peconic bay region preservation fund can be completed online effortlessly. Simply make use of FormsPal PDF tool to perform the job fast. FormsPal is committed to providing you with the ideal experience with our editor by consistently introducing new features and enhancements. Our tool is now even more user-friendly with the most recent updates! So now, working with documents is simpler and faster than ever. Here's what you'd need to do to begin:

Step 1: Just hit the "Get Form Button" above on this page to start up our pdf form editor. There you'll find all that is necessary to fill out your file.

Step 2: This tool provides you with the capability to modify almost all PDF documents in many different ways. Transform it by adding your own text, correct original content, and place in a signature - all at your convenience!

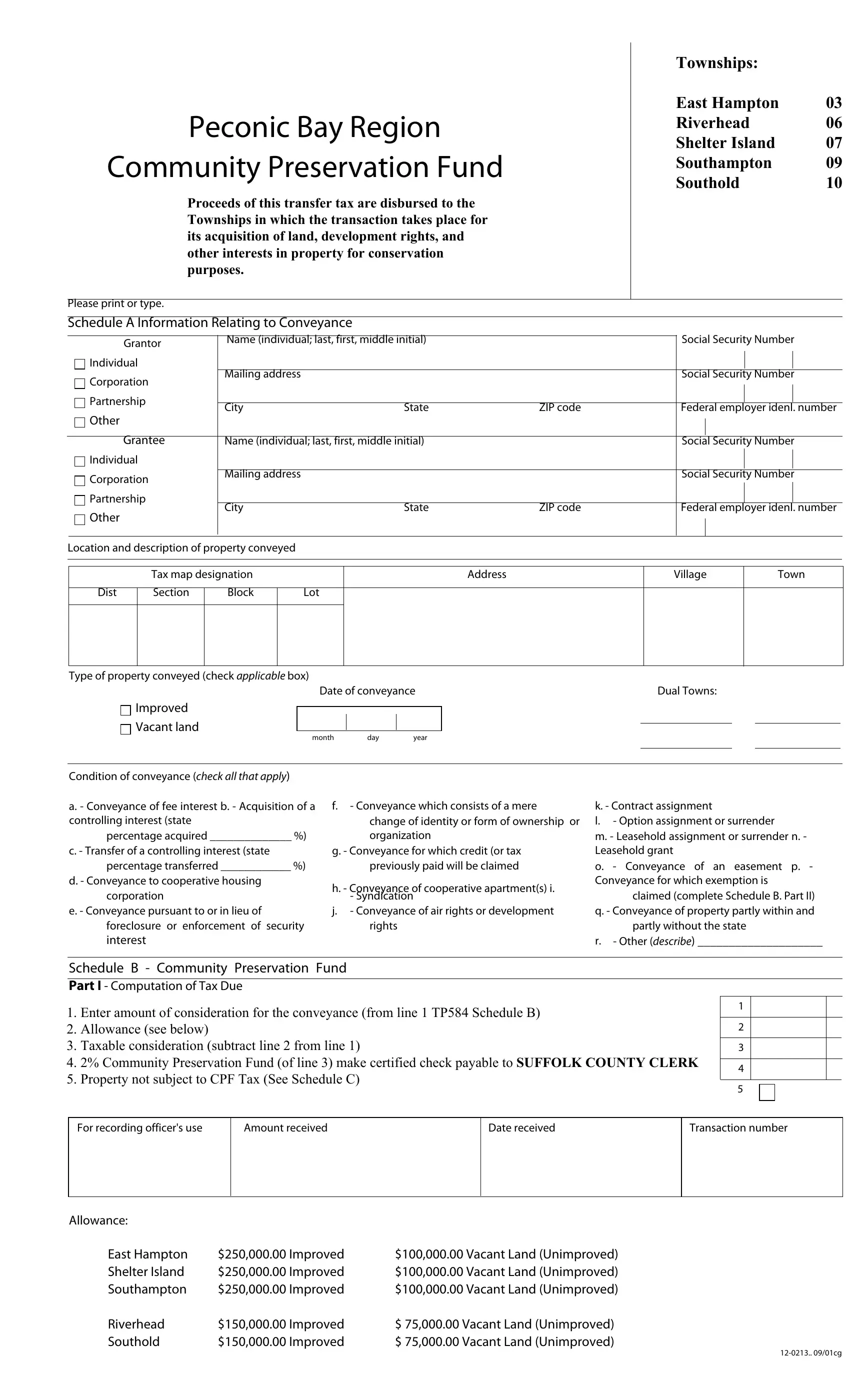

With regards to the blanks of this specific form, here is what you need to know:

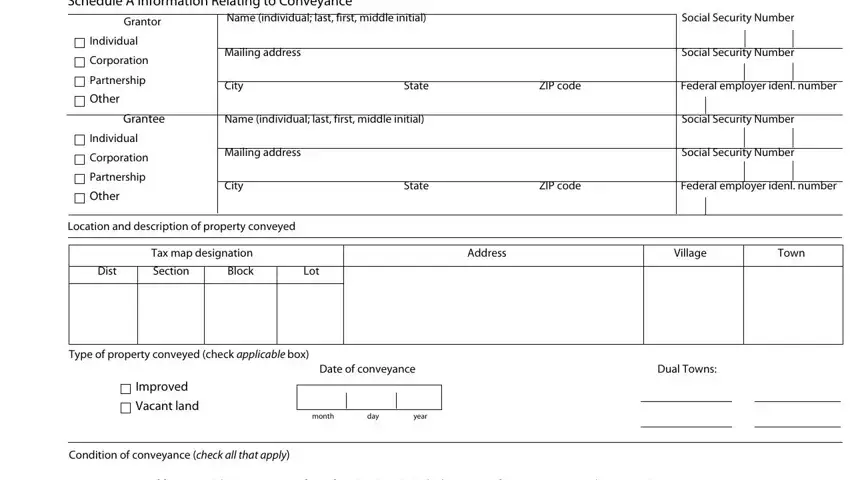

1. The peconic bay region preservation fund usually requires certain information to be inserted. Make certain the following blank fields are completed:

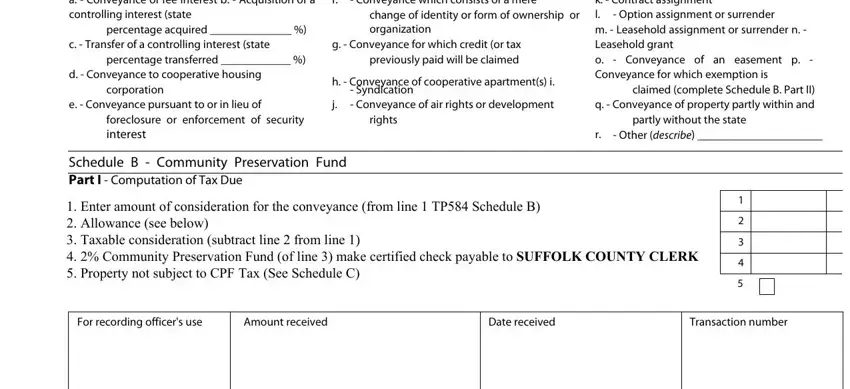

2. Once your current task is complete, take the next step – fill out all of these fields - a Conveyance of fee interest b, percentage acquired, c Transfer of a controlling, percentage transferred, d Conveyance to cooperative, corporation, e Conveyance pursuant to or in, foreclosure or enforcement of, rights, Schedule B Community Preservation, Conveyance which consists of a, change of identity or form of, g Conveyance for which credit or, h Conveyance of cooperative, and Syndication Conveyance of air with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

A lot of people generally get some things wrong while completing Conveyance which consists of a in this part. Be sure you re-examine what you type in here.

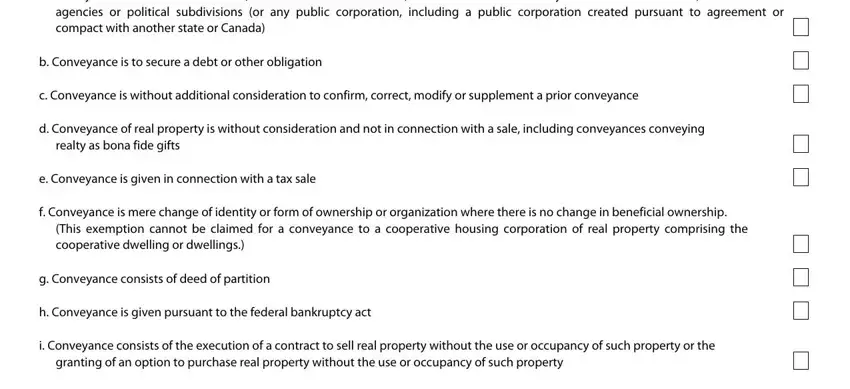

3. The following step is about a Conveyance is to the United, agencies or political subdivisions, b Conveyance is to secure a debt, c Conveyance is without additional, d Conveyance of real property is, realty as bona fide gifts, e Conveyance is given in, f Conveyance is mere change of, This exemption cannot be claimed, g Conveyance consists of deed of, h Conveyance is given pursuant to, i Conveyance consists of the, and granting of an option to purchase - complete all these fields.

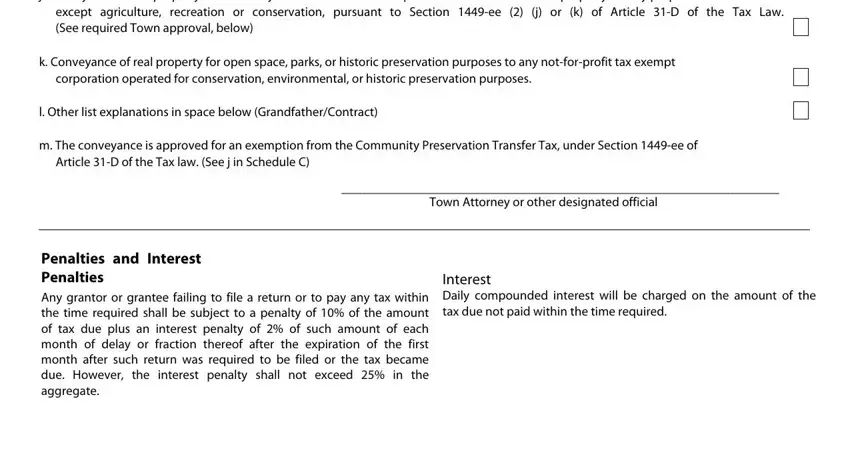

4. It is time to start working on this fourth part! Here you will have all of these j Conveyance or real property, except agriculture recreation or, k Conveyance of real property for, corporation operated for, l Other list explanations in space, m The conveyance is approved for, Article D of the Tax law See j in, Town Attorney or other designated, Penalties and Interest, Penalties, Any grantor or grantee failing to, and Interest Daily compounded interest blank fields to do.

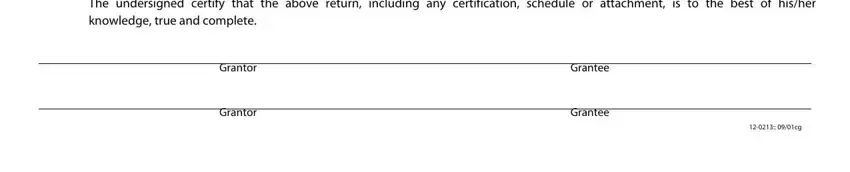

5. Lastly, the following last subsection is what you have to wrap up before using the PDF. The fields in this instance include the next: Signature sign The undersigned, Grantor, Grantor, Grantee, and Grantee.

Step 3: Right after rereading your form fields, hit "Done" and you're good to go! Go for a 7-day free trial account at FormsPal and acquire immediate access to peconic bay region preservation fund - readily available from your personal cabinet. At FormsPal.com, we do our utmost to make sure that your information is maintained private.