|

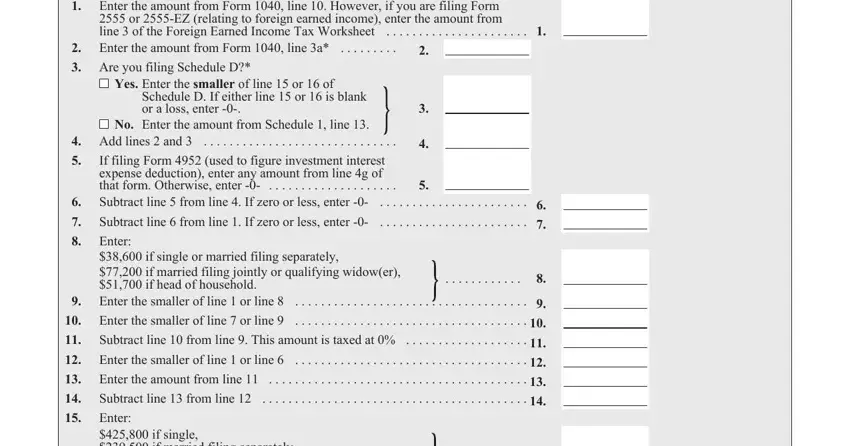

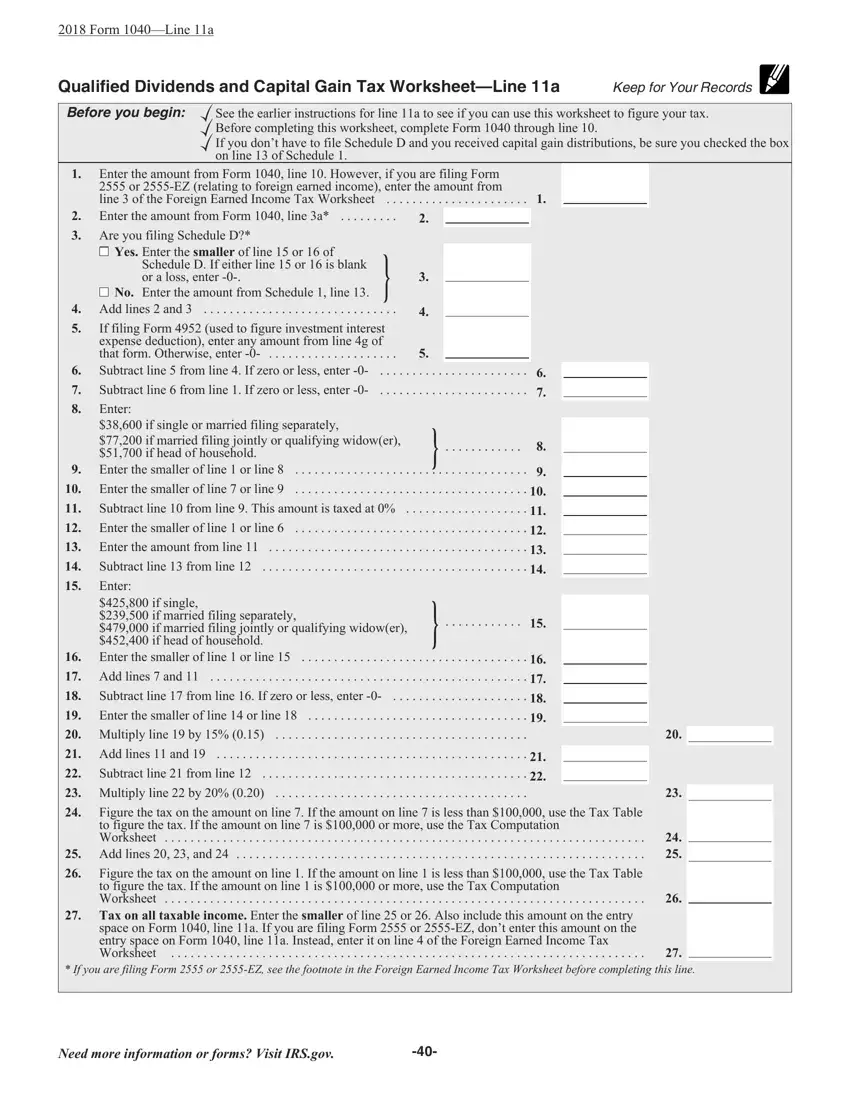

If filing Form 4952 (used to figure investment interest |

|

|

|

|

|

|

|

|

|

|

|

|

expense deduction), enter any amount from line 4g of |

5. |

|

|

|

|

|

|

|

|

|

|

6. |

that form. Otherwise, enter -0- |

|

|

|

|

|

|

|

|

|

|

Subtract line 5 from line 4. If zero or less, enter -0- |

. .6. |

|

|

|

|

|

|

|

|

|

|

|

|

7. |

.Subtract line 6 from line 1. If zero or less, enter -0- |

. . . . . . . . . . . . . . .. .7. |

|

|

|

|

|

|

8. |

Enter: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$38,600 if single or married filing separately, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$77,200 if married filing jointly or qualifying widow(er), |

8. |

|

|

|

|

|

|

|

$51,700 if head of household. |

|

|

|

|

|

|

9. |

Enter the smaller of line 1 or line 8 |

. . . . . . . . . . . . . . . . . 9. |

|

|

|

|

|

|

10. |

.Enter the smaller of line 7 or line 9 |

. . . . . . . . . . . . . . . . . 10. |

|

|

|

|

|

|

11. |

.Subtract line 10 from line 9. This amount is taxed at 0% . |

. . . . . . . . . . . . . . . . . 11. |

|

|

|

|

|

|

12. |

.Enter the smaller of line 1 or line 6 |

. . . . . . . . . . . . . . . . . 12. |

|

|

|

|

|

|

13. |

.Enter the amount from line 11 |

. . . . . . . . . . . . . . .. .13. |

|

|

|

|

|

|

14. |

Subtract line 13 from line 12 |

. .14. |

|

|

|

|

|

|

|

|

|

|

|

|

15. |

Enter: |

|

|

|

|

|

|

|

|

|

|

|

|

$425,800 if single, |

|

|

|

|

|

|

|

|

|

|

|

|

$239,500 if married filing separately, |

|

|

. . . . . . . . . . . . |

15. |

|

|

|

|

|

|

|

$479,000 if married filing jointly or qualifying widow(er), |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

$452,400 if head of household. |

|

|

|

|

|

|

|

|

|

|

|

Enter the smaller of line 1 or line 15 |

. . . . . . . . . . . . . . . . . 16. |

|

|

|

|

|

|

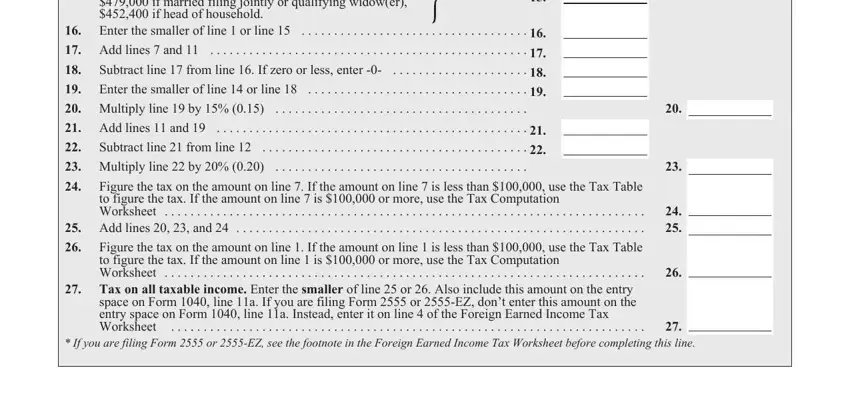

17. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Add lines 7 and 11 |

. . . . . . . . . . . . . . . . . 17. |

|

|

|

|

|

|

18. |

.Subtract line 17 from line 16. If zero or less, enter -0- . . . |

. . . . . . . . . . . . . . . . . 18. |

|

|

|

|

|

|

19. |

.Enter the smaller of line 14 or line 18 |

. . . . . . . . . . . . . . .. .19. |

|

|

|

|

|

|

20. |

Multiply line 19 by 15% (0.15) |

|

|

|

|

20. |

|

|

|

|

|

|

|

|

21. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Add lines 11 and 19 |

. . . . . . . . . . . . . . . . . 21. |

|

|

|

|

|

|

22. |

.Subtract line 21 from line 12 |

. . . . . . . . . . . . . . .. .22. |

|

|

|

|

|

|

23. |

Multiply line 22 by 20% (0.20) |

|

|

|

|

23. |

|

|

|

|

|

|

|

|

|

24. |

Figure the tax on the amount on line 7. If the amount on line 7 is less than $100,000, use the Tax Table |

|

|

|

|

|

|

to figure the tax. If the amount on line 7 is $100,000 or more, use the Tax Computation |

|

|

|

|

|

Worksheet |

. .24 |

|

25. |

Add lines 20, 23, and 24 |

25. |

|

|

|

|

|

|

|

26. |

Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use the Tax Table |

|

to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation |

|

Worksheet |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26. |

|

|

|

Worksheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27.