Managing financial obligations within the workplace, especially for federal employees, involves a structured process to ensure both accountability and fairness. PS Form 3239, titled "Payroll Deduction Authorization to Liquidate Postal Service™ Indebtedness," represents a critical tool in this regard. Crafted to aid employees in meeting their financial responsibilities to the Postal Service through manageable deductions from their payroll, this form outlines the procedures and limitations for such deductions. The terms "disposable pay" and "current pay" are crucial in determining the amount that can be deducted, reflecting an employee's salary after mandatory deductions. The form is structured to accommodate various types of obligations, including voluntary debts and those resulting from court judgments, with caps on deduction amounts to safeguard the employee's financial well-being. Completing the form involves a detailed process where the postmaster or installation head plays a key role, involving multiple copies sent to relevant parties to ensure transparency and proper record-keeping. This meticulous approach underscores the balance between the employee’s obligation to settle debts and their rights to fair treatment and clear communication, further accentuated by the form's sections on voluntary and involuntary authorization, along with a privacy act statement ensuring the confidentiality and proper use of personal information.

| Question | Answer |

|---|---|

| Form Name | Ps Form 3239 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | payroll postal refer, indebtedness prosecutorial deductions, ps 3239, ps liquidate |

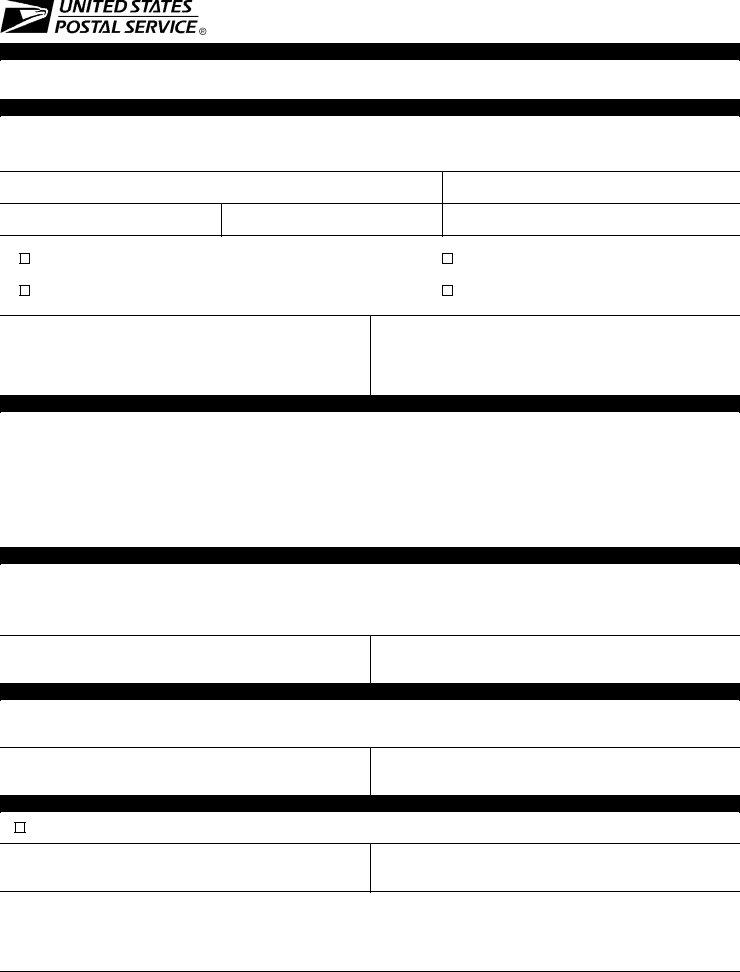

Payroll Deduction Authorization to Liquidate

Postal Service™ Indebtedness

Definitions

*The terms "disposable pay" and "current pay" refer to that part of an employee's salary which remains after all required deductions, normal retirement contributions, FICA and Medicare insurance taxes, and

General Information

The postmaster/installation head completes this form in triplicate.

Send Part 1 to the USPS Scanning and Imaging Center, PO Box 9000, Sioux Falls SD

Employee Name (As shown on paycheck)

Social Security Number

Finance Number

PRD Reference Number

Total Debt

Type of Offset

Administrative —

Administrative — Bargaining Unit Employee (Maximum 15% of disposable pay * or 20% of gross pay, whichever is lower when salary offset starts)

Court Judgment (Maximum 25% of current pay *)

Voluntary (No maximum)

Home Address (Include ZIP + 4®)

Postal Facility Where Employed (Include ZIP + 4)

Pay Period Deductions

NOTE: A request must be received at the ASC no later than Tuesday of the week in which the pay period ends in order to be effective for the pay period.

Deductions Begin: |

Pay Period |

Year |

|

|

|

|

|

|

|

|

|

|

Bargaining Unit Employee |

|

|

Deduction Per |

$ ____________ or _________ % of disposable/ |

$ ____________ or |

_________ % of disposable/ |

Pay Period: |

current pay. * |

|

current pay * |

|

|

|

|

|

|

or |

_________ % of gross pay. |

|

|

|

|

Voluntary Authorization

I acknowledge that I am indebted to the Postal Service in the amount specified above, and I request that I be permitted to liquidate this debt through payroll deduction from my salary checks as indicated above. If, at the time of my separation from the Postal Service, this debt has not been fully satisfied, the Postal Service may apply any sums due me, without limitation, to the outstanding balance. I hereby certify, that the foregoing statements are true and correct to the best of my knowledge and belief, and they are made of my own free will and at my discretion.

Signature

Date

Involuntary Authorization

The employee has been notified of the Postal Service's determination of the debt set forth above and the applicable

Authorized Individual's Printed Name, Title, and Signature

Date

Cancellation

Cancel deduction in accordance with instructions on file in this office.

Authorized Individual's Printed Name, Title, and Signature

Date

Privacy Act Statement. The collection of this information is authorized by 39 USC § 401. This information will be used to settle a financial difference with the Postal Service. As a routine use, this information may be disclosed to an appropriate law enforcement agency for investigative or prosecutorial purposes, to a congressional office at your request, to OMB for review of private relief legislation, to a labor organization as required by the NLRA, and where pertinent, in a legal proceeding to which the Postal Service is a party. Completion of this form is voluntary. However, if this information is not provided, your personal situation may not be fully considered during the resolution of the difference.

PS Form 3239, March 2004 |

1 - Eagan ASC |

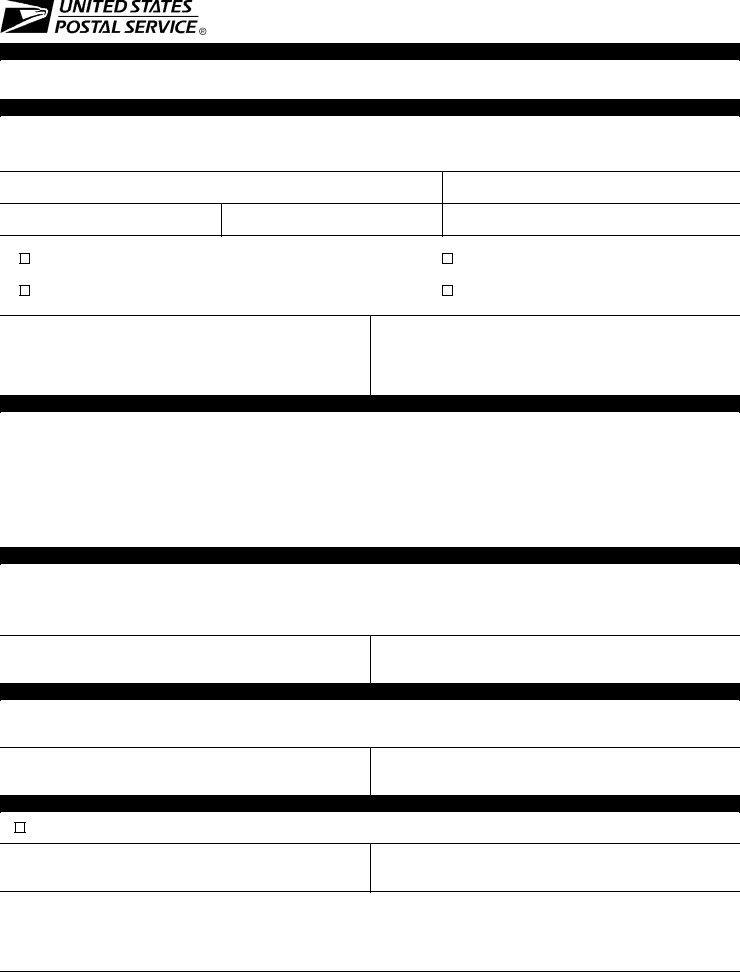

Payroll Deduction Authorization to Liquidate

Postal Service™ Indebtedness

Definitions

*The terms "disposable pay" and "current pay" refer to that part of an employee's salary which remains after all required deductions, normal retirement contributions, FICA and Medicare insurance taxes, and

General Information

The postmaster/installation head completes this form in triplicate.

Send Part 1 to the USPS Scanning and Imaging Center, PO Box 9000, Sioux Falls SD

Employee Name (As shown on paycheck)

Social Security Number

Finance Number

PRD Reference Number

Total Debt

Type of Offset

Administrative —

Administrative — Bargaining Unit Employee (Maximum 15% of disposable pay * or 20% of gross pay, whichever is lower when salary offset starts)

Court Judgment (Maximum 25% of current pay *)

Voluntary (No maximum)

Home Address (Include ZIP + 4®)

Postal Facility Where Employed (Include ZIP + 4)

Pay Period Deductions

NOTE: A request must be received at the ASC no later than Tuesday of the week in which the pay period ends in order to be effective for the pay period.

Deductions Begin: |

Pay Period |

Year |

|

|

|

|

|

|

|

|

|

|

Bargaining Unit Employee |

|

|

Deduction Per |

$ ____________ or _________ % of disposable/ |

$ ____________ or |

_________ % of disposable/ |

Pay Period: |

current pay. * |

|

current pay * |

|

|

|

|

|

|

or |

_________ % of gross pay. |

|

|

|

|

Voluntary Authorization

I acknowledge that I am indebted to the Postal Service in the amount specified above, and I request that I be permitted to liquidate this debt through payroll deduction from my salary checks as indicated above. If, at the time of my separation from the Postal Service, this debt has not been fully satisfied, the Postal Service may apply any sums due me, without limitation, to the outstanding balance. I hereby certify, that the foregoing statements are true and correct to the best of my knowledge and belief, and they are made of my own free will and at my discretion.

Signature

Date

Involuntary Authorization

The employee has been notified of the Postal Service's determination of the debt set forth above and the applicable

Authorized Individual's Printed Name, Title, and Signature

Date

Cancellation

Cancel deduction in accordance with instructions on file in this office.

Authorized Individual's Printed Name, Title, and Signature

Date

Privacy Act Statement. The collection of this information is authorized by 39 USC § 401. This information will be used to settle a financial difference with the Postal Service. As a routine use, this information may be disclosed to an appropriate law enforcement agency for investigative or prosecutorial purposes, to a congressional office at your request, to OMB for review of private relief legislation, to a labor organization as required by the NLRA, and where pertinent, in a legal proceeding to which the Postal Service is a party. Completion of this form is voluntary. However, if this information is not provided, your personal situation may not be fully considered during the resolution of the difference.

PS Form 3239, March 2004 |

2 - Personnel |

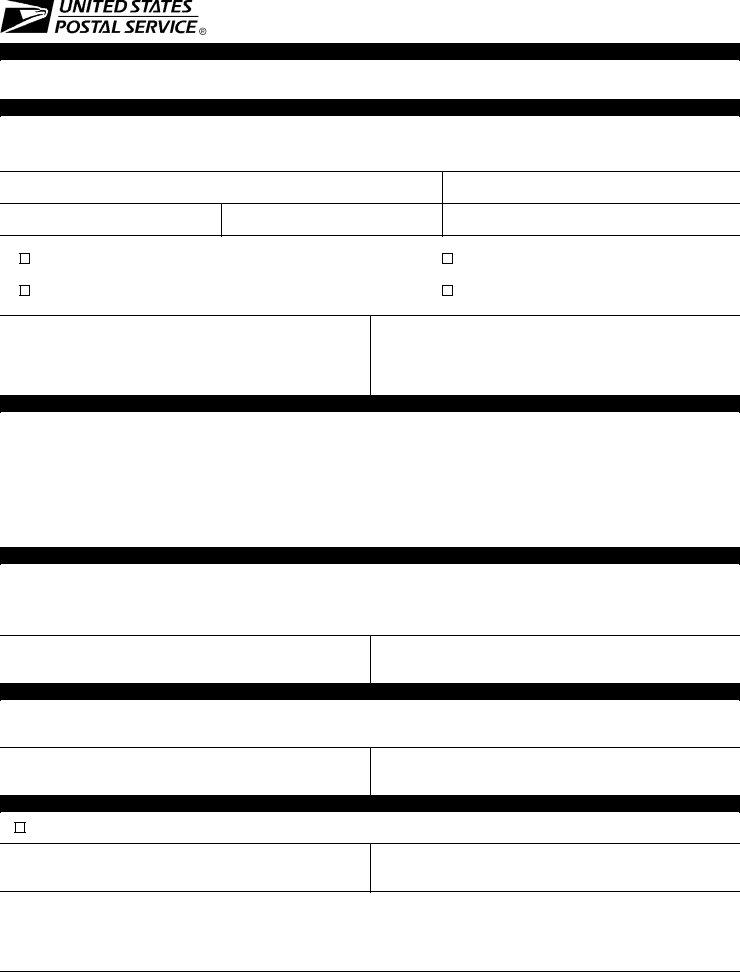

Payroll Deduction Authorization to Liquidate

Postal Service™ Indebtedness

Definitions

*The terms "disposable pay" and "current pay" refer to that part of an employee's salary which remains after all required deductions, normal retirement contributions, FICA and Medicare insurance taxes, and

General Information

The postmaster/installation head completes this form in triplicate.

Send Part 1 to the USPS Scanning and Imaging Center, PO Box 9000, Sioux Falls SD

Employee Name (As shown on paycheck)

Social Security Number

Finance Number

PRD Reference Number

Total Debt

Type of Offset

Administrative —

Administrative — Bargaining Unit Employee (Maximum 15% of disposable pay * or 20% of gross pay, whichever is lower when salary offset starts)

Court Judgment (Maximum 25% of current pay *)

Voluntary (No maximum)

Home Address (Include ZIP + 4®)

Postal Facility Where Employed (Include ZIP + 4)

Pay Period Deductions

NOTE: A request must be received at the ASC no later than Tuesday of the week in which the pay period ends in order to be effective for the pay period.

Deductions Begin: |

Pay Period |

Year |

|

|

|

|

|

|

|

|

|

|

Bargaining Unit Employee |

|

|

Deduction Per |

$ ____________ or _________ % of disposable/ |

$ ____________ or |

_________ % of disposable/ |

Pay Period: |

current pay. * |

|

current pay * |

|

|

|

|

|

|

or |

_________ % of gross pay. |

|

|

|

|

Voluntary Authorization

I acknowledge that I am indebted to the Postal Service in the amount specified above, and I request that I be permitted to liquidate this debt through payroll deduction from my salary checks as indicated above. If, at the time of my separation from the Postal Service, this debt has not been fully satisfied, the Postal Service may apply any sums due me, without limitation, to the outstanding balance. I hereby certify, that the foregoing statements are true and correct to the best of my knowledge and belief, and they are made of my own free will and at my discretion.

Signature

Date

Involuntary Authorization

The employee has been notified of the Postal Service's determination of the debt set forth above and the applicable

Authorized Individual's Printed Name, Title, and Signature

Date

Cancellation

Cancel deduction in accordance with instructions on file in this office.

Authorized Individual's Printed Name, Title, and Signature

Date

Privacy Act Statement. The collection of this information is authorized by 39 USC § 401. This information will be used to settle a financial difference with the Postal Service. As a routine use, this information may be disclosed to an appropriate law enforcement agency for investigative or prosecutorial purposes, to a congressional office at your request, to OMB for review of private relief legislation, to a labor organization as required by the NLRA, and where pertinent, in a legal proceeding to which the Postal Service is a party. Completion of this form is voluntary. However, if this information is not provided, your personal situation may not be fully considered during the resolution of the difference.

PS Form 3239, March 2004 |

3 - Employee |