trust in their elected and appointed officials.

| Question | Answer |

|---|---|

| Form Name | Pdc Form F 1 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | RM, officeholders, FILER, Divested |

PUBLIC |

DISCLOSURE COMMISSION |

|

PDC FORM |

|

|

|

|

|

|

|

|

P |

M PDC OFFICE USE |

|||||||||||

|

711 CAPITOL WAY RM 206 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

PERSONAL FINANCIAL |

O |

A |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

PO BOX 40908 |

|

|

|

S |

R |

||||||||||||||||||

|

OLYMPIA WA |

|

|

|

AFFAIRS STATEMENT |

T |

K |

|||||||||||||||||

|

(360) |

|

|

|

|

|

|

(2/07) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOLL FREE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Refer to instruction manual for detailed assistance and examples. |

|

|

|

|

DOLLAR |

|

|

|

|

|

R |

|

|

|

|

|

||||||||

|

|

|

|

CODE |

AMOUNT |

E |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

A |

$1 to $2,999 |

C |

|

|

|

|

|

|||||

Deadlines: |

Incumbent elected and appointed officials |

|

|

E |

|

|

|

|

|

|||||||||||||||

|

Candidates and others |

|

|

B |

$3,000 to $14,999 |

I |

|

|

|

|

|

|||||||||||||

|

candidate or being newly appointed to a position. |

|

|

|

|

C |

$15,000 to $29,999 |

V |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

D |

$30,000 to $74,999 |

E |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|||||||

SEND REPORT TO PUBLIC DISCLOSURE COMMISSION |

|

|

|

|

E |

$75,000 or more |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Last Name |

First |

|

Middle Initial |

Names of immediate family members. If there is no |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

reportable information to disclose for dependent children, or |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

other dependents living in your household, do not identify |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

them. Do identify your spouse. See |

|||||||||||

Mailing Address (Use PO Box or Work Address) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

City |

County |

|

Zip + 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Filing Status (Check only one box.) |

|

|

|

|

|

|

Office Held or Sought |

|

|

|

|

|

|

|

||||||||||

An elected or state appointed official filing annual report |

|

|

|

|

|

|

Office title: |

|

|

|

|

|

|

|

||||||||||

Final report as an elected official. Term expired: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

County, city, district or agency of the office, |

||||||||||||||||||

Candidate running in an election: month |

|

|

|

year |

|

|

|

|||||||||||||||||

|

|

|

name and number: |

|

|

|

|

|

|

|

||||||||||||||

Newly appointed to an elective office |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

Position number: |

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Newly appointed to a state appointive office |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

Term begins: |

|

|

ends: |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Professional staff of the Governor’s Office and the Legislature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

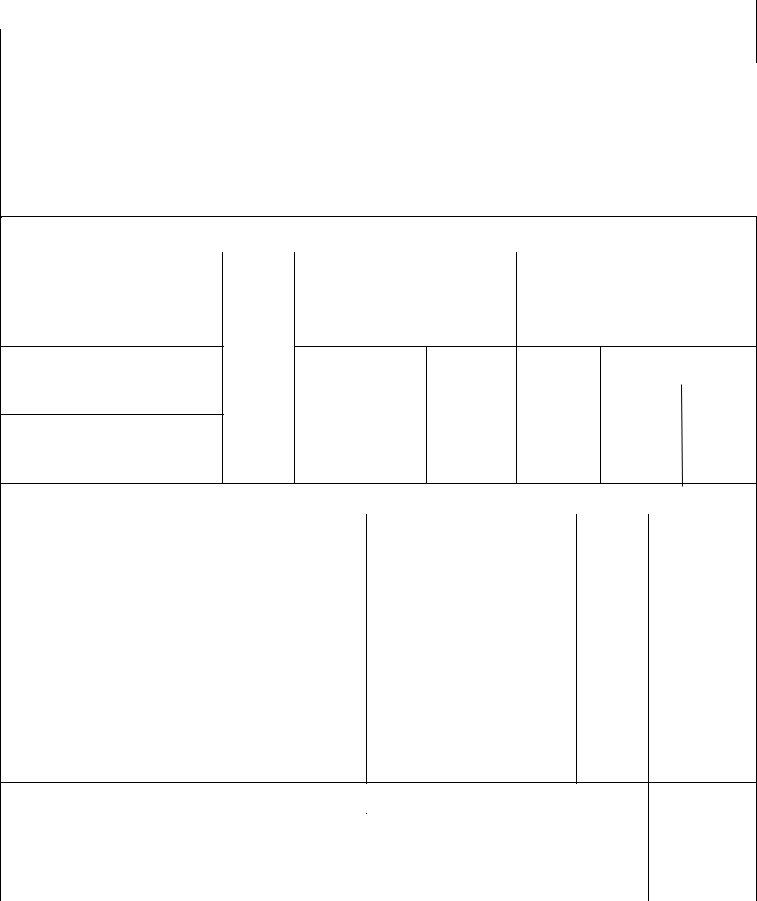

Show Self (S)

Spouse (SP)

Dependent (D)

List each employer, or other source of income (pension, social security, legal judgment, etc.) from which you or a family

INCOME |

member received $1,500 or more during the period. (Report interest and dividends in Item 3 on reverse) |

||

|

|||

|

|

|

|

Name and Address of Employer or Source of Compensation |

Occupation or How Compensation |

Amount: |

|

|

|

Was Earned |

(Use Code) |

Check Here

if continued on attached sheet

2 |

|

List street address, assessor’s parcel number, or legal description AND county for each parcel of Washington |

||||||

REAL ESTATE |

real estate with value of over $7,500 in which you or a family member held a personal financial interest during the |

|||||||

|

|

reporting period. (Show partnership, company, etc. real estate on |

|

|

||||

Property Sold or Interest Divested |

|

Assessed |

Name and Address of Purchaser |

Nature and Amount (Use Code) of Payment or |

||||

|

|

|

Value |

|

|

Consideration Received |

|

|

|

|

|

(Use Code) |

|

|

|

|

|

|

|

|

|

|

|

|

||

Property Purchased or Interest Acquired |

|

Creditor’s Name/Address |

Payment Terms |

Security Given |

Mortgage Amount - (Use Code) |

|||

|

|

|

|

|

|

|

Original |

Current |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

All Other Property Entirely or Partially Owned |

|

|

|

|

|

|

||

Check here |

if continued on attached sheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

CONTINUE ON NEXT PAGE

3 |

ASSETS / INVESTMENTS - INTEREST / DIVIDENDS |

List bank and savings accounts, insurance policies, stock, bonds and other |

|||||||

intangible property held during the reporting period. |

|

|

|||||||

A. |

Name and address of each bank or financial institution in which you |

Type of Account or Description of Asset |

Asset Value |

Income Amount |

|||||

|

or a family member had an account over $15,000 any time during the |

|

|

(Use Code) |

(Use Code) |

||||

|

report period. |

|

|

|

|

|

|

|

|

B. Name and address of each insurance company where you or a family |

|

|

|

|

|

||||

|

member had a policy with a cash or loan value over $15,000 during |

|

|

|

|

|

|||

|

the period. |

|

|

|

|

|

|

|

|

C. Name |

and address of each company, association, government |

|

|

|

|

|

|||

|

agency, etc. in which you or a family member owned or had a |

|

|

|

|

|

|||

|

financial interest worth over $1,500. Include stocks, bonds, |

|

|

|

|

|

|||

|

ownership, retirement plan, IRA, notes, and other intangible property. |

|

|

|

|

|

|||

Check here |

if continued on attached sheet. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

4 |

CREDITORS |

List each creditor you or a family member owed $1,500 or more any time during the period. |

AMOUNT |

||||||

Don’t include retail charge accounts, credit cards, or mortgages or real estate reported in Item 2. |

(USE CODE) |

||||||||

|

|

|

Creditor’s Name and Address |

|

Terms of Payment |

Security Given |

Original |

Present |

|

Check here |

if continued on attached sheet. |

|

|

|

|

|

|

||

|

|

|

|

|

|

||||

5 |

All filers answer questions A thru D below. If the answer is YES to any of these questions, the |

||||||||

part of this report. If all answers are NO and you are a candidate for state or local office, an appointee to a vacant elective office, or a state |

|||||||||

executive officer filing your initial report, no

Incumbent elected officials and state executive officers filing an annual financial affairs report also must answer question E. An

A.At any time during the reporting period were you, your spouse or dependents (1) an officer, director, general partner or trustee of any corporation, company, union, association, joint venture or other entity or (2) a partner or member of any limited partnership, limited liability partnership, limited liability company or similar entity including but not limited to a professional limited liability company? __ If yes, complete Supplement, Part A.

B.Did you, your spouse or dependents have an ownership of 10% or more in any company, corporation, partnership, joint venture or other business at any time during the reporting period? __ If yes, complete Supplement, Part A.

C.Did you, your spouse or dependents own a business at any time during the reporting period? __ If yes, complete Supplement, Part A.

D.Did you, your spouse or dependents prepare, promote or oppose state legislation, rules, rates or standards for current or deferred compensation (other than pay for a

E.Only for Persons Filing Annual Report. Regarding the receipt of items not provided or paid for by your governmental agency during the previous calendar year: 1) Did you, your spouse or dependents (or any combination thereof) accept a gift of food or beverages costing over $50 per occasion? __ or 2) Did any source other than your governmental agency provide or pay in whole or in part for you, your spouse and/or dependents to travel or to attend a seminar or other training? __ If yes to either or both questions, complete Supplement, Part C.

ALL FILERS EXCEPT CANDIDATES. Check the appropriate box.

I hold a state elected office, am an executive state officer or professional staff. I have read and am familiar with RCW 42.52.180 regarding the use of public resources in campaigns.

I hold a local elected office. I have read and am familiar with RCW 42.17.130 regarding the use of public facilities in campaigns.

CERTIFICATION: I certify under penalty of perjury that the information contained in this report is true and correct to the best of my knowledge.

Signature |

Date |

||

Contact Telephone: ( |

) |

|

|

Email: |

|

|

(work) |

Email: |

|

|

(Home) |

REPORT NOT ACCEPTABLE WITHOUT FILER’S SIGNATURE

Information Continued |

|

Name |

|

|

|

1

Show Self (S)

Spouse (SP)

Dependent (D)

INCOME |

(continued) |

|

|

|

|

|

|

Name and Address of Employer or Source of Compensation |

Occupation or How Compensation |

Amount: |

|

|

|

Was Earned |

(Use Code) |

|

|

|

|

2 |

REAL ESTATE |

(continued) |

|

|

|

|

|

|

|

Property Sold or Interest Divested |

Assessed |

Name and Address of Purchaser |

Nature and Amount (Use Code) of Payment or |

|

|

|

Value |

|

Consideration Received |

|

|

(Use Code) |

|

|

Property Purchased or Interest Acquired

Creditor’s Name/Address |

Payment Terms |

Security Given |

Mortgage Amount - (Use Code) |

|

|

|

|

Original |

Current |

All Other Property Entirely or Partially Owned

3 |

ASSETS / INVESTMENTS - INTEREST / DIVIDENDS |

(continued) |

|

|

|

|

|

||

A. |

Name and address of each bank or financial institution |

Type of Account or Description of Asset |

Asset Value |

Income Amount |

|

|

|

(Use Code) |

(Use Code) |

B.Name and address of each insurance company

C.Name and address of each company, association, government agency

4 |

CREDITORS |

(continued) |

|

|

AMOUNT |

|

|

|

(USE CODE) |

||||

|

|

|

||||

|

|

Creditor’s Name and Address |

Terms of Payment |

Security Given |

Original |

Present |

|

|

|

|

|

|

|