You could fill in XXXXXXXXXXXXXX effortlessly with the help of our PDFinity® online PDF tool. The editor is continually maintained by our staff, getting additional features and turning out to be greater. Getting underway is easy! Everything you need to do is adhere to these basic steps directly below:

Step 1: Hit the "Get Form" button above. It'll open our pdf tool so you can start completing your form.

Step 2: Using our handy PDF tool, it is easy to accomplish more than merely complete blank fields. Try all the functions and make your documents seem faultless with custom text incorporated, or adjust the original input to perfection - all comes with an ability to incorporate just about any photos and sign the PDF off.

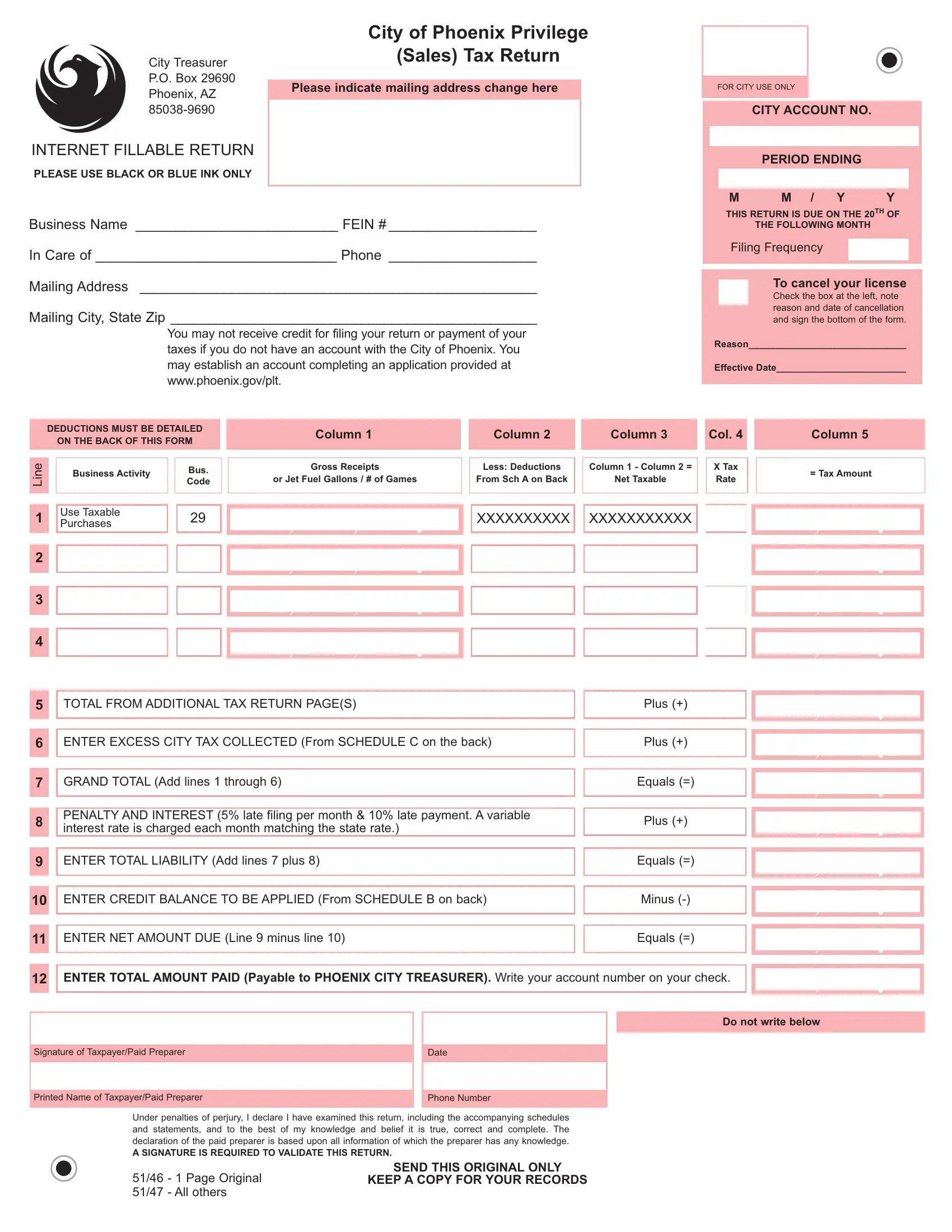

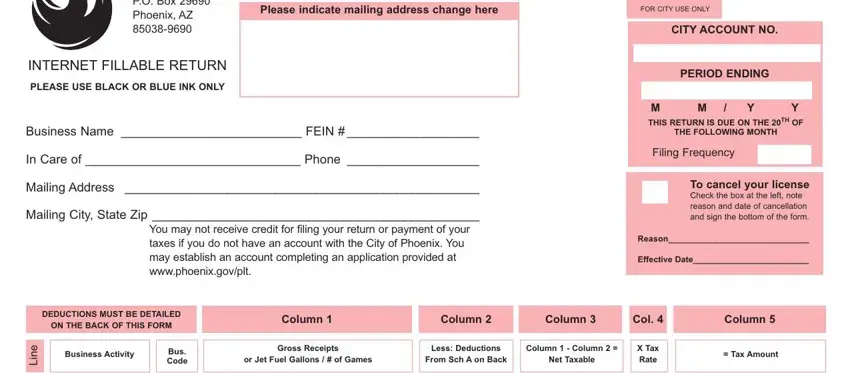

This PDF will need particular data to be filled out, so you need to take the time to provide what is expected:

1. The XXXXXXXXXXXXXX will require certain details to be inserted. Ensure that the following fields are complete:

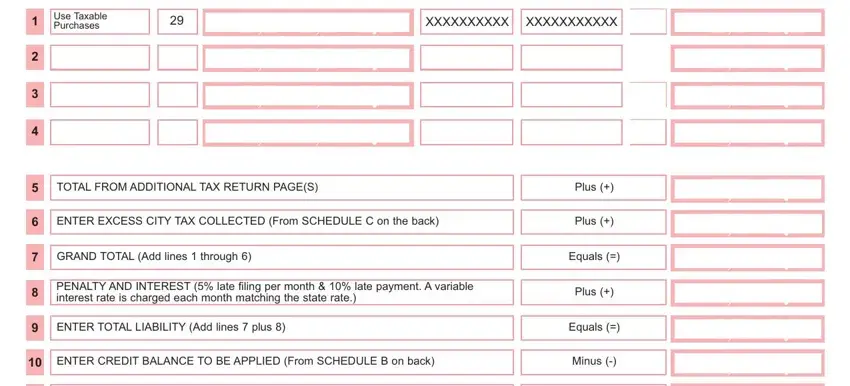

2. Once your current task is complete, take the next step – fill out all of these fields - Use Taxable Purchases, XXXXXXXXXX, XXXXXXXXXXX, TOTAL FROM ADDITIONAL TAX RETURN, ENTER EXCESS CITY TAX COLLECTED, GRAND TOTAL Add lines through, PENALTY AND INTEREST late filing, ENTER TOTAL LIABILITY Add lines, ENTER CREDIT BALANCE TO BE, Plus, Plus, Equals, Plus, Equals, and Minus with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Concerning TOTAL FROM ADDITIONAL TAX RETURN and ENTER CREDIT BALANCE TO BE, be sure that you don't make any errors here. These two are the key fields in this form.

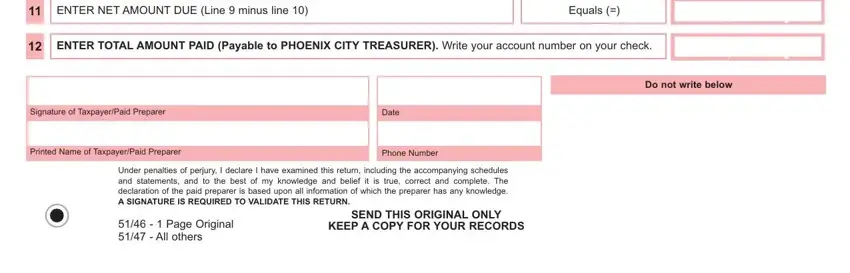

3. The following segment is considered relatively uncomplicated, ENTER NET AMOUNT DUE Line minus, Equals, ENTER TOTAL AMOUNT PAID Payable, Signature of TaxpayerPaid Preparer, Date, Printed Name of TaxpayerPaid, Phone Number, Under penalties of perjury I, Page Original All others, SEND THIS ORIGINAL ONLY, KEEP A COPY FOR YOUR RECORDS, and Do not write below - all these form fields is required to be filled out here.

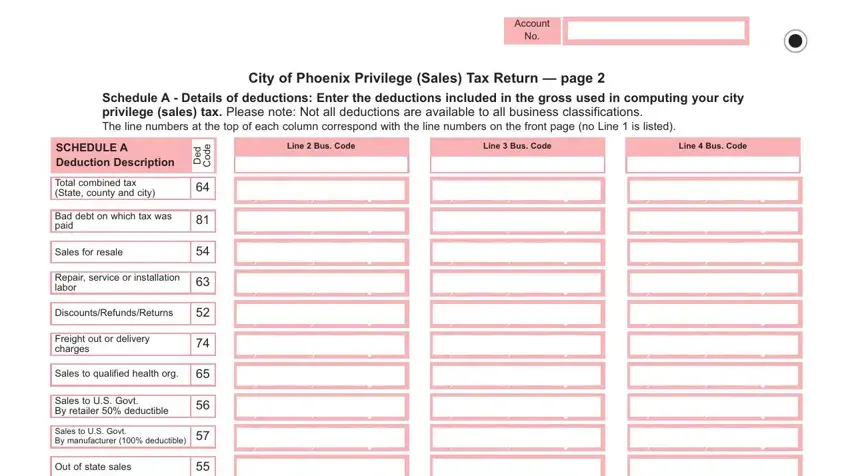

4. Now start working on the next form section! Here you've got these Account, City of Phoenix Privilege Sales, Schedule A Details of deductions, Line Bus Code, Line Bus Code, Line Bus Code, SCHEDULE A Deduction Description, d e D, e d o C, Total combined tax State county, Bad debt on which tax was paid, Sales for resale, Repair service or installation, DiscountsRefundsReturns, and Freight out or delivery charges blank fields to fill in.

5. As you get close to the end of your form, you will find just a few more requirements that must be fulfilled. Mainly, Tradeins, Construction Contracting, Exempt Subcontracting Income, Outofcity contracting, Food stamp sales, Sales of motor vehicle gasoline, SalesLeases of exempt machinery, Prescription drugsprosthetics, Lottery ticket sales, Misc Deductions Please Explain, TOTAL DEDUCTIONS Copy to Front, SCHEDULE B Credit Details please, and SCHEDULE C Excess Tax Collected should all be filled out.

Step 3: Soon after taking one more look at your entries, click "Done" and you are good to go! Join FormsPal right now and immediately use XXXXXXXXXXXXXX, set for downloading. Each change you make is conveniently preserved , so that you can edit the file at a later stage when necessary. FormsPal provides safe document editor with no personal data recording or sharing. Be assured that your information is secure with us!