It is easy to complete forms with the use of our PDF editor. Updating the rev 1605 ct file is not hard for those who adhere to the following steps:

Step 1: You can press the orange "Get Form Now" button at the top of this webpage.

Step 2: Once you have accessed the editing page rev 1605 ct, you will be able to notice every one of the options readily available for the file in the upper menu.

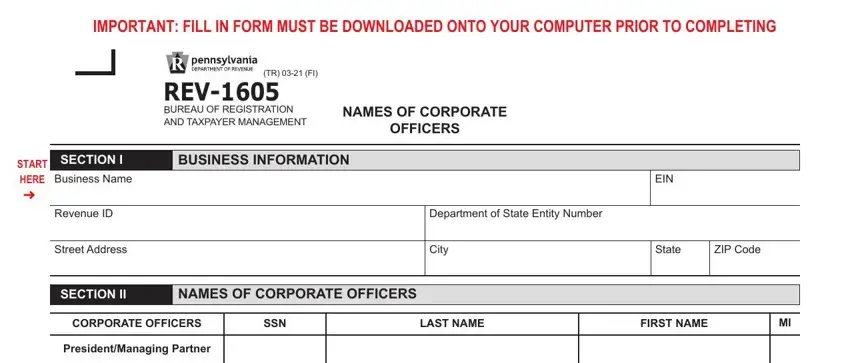

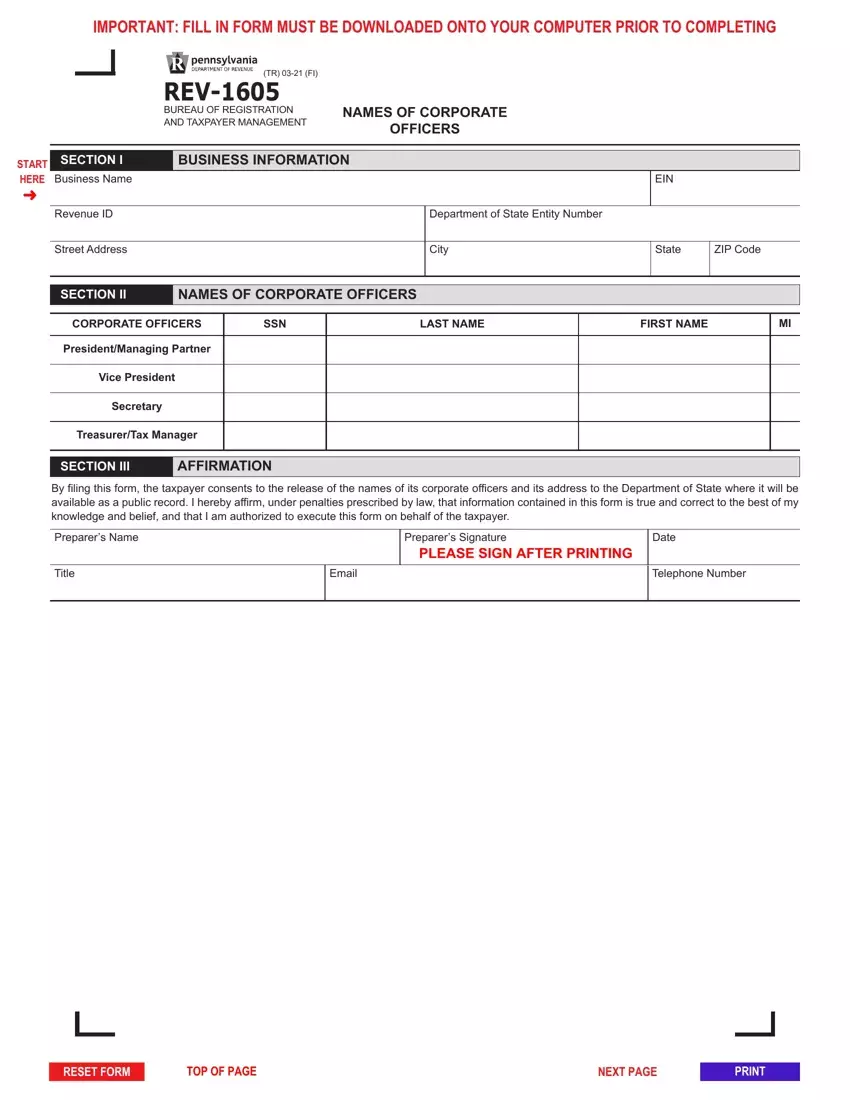

You have to type in the next data if you want to fill out the file:

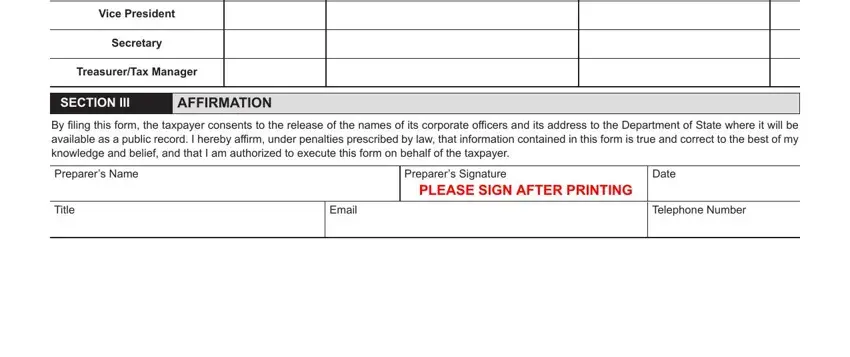

Provide the essential data in the Vice President, Secretary, TreasurerTax Manager, SECTION III, AFFIRMATION, By filing this form the taxpayer, Preparers Name, Preparers Signature, Date, Title, Email, and Telephone Number segment.

In the area, emphasize the relevant information.

Identify the rights and obligations of the parties inside the field wwwrevenuepagov, and REV.

Step 3: As soon as you've selected the Done button, your form should be readily available export to any gadget or email address you identify.

Step 4: Attempt to make as many copies of your file as you can to keep away from possible misunderstandings.

(TR)

(TR)