When goods originally manufactured in the United States are returned after being exported, navigating the customs process to reimport them can be complex. However, the Returned American Goods form, specifically Form 3311, provides a streamlined approach for declaring these items for duty-free entry back into the U.S. This form is a vital tool authorized by the U.S. Department of Homeland Security and the Bureau of Customs and Border Protection, designed to facilitate the free entry of American products that are being returned. It encompasses various regulations outlined under the 19 CFR, such as sections 7.8, 10.1, 10.5, among others, ensuring compliance with the legal framework for re-entry of goods. Importantly, the form requires detailed information including the port of entry, date, manufacturer details, reason for return, and a declaration that the items have not been improved in value or condition, ensuring that no duties are evaded. Additionally, for goods valued at $10,000 or more, further documentation may be required to substantiate the claim for duty-free status. Signatories to this form, including the declarant and authorizing CBP officer, affirm the accuracy and truthfulness of the provided information, underpinning the integrity of the process. This form not only supports businesses in efficiently managing their inventory and logistics but also underscores the importance of regulatory compliance in international trade.

| Question | Answer |

|---|---|

| Form Name | Returned American Goods Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | fedex sample form, american goods return form, sample form 3311, returned american goods |

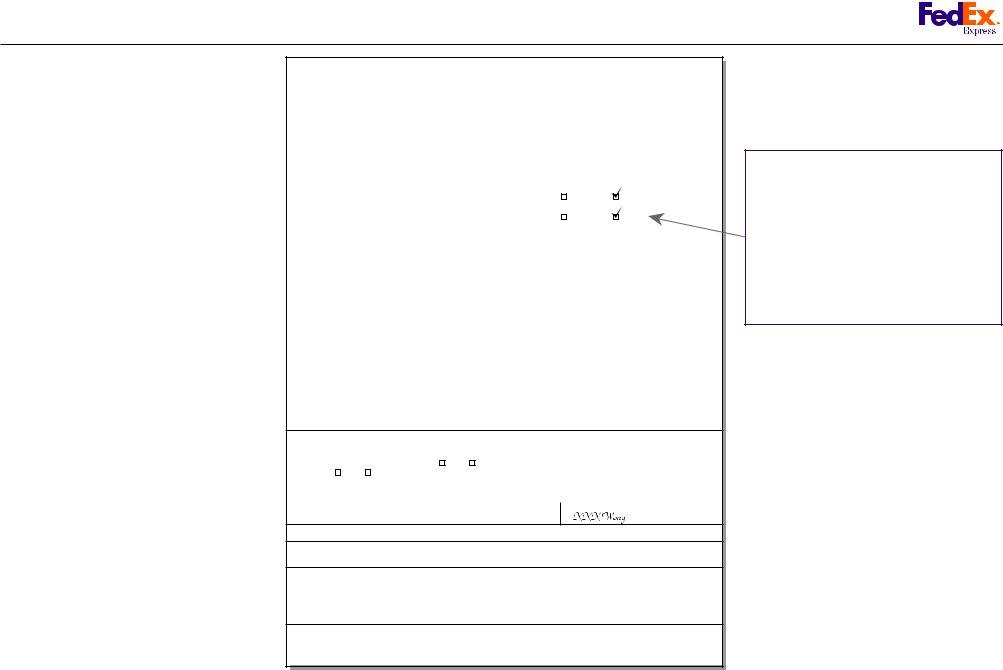

Sample Form 3311 American Goods Returned Declaration (AGR) for American Goods Return Shipment

U.S. DEPARTMENT OF HOMELAND SECURITY

|

Bureau of Customs and Border Protection |

Form Approved |

|||

|

OMB No. |

||||

|

DECLARATION FOR FREE ENTRY OF |

|

|||

|

RETURNED AMERICAN PRODUCTS |

|

|||

|

19 CFR 7.8, 10.1, 10.5, 10.66, 10.67, 12.41, 123.4, 143.23, 145.35 |

|

|||

|

|

|

|

|

|

1. PORT |

|

2. DATE |

3. ENTRY NO. & DATE |

|

|

|

|

|

|

|

|

4. NAME OF MANUFACTURER |

ABC Environmental Equipment Inc. |

5. CITY AND STATE OF MANUFACTURE |

|||

|

Denver, Colorado, USA |

||||

|

|

|

|||

6. REASON FOR RETURN |

|

|

7. U.S. DRAWBACK PREVIOUSLY |

||

|

|

|

CLAIMED |

UNCLAIMED |

|

|

Repair |

|

|

|

|

|

8. PREVIOUSLY IMPORTED UNDER HTSUS 864.05? |

||||

|

|

|

|||

|

|

|

YES |

NO |

|

|

|

|

|

||

9. MARKS, NUMBERS, AND DESCRIPTION OF ARTICLES RETURNED |

|

|

10. VALUE* |

||

Handles for Printing machine, made of stainless steel,. 23 pcs |

|

US$2,300 |

|||

|

|

|

|

|

|

*If the value of the article is $10,000 or more and the articles are not clearly marked with the name and address of U.S. manufacturer, please attach copies of any documentation or other evidence that you have that will support or substantiate your claim for duty free status as American Goods Returned.

11.I declare that the information given above is true and correct to the best of my knowledge and belief; that the articles described above are the growth, production, and manufacture of the United States and are returned without having been advanced in value or improved in condition by any process of

manufacture or other means; that no drawback bounty, or allowance have been paid or admitted thereon, or on any part thereof; and that if any notice(s)

of exportation of artivles with benefit of drawback |

was |

were |

filed upon exportation of the merchandise from the United States, such |

|||

notice(s) |

has |

have |

been abandoned. |

|

|

|

|

|

|

|

|||

12. NAME OF DECLARANT |

|

|

13. TITLE OF DECLARANT |

|||

XXX Wong |

|

|

|

Shipping Manager |

||

|

|

|

|

|||

14. NAME OF CORPORATION OR PARTNERSHIP (If any) |

|

15. SIGNATURE (See note) |

||||

ABC International Corporation

16. SIGNATURE OF AUTHORIZING CBP OFFICER

NOTE: If the owner or ultimate consignee is a corporation, this form must be signed by the president, vice president, secretary, or treasurer of the corporation, or by any employee or agent of the corporation who holds a power of attorney and a certificate by the corporation that such employee or agent has or will have knowledge of the pertinent facts.

PAPERWORK REDUCTION ACT NOTICE: This information is needed to ensure that importers/exporters are complying with Customs laws, to allow us to compute and collect the right amount of money, to enforce other agency requirements, and to collect accurate statistical information on imports. Your response is mandatory. The estimated average burden associated with this collection is 6 minutes per respondent or recordkeeper depending on individual circumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to Bureau of Customs and Border Protection, Information Services Branch, Washington DC 20229, and to the Office of Management and Budget, Paperwork Reduction Project

PREVIOUS EDITIONS ARE OBSOLETE |

CBP FORM 3311 (06/96) |

www.fedex.com/hk_english/services/tools/agr.html

USTSA stands for US Tariff Schedule (also known as Harmonized Tariff Schedule of the US). What this field is used for is to indicate if a shipment had been previously imported into the US and then exported. If yes in this field, the original importer can claim duty repayment. It is best that the shipper check NO if they do not know.