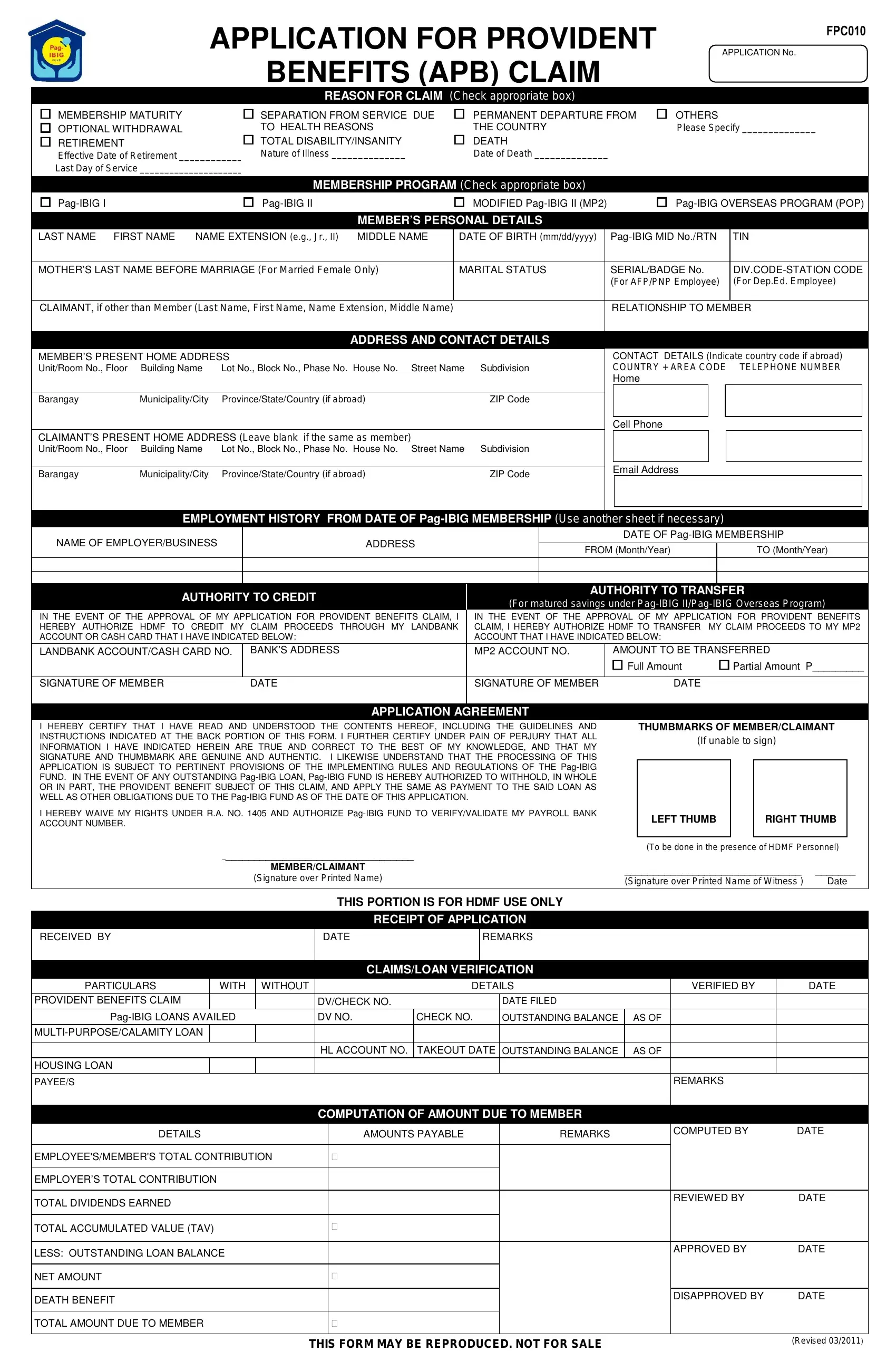

GUIDELINES AND INSTRUCTIONS

A.When to File

The Application for Provident Benefits Claim (APB [FPC010]) may be filed upon the occurrence of any of the following:

1.Membership Maturity - a period of not less than 20 years commencing from the 1st day of the month to which the member's initial contribution to the Fund applies, provided that the member has actually contributed a total of 240 monthly contributions to the Fund at the time of maturity;

2.Optional Withdrawal of Pag-IBIG Savings - allowed for members who registered under R.A. No. 7742, as well as members who voluntarily joined the Fund under E.O. No. 90.

Partial withdrawal of savings may be made after 10 or 15 years of continuous membership from January 1995. For members who registered under R.A. No. 9679 shall have the option to withdraw his or her Total Accumulated Value (TAV) on the fifteenth (15th) year of continuous membership. Provided, a member has no outstanding loan with the Fund. This option may be exercised only once during the membership term.

3.Retirement – a member shall be compulsorily retired under the Fund upon reaching age sixty-five (65). He may, however, opt to retire earlier under the Fund upon the occurrence of any of the following:

a.his actual retirement from the SSS, GSIS or separate employer provident/retirement plan, provided, however, that under the latter case, the member has at least reached age forty-five (45).

b.notwithstanding his continued employment or service, upon reaching age sixty (60), provided he is not a member-borrower;

4.Total Disability or Insanity – loss or impairment of a physical or mental function resulting from injury or sickness which completely incapacitates a member to perform any work or engage in any business or occupation as determined by the Fund;

5.Separation from the service due to health reasons;

6.Permanent Departure from the Philippines;

7.Death.

B.Who May File

The application may be filed by the member, his guardian, or any authorized representative/s. If the reason for claim is death of the member, the application may be filed by his beneficiary/ies or the latter’s representative/s, or any appointed court administrator or executor.

In all instances wherein Application for Provident Benefits (APB) Claim is filed by an authorized representative, the Special Power of Attorney (FPC014) and the identification cards of both the member and his/her representative/s shall be presented and/or submitted.

C.Payment of Benefits

1.Amount

The Provident Benefits of a member shall consist of his Total Accumulated Value (TAV), which includes the member’s personal contributions to the Fund, his employer’s counterpart contribution, if applicable, and the dividend earnings of the total contributions declared by Pag-IBIG Fund.

2.Application of TAV

In the event of membership termination, the outstanding balance of the member’s Short-Term Loan (STL) shall be deducted from his TAV. Likewise, the outstanding balance of the member’s housing loan shall be deducted from his TAV, unless the guidelines prevailing at the time of loan takeout provided otherwise.

Borrower/s who opt to continue amortizing the housing loan balance shall be required to continue paying the monthly membership contribution in accordance with the terms and conditions of the Promissory Note or Loan and Mortgage Agreement (PN/LMA) until the loan obligation is fully settled.

For accounts taken out under the UHLP Multi-Window Lending System, the following shall apply:

a.Upon termination of the borrower’s membership which entitles him to the benefits as provided for under the rules of the SSS, GSIS, and Pag-IBIG, the TAV to be received by the borrower shall be applied to his outstanding housing loan.

In case of death, the provision of the borrower’s Mortgage Redemption Insurance (MRI) shall apply, and if an unpaid balance remains, the borrower’s TAV or death benefits shall be applied in payment thereof, subject to the existing policies, rules and regulations.

b.Upon the occurrence of an event of default, the lending window or its assignee/transferee may apply any of the borrower’s funds in the possession of the lending window or its assignee/transferee in full or partial payment of the borrower’s obligations as stated in the LMA and Promissory Note.

For this purpose, the LMA provides further that the borrower authorizes the lending window or its assignee/transferee to secure and apply without prior notice to the borrower any fund belonging to him in the possession or control of the lending window or its assignee/transferee.

3.Manner of Payment

For claims due to membership maturity, the benefits shall be paid either by check directly to the member or deposited to the member’s payroll bank account.

For claims other than membership maturity, the benefits shall be made directly to the member, his guardian or any authorized representative, provided that, in the event of death of a member, payment shall be made to his beneficiary/ies or the latter’s guardian/authorized representative/s, or any duly appointed court administrator or executor.

Should there be any contribution due the member but not yet received by the Fund at the time of the above payment, the same shall be correspondingly released after receipt of the unremitted contributions.

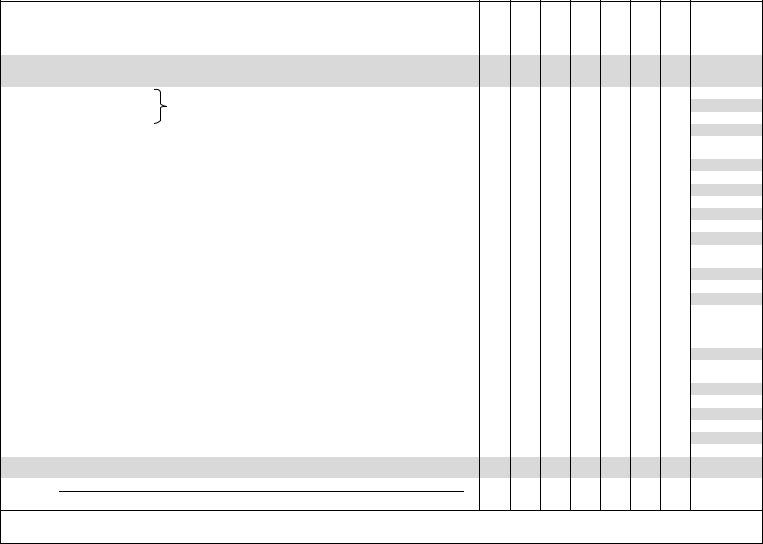

LIST OF REQUIRED DOCUMENTS

|

REQUIREMENTS |

MM |

OW |

R |

SS |

TD |

PD |

D |

Remarks |

1. |

Notarized Certificate of Early Retirement (For Private Employee, at least 45 years old) |

|

|

X |

|

|

|

|

|

2. |

Updated Service Record (For Government Employee) |

X |

X |

X |

X |

X |

|

|

|

3. |

Any of the following: (For Private/Government Employee) |

|

|

X |

|

|

|

|

|

National Statistic Office (NSO) Certified True Copy of Member’s Birth Certificate*

SSS Retirement Voucher (For Private Employee)/GSIS Retirement Voucher (For Government Employee)

Valid ID card with photo and signature or 2 valid ID cards stating date of birth

4. |

Order of Retirement |

|

|

|

X |

|

|

|

|

5. |

Updated Statement of Service |

(For AFP, Phil. Navy & Phil. Army personnel) |

X |

|

X |

|

|

6. |

Statement of Last Payment |

|

|

X |

|

X |

7. |

Physician’s Certificate/Statement |

|

|

X |

|

|

|

8. |

Notarized Sworn Employer’s Certification that the Member was separated from service due to health |

|

X |

|

reasons |

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Latest SSS Disability Voucher (For Private Employee) |

|

X |

|

|

|

10. |

Physician’s Certificate or Statement of Insanity |

|

|

X |

11. |

SSS Total Disability Voucher |

|

|

|

X |

|

|

12. |

Compulsory Disability Discharge (CDD) Order (For AFP, Phil. Navy & Phil. Army Personnel) |

|

|

X |

13. |

Photocopy of Passport |

|

|

|

|

|

|

X |

|

14. |

Notarized Sworn Declaration of Intention to Depart from the Philippines Permanently [FPC013] |

|

|

|

X |

15. |

Any of the following: |

|

|

|

|

|

|

X |

|

|

|

Immigrant Visa;or |

|

Settlement Visa; or |

|

|

|

|

|

|

|

Residence Visa; or |

|

Such other equivalent document depending on the issuing country |

|

|

|

|

|

16. |

NSO Certified True Copy of Member’s Death Certificate |

|

|

|

|

X |

17. |

Notarized Proof of Surviving Legal Heirs [FPC011] |

|

|

|

|

X |

18. |

To establish kinship to the deceased member, the claimant shall submit any of the following: |

|

|

|

|

X |

NSO Certified True Copy of Member’s/Claimant’s Birth Certificate; or

NSO Certified True Copy of Member’s Marriage Contract (If member is married); or

Certified True Copy of Member’s/Claimant’s Baptismal/Confirmation Certificate

Certificate of No Marriage (CENOMAR) (For Single Only)

19. |

NSO Certified True Copy of Birth Certificate* of all Children (if any) or Baptismal/Confirmation Certificate |

|

|

|

|

|

|

X |

20. |

Notarized Affidavit of Guardianship (For children 18 years old and below, or physically/mentally incompetent) |

|

|

|

|

|

|

X |

|

[FPC012] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

Funeral Receipt |

|

|

|

|

|

|

X |

22. |

Two (2) valid ID cards with signature and photo of claimant |

X |

X |

X |

X |

X |

X |

X |

23. |

POP Passbook (For POP Members only) |

X |

|

|

|

|

|

|

24. |

Special Power of Attorney [FPC014] (If member cannot claim personally) |

X |

X |

X |

X |

X |

X |

|

25. |

Certification of Foreclosure/Dacion En Pago issued by the Foreclosure Department (If applicable) |

|

|

|

|

|

|

|

26. |

*NSO Certified True Copy of Non-Availability of Birth Record of Member together with any of the ff: |

|

|

X |

|

|

|

X |

Notarized Joint Affidavit of Two (2) Disinterested Persons [FPC015]; or

Photocopy of two (2) valid ID cards or any document indicating member’s date of birth 27.Others

Pag-IBIG Fund reserves the right to request additional documents if deemed necessary.

IMPORTANT:

1.PROCESSING OF CLAIMS WILL COMMENCE ONLY UPON SUBMISSION OF COMPLETE DOCUMENTS.

2.IN ALL INSTANCES WHEREIN PHOTOCOPIES ARE SUBMITTED, THE ORIGINAL DOCUMENTS SHALL BE PRESENTED FOR AUTHENTICATION.

LEGEND: |

MM |

- |

Membership Maturity |

R |

- |

Retirement |

TD |

- |

Total Disability/Insanity |

|

OW |

- |

Optional Withdrawal |

SS |

- |

Separation from the Service Due to Health Reason |

PD |

- |

Permanent Departure from the country |

|

|

|

|

|

|

|

D |

- |

Death |