If you’re a USPS employee looking for information about PS Form 4, the Postal Service™ Official Change of Address form, you’ve come to the right place. Effectively managing your change of address requests is critical to running an efficient post office and providing smooth mail service changes for customers—which is why we created this comprehensive guide to PS Form 4! Here, we explain in detail what it is, when and how it should be used, and common issues that may arise from incorrectly using or completing the form. With our help, you can quickly become familiar with everything you need to know about PS Form 4 so that your postal operations run smoothly without errors.

| Question | Answer |

|---|---|

| Form Name | PS Form 4 |

| Form Length | 1 pages |

| Fillable? | Yes |

| Fillable fields | 20 |

| Avg. time to fill out | 4 min 19 sec |

| Other names | ny ps city withholding form, new york ps city withholding, ps form 4 usps, ny ps county withholding |

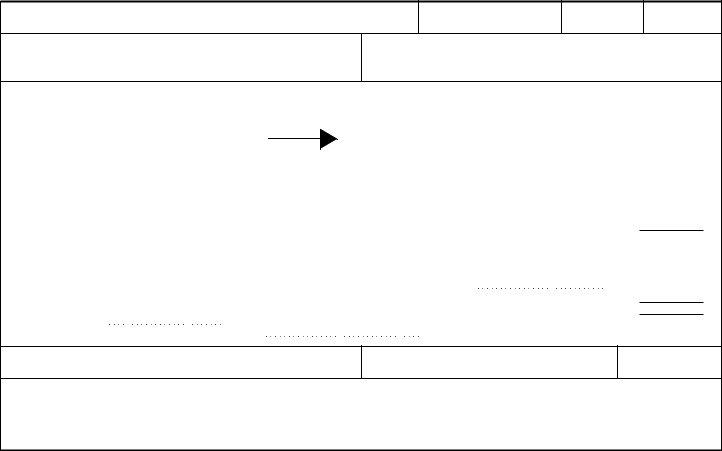

EMPLOYEE'S CITY OR COUNTY WITHHOLDING CERTIFICATE

(Employee: File this notice with your employer, or no local tax will be withheld from your wages.)

Full Name (Type or print)

Social Security No.

Finance No.

Pay Location

Address (City, State and ZIP+4 Code)

Regular Place of Employment

Complete Applicable Items Only

Indicate Tax Applicable to This Request

Local |

Tax Type |

Name of Taxing Authority |

|

Tax Code |

|

||

|

|

|

|

|

City Tax |

|

|

|

Occupational Tax |

|

|

|

County Tax |

|

|

Out of State Residents. If you are not a resident of the state in which you are employed, you may either (a) so indicate by entering 000 on line 2 below and

(1)If your

exemptions claimed

(2)Based on the

the percent of your compensation that is taxable. (Note: this does not apply if more than 75% of your services are

performed within the city or county.) Enter 100% if ALL service is performed within the taxing jurisdiction |

% |

(3)If the tax ordinance provides for a

(4)Additional withholding per pay period (whole dollar amounts only)

(5) |

Marital Status |

#Single |

#Married |

|

(6) |

Occupation tax paid? (Complete ONLY if applicable) |

#Yes |

#No |

|

I certify under penalty provided by law that the above statements are correct and complete to the best of my knowledge.

Signature

Date

"The collection of this information is authorized by 39 USC 401, 1003, 1005, 5 USC 8339. It will be used to withhold local taxes from your wages. As a routine use, this information may be disclosed to an appropriate law enforcement agency for investigative or prosecution proceedings, to a congressional office at your request, to the OMB for review of private relief legislation, and where pertinent, in a legal proceeding to which the Postal Service is a party.

PS Form 4, February 1982 |

Employee's City or County Withholding Certificate |