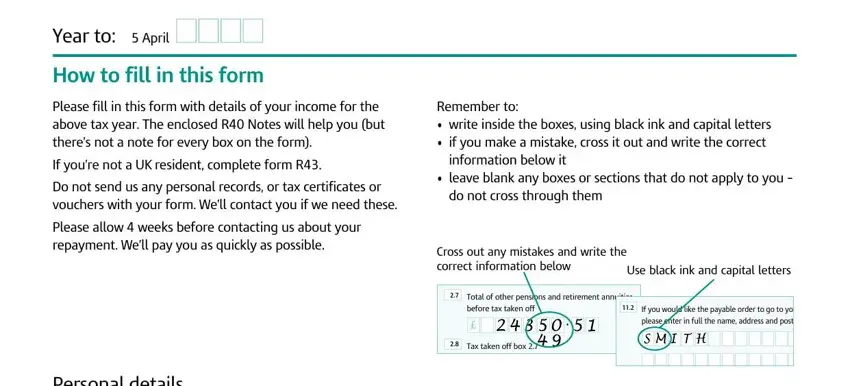

Working with PDF documents online is actually simple with this PDF tool. You can fill in R40 Online Form here in a matter of minutes. The editor is constantly maintained by our team, acquiring new features and turning out to be much more versatile. Here's what you'd need to do to start:

Step 1: Press the "Get Form" button at the top of this webpage to open our PDF tool.

Step 2: Once you launch the PDF editor, you'll notice the form prepared to be filled in. Other than filling out different fields, you may also do many other things with the PDF, namely putting on your own text, modifying the initial text, adding illustrations or photos, putting your signature on the document, and more.

It really is straightforward to fill out the pdf using this practical tutorial! This is what you need to do:

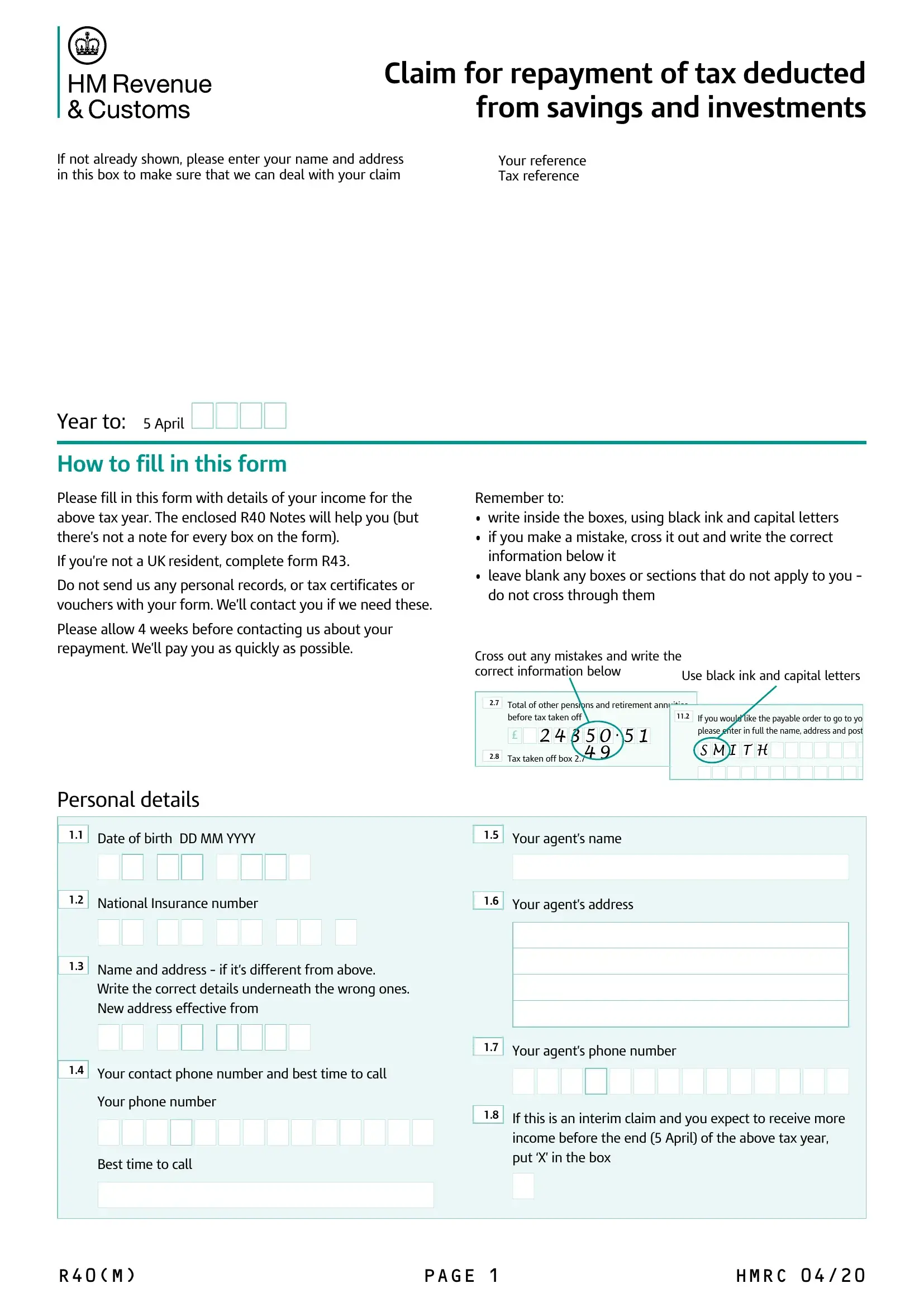

1. Start completing your R40 Online Form with a number of major blanks. Consider all the necessary information and ensure there is nothing neglected!

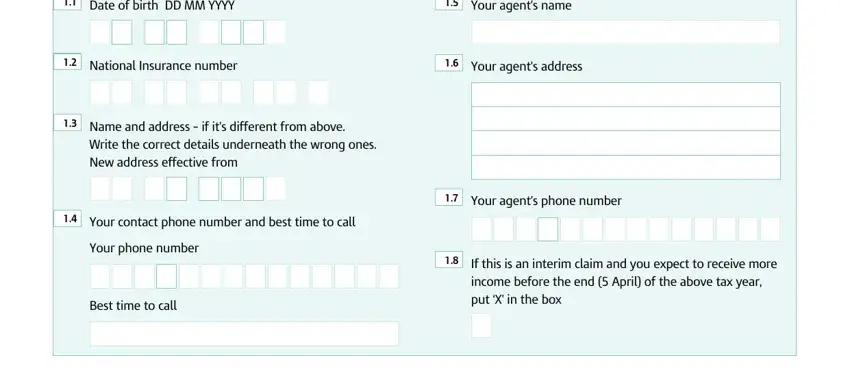

2. Right after filling in the previous step, go on to the next stage and complete the essential details in all these blanks - Date of birth DD MM YYYY, Your agents name, National Insurance number, Your agents address, Name and address if its, Write the correct details, Your contact phone number and, Your agents phone number, Your phone number, Best time to call, If this is an interim claim and, and income before the end April of.

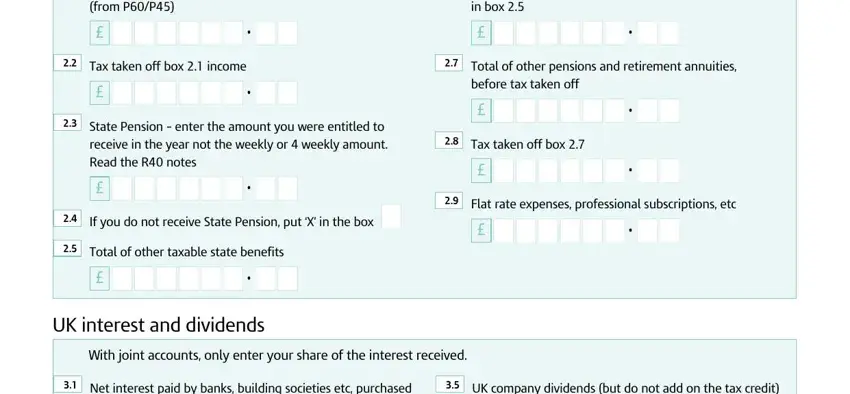

3. This next part will be easy - fill in all the fields in from PP, Tax taken off box income, State Pension enter the amount, If you do not receive State, Total of other taxable state, UK interest and dividends, in box, Total of other pensions and, before tax taken off, Tax taken off box, Flat rate expenses professional, With joint accounts only enter, Net interest paid by banks, and UK company dividends but do not in order to finish this part.

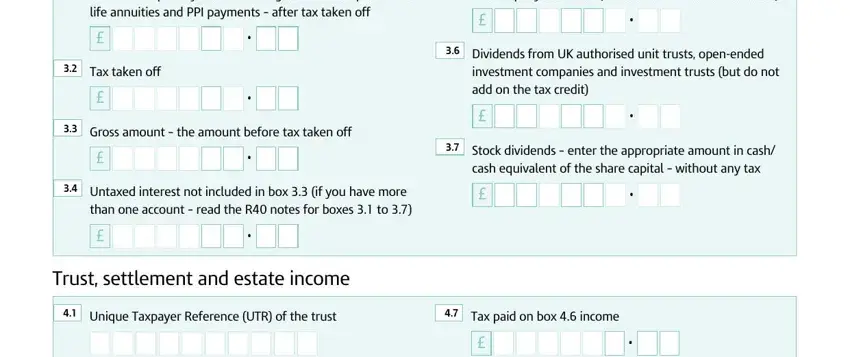

4. This specific part comes with the next few blanks to fill out: Net interest paid by banks, UK company dividends but do not, life annuities and PPI payments, Tax taken off, Gross amount the amount before, Dividends from UK authorised unit, investment companies and, Stock dividends enter the, cash equivalent of the share, Untaxed interest not included in, Trust settlement and estate income, Unique Taxpayer Reference UTR of, and Tax paid on box income.

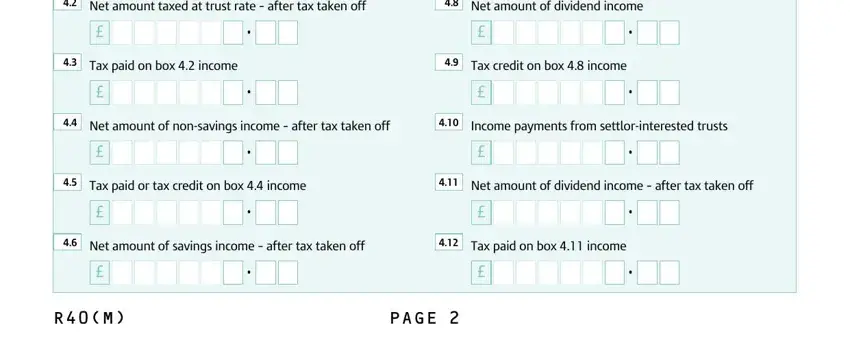

5. To conclude your form, this final segment involves a number of additional blanks. Typing in Net amount taxed at trust rate, Net amount of dividend income, Tax paid on box income, Tax credit on box income, Net amount of nonsavings income, Income payments from, Tax paid or tax credit on box, Net amount of dividend income, Net amount of savings income, Tax paid on box income, and PAGE will certainly finalize the process and you'll be done in no time at all!

When it comes to Tax credit on box income and Tax paid on box income, ensure you don't make any errors here. These could be the key ones in this document.

Step 3: Once you have glanced through the information you given, press "Done" to conclude your form. Obtain the R40 Online Form once you register at FormsPal for a 7-day free trial. Quickly access the document in your FormsPal account page, along with any modifications and changes conveniently saved! FormsPal guarantees protected form tools with no data record-keeping or distributing. Rest assured that your information is secure here!