We chose the best computer programmers to set-up our PDF editor. The application will allow you to create the Proof Of Claim Attachment file conveniently and won't take too much of your time. This easy-to-follow procedure will enable you to get going.

Step 1: Click the "Get Form Here" button.

Step 2: Now you are able to manage Proof Of Claim Attachment. You have a lot of options thanks to our multifunctional toolbar - you can include, remove, or change the content, highlight the certain components, and conduct other commands.

The particular parts are going to make up your PDF file:

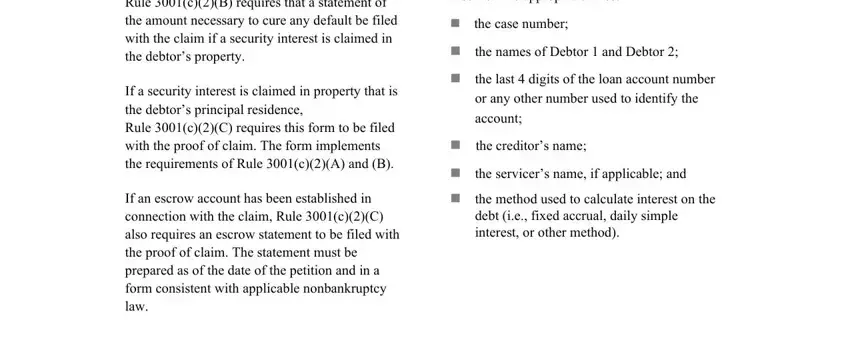

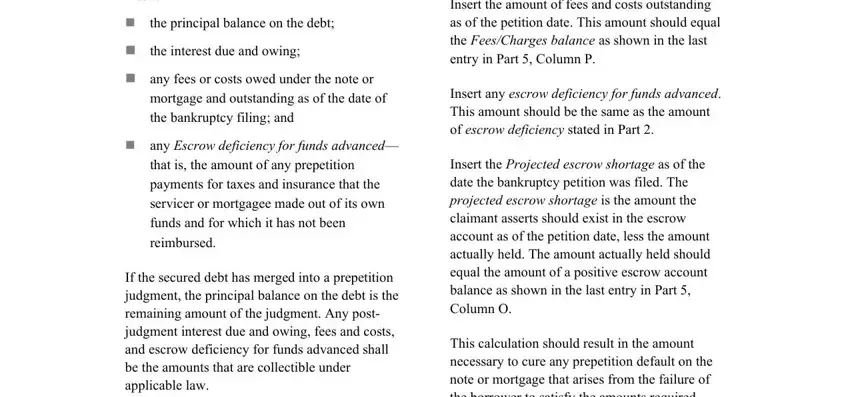

You should insert your data inside the section Insert, the, principal, balance, on, the, debt the, interest, due, and, owing any, fees, or, costs, owed, under, the, note, or mortgage, and, outstanding, as, of, the, date, of the, bankruptcy, filing, and any, Escrow, deficiency, for, funds, advanced that, is, the, amount, of, any, p, repetition payments, for, taxes, and, insurance, that, the service, r, or, mortgagee, made, out, of, its, own funds, and, for, which, it, has, not, been and reimbursed.

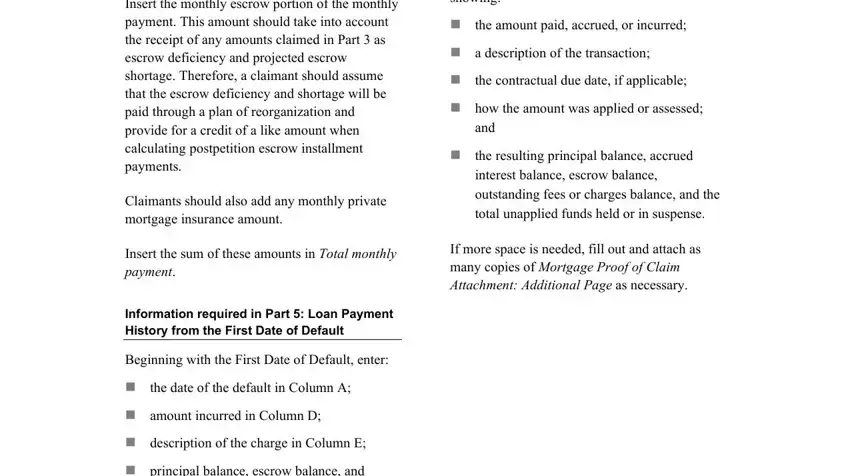

In the field talking about the, amount, paid, accrued, or, incurred a, description, of, the, transaction the, contractual, due, date, if, applicable how, the, amount, was, applied, or, assessed and, the, resulting, principal, balance, accrued interest, balance, escrow, balance total, un, applied, funds, held, or, in, suspense the, date, of, the, default, in, Column, A amount, incurred, in, Column, D description, of, the, charge, in, Column, E and principal, balance, escrow, balance, and you have to note down some demanded particulars.

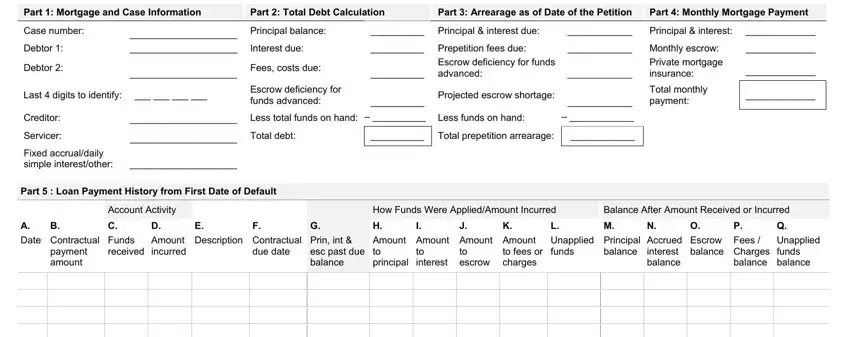

Inside the paragraph Part, Mortgage, and, Case, Information Part, Total, Debt, Calculation Part, Ar, rear, age, as, of, Date, of, the, Petition Part, Monthly, Mortgage, Payment Case, number Debtor, Debtor, Principal, balance Interest, due Fees, costs, due Principal, interest, due P, repetition, fees, due Escrow, deficiency, for, funds, advanced Last, digits, to, identify and Escrow, deficiency, for, funds, advanced include the rights and responsibilities of the sides.

Finish the form by reviewing all of these sections: Official, Form, A Mortgage, Proof, of, Claim, Attachment and page, of

Step 3: Choose "Done". It's now possible to upload your PDF document.

Step 4: Attempt to generate as many duplicates of your form as you can to keep away from possible issues.