If you desire to fill out T-79, you don't have to install any sort of programs - simply try our PDF editor. FormsPal development team is ceaselessly endeavoring to improve the tool and help it become much faster for clients with its cutting-edge features. Bring your experience to a higher level with continually growing and exceptional opportunities we offer! Getting underway is simple! What you need to do is stick to the following basic steps down below:

Step 1: Access the PDF inside our editor by hitting the "Get Form Button" at the top of this page.

Step 2: When you start the tool, you'll see the document all set to be filled out. Other than filling out different fields, you can also do several other things with the PDF, namely writing your own words, editing the initial textual content, adding illustrations or photos, putting your signature on the form, and more.

Filling out this form requires attentiveness. Make certain every blank field is filled in accurately.

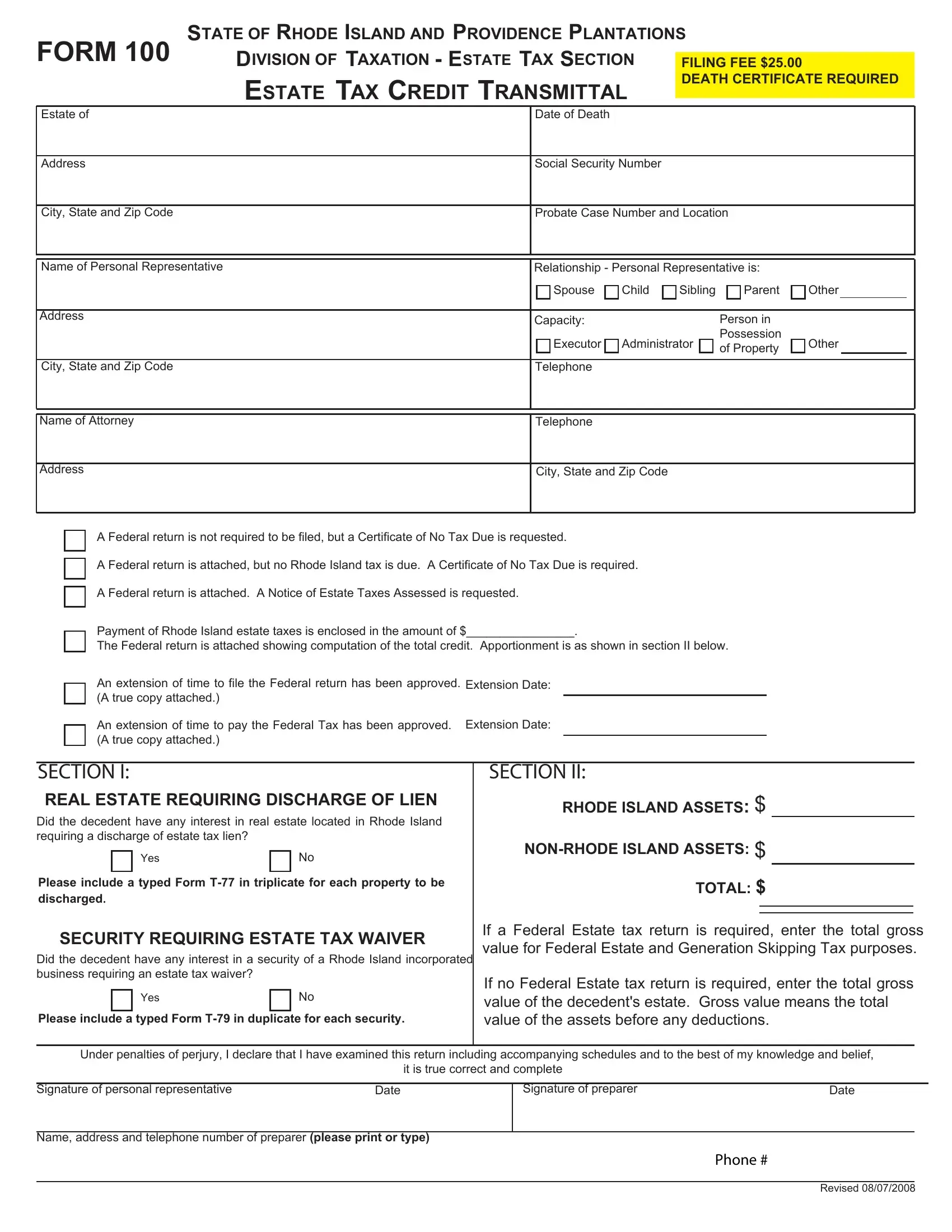

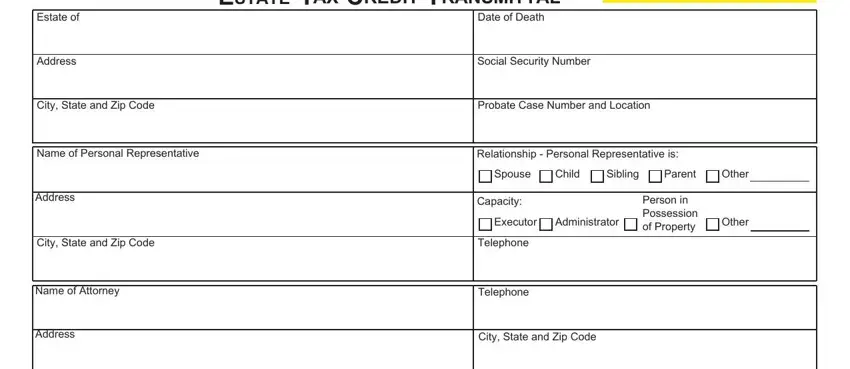

1. Begin completing your T-79 with a selection of essential blanks. Gather all the important information and ensure absolutely nothing is omitted!

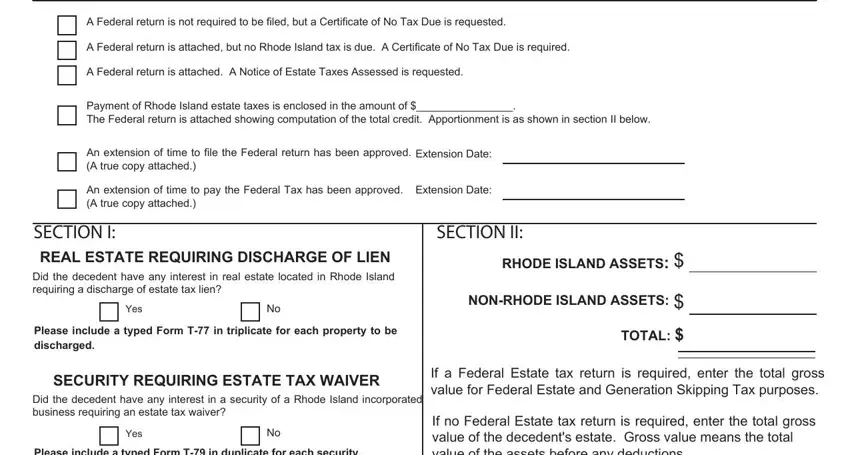

2. After performing the previous part, go on to the subsequent step and complete the necessary details in these fields - A Federal return is not required, A Federal return is attached but, A Federal return is attached A, Payment of Rhode Island estate, An extension of time to file the, Extension Date, An extension of time to pay the, Extension Date, SECTION I REAL ESTATE REQUIRING, Yes, Please include a typed Form T in, SECTION II, RHODE ISLAND ASSETS, NONRHODE ISLAND ASSETS, and TOTAL.

It is easy to make errors while filling in your A Federal return is attached A, therefore be sure you go through it again before you submit it.

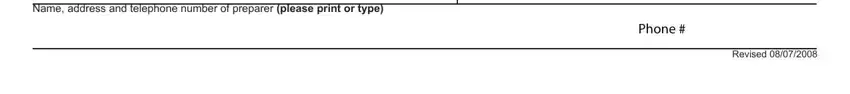

3. This third part will be straightforward - fill in all of the form fields in Name address and telephone number, Phone, and Revised to complete this part.

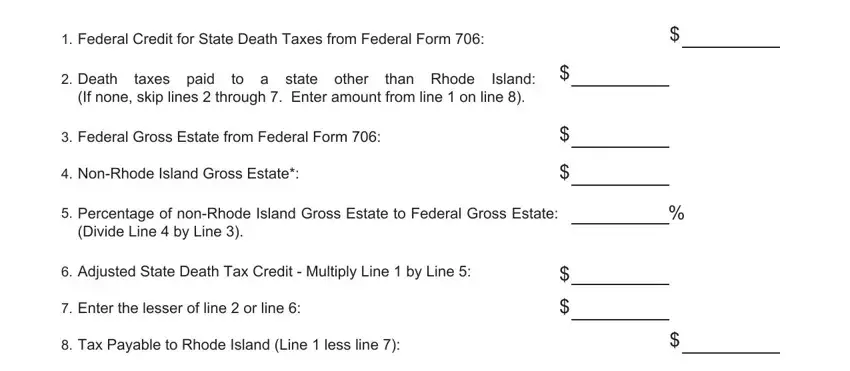

4. This next section requires some additional information. Ensure you complete all the necessary fields - Federal Credit for State Death, Death If none skip lines through, to a state other, taxes paid, than Rhode, Island, Federal Gross Estate from Federal, NonRhode Island Gross Estate, Percentage of nonRhode Island, Adjusted State Death Tax Credit, Enter the lesser of line or line, and Tax Payable to Rhode Island Line - to proceed further in your process!

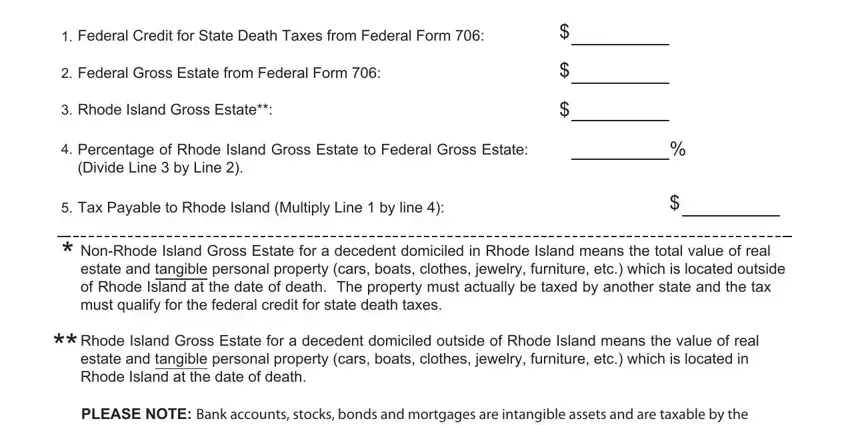

5. To finish your form, the final area involves a number of additional blank fields. Entering Federal Credit for State Death, Federal Gross Estate from Federal, Rhode Island Gross Estate, Percentage of Rhode Island Gross, Tax Payable to Rhode Island, NonRhode Island Gross Estate for a, Rhode Island Gross Estate for a, and PLEASE NOTE Bank accounts stocks is going to finalize the process and you will be done in a blink!

Step 3: Go through the information you've typed into the form fields and then press the "Done" button. Obtain the T-79 when you sign up at FormsPal for a 7-day free trial. Instantly access the pdf file from your FormsPal cabinet, together with any edits and changes conveniently kept! When using FormsPal, you're able to fill out forms without needing to worry about database breaches or data entries being shared. Our secure platform helps to ensure that your personal data is maintained safe.