These Terms and Conditions of Empanelment as a Distributor of Reliance Mutual Fund are a binding contract between yourself and Reliance Capital Asset Management Limited ('RCAM') (as asset manager of Reliance Mutual Fund ('RMF')) for your appointment as a distributor of Reliance Mutual Fund. Please read these Terms and Conditions carefully. By signing these Terms and Conditions you acknowledge that you have read, understood and agree to be legally bound by them.

OBLIGATIONS OF THE DISTRIBUTOR:

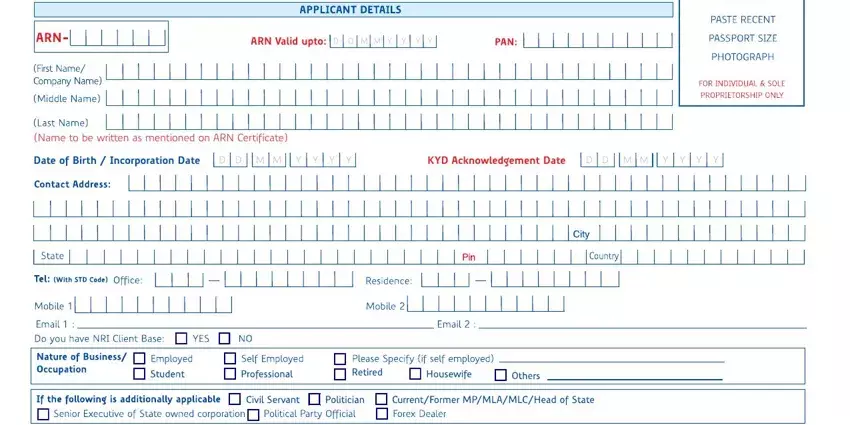

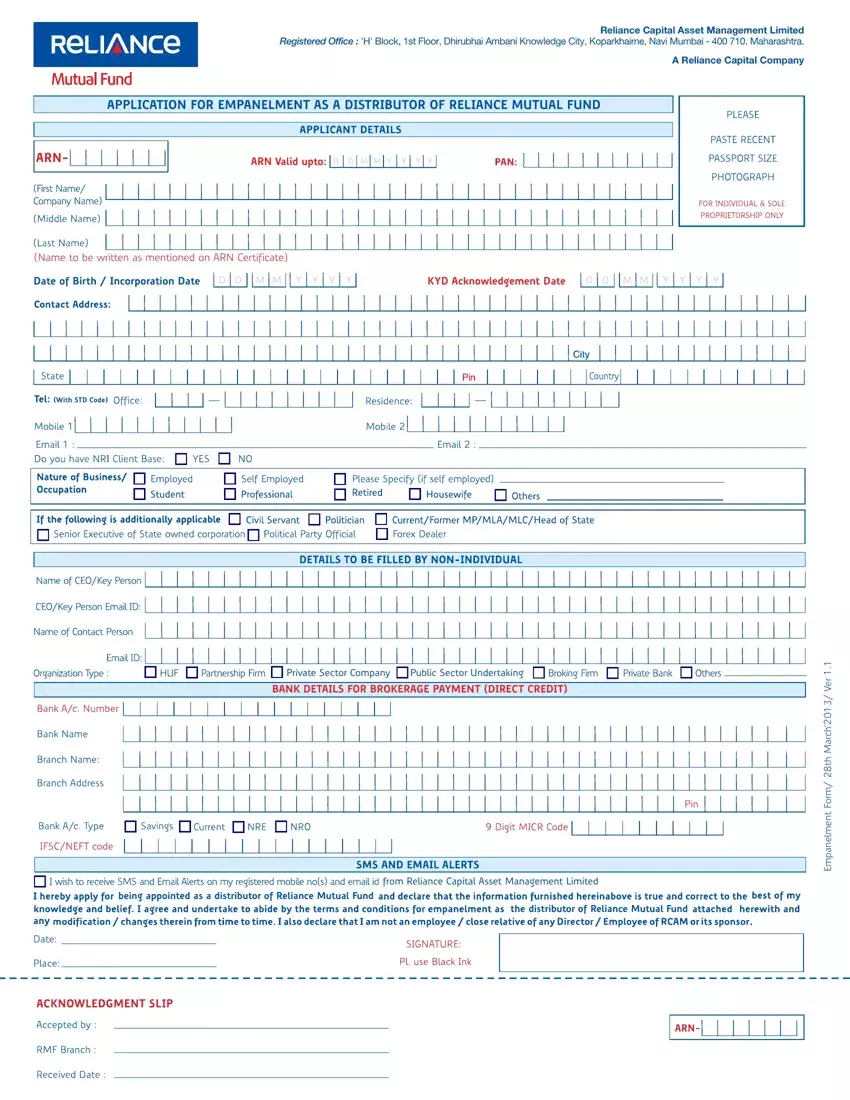

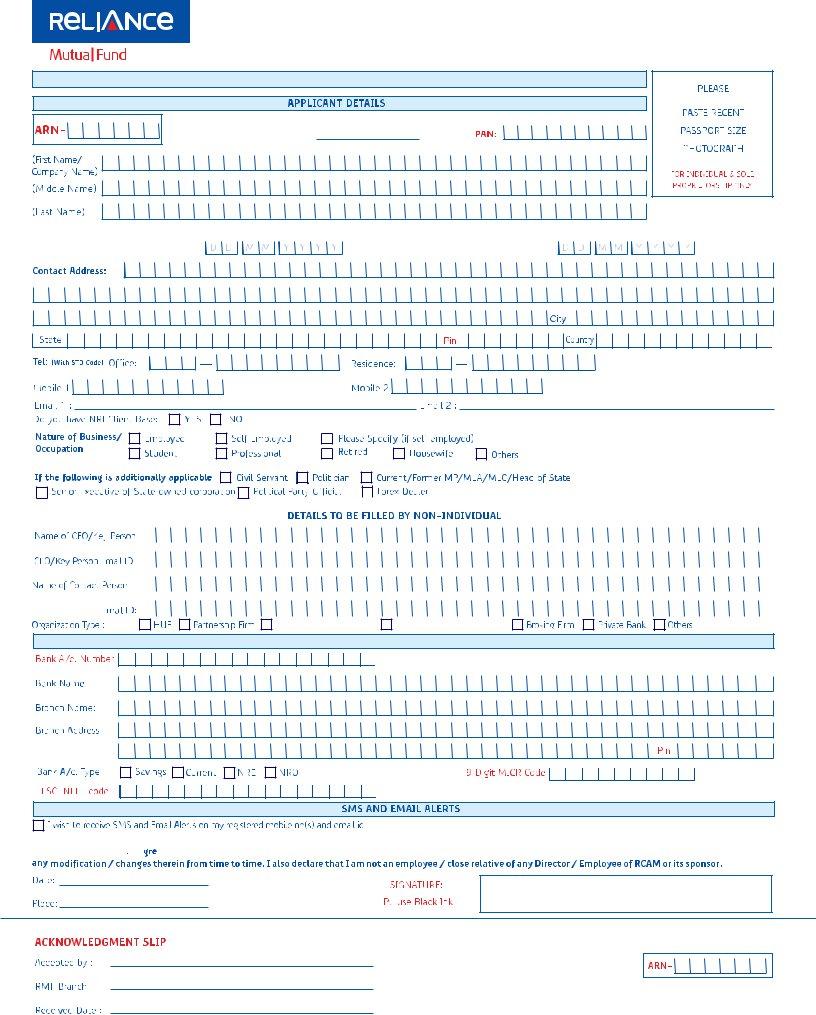

1.The Distributor and its employees who will be involved in the distribution of the units of the schemes of RMF represent and warrant that they are authorised to act as a distributor of mutual fund product(s) and have passed the Association of Mutual Funds of India ('AMFI') Certification Test (Advisor Module) and a copy of the AMFI Registration Number (ARN) shall be submitted to RCAM for its verification and records.

2.In terms of Circular No. 35P/ MEM-COR/ 13/ 10-11 dated August 27, 2010 issued by AMFI, the Distributor will comply with the know your distributor requirements.

3.The Distributor and its employees who will be involved in distribution of units of the schemes of RMF must carry out such directions and instructions as may be issued by RCAM from time to time and shall, at all times, comply with all the extant applicable laws, rules, regulations, guidelines, directions, etc.

4.The Distributor must carefully read and understand the Scheme Information Document ('SID') of the scheme(s) of RMF and Statement of Additional Information ('SAI') and explain to the investors, the investment objectives, features of the schemes and risks associated therein. The Distributor must not make any representation concerning RMF or any scheme of RMF except those contained in relevant SID, SAI, the Key Information Memorandum ('KIM') and / or the marketing material issued by RCAM.

5.The Distributor shall use only the SID, SAI, KIM and marketing material as is provided to him by RCAM and the Distributor shall not design his own marketing material in respect of any scheme of RMF unless he has obtained prior written approval of RCAM for the same.

6.The Distributor shall at all times conduct himself with propriety and decorum and in a manner which is not prejudicial to the interest of RCAM / RMF.

7.The Distributor must not use any unethical means to sell, distribute, market, solicit or induce any investor to undertake any transaction pertaining to the units of any scheme of RMF.

8.The Distributor shall, at all times, comply with and adhere to the code of conduct for Distributors (enclosed herewith as Annexure), including any amendments thereto from time to time.

9.The Distributor shall comply with the provisions of the Securities and Exchange Board of India (Mutual Funds) Regulations, 1996 and guidelines issued by Securities and Exchange Board of India ('SEBI') / AMFI from time to time pertaining to mutual funds with specific focus on regulations / guidelines on advertisements, sales literature and code of conduct.

10.The Distributor is not permitted to accept / receive cash towards investment in units of any scheme of RMF or otherwise on behalf of RCAM. The Distributor cannot, on behalf of RCAM, issue receipt of any application form(s), cheque(s), demand draft(s), etc. received towards subscription or any transaction in the units of any scheme of RMF.

11.The Distributor shall help RCAM/ RMF in complying with the relevant extant statutory and other applicable regulatory requirements relating to anti money laundering and know your client.

12.The Distributor shall be responsible for providing the foreign inward remittance certificate or the certificate evidencing the subscription by way of debit to the NRE/ FCNR account of any non-resident Indian investor, within five days from the receipt of subscription by RMF from such investor.

13.The Distributor shall not in any way pledge or have any lien or charge on the properties of the RCAM, RMF, the trustee company of RMF ('RCTC') or any investor, that are in its possession, towards the fees payable to the Distributor for the services rendered herein.

14.RCAM shall have a right to call upon the Distributor to furnish any information or statistics including but not limiting to his business with respect to other mutual fund(s), which the Distributor shall be bound to furnish.

15.The Distributor shall neither use nor display the name, logo, mark or any intellectual property of RCAM (or any things identical thereto) in any manner whatsoever, except as permitted by RCAM.

16.RCAM shall furnish to the Distributor through email, the copies of notices, addendums and all other documents as may be related to the schemes of RMF. The Distributor undertakes to:

(a)properly display such documents in its places of business;

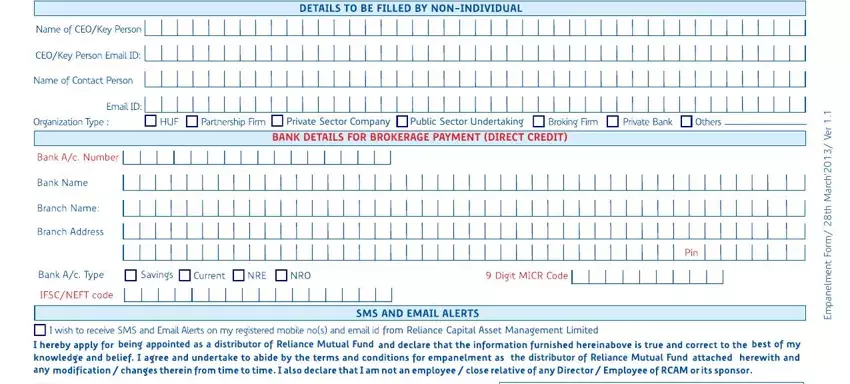

(b)provide his email address to RCAM and keep RCAM informed about the changes thereto;

(c)provide legible hard copies of such documents to investors/potential investors of RMF.

FEES AND CHARGES PAYABLE TO THE DISTRIBUTOR:

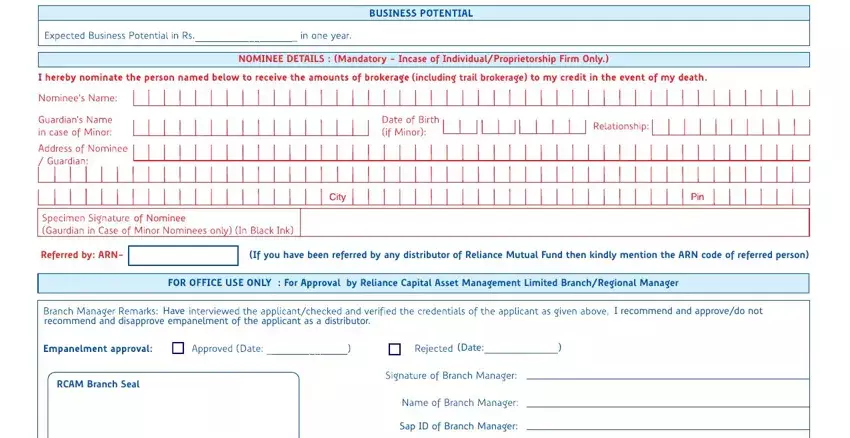

17.The Distributor shall be eligible for a fee, on the amount of subscriptions sourced by him towards investment in any scheme of RMF, at the rates prescribed by RCAM from time to time. The rate(s) of fee are subject to revision, from time to time, at the sole discretion of RCAM and the Distributor shall be bound by such revisions. The fee payable by RCAM shall be inclusive of all taxes, service tax, costs, charges and expenses incurred by the Distributor in connection with his rendering of the services herein.

18.In case the Distributor receives any fee which is not due or payable to the Distributor, RCAM / RMF shall be entitled to recover or adjust all such wrongly paid amounts from the amounts due to the Distributor.

19.RCAM will directly credit the fee payable to the Distributor in his bank account, as per the details provided by him from time to time, or through such means as may be deemed appropriate by RCAM.

20.In case any fee is paid to the Distributor, in advance, in respect of proposed subscriptions by any investor, RCAM shall have a right to recover such amount of advance fees, as is paid to the Distributor in respect of any subscriptions which are not made by the investor.

21.The Distributor shall be entitled to only the fee specified herein above for the services rendered by him in terms of this agreement.

INDEMNITY:

22. The Distributor hereby declares and covenants to defend, indemnify and hold RCAM and its directors, affiliates, promoters, employees, successors in interest and permitted assigns harmless from and against all claims, liabilities, costs, charges, damages or assertions of liability of any kind or nature resulting from:

a.Any breach of terms, covenants and conditions or other provisions hereof, or any SID(s) / SAI or any actions or omissions there under;

b.Any failure to comply with all applicable legislation, statutes, ordinances, regulations, administrative rulings or requirements of law;

c.The misfeasance, malfeasance, negligence, defaults, misconduct or fraudulent acts of & by the Distributor or its representatives, employees, directors, agents, representatives; and

d.Any and all actions, suits, proceedings, assessments, settlement, arbitration judgments, cost and expenses, including attorneys' fees, resulting from any of the matters set forth herein above.

TERM AND TERMINATION:

23.The appointment of the Distributor shall continue to remain in full force and effect unless terminated by RCAM or the Distributor, in accordance with the provisions contained herein. RCAM shall be entitled to terminate the engagement of the Distributor forthwith, if:

a.the Distributor is found to be a minor or adjudicated as an insolvent or found to be of unsound mind by a court of competent jurisdiction;

b.it is found that the Distributor has knowingly participated in or connived in any fraud, dishonesty or misrepresentation against RCAM / RMF or any unitholder of RMF.

c.any statement made by the Distributor in the Distributor Empanelment Form is found to be false or misleading or intended to mislead.

d.the Distributor conducts or acts in any manner, which is deemed prejudicial to the interest of RCAM / RMF;

e.the Distributor does not comply with all applicable legislations, statutes, ordinances, regulations, administrative rulings or requirements.

f.the Distributor remains inactive in business with RCAM for a considerable period of time, as decided by RCAM from time to time. RCAM also reserves the right to suspend brokerage under such cases.

Reliance Capital Asset Management Limited

Registered Office : 'H' Block, 1st Floor, Dhirubhai Ambani Knowledge City, Koparkhairne, Navi Mumbai - 400 710. Maharashtra.

A Reliance Capital Company