The Rev267 form serves a crucial function in the context of estate planning and the administration of deceased estates within South Africa. As mandated by Section 7 of the Estate Duty Act, Act 45 of 1955, this form is a structured document that demands comprehensive information pertaining to the deceased individual's assets, liabilities, and the pertinent specifics that influence the calculation of estate duty. Key elements addressed in this form include the calculation of gross value of all disclosed property, deductions for insurance proceeds, adjustments for the value of certain assets, and specifics regarding property deemed to be part of the deceased's estate for duty purposes. Importantly, it also covers the implications of Section 10 on interest payable on estate duty, providing for circumstances under which interest may or may not be charged on the duty, based on the timing of the payment post-assessment and considerations for deposits made against assessed duty. Moreover, this form accommodates details about surviving spouses and outlines considerations for property within and outside the Republic of South Africa, highlighting the global nature of modern estates. In essence, the Rev267 form encapsulates the breadth of information necessary for accurately assessing estate duty, showcasing the complexity of estate management and the legal obligations survivors or executors must navigate through during such a challenging time.

| Question | Answer |

|---|---|

| Form Name | Rev267 Form |

| Form Length | 8 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min |

| Other names | rev 267 pdf, rev267 estate duty form, rev 267 form, rev 267 sars form |

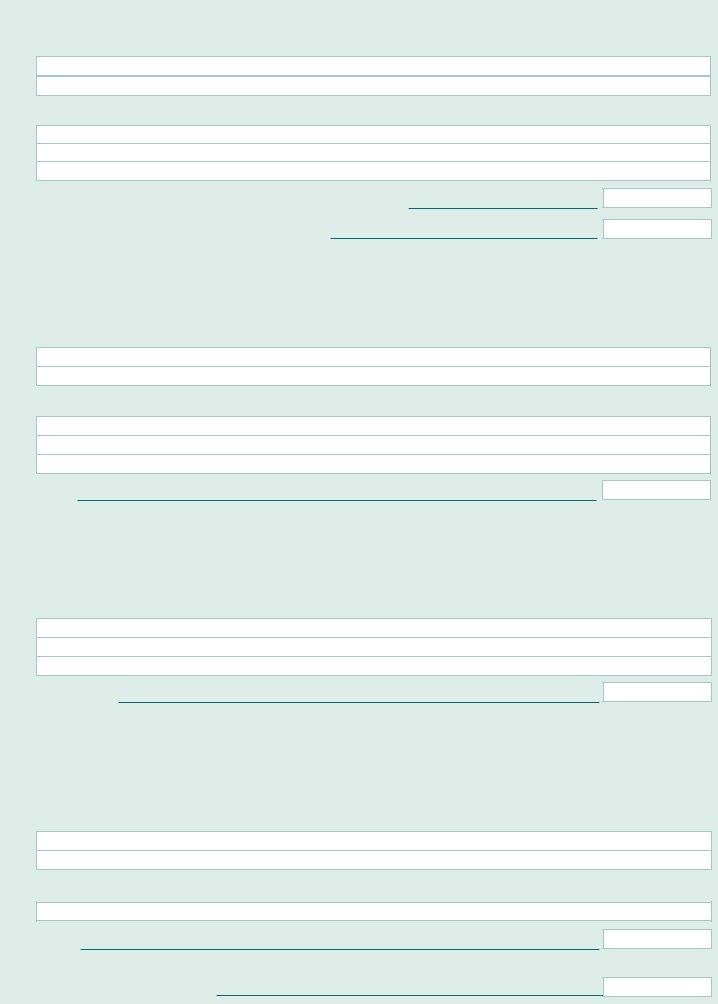

ESTATE DUTY |

REV267 |

|

BOEDELBELASTING |

||

|

||

|

|

Return of information required in terms of section 7 of the Estate Duty Act, Act 45 of 1955

Opgawe van inligting wat ingevolge artikel 7 van die Boedelbelastingwet, Wet 45 van 1955, vereis word

NB. Interest on Estate Duty

Section 10 of the Estate Duty Act, Act 45 of 1955, provides that interest must be paid on the amount of any estate duty which is paid within 30 days of the date of the assessment notice, or, if the assessment is made more than 12 months after the date of death, from a date twelve months after death.

The Commissioner may allow an extension of the time within which payment may be made without interest if a reasonable amount is paid as a deposit against the duty to be assessed and application is made in writing for such extension, provided the deposit is made and the application for extension is lodged before the thirty days period or the twelve month period, as the case may be, has expired.

No formal documentation is required for the payment of a deposit against estate duty at SARS branch offices. (Name, number of estate and date of death must be furnished.)

LW. Rente op Boedelbelasting

Artikel 10 van die Boedelbelastingwet, Wet 45 van 1955, bepaal dat rente betaal moet word op die bedrag van enige boedelbelasting wat nie binne 30 dae vanaf die datum van die aanslagkennisgewing of, indien die aanslag meer as twaalf maande na die datum van dood gehef word, vanaf ‘n datum twaalf maande na dood, vereffen is nie.

Die Kommissaris mag ‘n verlenging toestaan van die tydperk waarin betaling sonder rente gemaak mag word indien ‘n redelike bedrag gestort is as ‘n deposito ten opsigte van die belasting wat aangeslaan moet word en skriftelik aansoek gedoen is vir sodanige verlenging, mits die deposito gemaak word en die aansoek om verlenging ingedien word voor die verstryking van die tydperk van dertig dae of die tydperk van twaalf maande, soos die geval mag wees.

Geen formele dokumentasie word vereis vir die betaling van ‘n deposito teen boedelbelasting by SARS takkantore nie. (Naam en nommer van boedel en die datum van afsterwe moet verstrek word.)

If there is insufficient space on this form, the information must be submitted on a separate sheet

Indien die spasie op hierdie vorm onvoldoende is, moet die inligting op ‘n aparte vel papier verstrek word.

Deceased details

Oorledene se besonderhede

Surname

Van

First name(s)

Voorname

Date of birth Geboortedatum

Date of death Datum van dood

Master’s office where estate is reported Meesterskantoor waar boedel geraporteer is

Last residential address

Laaste woonadres

Postal code

Poskode

Country of ordinary residence

Land waar gewoonlik woonagtig

Identity number

Identiteitsnommer

Estate number

Boedelnommer

Period from |

|

to |

Tydperk vanaf |

|

tot |

If ordinarily resident in a country other than RSA during 10 years immediately preceding the date of death, state name of country and periods resident in that country

Indien binne tien jaar onmiddelik voor datum van dood in ‘n ander land as RSA woonagtig, meld naam van land en tydperke aldaar woonagtig

Period from Tydperk vanaf

Details of surviving spouse (if any)

Besonderhede van nagelate gade (indien enige)

Name and Surname

Naam en Van

Address

Adres

Postal code

Poskode

Indicate whether marriage was: |

|

In community of property |

|

Out community of property |

|

Subject to the accrual system |

||||

Dui aan of die huwelik |

|

Binne gemeenskap van goedere |

|

Buite gemeenskap van goedere |

|

Onderworpe aan die aanwasbedeling |

||||

Place of marriage |

|

|

|

|

|

Date of marriage |

|

|

||

|

|

|

|

|

|

|

||||

|

|

|

|

|

||||||

Plek van huwelik |

|

|

|

|

|

Datum van huwelik |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 - 8 |

|

|

|

|

|

|

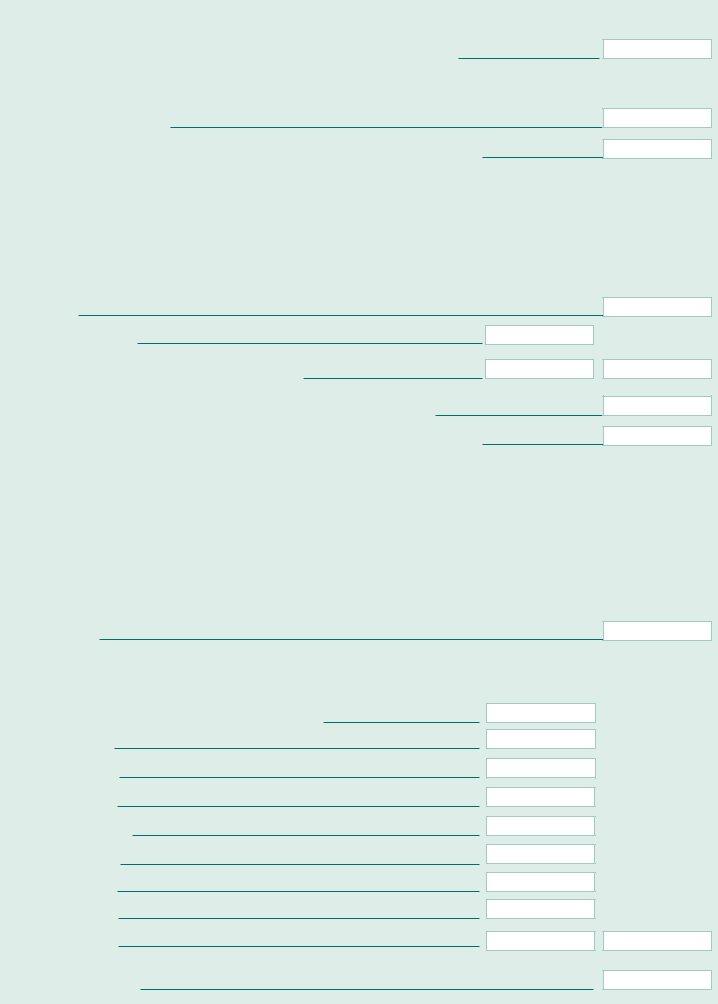

Account 1 - Property of the deceased as at date of death

Rekening 1 - Eiendom van die oorledene soos op datum van dood

A(i) Gross value of all property disclosed in the liquidation and distribution (L&D) account Bruto waarde van alle eiendom in die likwidasie- en distribusierekening (L&D) aangetoon

Deduct: |

Proceeds of all “domestic policies” of insurance upon the life of the deceased |

|

||

Min: |

reflected in the L&D account (sec 3(3)(a)) |

|

|

|

|

Opbrengs van alle “binnelandse assuransiepolisse” op die lewe van die |

|

||

|

R |

|||

|

oorledene wat in die L&D rekening aangetoon word. |

|

|

|

|

|

|

|

|

|

Any benefit which is due and payable by a fund reflected in the L&D account |

|

||

|

(sec 3(3)(a)bis) |

|

|

|

|

Enige voordeel deur ‘n fonds uitbetaal wat in L&D rekening aangetoon word |

|

||

|

R |

|||

|

(artikel 3(3)(a)bis) |

|

|

|

|

|

|

|

|

|

Value of any property which is not “property” as defined in section |

|

||

|

Waarde van enige eiendom wat nie “eiendom” is nie soos in artikel |

|

||

|

R |

|||

|

omskryf |

|

|

|

|

|

|

|

|

|

Selling price of |

|

|

|

|

|

|

R |

|

|

Verkoopsprys van ongenoteerde aandele / ledebelang in BK |

|

|

|

|

|

|

|

|

|

Fair market value of farming property as per valuation |

|

|

|

|

|

|

R |

|

|

Billike markwaarde van boerdery eiendom per waardasie |

|

|

|

|

|

|

|

|

Add: |

|

|||

Plus: |

in the liabilities reflected in Account 3 |

|

|

|

|

Kontra eis vir borgstelling gegee deur oorledene - indien sodanige eis ingesluit |

|

||

|

R |

|||

|

is by die laste in Rekening 3 |

|

|

|

|

|

|

|

|

|

Valuation of |

|

|

|

|

|

|

R |

|

|

Waardasie van ongenoteerde aandele / ledebelang in BK |

|

|

|

|

|

|

|

|

|

Fair market value of farming property as per valuation |

|

|

|

|

R |

|

|

|

|

Billike markwaarde van boerdery eiendom per waardasie |

|

|

|

|

|

|

|

|

|

Less: 30% in terms of (b) of the definition of “fair market |

|

|

|

|

value” |

|

|

|

|

Min: 30% in terme van (b) van die wooromskrywing van |

|

|

|

|

R |

|

R |

|

|

“billike markwaarde” |

|

||

|

|

|

|

|

R

R

R

(Where no L&D account is required to be rendered to any Master of the High Court, a separate statement of all property owned by the deceased at the date of his/her death should be submitted with this return.)

(Waar dit nie vereis word dat ‘n L&D rekening aan ‘n Meester van die Hooggeregshof verstrek word nie, moet ‘n afsonderlike staat van alle eiendom, deur die oorledene op datum van sy/haar dood besit, saam met hierdie opgawe verstrek word.)

(ii)Value of other property (if any) not reflected in the L&D account:

Waarde van ander eiendom (indien enige) nie in die L&D rekening aangetoon word nie:

(a) Property of which a beneficiary becomes the owner by a nomination agreement entered into by the deceased during his / her lifetime. (See

remark 1a on last page)

Eiendom waarvan ‘n begunstigde die eienaar word deur middel van ‘n nominasie ooreenkoms deur die oorledene gesluit tydens sy / haar leeftyd. (Sien nota 1a op laaste bladsy)

Description of property Beskrywing van eiendom

Value

Waarde

(b)Immovable and movable property situated outside the Republic. (See remark 1b on last page) Roerende en onroerende eiendom buite die Republiek geleë. (Sien nota 1b op laaste bladsy)

Description of property and where situated Beskrywing van eiendom en waar geleë

R

Value Waarde

R

(c)Shares held by or on behalf of the deceased in a company (See remark 1c on last page) Aandele deur of namens die oorledene gehou in ‘n maatskappy (Sien nota 1c op laaste bladsy)

Name of company and country of incorporation as well as the number and description of shares held Naam van maatskappy en land waar geinkorporeer asook die aantal en beskrywing van aandele gehou

Value Waarde

R

2 - 8

Account 1 - Property of the deceased as at date of death (continued)

Rekening 1 - Eiendom van die oorledene soos op datum van dood (vervolg)

(d)Any debt not recoverable or right of action not enforceable in the courts of the Republic (See remark 1d on last page)

Enige skuld of reg van aksie wat nie in die geregshowe van die Republiek verhaalbaar of afdwingbaar is nie (Sien nota 1d op laaste bladsy)

Name and address of debtor or other institution, etc., liable for payment

Naam en adres van skuldenaar of ander inrigting, ens., wat vir betaling aanspreeklik is

Value

Waarde

(e)Gratuities or benefit society awards (See remark 1e on last page)

Gratifikasie of toekenings van ‘n onderlinge hulpverening (Sien nota 1e op laaste bladsy)

By whom payable as well as the name and address of person to whom gratuity or reward is payable

Deur wie betaalbaar asook die naam en adres van die persoon aan wie die gratifikasie of toekenning betaalbaar is

Value

Waarde

Total of A(i), A(ii), (a), (b), (c), (d) and (e)

Totaal van A(i), A(ii), (a), (b), (c), (d) en (e)

Less: Survivor’s share thereof if the marriage was in community of property

Min: Oorlewende se aandeel indien die huwelik in gemeenskap van goedere was

A

B. Value of any fiduciary, usufructuary or other like interest in property situated in the Republic. Section 3(2)(a) read with section 5(1)(b) Waarde van enige fidusiêre reg, vruggebruik of ander derglike reg op eiendom in die Republiek geleë. Artikel 3(2)(a) saamgelees met artikel 5(1)(b)

Description of the burdened property

Beskrywing van beswaarde eiendom

Nature of interest, when and how the deceased acquired it.

Aard van reg, hoe en wanneer oorledene dit verkry het.

Fair market value of property at date of death of deceased (except farming property)

Billike markwaarde van eiendom op datum van dood van oorledene (uitgesonderd boerdery eiendom) Fair market value of farming property less 30%

Billike markwaarde van boerdery eiendom min 30%

R

R

Name, address and date of birth of person who upon the cessation of deceased’s interest becomes entitled to the right of enjoyment of the property and period for which such right is held.

Naam, adres en datum van geboorte van persoon wat by verstryking van die oorledene se reg, op die reg van genot van die eiendom geregtig word en die tydperk wat hy/sy die reg sal hou.

Less: Consideration paid for right of ownership and date of payment

Min: Vergoeding betaal vir die eiendomsreg en datum van betaling

R

B

R

3 - 8

Account 1 - Property of the deceased as at date of death (continued) Rekening 1 - Eiendom van die oorledene soos op datum van dood (vervolg)

C. Value of any right to an annuity. (Section 3(2)(b) read with section 5(1)(d))

Waarde van enige reg op ‘n jaargeld. (Artikel 3(2)(b) saamgelees met artikel 5(1)(d))

Annual amount of annuity

Jaarlikse bedrag van die jaargeld

R

How and when deceased first acquired it.

Hoe en wanneer deur oorledene die eerste maal verkry.

Name, address and date of birth of person to whom the annuity accrues on death of deceased and period for which such person is to enjoy the annuity.

Naam, adres en datum van geboorte van persoon aan wie die jaargeld toeval op datum van dood van die oorledene en die periode waarvoor sodanige persoon die jaargeld kan geniet.

Period for which such person is to enjoy the annuity

Tydperk waarvoor sodanige persoon die jaargeld kan geniet

Value of interest calculated in terms of paragraph (d) of subsection (1) of section 5 of the Act Waarde van reg bereken ingevolge paragraaf (d) van subartikel (1) van artikel 5 van die Wet.

Property of the deceased: |

Total of A + B + C |

Eiendom van die oorledene: |

Totaal van A + B + C |

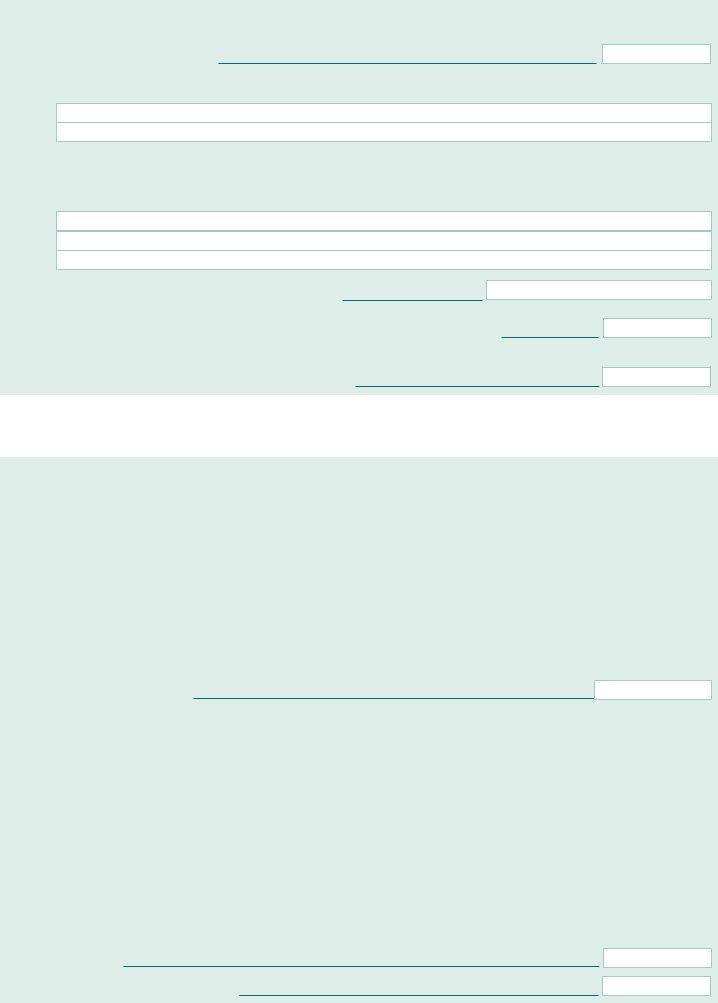

Account 2 - Property deemed to be property of the deceased as at the date of death

Rekening 2 - Eiendom wat geag word die eiendom van die oorledene te wees op die datum van dood

AProceeds of all ‘domestic’ policies of insurance upon the life of deceased (Section 3(3)(a)) Opbrengs van alle ‘binnelandse’ assuransiepolisse op die lewe van oorledene (Artikel 3(3)(a))

R

R

Name of company |

|

Number of policy |

|

Name and address of person to whom proceeds are payable |

|

Gross proceeds of policy |

Naam van maatskappy |

|

Nommer van polis |

|

Naam en adres van die persoon aan wie die opbrengs betaalbaar is |

|

Bruto opbrengs van polis |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross value of all policies Bruto waarde van alle polisse

R

Less: (i) Aggregate amount of premiums paid by the person (other than the deceased) entitled to the proceeds plus interest at 6% per annum

Min: |

thereon as calculated on a separate sheet. |

|

Totale bedrag premies betaal deur die persoon (behalwe die oorledene) wat geregtig is op die opbrengs plus rente daarop teen 6% |

|

per jaar soos bereken op ‘n aparte bladsy. |

(ii)Consideration paid by the person entitled to the proceeds plus interest at 6% per annum thereon. Vergoeding betaal deur die persoon geregtig op die opbrengs plus rente daarop teen 6% per jaar.

(iii)Proceeds of policy recoverable by surviving spouse or child of deceased under a registered antenuptial or post nuptial contract. Opbrengs van polis verhaalbaar deur die oorlewende eggenoot of kind van die oorledene uit hoofde van ‘n regeregistreerde voor- of

(iv)Proceeds of policy taken out or acquired by a

Opbrengs van polis uitgeneem deur ‘n

(v)Proceeds of policies which were not effected by or at the instance of the deceased, as envisaged in terms of section 3(3)(a)(ii). Opbrengs van polisse wat nie deur of in opdrag van die oorledene uitgeneem is nie, soos omskryf in artikel 3(3)(a)(ii).

Total of (i) - (v)

Totaal van (i) - (v)

Net value of all taxable policies

Netto waarde van alle belasbare polisse

R

R

4 - 8

Account 2 - Property deemed to be property of the deceased as at the date of death (continued)

Rekening 2 - Eiendom wat geag word die eiendom van die oorledene te wees op die datum van dood (vervolg)

BBenefit due and payable from a fund: (Section 3(3)(a)bis)

Voordeel uit fonds verskuldig en betaalbaar: (Artikel 3(3)(a)bis)

Name of fund Naam van fonds

Name and address of the person to whom payable Naam en adres van die persoon aan wie betaalbaar

Less: Contributions or consideration paid by the beneficiary together with 6% interest.

Min: Bydraes of vergoeding betaal deur die begunstigde tesame met 6% rente

Net benefit due and payable by any fund

Netto voordeel verskuldig en betaalbaar deur enige fonds

R

R

CValue of property donated in terms of section 56(1)(c) or (d) of the Income Tax Act, if not otherwise included as property of the deceased for purposes of this Act. (Section 3(3)(b))

Waarde van eiendom geskenk ingevolge artikel 56(1)(c) of (d) van die Inkomstebelastingwet, indien nie andersins ingesluit as eiendom van die oorledene, vir doeleindes van hierdie Wet. (Artikel 3(3)(b))

Description of property

Beskrywing van eiendom

Name and address of the person benefiting

Naam en adres van die bevoordeelde persoon

Value Waarde

R

DProperty acquired by the deceased under section 3 of the Matrimonial Property Act, 1984, in respect of any accrual contemplated in that section: (Section 3(3)(cA))

Eiendom verkry deur die oorledene kragtens artikel 3 van die Wet op Huweliksgoedere, 1984, ten opsigte van enige toevalling in daardie artikel: (Artikel 3(3)(cA))

Name and address of deceased’s spouse or, if deceased, name and address of executor, estate’s number and Master’s office where reported. Naam en adres van die oorledene se gade of, indien oorlede, die naam en adres van die eksekuteur, boedelnommer en Meesterskantoor waar boedel gerapporteer is

Amount of claim Bedrag van eis

R

EProperty, meaning property situated where ever (i.e. property which has not already been accounted for in this return) of which the deceased was immediately prior to his death competent to dispose of for his own benefit or the benefit of his estate (Section 3(3)(d) read with Section 3(5))

Eiendom, met inbegrip van eiendom waar ook al geleë (dws. eiendom nie voorheen in hierdie opgawe verantwoord nie) waaroor die oorledene onmiddellik voor sy dood bevoeg was om vir sy eie voordeel of vir die voordeel van sy boedel te beskik (Artikel 3(3)(d) saamgelees met Artikel 3(5))

Description of property Beskrywing van eiendom

Person in whose name registered Persoon in wie se naam geregistreer

Value

Waarde

Total of A + B + C + D + E Totaal van A + B + C + D + E

R

R

5 - 8

Account 3 - Deductions claimed in terms of section 4 of the Act

Rekening 3 - Kortings geëis ingevolge artikel 4 van die Wet

ATotal amount of liabilities disclosed in the L&D account (where no L&D account is required to be rendered to any Master of the High Court a separate statement of liabilities should be submitted with this return)

Totale bedrag laste soos in die L&D rekening aangetoon (waar dit nie vereis word dat ‘n L&D rekening aan ‘n Meester verstrek word nie moet ‘n afsonderlike staat van laste met hierdie opgawe verstrek word).

Less: Any claim to property donated by the deceased in terms of section 56(1)(c) or (d) of the Income Tax Act included in the total amount of liabilities

Min: Eiendom geskenk deur die oorledene ingevolge artikel 56(1)(c) of (d) van die

Total A

Totaal A

R

R

R

BThe calculation hereunder only applies where the deceased was married in community of property

Die ondergemelde berekening is slegs van toepassing indien die oorledene binne gemeenskap van goedere getroud was

Total A

Totaal A

Less: Funeral costs

Min: Begrafniskoste

½share of liabilities (excluding funeral costs)

½aandeel van die laste (uitgesluit begrafniskoste)

Add: Funeral costs - where the deceased was married in community of property

Plus: Begrafniskoste - waar oorledene binne gemeenskap van goedere getroud was

R

R

Total B

Totaal B

R

R

R

R

Total A or B

Totaal A of B

Add: Deduction claimed in terms of:

Plus: Korting geëis ingevolge:

Section 4(e) deduction (If the deceased was married in community of property claim only ½ share of the value of the said property)

Artikel 4(e) aftrekking (Indien oorledene binne gemeenskap van goedere getroud was, eis slegs ½ van die waarde van die betrokke eiendom)

Section 4(f)

Artikel 4(f)

Section 4(g)

Artikel 4(g)

Section 4(h)

Artikel 4(h)

Section 4(i) & (j)

Artikel 4(i) & (j)

Section 4(m)

Artikel 4(m)

Section 4(o)

Artikel 4(o)

Section 4(p)

Artikel 4(p)

Section 4(q)

Artikel 4(q)

Total deductions claimed

Totale kortings geëis

R

R

R

R

R

R

R

R

R

R

R

R

6 - 8

Summary

Opsomming

Account 1 - Value of all property of the deceased

Rekening 1 - Waarde van alle eiedom van die oorledene

Account 2 - Value of all property deemed to be property of the deceased

Rekening 2 - Waarde van alle eiendom wat geag word eiendom van die oorledene te wees

Less: Account 3 - Deductions claimed in terms of section 4 of the Act

Min: Rekening 3 - Aftrekkings geeis ingevolge artikel 4 van die Wet

Net value of estate |

|

|

Netto waarde van boedel |

|

|

Less: Section 4A |

|

|

Min: Artikel 4A |

|

|

Dutiable amount |

|

|

Belasbare bedrag |

|

|

Estate duty payable @ |

% |

|

Boedelbelasting betaalbaar @ |

||

|

Interest on Estate Duty - see section 10 of the Act

Rente op Boedelbelasting - sien artikel 10 van die Wet

Details of executor/executrix

Besonderhede van eksekuteur/eksekutrise

Name

Naam

Address

Adres

Postal code

Poskode

Name

Naam

Address

Adres

Postal code

Poskode

Details of agent

Besonderhede van agent

Name

Naam

Address

Adres

Postal code

Poskode

R

R

R

R

R

R

R

R

R

Declaration by executor(s)

Verklaring deur eksekuteur(s)

I/We, the aforesaid executor(s), hereby certify that the particulars stated in this return are true and correct to the best of my/our knowledge and belief, and that, having made due and diligent enquiry, I/we are not aware of any other property which should be included in the return.

Ek/Ons, die voormelde eksekuteur(s), verklaar dat die besonderhede in hierdie opgaaf uiteengesit juis en waar is na my/ons beste kennis en wete, en dat, nadat ons behoorlik en deeglik ondersoek gedoen het, ek/ons nie bewus is van enige ander eiendom wat daarby ingesluit moet word nie.

Name of executor(s) Naam van eksekuteur(s)

Signature(s) of executor(s) Handtekening(e) van eksekuteur(s)

Signed at Geteken te

on this op hierdie

day of dag van

20

7 - 8

1.Value of other property Waarde van ander eiendom

(a)Certain investments are structured to grant the owner an option either to transfer the investment into the name of the deceased estate or to be redeemed in full at the request of the executor (in which case it constitutes “property of the deceased”) or in the event of a beneficiary being nominated, to be paid to the nominated beneficiary, in which case the value of the investment as at date of death of the deceased must be reflected in the space provided for. The investment can also consist of a “policy” (excluding a “domestic policy on the life of the deceased”) which does not mature or pay out on the death of the deceased (owner). Such policies run for an agreed time and can be terminated at the request of the owner.

Sekere beleggings is so saamgestel dat die eienaar daarvan die keuse het dat die belegging by sy / haar boedel of op versoek van die eksekuteur opgevra word (in welke geval dit “eiendom van die oorledene” verteenwoordig) of in die geval waar ‘n begunstigde (genomineerde) benoem is gedurende die oorledene se leeftyd, die opbrengs aan die genomineerde uitbetaal word, in welke geval die waarde van die belegging soos op datum van afsterwe verantwoord moet word in die gemelde spasie. Sodanige belegging kan ook bestaan uit ‘n “polis” (uitgesonderd ‘n “binnelandse polis op die lewe van die oorledene”) wat nie opeisbaar of uitbetaal word op datum van afsterwe van die oorledene (eienaar) nie. Sodanige polisse het ‘n ooreengekome leeftyd wat beeindig word op versoek van die eienaar.

(b)Movable and immovable property situated outside the Republic (to be completed only in cases in which the deceased was ordinarily resident in the Republic)

Roerende en onroerende eiendom buite die Republiek geleë (voltooi slegs in gevalle waar die oorledene sy gewone verblyfplek in die Republiek gehad het)

(c)Shares held by or for the deceased in a company which, although not incorporated or registered under any law in force in the Republic, carries on business or has an office or place of business or maintains a share transfer register in the Republic, and, in additional, in the case of a deceased person who was ordinarily resident in the Republic at the date of his death, shares held by or for him in any company whatsoever.

Aandele deur of namens die oorledene gehou in ‘n maatskappy wat, alhoewel nie geinkorporeer of geregistreer ingevolge ‘n Wet wat in die Republiek van krag is nie, in die Republiek besigheid doen of ‘n kantoor of ‘n besigheidsplek het of ‘n aandeleregister in die Republiek in stand hou, en daarbenewens, in die geval van ‘n oorledene wat op datum van dood sy gewone verblyfplek in die Republiek gehad het, aandele deur of namens hom gehou in enige maatskappy hoegenaamd.

(d)Any debt not recoverable or right or action not enforceable in the courts of the Republic, including credits at any bank, building society, corporation, trust, etc., outside the Republic (to be completed only in cases in which the deceased was ordinarily resident in the Republic). Enige skuld of reg van aksie wat nie in die geregshowe van die Republiek verhaalbaar of afdwingbaar is nie, met inbegrip van bedrae wat op krediet van die oorledene staan by enige bank, bougenootskap, maatskappy, trust ens., buite die Republiek (moet slegs ingevul word in gevalle waar die oorledene sy gewone verblyfplek in die Republiek gehad het).

(e)Gratuities or benefit society awards in respect of which the deceased or his estate has a right of action enforceable in the courts of the Republic, and, in additional, in the case of a deceased who was ordinarily resident in the Republic at the date of his death, gratuities or benefit society awards, etc., the rights of action in correction with which are enforceable outside the Republic.

Gratifikasies of toekenings van ‘n onderlinge hulpvereniging ten opsigte waarvan die reg van aksie buite die Republiek afdwingbaar is. In die geval van gratifikasies betaalbaar kragtens enige Wet, vermeld die Wet of magtiging waar kragtens toegestaan.

2.Value of any fiduciary, usufructuary or other like interest in property situated in the Republic (including a right to an annuity charged upon such property) held by the deceases immediately prior to his death, and, in addition, in the case of a deceased who was ordinarily resident in the Republic at the date of his death, the value of any such interest held in property situated outside the Republic.

Waarde van enigefidusiëre reg, vruggebruik of ander dergelike reg op eiendom in die Republiek geleë (Met inbegrip van ‘n reg op ‘n jaargeld waarmee sodanige goed beswaar is) wat die oorledene onmiddelik voor sy dood besit het, en daarbenewens, in die geval van ‘n oorledene wat op datum van dood sy gewone verblyfplek in die Republiek gehad het, die waarde van enige sodanige belang in eiendom wat buite die Republiek geleë is.

3.Value of any right to an annuity (other than a right to an annuity charged upon property) enjoyed by the deceases immediately prior to his death which accrued to some other person on his death.

Waarde van enige reg op ‘n jaargeld (behalwe ‘n reg op ‘n jaargeld waarmee enige goed beswaar is) wat die oorledene onmiddelik voor sy dood besit het en wat by sy dood aan iemand anders toeval.

4.If this form is completed in respect of a date prior to 16 March 1988, the names and addresses of the children of the deceased that survive him (stepchildren excluded) and also the names of children of the deceased who predeceased the deceased leaving issue or a spouse surviving the deceased who had not remarried on or before the date of death of the deceased (stepchildren excluded) must be mentioned.

Indien hierdie vorm voltooi word ten opsigte van ‘n datum voor 16 Maart 1988 moet die name en die adresse van kinders van die oorledene wat hom/haar oorleef (stiefkinders uitgesluit) asook die name van kinders van die oorledene wat voor hom te sterwe gekom het en wat nakomelinge nagelaat het wat die oorledene oorleef, of ‘n eggenoot nagelaat het wat die oorledene oorleef en wie nie op of voor die datum van afsterwe van die oorledene hertrou het nie, vermeld word.

5.Penalties:

Any person who, after having been called upon to do so by the Commissioner in terms of section 7 of the Act, fails within the period prescribed by the Commissioner, to submit the return required to be submitted in terms of that section or knowingly omits from such return any particulars by the Act to be included therein, shall be guilty of an offence and liable on conviction to a fine or to imprisonment for a period not exceeding two years. In terms of section 28A of the Act, the Commissioner has the power to publish in the GOVERNMENT GAZETTE the names and particulars of the persons who have been convicted of any offence in terms of section 28 and the common law, where the criminal conduct corresponds materially with an offence referred to in section 28 of the Act.

Strafbepalings:

Iemand wat, nadat hy/sy kragtens artikel 7 van die Wet, deur die Kommissaris daartoe aangesê is, versuim om binne die voorgeskrewe tydperk die opgawe voor te lê wat volgens daardie artikel voorgelê moet word of wetens besonderhede wat volgens Wet daarin vertstrek moet word, so ‘n opgawe weglaat, is aan ‘n misdryf skuldig en by skuldigbevinding strafbaar met ‘n boete of met gevangenisstraf vir ‘n tydperk van hoogtens twee jaar. Die Kommissaris het kragtens die bepalings van artikel 28A van die Wet die bevoegdeheid om die name en besonderhede van die persone wat skuldig bevind word aan ‘n misdryf ingevolge artikel 28 van die Wet en die gemenereg, waar die strafbare gedrag wesenlik ooreenstem met die misdryf in artikel 28 van die Wet, in die STAATSKOERANT te publiseer.

8 - 8