The notion behind our PDF editor was to permit it to be as straightforward as possible. The overall procedure of completing state of michigan rd108 stress-free so long as you adhere to all of these actions.

Step 1: Hit the orange button "Get Form Here" on the page.

Step 2: Now you are on the document editing page. You may edit, add information, highlight certain words or phrases, place crosses or checks, and include images.

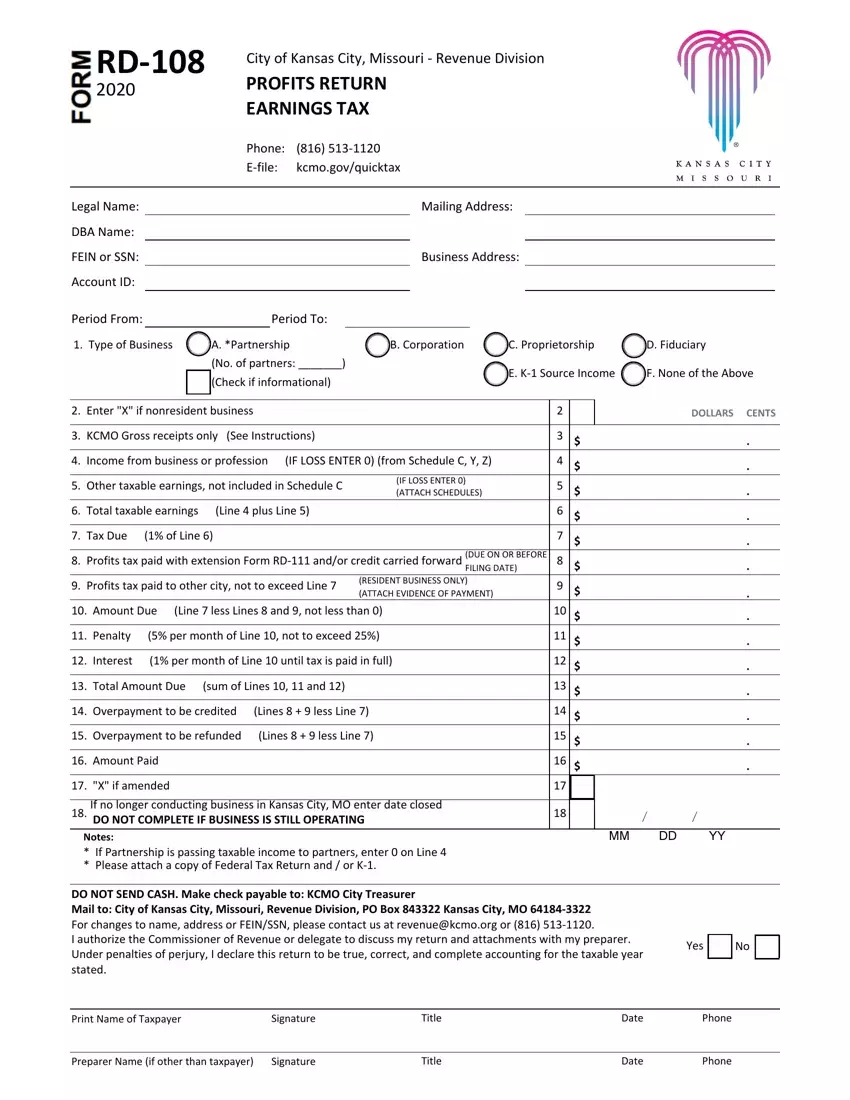

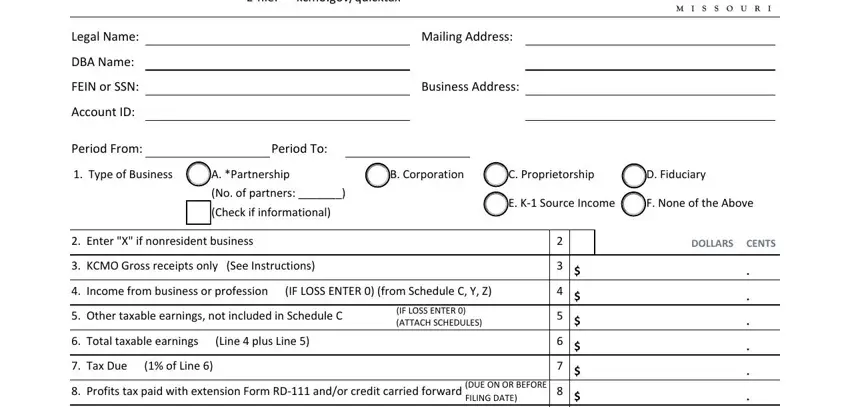

You will need to enter the next details to complete the document:

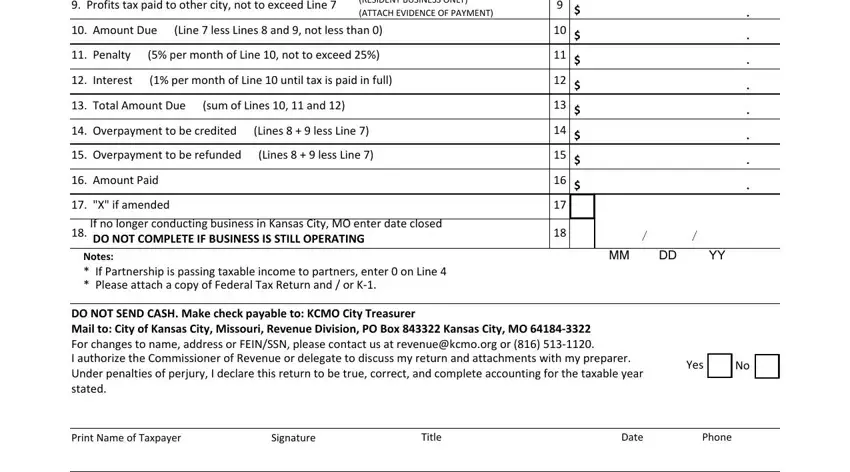

Remember to complete the Profits tax paid to other city, RESIDENT BUSINESS ONLY ATTACH, Amount Due Line less Lines and, Penalty per month of Line not, Interest per month of Line, Total Amount Due sum of Lines, Overpayment to be credited Lines, Overpayment to be refunded Lines, Amount Paid, X if amended, If no longer conducting business, Notes If Partnership is passing, DO NOT SEND CASH Make check, Yes, and Print Name of Taxpayer field with the appropriate details.

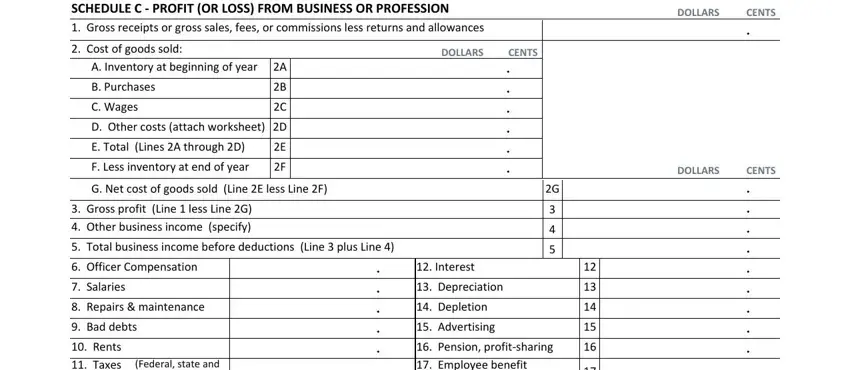

It is important to note particular data inside the area SCHEDULE C PROFIT OR LOSS FROM, DOLLARS, CENTS, Cost of goods sold, A Inventory at beginning of year, B Purchases, C Wages, D Other costs attach worksheet, E Total Lines A through D, F Less inventory at end of year, G Net cost of goods sold Line E, Gross profit Line less Line G, Total business income before, DOLLARS, and CENTS.

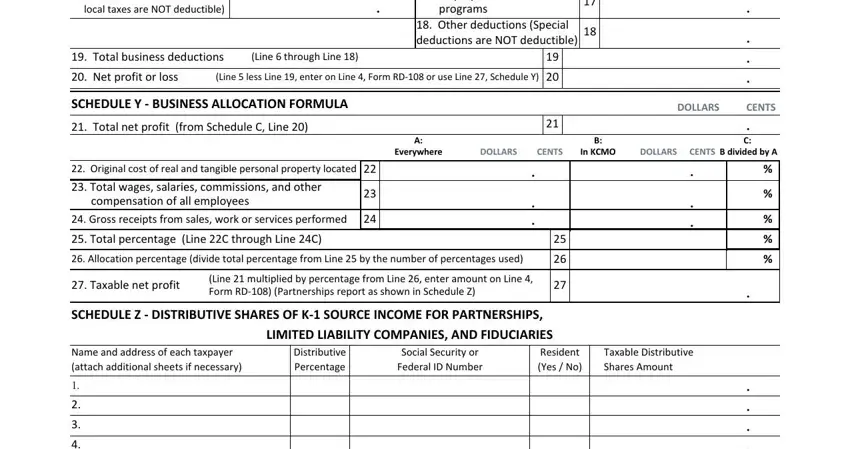

You will need to identify the rights and responsibilities of every party in paragraph Rents Taxes, Federal state and local taxes are, Pension profitsharing Employee, programs, Other deductions Special, Total business deductions, Line through Line, Net profit or loss, Line less Line enter on Line, SCHEDULE Y BUSINESS ALLOCATION, Total net profit from Schedule C, Original cost of real and, compensation of all employees, Gross receipts from sales work or, and Total percentage Line C through.

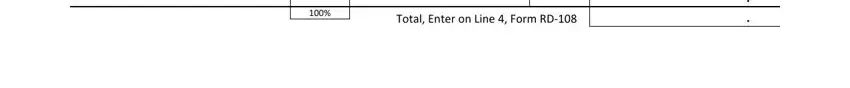

End up by checking the next areas and filling them in as required: Total Enter on Line Form RD.

Step 3: In case you are done, choose the "Done" button to transfer your PDF file.

Step 4: You should create as many duplicates of your file as you can to avoid possible problems.