Filling in real estate agent p l template is a breeze. We developed our editor to make it simple to use and assist you to fill in any PDF online. Here are some steps that you need to follow:

Step 1: Select the orange button "Get Form Here" on the following website page.

Step 2: You are now capable of update real estate agent p l template. You have a lot of options with our multifunctional toolbar - it's possible to add, erase, or change the content material, highlight its certain areas, and carry out several other commands.

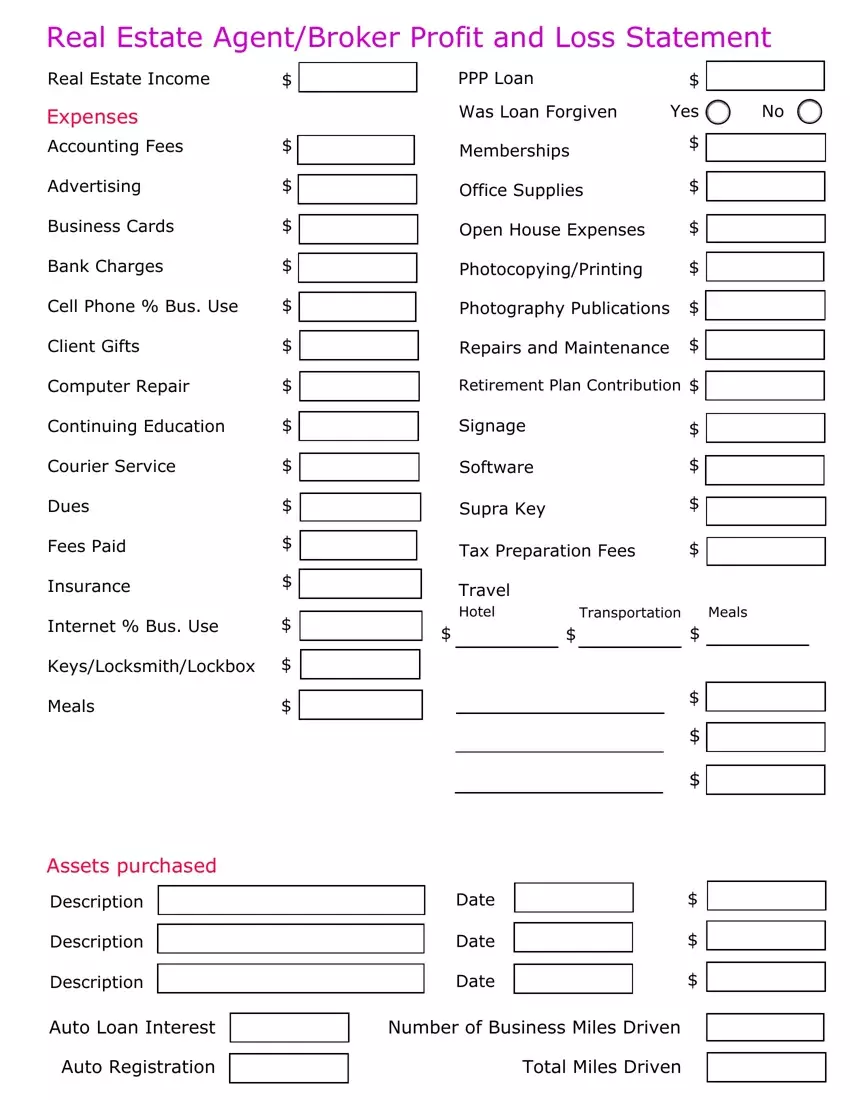

Make sure you enter the following details to create the real estate agent p l template PDF:

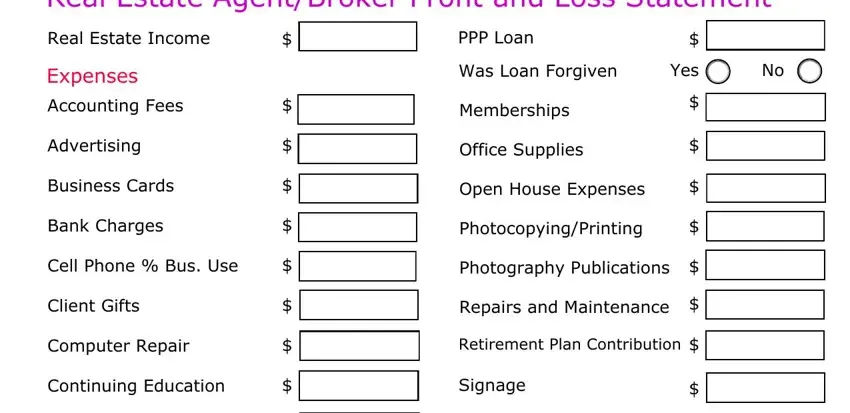

Make sure you write down the necessary information in the Courier Service, Dues, Fees Paid, Insurance, Internet Bus Use, KeysLocksmithLockbox, Meals, Software, Supra Key, Tax Preparation Fees, Travel Hotel, Transportation, Meals, Assets purchased, and Description area.

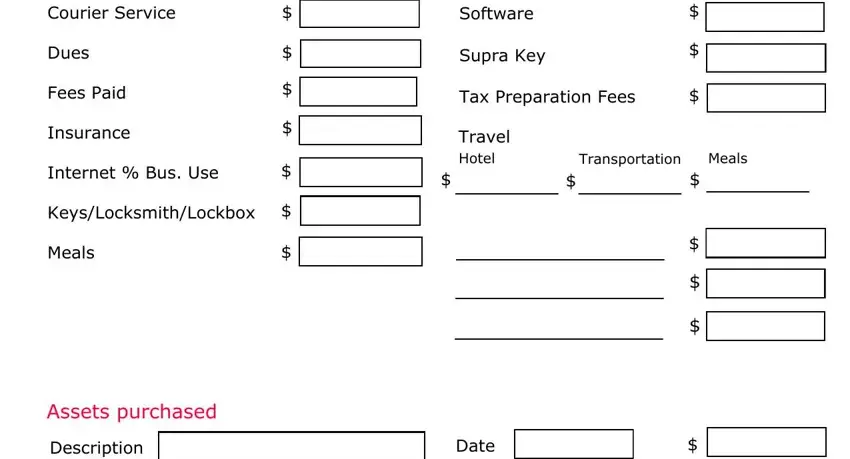

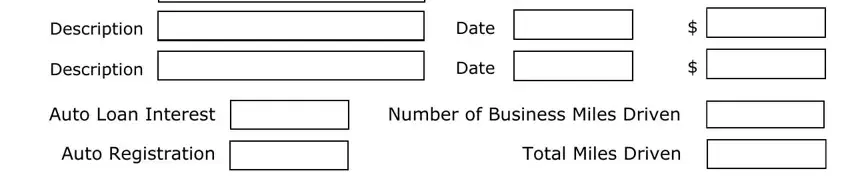

It is vital to write down some information in the area Description, Description, Description, Date, Date, Auto Loan Interest, Number of Business Miles Driven, Auto Registration, and Total Miles Driven.

Step 3: Choose the Done button to make sure that your completed form may be transferred to any device you choose or delivered to an email you specify.

Step 4: Be sure to create as many duplicates of the document as possible to stay away from future problems.