Dealing with PDF documents online is definitely super easy with our PDF tool. Anyone can fill out W-2 here painlessly. Our tool is constantly developing to give the best user experience attainable, and that's due to our commitment to constant improvement and listening closely to comments from users. Starting is effortless! All you should do is take these basic steps directly below:

Step 1: Open the PDF file in our tool by clicking the "Get Form Button" above on this webpage.

Step 2: With our online PDF tool, you can actually do more than simply fill out blank fields. Edit away and make your docs seem high-quality with customized text added, or fine-tune the file's original input to perfection - all comes along with the capability to incorporate stunning images and sign the file off.

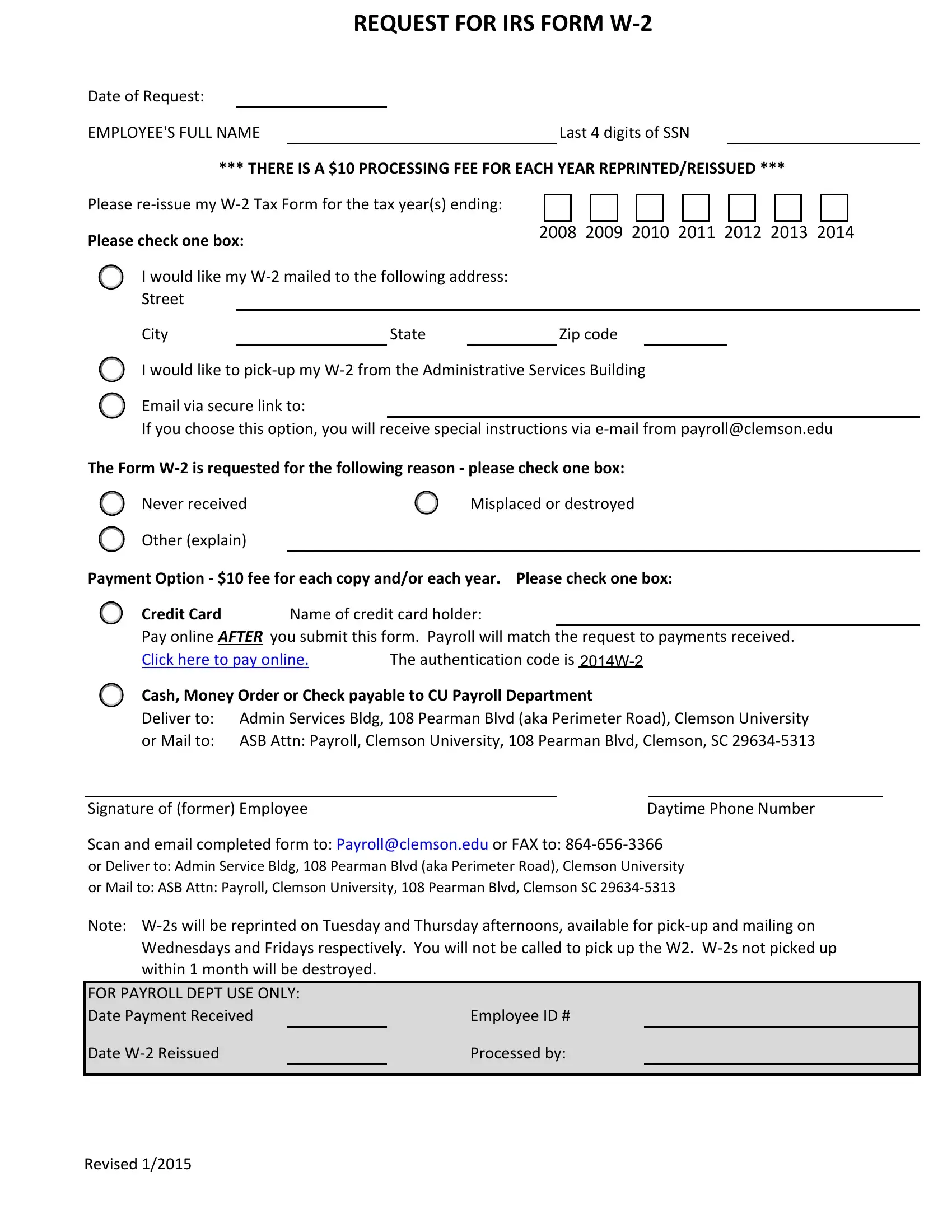

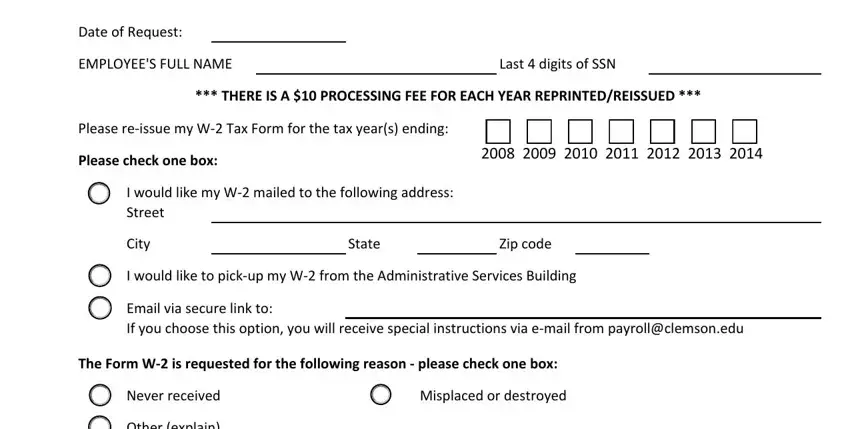

This document will need particular information to be entered, therefore you should definitely take whatever time to fill in what's required:

1. The W-2 requires particular information to be entered. Be sure the next fields are completed:

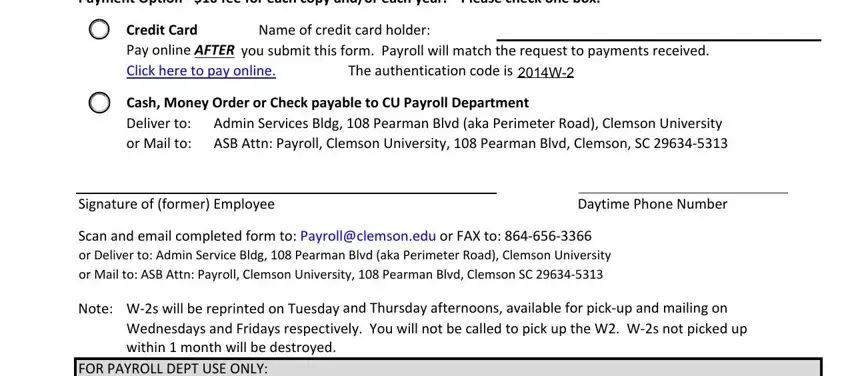

2. Once your current task is complete, take the next step – fill out all of these fields - Payment Option fee for each copy, Credit Card Pay online AFTER you, Name of credit card holder, The authentication code is, Cash Money Order or Check payable, Admin Services Bldg Pearman Blvd, Signature of former Employee, Daytime Phone Number, Scan and email completed form to, or Mail to ASB Attn Payroll, A o, Note Ws will be reprinted on, Wednesdays and Fridays, and FOR PAYROLL DEPT USE ONLY Date with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

In terms of Payment Option fee for each copy and Cash Money Order or Check payable, make certain you do everything right here. The two of these are the most significant fields in the document.

Step 3: Right after going through the form fields you've filled out, press "Done" and you are done and dusted! Make a free trial option at FormsPal and get immediate access to W-2 - downloadable, emailable, and editable inside your FormsPal cabinet. FormsPal guarantees protected document editor with no data record-keeping or sharing. Rest assured that your details are safe here!