Filling in realtor tax deductions is a breeze. Our experts made our software to really make it easy to use and help you fill out any PDF online. Below are some steps that you should follow:

Step 1: Pick the button "Get Form Here".

Step 2: As soon as you have entered the realtor tax deductions edit page, you'll see all functions you can take regarding your template in the upper menu.

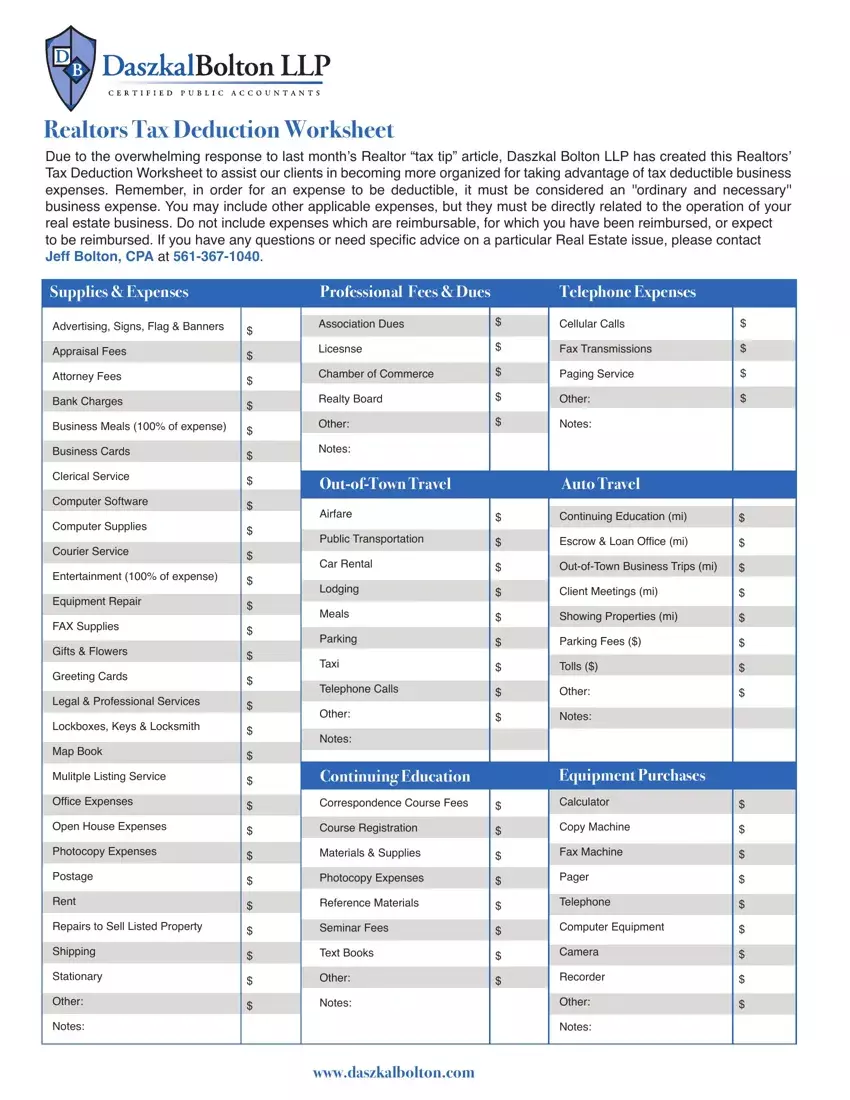

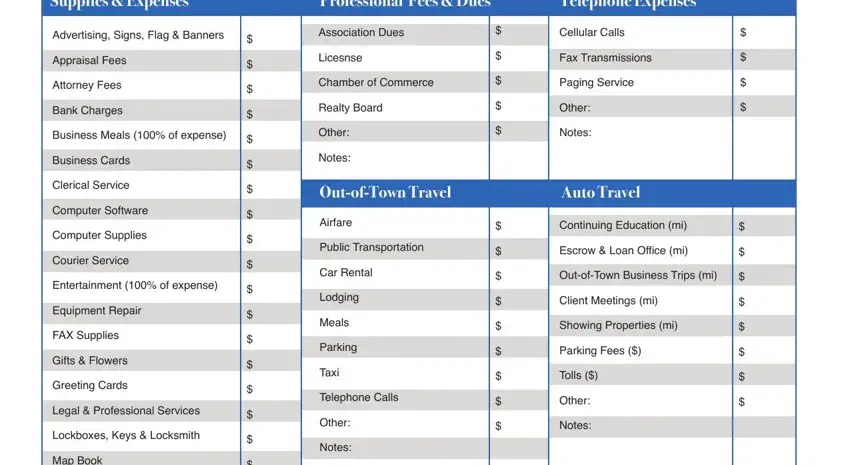

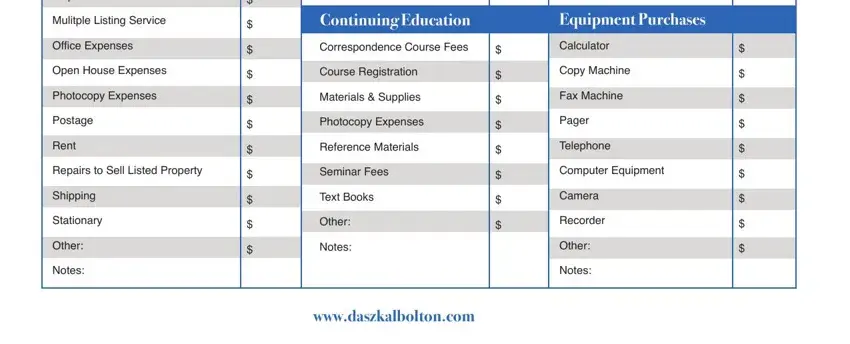

These sections are going to make up the PDF document:

Inside the field Map Book, Mulitple Listing Service, Office Expenses, Open House Expenses, Photocopy Expenses, Postage, Rent, Repairs to Sell Listed Property, Shipping, Stationary, Other, Notes, Continuing Education, Correspondence Course Fees, and Course Registration note the data which the platform demands you to do.

Step 3: Click the "Done" button. Next, it is possible to export the PDF document - save it to your electronic device or deliver it by using email.

Step 4: To avoid any sort of problems down the road, try to prepare up to a few copies of your file.