In case you desire to fill out Reg 1E Form, there's no need to install any sort of programs - just use our PDF editor. We are focused on providing you with the ideal experience with our tool by regularly releasing new capabilities and upgrades. With all of these improvements, using our editor gets easier than ever! Getting underway is effortless! All you have to do is follow these basic steps down below:

Step 1: Press the orange "Get Form" button above. It will open up our pdf tool so that you can begin filling out your form.

Step 2: With our handy PDF file editor, it's possible to do more than just fill out forms. Express yourself and make your docs appear perfect with custom text put in, or fine-tune the file's original input to perfection - all that comes with an ability to incorporate almost any graphics and sign the PDF off.

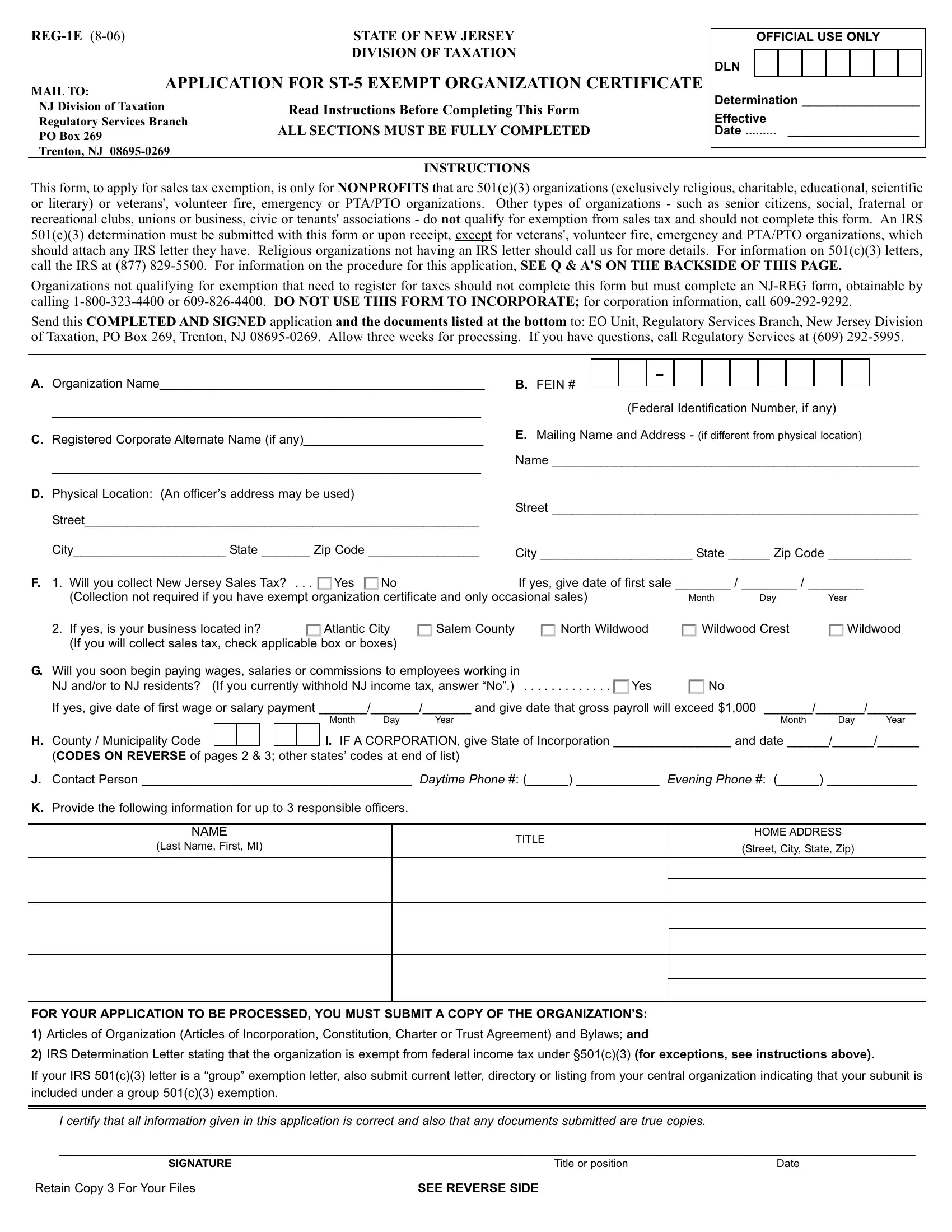

If you want to complete this PDF form, be sure you enter the information you need in each and every blank:

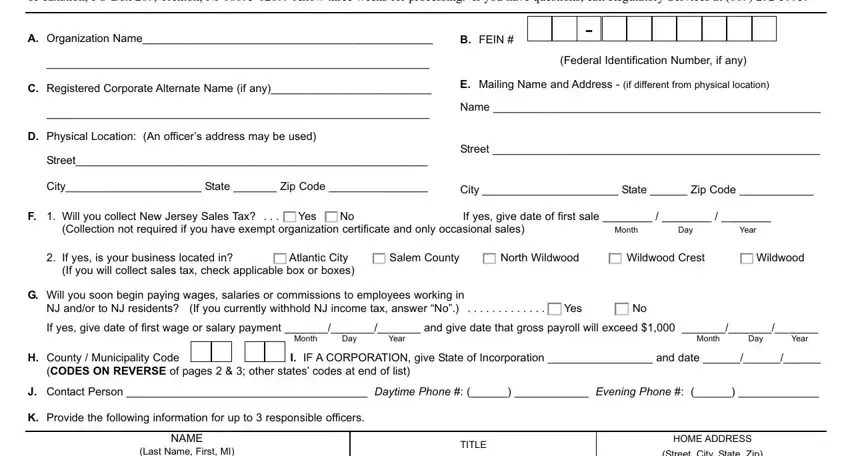

1. The Reg 1E Form necessitates certain information to be entered. Be sure the next fields are filled out:

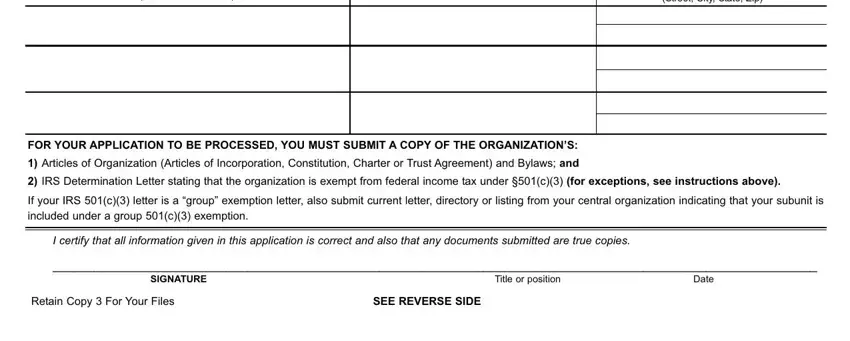

2. Right after this part is completed, proceed to enter the relevant details in all these: Last Name First MI, Street City State Zip, FOR YOUR APPLICATION TO BE, Articles of Organization Articles, IRS Determination Letter stating, If your IRS c letter is a group, I certify that all information, SIGNATURE, Title or position, Date, Retain Copy For Your Files, and SEE REVERSE SIDE.

Many people generally make mistakes while filling out I certify that all information in this area. You need to read twice everything you enter right here.

Step 3: Prior to submitting the document, make sure that blanks are filled in the right way. The moment you verify that it is good, press “Done." After starting a7-day free trial account at FormsPal, you will be able to download Reg 1E Form or email it without delay. The file will also be easily accessible from your personal account with your edits. When you work with FormsPal, you're able to complete documents without worrying about database incidents or data entries being distributed. Our protected software makes sure that your private information is stored safe.