Earnest Money Contract Form

An earnest money receipt is a document that is commonly used in the real estate market. An earnest money receipt binds the parties into the agreement by giving certain protections to both of them. It should be attached to a printable real estate sales contract — a crucial document that sets out prices and terms for deals involving real estate. In this article, we will reveal the components of this addendum to real estate purchase contract and tell who and how might benefit from it.

Release of Earnest Money – use this form to release all or one party under the purchase agreement from liability and determine how the earnest money deposit should be distributed.

What Is an Earnest Money Deposit Receipt?

An earnest money receipt is a document that is given by an escrow agent to the buyer after the latter puts their funds on an escrow account or trust. It is common in situations where the buyer shows an interest in real estate and attaches the receipt to an offer to the seller about purchasing their property. In most cases, the earnest money is received when the property purchase agreement has signatures of both buyer and seller.

The earnest money deposit rate is typically set at 1%-3% of the sales price (in the majority of cases, buyers have to pay a minimum of $1,000).

After money has been deposited, they are held in an escrow or trust account until closing, and the parties to an agreement are obliged to move forward with the negotiations regarding the agreement. If the deal is successful, the deposited money can be used as a part of the closing costs or eventual down payment the buyer pays or as a return to the buyer when the seller gets the sales price in full.

In case the deal fails, the earnest money deposit will go to one of the parties, depending on the provisions in the agreement. For instance, there might be a contingency in the purchase agreement about the earnest money deposit being forfeited if the financing issue arises that interferes with the sale. In this case, deposited money is not refundable.

When to Use an Earnest Money Contract

It is common to include earnest money provision in real property purchase agreements. It is not a secret that sellers are more inclined to accept an offer with the most favorable financial profile. An earnest moment deposit acts as proof of a good financial profile of a purchaser and helps a seller think that they will have more assurances and a sale might close on time. Sellers need the assurances because the multiple listing service (MLS) which is used by real estate brokers helps see the status of the home as “under contract” in case the seller accepts an offer to purchase their home. Consequently, another potential buyer and their real estate agent will pass by the listing and look for homes that are still available.

Earnest Money vs. Down Payment

Earnest money and down payment differ by purpose. If you keep the earnest money on an escrow account, or a trust it implies a promise to the seller that you as a buyer take the deal seriously and show your good faith to buy their real estate. In this case, the promise is made to the owner of the property. Downpayment, in its turn, is paid when the property is already purchased and acts as the sum paid to a seller upfront (typically, 20%). This sum is usually paid to the lender to approve the loan on the real property, while a financial institution provides the remaining amount. A downpayment is typically paid after an agreement is reached and signed, and the sale is on its way to being completed. In this case, the promise of making the payment is made to the lender.

Benefits of Using an Earnest Money Receipt

For a buyer, there are certain benefits they get when they use an earnest money receipt. First, they are able to show that they are a serious contender who seriously takes the deal. Second, it shows that the buyer has a sufficient amount of funds to seal the deal. In some cases, having a considerable deposit might even help the buyer get chosen among other candidates. Third, if the seller after getting an earnest money receipt tries to avoid the agreement, the buyer can legally sue for specific performance. It might result in a court issuing an order requiring the seller to perform a specific act, in our case, a sale specified in the agreement. Along with that, they might also have to pay damages to the buyer.

In total, an earnest money receipt helps put the purchaser in more favorable agreement terms as they have started their relations with the seller by presenting good faith. For a seller, the advantages of using earnest money deposits are obvious too. First, avoiding the agreement might make them lose their earnest money. Further, they might be monetarily assured that the buyer will not back out of the agreement unless key terms are breached (for instance, if the home inspection shows unsatisfactory results and the buyer has the right to get earnest money back).

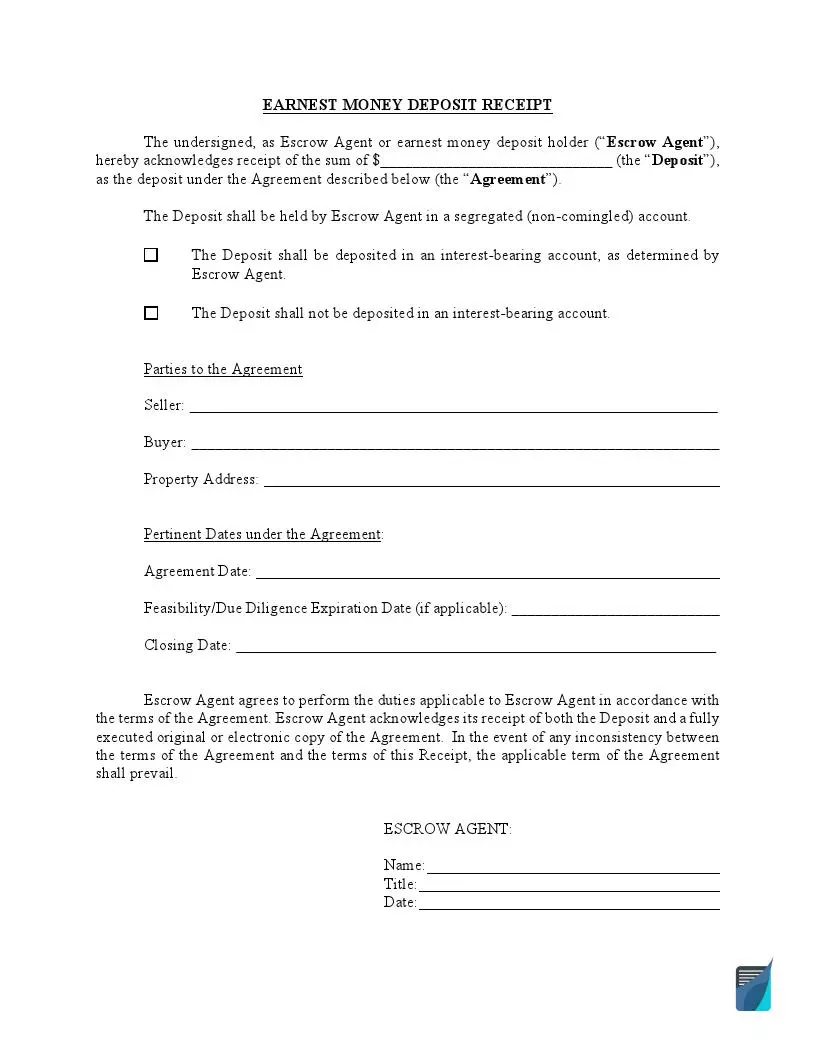

What Are the Main Components of the Receipt?

There are certain components that should be included in every earnest money receipt.

- Original agreement dates. The dates of the original purchase agreement should go first in the document.

- Buyer and seller. Information about the parties who are considering entering the contract or who have already done it should be included.

- Amount of the deposit. The document should explicitly state what dollar amount should be deposited in an account.

- Property address. The receipt should also mention the physical address of the property that is to be sold through a real estate purchase agreement.

- Escrow agent details. The name of an escrow agent, that is, the holder of an earnest money deposit has to be included in the body of the receipt.

Filling Out the Earnest Money Deposit Receipt Template

Step 1 — Date

The first thing to put on an earnest money receipt is the date. It should be placed in the top left corner of the receipt or beneath the name of the document.

Step 2 — Name of the holder

Further, the name of an earnest money deposit holder, that is, the escrow agent, should be placed in the document. There should be language about the holder acknowledging receipt of the earnest money.

Step 3 — Amount of Deposited Money

In the same paragraph, there should be a specification of the amount of funds to be held in the trust account. The amount should be written in dollars.

Step 4 — Form of Deposit

Next, the document should tell in what form the money was deposited. It can be a check, credit card, or any other means.

Step 5 — Details of the purchase agreement

The receipt should specify what real estate purchase agreement is concerned. It should state that the deposit was made on behalf of the seller and purchaser (their names should be mentioned) who entered the sales agreement at a certain date and regarding the property at a certain address.

Step 6 — Certification

Lastly, an escrow agent should certify that the above-given information is true and correct as to the best of their knowledge. The document should end with their signature. If you want to get an attorney-reviewed template of an earnest money receipt, use the one presented on our website.