Should you desire to fill out pnc hardship assistance package, you won't have to download and install any sort of software - simply try our online PDF editor. In order to make our tool better and easier to work with, we continuously develop new features, considering feedback from our users. All it requires is a couple of simple steps:

Step 1: Hit the "Get Form" button above on this webpage to access our PDF editor.

Step 2: When you open the file editor, you will find the form prepared to be filled in. Apart from filling out various fields, it's also possible to perform other things with the PDF, particularly putting on your own words, editing the original text, adding graphics, signing the PDF, and much more.

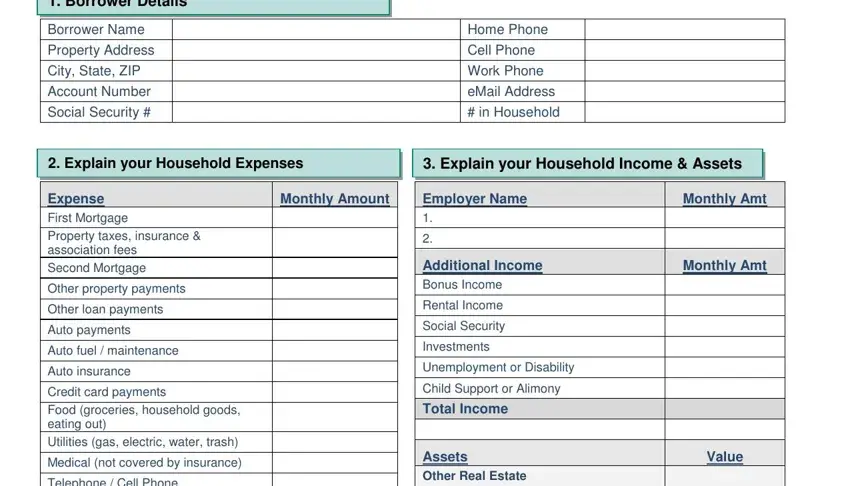

For you to complete this PDF form, make sure that you type in the information you need in every single blank:

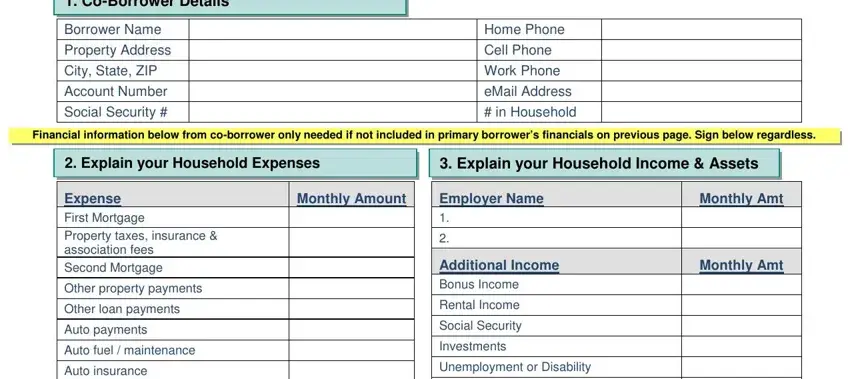

1. Fill out your pnc hardship assistance package with a selection of major blanks. Note all of the important information and ensure there is nothing neglected!

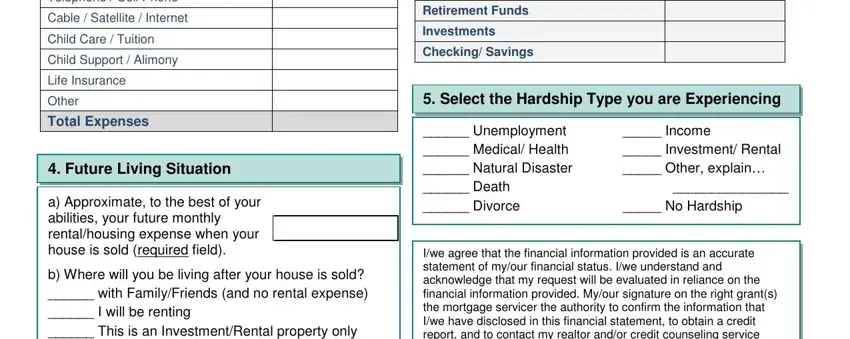

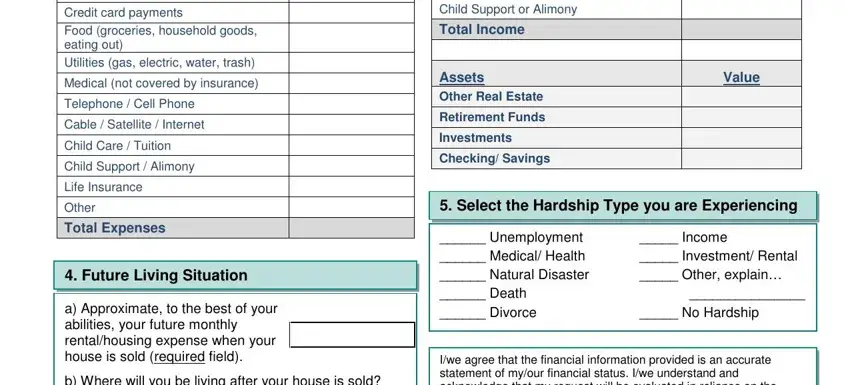

2. Soon after filling in the previous section, head on to the next stage and complete the necessary particulars in all these fields - Telephone Cell Phone, Cable Satellite Internet, Child Care Tuition, Child Support Alimony, Life Insurance, Other, Total Expenses, Future Living Situation, a Approximate to the best of your, b Where will you be living after, Retirement Funds, Investments, Checking Savings, Select the Hardship Type you are, and Unemployment Medical Health.

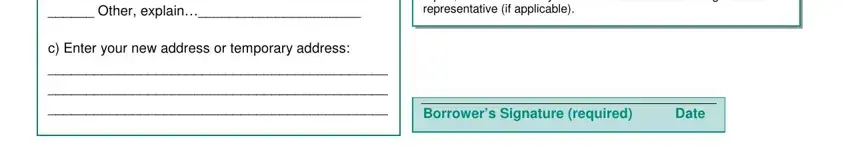

3. The next stage is usually hassle-free - fill in all the blanks in b Where will you be living after, Iwe agree that the financial, and Borrowers Signature required Date to conclude this part.

People generally make some mistakes when completing Iwe agree that the financial in this area. Ensure that you read again everything you type in here.

4. It's time to proceed to this fourth section! Here you'll have all these CoBorrower Details, Borrower Name, Property Address, City State ZIP, Account Number, Social Security, Home Phone, Cell Phone, Work Phone, eMail Address, in Household, Financial information below from, Explain your Household Expenses, Explain your Household Income, and Monthly Amount blank fields to complete.

5. The document must be wrapped up by going through this segment. Further there can be found a comprehensive list of blank fields that have to be filled out with appropriate details to allow your form submission to be complete: Child Support or Alimony, Total Income, Assets Other Real Estate, Retirement Funds, Investments, Checking Savings, Value, Select the Hardship Type you are, Unemployment Medical Health, Income Investment Rental Other, Iwe agree that the financial, Credit card payments Food, Medical not covered by insurance, Telephone Cell Phone, and Cable Satellite Internet.

Step 3: Immediately after taking another look at the fields and details, hit "Done" and you're good to go! Join FormsPal today and instantly get access to pnc hardship assistance package, available for downloading. Each and every change you make is handily saved , helping you to modify the document later if needed. We do not share or sell any information that you type in whenever dealing with documents at our site.