Navigating financial struggles, especially with mortgage repayments, can be a daunting prospect for any homeowner. In a concerted effort to support customers during such challenging times, Permanent TSB offers a comprehensive tool known as the Standard Financial Statement (SFS). The primary aim of the SFS is to provide a structured way for customers to present their financial situations accurately. This practice is fundamental in facilitating a mutual agreement on any alternative repayment arrangements that might be necessary. Acknowledging the seriousness of financial difficulties, Permanent TSB is committed to guiding customers throughout the process, advocating for open communication through various channels and ensuring access to trained personnel equipped to handle such sensitive circumstances. Customers are urged to meticulously document their income, expenses, debts, and assets within the SFS, including all basic living expenses and any applicable social welfare entitlements. Furthermore, the institution stresses the importance of submitting a thorough and accurate SFS accompanied by any relevant documentation to aid in the assessment of each individual case. Depending on this assessment, conducted by the Arrears Support Unit, a tailor-made alternative repayment plan may be devised to cater to the unique needs of the customer. In instances where an alternative arrangement cannot be offered, customers are provided with a written explanation and are informed of their right to appeal the decision, initially with Permanent TSB and subsequently with the Financial Services Ombudsman if needed. Additionally, support materials and advice from various sources, including independent agencies, are readily available to assist customers in navigating through this process.

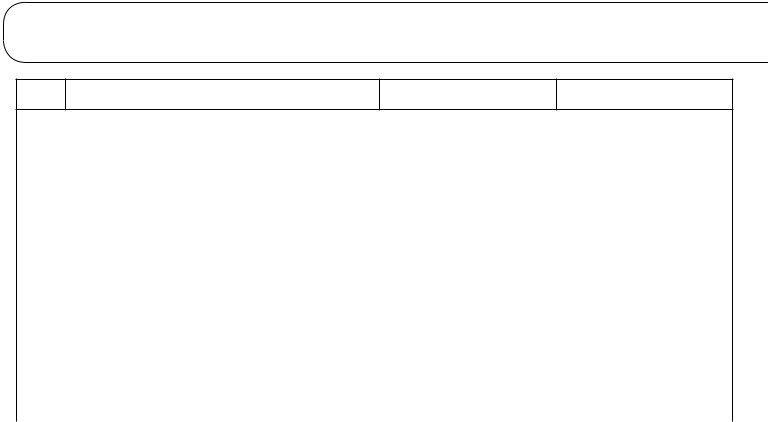

| Question | Answer |

|---|---|

| Form Name | Permanent Tsb Statement Form |

| Form Length | 12 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 3 min |

| Other names | permanent tsb e statement, permanent tsb standard financial statement, permanent tsb sfs form, permanent tsb bank statement |

Standard Financial Statement (SFS)

Guiding Principles for completing the SFS

1.We at permanent tsb are fully committed to working with customers who are in, or are facing, inancial dificulties with their mortgage repayments in order that a

2.We have

3.This Standard Financial Statement (SFS) is designed to assist you in setting out your current inancial circumstances.

4.We consider that the completion of the SFS is a serious undertaking and we will work with you to ensure that the information is accurate, enabling us to work with you to determine the most appropriate and viable option in each particular customer case.

5.The easiest way to see where you stand inancially is to gather all the relevant information and documents so that you can write down all the money you have coming in and going out each month and complete an SFS. (If your income is weekly, multiply it by 52 and divide the result by 12 to get your monthly income.)

6.In the SFS you will have to provide information on your current income, expenses and other amounts you owe and any assets you own. It is important that you include all of your basic living expenses. You are also encouraged to ensure that you are maximising your income, including what social welfare entitlements you may be eligible for such as Mortgage Interest Supplement (see www.keepingyourhome.ie).

7.It is important to ill out the SFS fully and accurately and to provide any relevant documentation that we may need to assess your situation; we will only seek information that is relevant to this assessment.

8.Your completed SFS and other factors relating to your case will be assessed by our Arrears Support Unit which will decide whether or not an alternative repayment arrangement is necessary and, if so, what type(s) of alternative repayment arrangement(s) appropriate to your circumstances can be made available.

9.If an alternative repayment arrangement is not offered to you, we will give you a reason for that decision in writing. You will have the right to appeal that decision; you may appeal to us initially and subsequently to the Financial Services Ombudsman.

10.If you require further information, you can avail of support material available through a number of sources including our website www.permanenttsb.ie, www.keepingyourhome.ie. You can also seek independent advice from MABS (www.mabs.ie) or an appropriate alternative. If you give us your written consent we will liaise with a third party, nominated by you, to act on your behalf.

1

Section A: Account & Borrower Details

|

Borrower Information |

Borrower 1 |

|

Borrower 2 |

|||

|

|

|

|

|

|

|

|

A1 |

Name |

|

|

|

|

||

|

|

|

|

|

|

|

|

A2 |

Mortgage Account Reference No.(s) |

|

|

|

|

||

|

|

|

|

|

|

|

|

A3 |

Outstanding Mortgage Balance (€) |

|

|

|

|

||

|

|

|

|

|

|

|

|

A4 |

Estimated Current Value of Primary Residence (€) |

|

|

|

|

||

|

|

|

|

|

|

|

|

A5 |

Monthly Mortgage Repayments Due (€) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Correspondence Address |

|

|

|

|

||

A6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property Address |

|

|

|

|

||

|

(if different to Correspondence Address) |

|

|

|

|

||

A7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please put tick beside preferred contact method |

|

|

|

|

||

|

|

|

|

|

|

|

|

A8 |

Home Telephone |

|

|

|

|

||

|

|

|

|

|

|

|

|

A9 |

Mobile |

|

|

|

|

||

|

|

|

|

|

|

|

|

A10 |

Work Telephone |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

A11 |

( *Any correspondence via email is not secure. We recommend |

|

|

|

|

||

|

that you indicate at least one other method of contact.) |

|

|

|

|

||

|

|

|

|

|

|

|

|

A12 |

Marital Status |

|

|

|

|

||

|

|

|

|

|

|||

A13 |

Date of birth |

DD/MM/YYYY |

|

DD/MM/YYYY |

|||

|

|

|

|

|

|

|

|

|

|

|

Child 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

No. and age of dependent children |

Child 2 |

|

|

|

|

|

A14 |

|

|

|

|

|

||

Child 3 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Child 4 |

|

|

|

|

|

|

|

|

|

|

|

|

A15 |

Total number in household |

|

|

|

|

||

|

|

|

|

|

|

|

|

A16 |

Employed Y/N; if |

|

|

|

|

||

|

|

|

|

|

|

|

|

A17 |

Occupation (if unemployed give previous occupation) |

|

|

|

|

||

|

|

|

|

|

|

|

|

A18 |

In Permanent employment Y/N |

|

|

|

|

||

|

|

|

|

|

|

|

|

A19 |

Name of Employer & Length of Service |

|

|

|

|

||

|

|

|

|

|

|

||

A20 |

Reason(s) for |

|

|

|

|

|

|

Review/Arrears |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

2

Section B: Your Monthly Income

|

Borrower Information |

Borrower 1 |

Borrower 2 |

Total |

||

|

|

|

|

|

|

|

|

Gross Monthly Salary |

|

|

|

|

|

B1 |

(before tax and any other |

|

|

|

|

|

|

deductions at source) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Monthly Salary |

|

|

|

|

|

B2 |

(after tax and any other deductions |

|

|

|

|

|

|

at source)¹ |

|

|

|

|

|

|

|

|

|

|

|

|

B3 |

Monthly Social Welfare Beneits |

|

|

|

|

|

Please list |

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

|

|

B3(a) |

Beneit- |

|

|

|

|

|

|

|

|

|

|

|

|

B3(b) |

Beneit- |

|

|

|

|

|

|

|

|

|

|

|

|

B3(c) |

Beneit- |

|

|

|

|

|

|

|

|

|

|

|

|

B4 |

Child Beneit |

|

|

|

|

|

|

|

|

|

|

|

|

B5 |

Mortgage Interest Supplement |

|

|

|

|

|

|

|

|

|

|

|

|

B6 |

Family Income Support |

|

|

|

|

|

|

|

|

|

|

|

|

B7 |

Maintenance |

|

|

|

|

|

|

|

|

|

|

|

|

B8 |

Other, e.g. Pension, room rent, |

|

|

|

|

|

grants (please specify) |

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Monthly Income from Property |

|

|

|

|

|

B9 |

assets (other than primary |

|

|

|

|

|

|

residence) (see E5) |

|

|

|

|

|

B10 |

Monthly income from |

|

|

|

|

|

assets (see F8) |

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

|

|

B11 |

Total Monthly Net Income |

|

|

|

G1 |

|

(sum of B2 to B10) |

|

|

|

|||

|

|

|

|

|

||

|

|

|

|

|

|

|

¹Do not include any deductions made from your salary at source (e.g., pension contribution, health insurance etc.) anywhere else on this form.

3

Section C: Monthly Household Expenditure

|

Utilities |

Average Charge ² |

Arrears |

|

(Where Applicable) |

||

|

|

|

|

|

|

|

|

C1 |

Electricity |

|

|

|

|

|

|

C2 |

Gas/Oil |

|

|

|

|

|

|

C3 |

Phone (Landline & Internet) ³ |

|

|

|

|

|

|

C4 |

TV/Cable 3 |

|

|

C5 |

Mobile Phone |

|

|

|

|

|

|

C6 |

Refuse Charges |

|

|

|

|

|

|

C7 |

TV Licence |

|

|

|

|

|

|

|

Household |

|

|

|

|

|

|

C8 |

Childcare |

|

|

|

|

|

|

C9 |

Elderly care (e.g., carer, nursing home fees, etc) |

|

|

|

|

|

|

C10 |

Food/Housekeeping/Personal Care |

|

|

|

|

|

|

C11 |

Clothing and Footwear |

|

|

|

|

|

|

C12 |

Household Repairs/Maintenance |

|

|

|

|

|

|

|

Transport Costs |

|

|

|

|

|

|

C13 |

Petrol |

|

|

|

|

|

|

C14 |

Motor Insurance /Tax/NCT |

|

|

|

|

|

|

C15 |

Rail/Bus/Taxi Costs (including school transport |

|

|

costs for children) |

|

|

|

|

|

|

|

C16 |

Car Maintenance/Repairs |

|

|

|

|

|

|

C17 |

Car Parking and Tolls |

|

|

|

|

|

|

|

Primary Residence |

|

|

|

|

|

|

C18 |

Mortgage Protection/Endowment Premium |

|

|

|

|

|

|

C19 |

Payment Protection |

|

|

|

|

|

|

C20 |

House Insurance |

|

|

|

|

|

|

|

Education |

|

|

|

|

|

|

C21 |

Books |

|

|

|

|

|

|

C22 |

School/ College Fees |

|

|

|

|

|

|

C23 |

Uniforms |

|

|

|

|

|

|

C24 |

Extra Curricular activities (e.g. school outings) |

|

|

|

|

|

|

²Average charge calculated by totalling last three utility bills and dividing by the number of months to get the average monthly cost.

³Please identify if these bills are bundled.

4

Section C: Monthly Household Expenditure

C25 Other (e.g. voluntary contributions)

|

Medical |

|

|

|

|

|

|

|

|

C26 |

Medical Expenses and Prescription Charges 4 |

|

|

|

C27 |

Health Insurance 5 |

|

|

|

|

|

|

|

|

|

Social |

|

|

|

|

|

|

|

|

C28 |

Lifestyle Expenses (e.g., family events, |

|

|

|

Christmas, Birthdays, eating out etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C29 |

Club membership |

|

|

|

|

|

|

|

|

C30 |

Other - please specify |

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

C31 |

Life Assurance |

|

|

|

|

|

|

|

|

C32 |

Pension Contribution 6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

C33 |

Maintenance paid to spouse/child (if applicable) |

|

|

|

|

|

|

|

|

C34 |

Rent |

|

|

|

|

|

|

|

|

C35 |

Property Service/Management Charges |

|

|

|

|

|

|

|

|

C35(b) |

Other - please specify |

|

|

|

|

|

|

|

|

C35(c) |

Other - please specify |

|

|

|

|

|

|

|

|

C36 |

Monthly expenditure on property assets (see E5) |

|

|

|

|

|

|

|

|

C37 |

Monthly Savings |

|

|

|

|

|

|

|

|

C38 |

Total Monthly Expenditure |

|

G2 |

|

(sum of C1 to C37) |

|

|

||

|

|

|

|

|

|

|

|

|

|

4Medical expenses include dentist, optician, and any other costs related to health.

5Do not include if Health Insurance is deducted from your wages at source, (i.e., if it has already been deducted from B2)

6Do not include if Pension Contribution is deducted from your wages at source, (i.e., if it has already been deducted from B2)

5

Please provide details of any steps you have already taken to reduce your monthly expenditure and the savings you have achieved:

Please provide details of any steps you propose to take to reduce your monthly expenditure and the savings you expect to achieve:

6

Section D: Your Current Monthly Debt Payments

|

|

Monthly Repayments |

|

|

Total |

|

|

|

|

Currently |

Payment |

||

|

Debt Type |

|

|

|

|

|

|

Protection |

|||||

|

|

|

|

|

Remaining |

Outstanding |

Arrears |

|

Purpose of |

Secured? |

Restructured? |

||

|

|

|

|

|

Lender |

Insurance? |

|||||||

|

Due € |

Being Paid € |

|

||||||||||

|

|

|

Term |

Balance € |

Balance € |

Loan |

Y/N |

Y/N |

|||||

|

|

|

Y/N |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D1 |

Mortgage for |

|

|

|

G4 |

|

|

|

|

|

|

|

|

Primary Residence |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D2 |

Court Mandated Debt 7 |

|

|

|

|

|

|

|

|

|

|

|

|

(please specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D3 |

Court Mandated Debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D4 |

Credit Union |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D5 |

Credit Union |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D6 |

Overdraft |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D7 |

Hire Purchase |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D8 |

Store Card |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D9 |

Catalogue Debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D10 |

Credit Card 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D11 |

Credit Card 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D12 |

Credit Card 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D13 |

Personal Loan 1 (please specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D14 |

Personal Loan 2 (please specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D15 |

Personal Loan 3 (please specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D16 |

Loans from family/friends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D17 |

Mortgage Debt on property other |

|

|

|

|

|

|

|

|

|

|

|

|

than primary residence (see E5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D18 |

Other Debt (please specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D19 |

Other Debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D22 |

Total Monthly Debt |

|

|

|

G5 |

|

|

|

|

|

|

|

|

(Sum of D2 to D21) |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 e.g., ines, instalment orders, judgements. |

7 |

Section E: Property Assets (other than Primary Residence)

|

Property |

|

|

|

|

|

Monthly |

|

Monthly Mortgage |

|

||

Property |

|

Current |

Loan |

Arrears |

Monthly |

Re- |

Payments |

For |

||||

Type |

Ownership |

Expenditure |

||||||||||

(give details |

Value |

Balance |

Balance |

Rental |

structured |

|

Lender |

Sale |

||||

(e.g. Buy to |

Type 8 |

(e.g., upkeep, |

|

|||||||||

below) |

(est) 9€ |

€ |

€ |

Income € |

Y/N |

|

|

Y/N |

||||

let) |

|

maintenance) |

Due € Being Paid € |

|||||||||

|

|

|

|

|

|

|

|

|||||

E1 1

E2 2

E3 3

E4 4

Total |

B |

C |

D |

|

9 |

36 |

17 |

||

|

||||

|

|

|

|

Property Assets (other than Primary Residence)

|

Property |

Address |

Date of |

|

Purchase |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

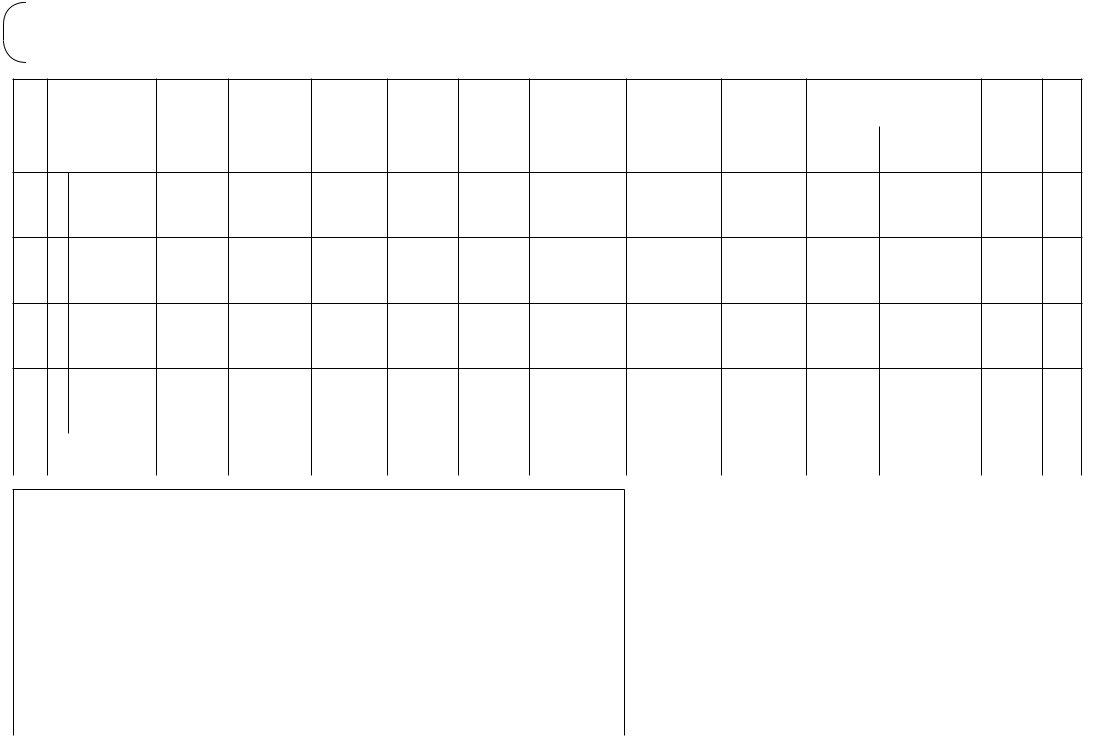

•Monthly income and expenditures related to property assets should also be included in sections B and C respectively

•Monthly mortgage repayments relating to property assets should be included in section D

8For example, sole or joint ownership. Where a property/ premises is not 100% owned by customer(s), please state the % amount that is owned.

9Please provide a reasonable estimate of the current value of these assets.

8

Section F:

|

|

Original |

Current |

Net Monthly |

|

Please Give Any |

|

Asset Type |

Estimated |

|

|||

|

Cost/Value € |

Income |

|

Relevant Details |

||

|

|

Value € |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F1 |

Savings/deposits/current account |

|

|

|

|

|

|

|

|

|

|

|

|

F2 |

Shares |

|

|

|

|

|

|

|

|

|

|

|

|

F3 |

Motor Vehicle(s) |

|

|

|

|

|

|

|

|

|

|

|

|

F4 |

Redundancy Payment(s) |

|

|

|

|

|

|

|

|

|

|

|

|

F5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

F6 |

Other investment(s) |

|

|

|

|

|

|

|

|

|

|

|

|

F7 |

Other Assets (e.g., stock, machinery etc) |

|

|

|

|

|

|

|

|

|

|

|

|

F8 |

Total (Sum of F1 to F7) |

|

|

|

B10 |

|

|

|

|

|

|

|

|

Please list all other liabilities, for example any guarantees given with respect to company borrowing or borrowing by a family member.

Please provide any other information which you believe to be relevant to above:

9

I/we understand that the information provided will only be used for the purpose of assisting permanent tsb to assess my/our inancial situation under its Mortgage Arrears Resolution Process (where applicable) or/and to assess my/our inancial situation for other debt restructuring.

Protecting Your Information

“permanent tsb will keep your information conidential and will only use this information for the purpose of assisting you in accordance with our Mortgage Arrears Resolution Process (where applicable) or/and other debt restructuring arrangements in accordance with permanent tsb’s obligations under the Data Protection Acts 1988 and 2003. For more information on your rights under the Data Protection Acts, see the Data Protection Commissioner’s website at www.dataprotection.ie”

I/we declare that the information I/we have provided represents my/our inancial situation, and commit to informing permanent tsb if my/our situation changes.

I/we consent to permanent tsb conducting a credit reference check.

permanent tsb p.l.c. is regulated by the Central Bank of Ireland.

10

Date:Signed: |

_____________________________________________________ |

_____________________________________________________ |

|

Date:Signed: |

|

____________________ ____________________

Section G: Financial Statement Summary (for ofice use only)

G1

Total Monthly Net Income (B11)

G2

Less Total Monthly Expenditure (C38)

G3

G4

Less Mortgage Repayments Being Paid (D1)

G5

Less Other Monthly Debt Being Paid (D22)

G6

Total Surplus/Deicit (subtract G4 and G5 from G3)

11

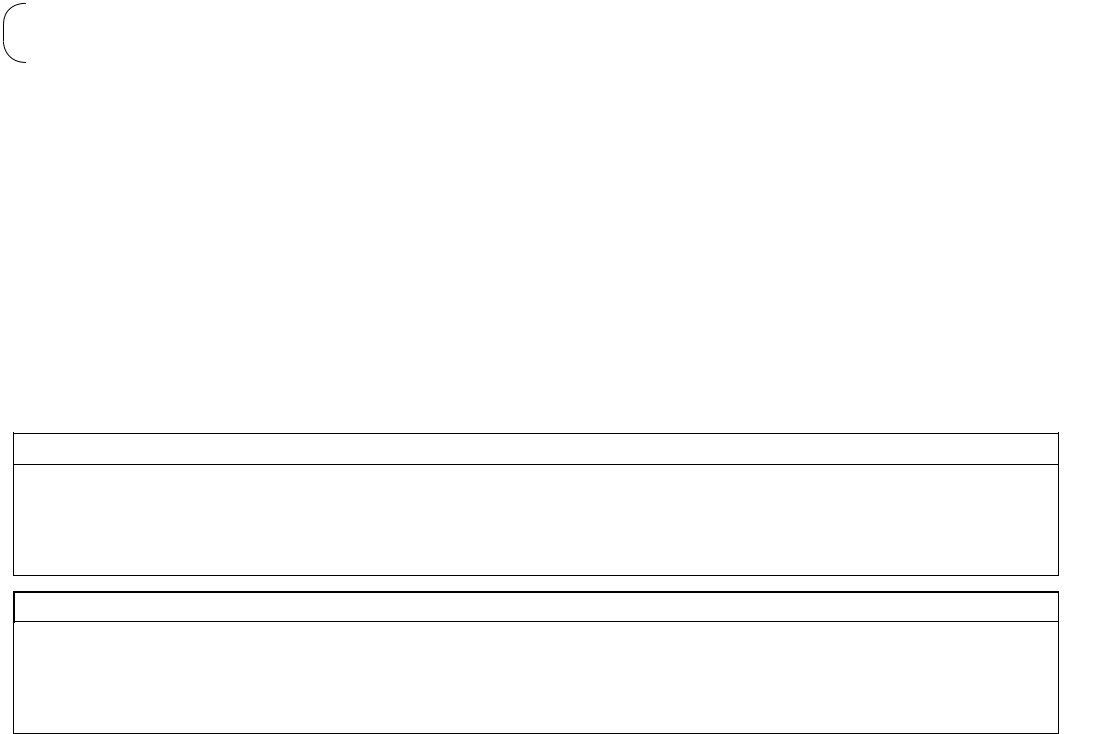

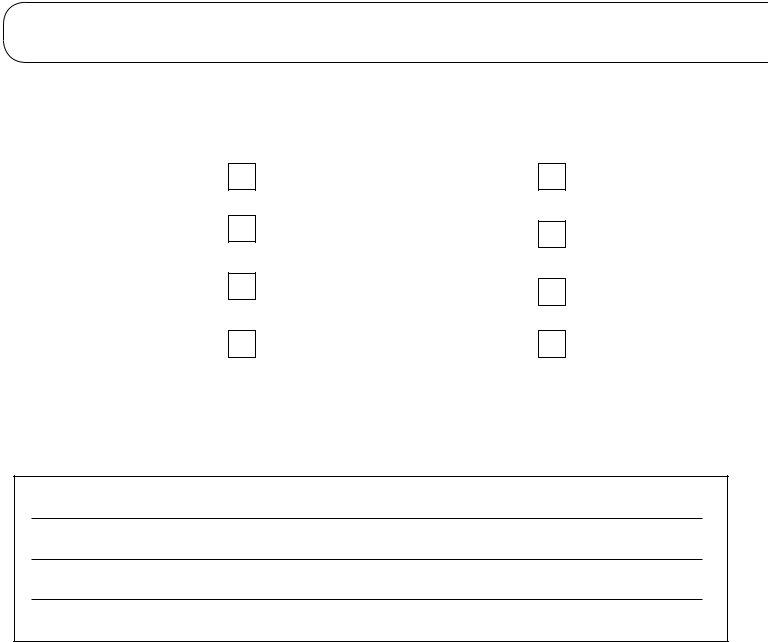

For Branch Use Only

I have reviewed & discussed the information supplied by the customer in the Standard Financial Statement. Based on the information provided, I recommend the following alternative repayment arrangement for this customer:

Capital Payment Holiday*

Partial Moratorium*

Capital Payment Minus*

Managed Arrangement*

Capital Payment Plus*

Capitalising the Arrears*

Moratorium*

Term Extension*

Other relevant information

*3 months most recent primary bank statements are required for all applicants.

Proof of your income in the form of 2 recent payslips, most recent P60, Social Welfare, Mortgage Interest Supplement, Family Income Supplement receipts/conirmation etc.

Self employed customers also need to supply 6 months up to date Business Bank Account Statements and fully completed permanent tsb’s Accountant Certiicate or the most recent 2 years audited accounts.

Name of Branch Advisor: ____________________ |

Signature: _______________________ |

Branch: ______________________________ |

Date: __________________________ |

12 |

BMK2045 Rev 08/12 |