The Pacific Gas and Electric Company (PG&E) provides an enticing opportunity for businesses to reduce their energy consumption and environmental impact while saving money through their Business Rebate Program. To participate, businesses must purchase and install eligible energy-efficient products within a specific timeframe and comply with predetermined requirements. The process involves selecting products listed in the PG&E Business Rebate Catalog(s), ensuring the purchase is made during the eligibility term, and having the installation completed and operational before submitting an application. Essential application materials include a recent PG&E bill, proof(s) of purchase, and, if required, additional documentation to support the claim. With an emphasis on streamlining the application process, participants are advised to apply online while also having the option to mail their application and necessary documents. Furthermore, applicants are encouraged to verify product eligibility, complete all sections of the application accurately, and adhere to the submission deadline to ensure their application is considered. This rebate program not only furnishes financial incentives but also equips businesses with valuable resources to further enhance energy efficiency, including access to energy management tools, information on other rebate programs, and guidance on upgrading lighting and HVAC systems for better performance and longevity.

| Question | Answer |

|---|---|

| Form Name | Rebate Application Form |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | pg e business rebate, rebate application form search, pge business rebate, pge rebate form get |

PG&E Business Rebate Application

Pacific Gas and Electric Company (PG&E) offers rebates on hundreds of

You’ll need:

•Business Rebate Catalog(s)

•PG&E Bill

•Proof(s) of Purchase

•Additional Documentation (if required)

Apply online:

www.pge.com/mybusiness/ erebates

Need help?

Call the Business Customer Service Center at

or visit www.pge.com/ businessrebates

How to Apply

Check that each item below is complete.

Read the Terms and Conditions to determine if you are eligible for a rebate.

Verify the product(s) you are going to install meet(s) the eligibility requirements listed in the Business Rebate Catalog(s). To download a catalog, visit www.pge.com/businessrebates or contact PG&E’s Business Customer Service Center at

Purchase and install qualifying product(s) during the rebate eligibility term from January 1, 2013 to December 31, 2014. Term duration and product eligibility may be subject to change. Ensure product(s) is/are installed and operational before submitting your application.

Complete the application or apply online at www.pge.com/mybusiness/erebates.

You will need to refer to your PG&E bill and proof(s) of purchase. Incomplete applications cannot be processed.

Include proof(s) of purchase and additional documentation, if required. Refer to Proof of Purchase Requirement section to the right.

Sign the application.

Note: HVAC replacements (measures

Make copies of all documentation for your records.

Mail your completed application, proof(s) of purchase and additional documentation, if required, as soon as possible as rebates are limited and awarded on a

Mail to:

PG&E Business Rebates

Integrated Processing Center

P.O. Box 7265

San Francisco, CA

A rebate check is generally mailed six to eight weeks after PG&E receives a completed application, including all required documentation. Sign up for

“My Energy” at www.pge.com/myenergy to check the status of your rebate online.

Proof of Purchase Requirement

Retail product receipt or invoices must be legible and include the following information:

•Retailer or contractor name, address and phone number.

•Itemized listing of each product including: the product description, quantity, manufacturer, model number, or other identifying information (e.g. SKU #).

This must match the requested product information listed on your application.

•Purchase price per product.

•Date paid with terms such as “Paid in Full”, “Charge” or “Net 30.”

•Date product was installed

(if installed by a contractor).

More ways for your business to save money.

Looking for more information on PG&E rebates and incentives for your business? Visit www.pge.com/moneybacksolutions to access the latest rebate information, catalogs, application and guidance for your next energy efficiency upgrade. In addition to rebates, you can find a wide range of tools and resources that can help your business save energy, money and help the environment.

•Sign up for PG&E’s Automated Benchmarking Service at www.pge.com/benchmarking. Use ENERGY STAR® Portfolio Manager to track and compare your facility’s energy performance over time.

•Use PG&E’s Business Energy Checkup tool at www.pge.com/businessenergycheckup to identify energy and money saving options for your facility, and get started on developing a comprehensive energy management plan.

•Find a suite of customized incentives for retrofitting outdated, inefficient equipment, as well as incentives to optimize existing equipment through retrocommissioning at www.pge.com/businessrebates.

•Log in to My Energy at www.pge.com/myenergy to view your energy use, compare rate options and access energy and money saving tools.

•See lighting in a new light at www.pge.com/bizlighting. Upgrading your lighting system is one of the best

•Find out how quality maintenance of your HVAC equipment can help you avoid expensive emergency repairs and accelerated unit replacement costs at www.pge.com/rethinkHVAC.

•Ready to get started with your next project and need the help of a contractor? Find local vendors who participate in PG&E’s Energy Efficiency Rebates for Your Business Program www.pge.com/tradeprodirectory.

•You can also apply online or check the status of your rebate through eRebates at www.pge.com/mybusiness/erebates.

•To learn how PG&E can help your business find innovative energy solutions, manage energy consumption and reduce costs, please contact PG&E’s Business Customer Service Center at

PG&E Business Rebate Application

Please complete all steps. Incomplete applications cannot be processed. If you are applying for rebates at more than one Service ID#, please list in Step 4.

STEP 1 Account and Customer Contact Information

PG&E will use the information you provide below to contact you, if necessary, about your application.

Please refer to your PG&E bill for Service ID#s.

Service ID# from Gas Account Detail |

|

|

|

Service ID# from Electric Account Detail |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Account holder/Company Name (as it appears on PG&E bill) |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Contact Name (if different from Account Holder) |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product Installation Address |

|

|

|

|

|

|

|

Suite |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

State |

Zip Code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Mailing Address (if different than Installation Address) |

|

|

|

Suite |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

State |

Zip Code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary Phone # |

|

|

|

|

Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes, I would like to be notified by email of other PG&E programs. |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Property occupied by: |

|

Owner |

|

Tenant Estimated Year Built |

|

Estimated Square Footage |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STEP 2 Business Payee Tax Information

Required information for all applications

Tax Status: To be completed by the person or entity receiving payment (”Payee”)

Corporation |

Partnership |

|

Individual/Sole Proprietor |

Exempt (Tax exempt, |

||||||||||||||||||

Tax ID Number: Please provide EITHER your EIN/Federal Tax ID or Social Security Number |

||||||||||||||||||||||

in the appropriate spaces below. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

OR |

|

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EIN or Federal Tax ID |

|

|

|

|

|

|

|

Social Security Number |

|

|

|

|

|

|

||||||||

Tax Liability: You are urged to consult your tax advisor concerning the taxability of rebates. PG&E is not responsible for any taxes that may be imposed on your business as a result of receipt of this rebate. Rebates are taxable if greater than $600 within one calendar year for business customers, and will be reported as income to you on IRS Form 1099 unless you have checked “Corporation” or “Exempt” tax status above.

STEP 3 Payment Release Authorization (If Applicable)

SKIP THIS SECTION IF REBATE CHECK WILL BE MADE PAYABLE TO ACCOUNT HOLDER

Complete this section only if payment is going to someone other than the PG&E account holder in Step 1. I am authorizing this payment of my rebate to the third party (“Payee”) named below and I understand that I will not be receiving the rebate check from PG&E. If “Payee” is a business, requested tax information must be provided. I also understand that my release of the payment to the third party does not exempt me from the rebate requirements outlined in this application. PLEASE USE BLUE OR BLACK INK.

AUTHORIZED BY:

PG&E Account Holder (print)

|

Signature |

|

|

Date |

|

|

|

|

|

|

|

|

|

CHECK SHOULD BE MADE PAYABLE TO: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payee: Individual/Business Name |

|

Phone # |

|

|

|

|

|

|

|

|

|

|

|

Payee Mailing Address |

City |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

Please complete steps 4 and 5 on the other side prior to signing

STEP 6 Customer Signature

I have read, understood, and agree to the Terms and Conditions. I certify that the information I have provided is true and correct and the product(s) for rebate is/are installed and operational and meet(s) the requirements in this application and the business rebate catalog(s). PLEASE USE BLUE INK.

SIGN HERE

Customer Signature |

Name (print) |

Date |

||

|

|

|

|

|

STEP 6A |

Contractor Signature |

(Required only for applications including |

||

measures |

|

|||

|

|

|

|

|

By signing below, I certify I am a licensed contractor and have followed applicable permitting requirements for this HVAC installation or replacement.

SIGN HERE

Contractor Signature |

Name (print) |

|

|

|

|

Permit Number |

Agency |

Date |

January 2014

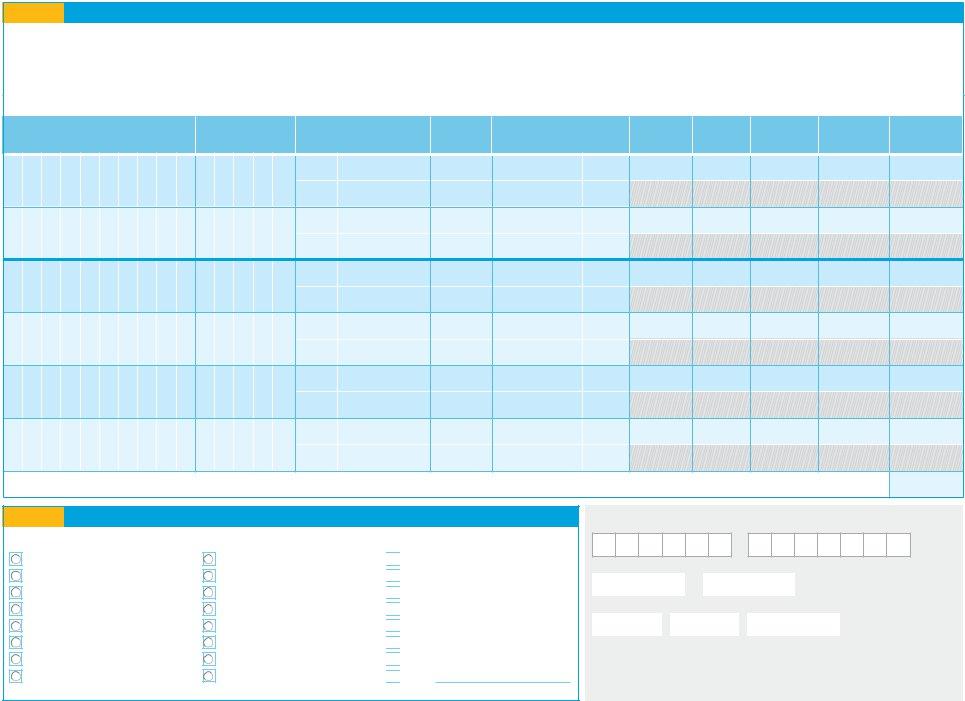

STEP 4 Rebate Product Information

Please refer to the following:

•Your PG&E bill for your Service ID#(s). If you are applying for rebates for more than one Service ID#, either gas or electric, you must provide the Service ID# where the specific product is installed.

•Business Rebate Catalogs at www.pge.com/businessrebates for product eligibility requirements, Rebate Code (for the product you are installing) and Rebate Per Unit.

•Your invoice/receipt for Manufacturer and Model Number.

•Optional: Please provide detail for ‘Old’ unit(s) being removed (if applicable). This information helps PG&E better serve our customers in the future.

Service ID# Gas/Electric |

Rebate |

Manufacturer |

Model # |

Technology in Watts (W) |

Date |

Unit of |

Number of |

Rebate |

Rebate |

(10 digits) |

Code |

|

|

or Therms (Th) |

Installed |

Measure |

Units (A) |

per Unit (B) |

Total (A X B) |

SAMPLENew: |

1 |

$1,000.00 |

$ |

||||||

New: |

Food Service US |

Oven |

0.14 Th |

1/15/2014 |

VAT |

$1,000.00 |

|||

1 2 3 4 5 6 7 8 9 0 F 1 0 0 |

|

|

|

|

|

|

|

|

|

Old: |

Oven Corp. |

Convection Oven |

0.32 Th |

|

|

|

|

|

|

New: |

LED Company |

25WLED |

LED Fixture |

25 W |

1/24/2014 |

Unit |

2 |

$25.00 |

$50.00 |

9 8 7 6 5 4 3 2 1 0 L 1 0 3 2 |

|

|

|

|

|

|

|

|

|

Old: |

Bulbs Inc. |

F19W60 |

Incandescent |

100 W |

|

|

|

|

|

Old: |

|

|

|

|

|

|

|

|

|

New: |

|

|

|

|

|

|

|

|

$ |

Old: |

|

|

|

|

|

|

|

|

|

New: |

|

|

|

|

|

|

|

|

$ |

Old: |

|

|

|

|

|

|

|

|

|

New: |

|

|

|

|

|

|

|

|

$ |

Old: |

|

|

|

|

|

|

|

|

|

Please note: If you need more space for additional items, either attach a separate sheet or download the form at www.pge.com/businessrebates. |

|

|

Total Rebate |

$ |

|||||

STEP 5 Business Property Type Description

Select one (1) property type that best represents your business:

Assembly/Meeting Hall |

Health/Medical: Nursing Home |

Education: Community College |

Lodging: Hotel |

Education: Primary School |

Lodging: Motel |

Education: Relocatable Classroom |

Manufacturing: Bio/Tech |

Education: Secondary School |

Manufacturing: Light Industrial |

Education: University |

Office: Large |

Grocery |

Office: Small |

Health/Medical: Hospital |

Restaurant: |

Restaurant:

Retail:

Retail:

Retail: Small

Storage: Conditioned

Storage: Refrigerated Warehouse

Storage: Unconditioned

Other

(please describe)

UTILITY USE ONLY

POST FIELD DATE |

|

|

|

|

|

|

|

VENDOR NUMBER |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail check to field office |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OBF Loan |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

TPI CODE |

|

|

REP ID |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

– |

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REP PHONE # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL REBATE |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

REVIEWER/AUTHORIZED SIGNATURE #1 |

|

AUTHORIZED SIGNATURE #2 (If > $5,000) |

|||||||||||||||||

Mail to: |

Need help? |

PG&E Business Rebates Integrated Processing Center |

Business Customer Service Center: |

P.O. Box 7265, San Francisco, CA |

Apply Online: www.pge.com/mybusiness/erebates |

TERMS AND CONDITIONS

1.To be eligible for a rebate in accordance with this application, I must be a customer of Pacific Gas and Electric Company (PG&E) with an active meter and be installing a qualified product(s). All references to the term “install, installation or similar phrases” shall mean that the product is completely installed and is entirely functional and operational.

2.I understand for each product installed the requirement is to identify each Service ID # on the “Rebate Product Information.”

I also agree to provide PG&E with 100 percent of the energy savings for the rated life of the product(s) or for a period of five years from receipt of rebate, whichever is less. If I do not provide the energy savings or if I cease to be a customer of PG&E during the five years, I shall refund a prorated amount of rebate dollars based on the time installed. The rebate may include labor cost only if an outside contractor is hired to perform the work.

3.I understand the rebate eligibility term is from January 1, 2013 through December 31, 2014 (“Term”). The Term may be extended upon approval by the California Public Utilities Commission (CPUC). Products purchased and installed within the Term are eligible for a rebate, provided rebate funding is still available. Funding is available on a

4.Rebate offerings and rebate amounts may change without notice during the Term. Resale products, rebuilt, rented or leased less than five years, received from warranty or insurance claims, exchanged, won as a prize, or new parts installed in existing products, do not qualify for any rebate. The terms and the application requirements may be modified or terminated without prior notice. Complete applications must be postmarked and received by PG&E's Integrated Processing Center (IPC) no later than January 31, 2015.

5.I understand only complete applications can be processed for rebates. Failure to submit a complete application may result in delay or rejection of a filed application. Complete applications must include all required application information, a signature, proof(s)

of purchase and other required documentation for all products as referenced in this application. Original applications will become the property of PG&E. PG&E is not responsible for items lost or destroyed in transit through the mail or electronic medium.

6.I will allow, if requested, a representative from PG&E, the CPUC, or any authorized third party reasonable access to my property to verify the installed product before a rebate is paid. I understand a rebate will not be paid if I refuse to participate in any required verification that is scheduled within 30 days of PG&E contacting me. PG&E may contact the product vendor and/or installer, if needed, to verify purchase and/or installation and may provide my name and/or address to third parties to complete this verification.

7.I certify that I have installed product(s) in accordance with all applicable federal, state, and local laws, building codes, manufacturer’s specifications, and permitting requirements. If a contractor performed the installation or improvement, the contractor holds the appropriate license for the work performed.

8.I understand the rebate amount cannot exceed the purchase price of the product,

nor can it include taxes or shipping costs. PG&E reserves the right to limit the number of products rebated.

9.I understand I cannot receive a rebate for the same product(s) from more than one California

10. PG&E MAKES NO REPRESENTATION OR WARRANTY, AND ASSUMES NO LIABILITY WITH RESPECT TO QUALITY, SAFETY, PERFORMANCE, OR OTHER ASPECT OF ANY DESIGN, SYSTEM PRODUCT OR APPLIANCE INSTALLED PURSUANT TO THIS AGREEMENT, AND EXPRESSLY DISCLAIMS ANY SUCH REPRESENTATION, WARRANTY OR LIABILITY. I AGREE TO INDEMNIFY PG&E, ITS AFFILIATES, SUBSIDIARIES, PARENT COMPANY, OFFICERS, DIRECTORS, AGENTS, AND EMPLOYEES AGAINST ALL LOSS, DAMAGE, EXPENSE, FEES, COSTS AND LIABILITY ARISING FROM ANY CLAIMS RELATED TO ANY PRODUCTS INSTALLED OR SERVICES PERFORMED DURING THE INSTALLATION OR MAINTENANCE OF SUCH PRODUCTS.

11. If I am a tenant, I am responsible for obtaining the property owner’s permission to install product(s) for which I am applying for a rebate. My signature on this application indicates I have obtained this permission.

“PG&E” refers to Pacific Gas and Electric Company, a subsidiary of PG&E Corporation. ©2014 Pacific Gas and Electric Company. All rights reserved. These offerings are funded by California utility customers and administered by PG&E under the auspices

of the California Public Utilities Commission. |

January 2014 |