Understanding the Privilege Sales Tax Return form is a crucial step for businesses operating within jurisdictions that impose this tax, reflecting a nuanced aspect of tax compliance. This comprehensive form serves as a tool for reporting taxable sales, calculating due taxes, and identifying applicable deductions across various business activities. Designed to cater to a myriad spectrum of sectors — from transportation, mining, and utilities to telecommunications, manufacturing, and retail — the form delineates specific tax rates and allowances pertinent to each category. Furthermore, it addresses special considerations for activities like jet fuel sales, restaurant and bar operations, amusement services, and hotel/motel accommodations, featuring adjusted rates and distinct deduction codes. In addition to outlining the base tax obligations, the form also advises on the classification of business activities, ensuring entities accurately identify their primary operations to apply the correct tax rates and allowable deductions. Additionally, it incorporates sections for city-specific regulations, exemplifying the importance of locality in determining tax liabilities. Completing the Privilege Sales Tax Return form accurately is not just a regulatory requirement but a comprehensive record-keeping practice that aids in financial planning and analysis for businesses, offering a glimpse into the intricacies of tax administration and compliance.

| Question | Answer |

|---|---|

| Form Name | Privilege Sales Tax Return Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | GRET1011, glendaleaz, ScalingNone, privilege form |

64 |

|

,(% ( ; |

|

*6, |

|

)<)>C4. |

|

|

|

|

|

4.E<)'>% |

|

|

F! |

|

|

|

|

|

B#DDDDDDDDDDDDDDDDDDDDDDDDDD |

*GRET1011* |

6DDDDDDDDDDDDDDDDDDDDDDDDDDDDDDD"DDDDDDDDDDDDDDDDDD |

|

1.DDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDD |

|

16 EDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDD |

|

*+/+/

+*+,+

! =

%( |

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*11A77, |

|

||

*(*% > ! |

|

|

|

|

|

|

|

|

|

|

|

).+) 4?)+*)*++@,+)

!! %!

!"# |

|

|

|

." |

11 |

$$ |

77 |

|

!"#""$ %&! !' % ("" "" |

|

"% |

|

|

|

.!"" " "

!'" %

B. |

|

B |

|

|

6 |

||

|

|

|

|

% ! $"

%6 "*

4 |

|

3 |

|

01 |

|

|

|

|

|

|

|

|

|

|

:. !" |

|

94 |

|

7 |

*%!!' |

|

8 "7 |

|

" |

|

|

|

|

|

|

|

|

|

|

2

87"

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

& |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

' |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

"*+, |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

5 |

|

3#303263 |

|

|

|

"*+, |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

3:*;, |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

< |

|

"3#.7.#$#303 *)=%>=? |

|

|

|

"*+, |

|

|

|

|

||||||||||||||

|

66 |

&%%@)(>*,, |

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

3:*;, |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

%> |

|

|

|

|

1*@, |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

%% |

|

|

|

|

|

|

|

|

|

|

|

3:*;, |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

%& |

|

+,+. "" 0C |

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*+/+/ |

||||

|

|

|

|

|

|

|

|

|

|

|

"# |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

!"" |

|

|

$ |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

"# |

|

|

|

|

|

|

|

|

|

||||

"#!"" |

|

|

"# |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.+.)0

.)++/

<+/*+/++.

">(!&>%>@%

*GRET1012* |

J |

" %# ( 7 |

"%9$( 4 |

! A . " !":" %" !"! " (% !$"(%"%# ( 70

*%,

" :

). |

$ 6 |

|

. !". !%$" |

||

"* ,6* |

5( |

|

, |

||

|

4A

3A

1A

55

0

0@

)(

0

$.

*,

5'

)&

9(

GH

5)

4

)>=

)5

#.

5A

))

B$"

<%

')=66

9>

"

6! B

00*

4,

1?4

/

9%

5&

)'

)A

G

"63:

9'

1$"G

"$

)<

5<

,!0. !"A 7$ B

+..+$"*%"

).

7! 7 !"

4

|

.6 |

|

|

|

B |

|||||||

|

|

|

|

|

|

|

|

|

|

|||

|

B6 |

|

|

B |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

|

6"6 |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

+ |

||||

|

"! |

|

|

|

|

|

|

|||||

|

*%>, |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

6 |

3 |

|

|

|

|

|

|

|

|

+ 1

"!

*5,

+,<+..+*,/*0

*+&:64*5&',A'>@'%A>*"%,7*5&',A'>@&%A9/*5&',A'>@&%<5

BBB0( C0!D"7!

">(!&>%>@%

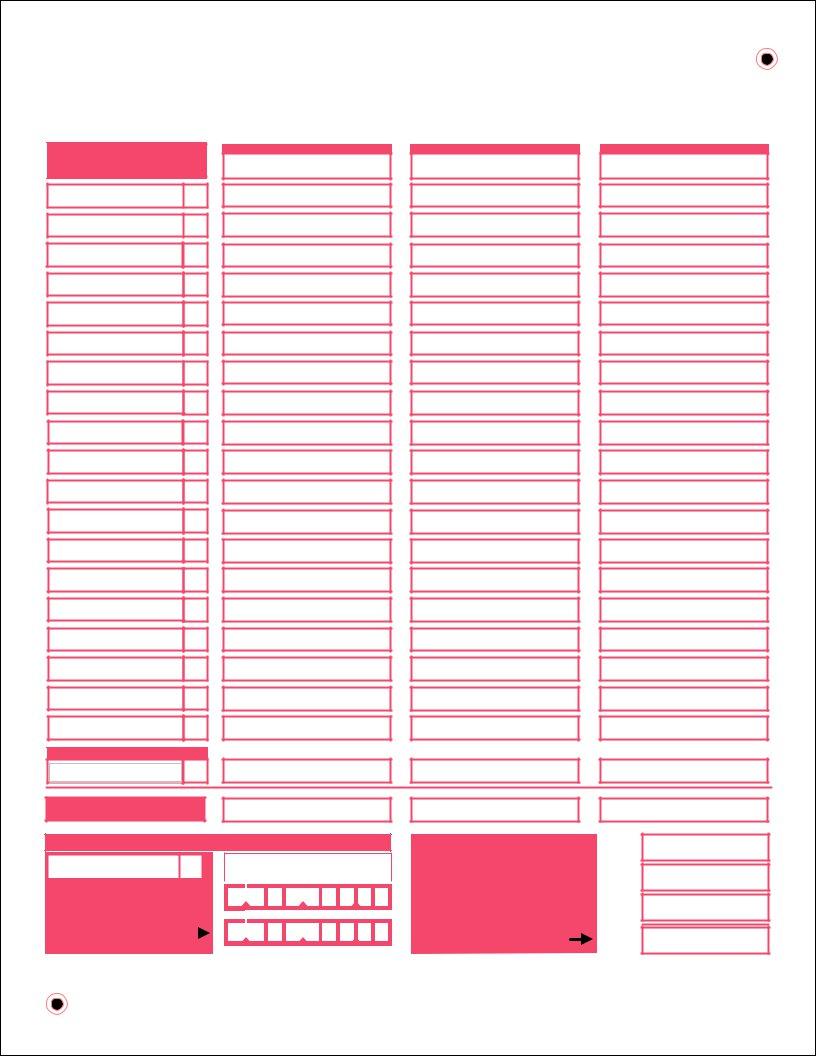

The chart below is intended to assist you in selecting the proper tax rate for your business class/ activity.

When printing this document set Page Scaling=”None”.

Class |

Activity |

Tax |

Allowable Deduction Codes |

|

|

Rate |

(Definitions listed in schedule A) |

01 |

Transportation |

2.2% |

52, 53, 64, 75, 81 |

02 |

Mining |

0.1% |

52, 53, 64, 74, 75, 81 |

03 |

Jet Fuel (cents per gallon) |

0.021 |

52, |

04 |

Utilities |

2.2% |

|

05 |

Telecommunications |

5.4% |

|

06 |

Manufactured Buildings |

2.2% |

|

09 |

Publishing |

2.2% |

|

10 |

Printing |

2.2% |

|

11 |

Restaurant/Bars |

3.2% |

52, 53, 64, 65, 74, 75, 81 |

12 |

Amusement |

2.2% |

52, 53, 64, 75, 81 |

13 |

Residential Rental of Real Property |

2.2% |

|

14 |

Rental of Personal Property |

2.2% |

|

15 |

Contracting |

2.2% |

|

17 |

Retail Sales |

2.2% |

|

18 |

Advertising |

2.2% |

52, 53, 64, 69, 75, 81 |

25 |

Hotel/Motel |

5.6% |

52, 53, 64, 75, 81 |

30 |

Retail Sales- Food for Home |

1.8% |

52, 53, 56, 64, 65, 74, 75, 81 |

|

Consumption |

|

|

35 |

Contracting |

1.8% |

|

|

(Contracts prior to 11/1/07) |

|

|

40 |

Commercial Rental of Real Property |

2.2% |

|

|

|

|

|

|

|

|

|

99 |

Use Tax |

2.2% |

Not Applicable |

City of Glendale Arizona

License Application Codes

Title Code: |

|

Government Issued ID Type: |

|

Accountant/CPA |

ACC |

Driver License |

DRLC |

Agent |

AGT |

Misc. Foreign ID |

MFID |

Attorney |

ATT |

Military ID |

MIID |

Audit Contact |

AUD |

Matricula Consular |

MTCL |

Bankruptcy Attorney |

BKA |

Passport |

PPRT |

Bankruptcy Trustee |

BKT |

Permanent Resident |

PRES |

Chief Executive Officer |

CEO |

Resident Alien |

RESA |

Chief Financial Officer |

CFO |

US Employment Authorization |

USEA |

Chairman of Board |

COB |

US |

USID |

Controller |

CON |

Visa |

VISA |

Director |

DIR |

Miscellaneous US ID |

MUID |

Employee |

EMP |

|

|

General Partner |

GEN |

Color of Eyes: |

|

General Manager |

GMR |

|

|

Limited Partner |

LIM |

Black |

BL |

Liquor Agent |

LQA |

Brown |

BR |

Member |

MBR |

Blue |

BU |

Management Co |

MCO |

Green |

GN |

Manager |

MGR |

Gray |

GR |

Managing Member |

MMB |

Hazel |

HZ |

Managing Agent |

MNA |

Pink |

PK |

Owner |

OWN |

Violet |

VT |

President |

PRE |

|

|

Partner |

PRT |

Color of Hair: |

|

Statutory Agent |

SAG |

|

|

Secretary |

SEC |

Bald |

BA |

Shareholder |

SHH |

Blond |

BD |

Treasurer |

TRE |

Black |

BL |

Trustee |

TRU |

Brown |

BR |

VPR |

Gray |

GR |

|

|

|

Red |

RD |

|

|

White |

WH |