The publication 501 filling in course of action is quick. Our editor allows you to work with any PDF document.

Step 1: Initially, select the orange button "Get Form Now".

Step 2: As soon as you have accessed your publication 501 edit page, you'll discover all actions you may undertake with regards to your template at the upper menu.

You will have to type in the next data if you need to create the template:

Write down the details in Whats New Who must file In some, and Reminders Future developments.

Indicate the main details in Get forms and other information, Jan, and Reminders Future developments box.

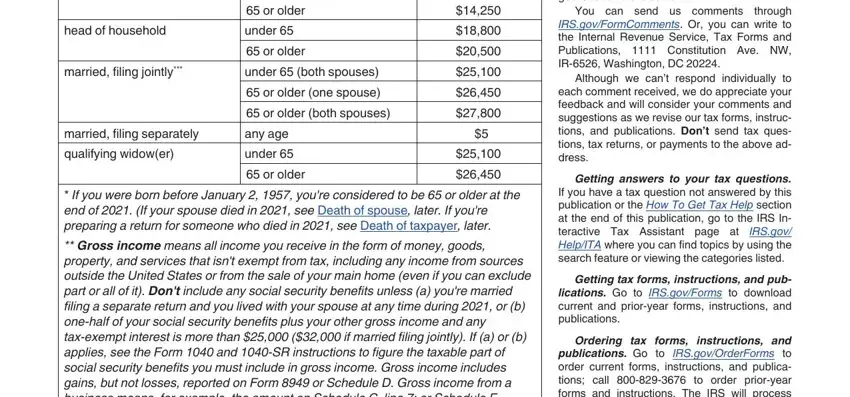

The head of household, or older, under, or older, married filing jointly, under both spouses, or older one spouse, or older both spouses, married filing separately, qualifying widower, any age, under, or older, If you were born before January, and Gross income means all income you field needs to be used to note the rights or obligations of both parties.

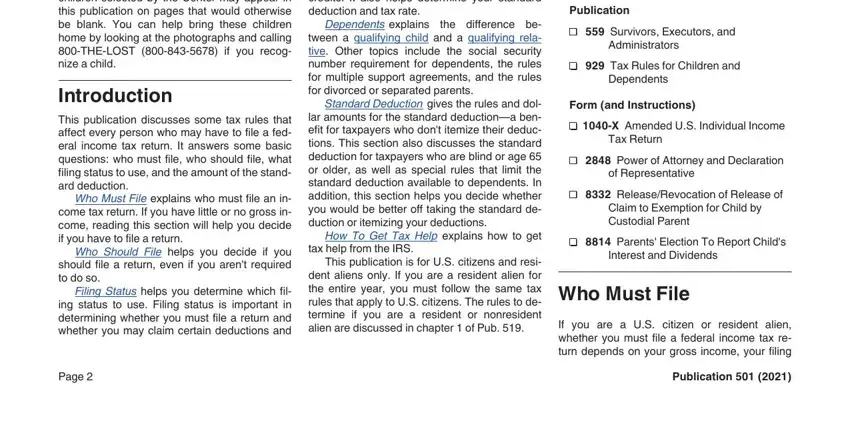

Finish by looking at the following fields and completing them accordingly: children selected by the Center, Introduction This publication, Who Must File explains who must, Who Should File helps you decide, Filing Status helps you determine, credits It also helps determine, Dependents explains, the difference be tween a, Standard Deduction gives the rules, How To Get Tax Help explains how, tax help from the IRS, This publication is for US, Page, Publication, and Survivors Executors and.

Step 3: Hit the "Done" button. Finally, it is possible to transfer your PDF file - save it to your device or send it by means of electronic mail.

Step 4: Make copies of your document. It will protect you from future problems. We don't view or publish your details, thus be certain it is secure.