Ri 1040 Form can be completed online easily. Simply make use of FormsPal PDF editor to finish the job right away. We are focused on giving you the absolute best experience with our tool by constantly introducing new capabilities and enhancements. With all of these improvements, using our editor gets better than ever before! With just a couple of easy steps, you are able to begin your PDF editing:

Step 1: Simply click on the "Get Form Button" at the top of this page to access our pdf file editing tool. This way, you'll find all that is necessary to fill out your document.

Step 2: After you launch the editor, you will see the document all set to be filled out. Besides filling in various fields, you may also do several other things with the Document, namely adding any textual content, modifying the original text, adding images, signing the PDF, and much more.

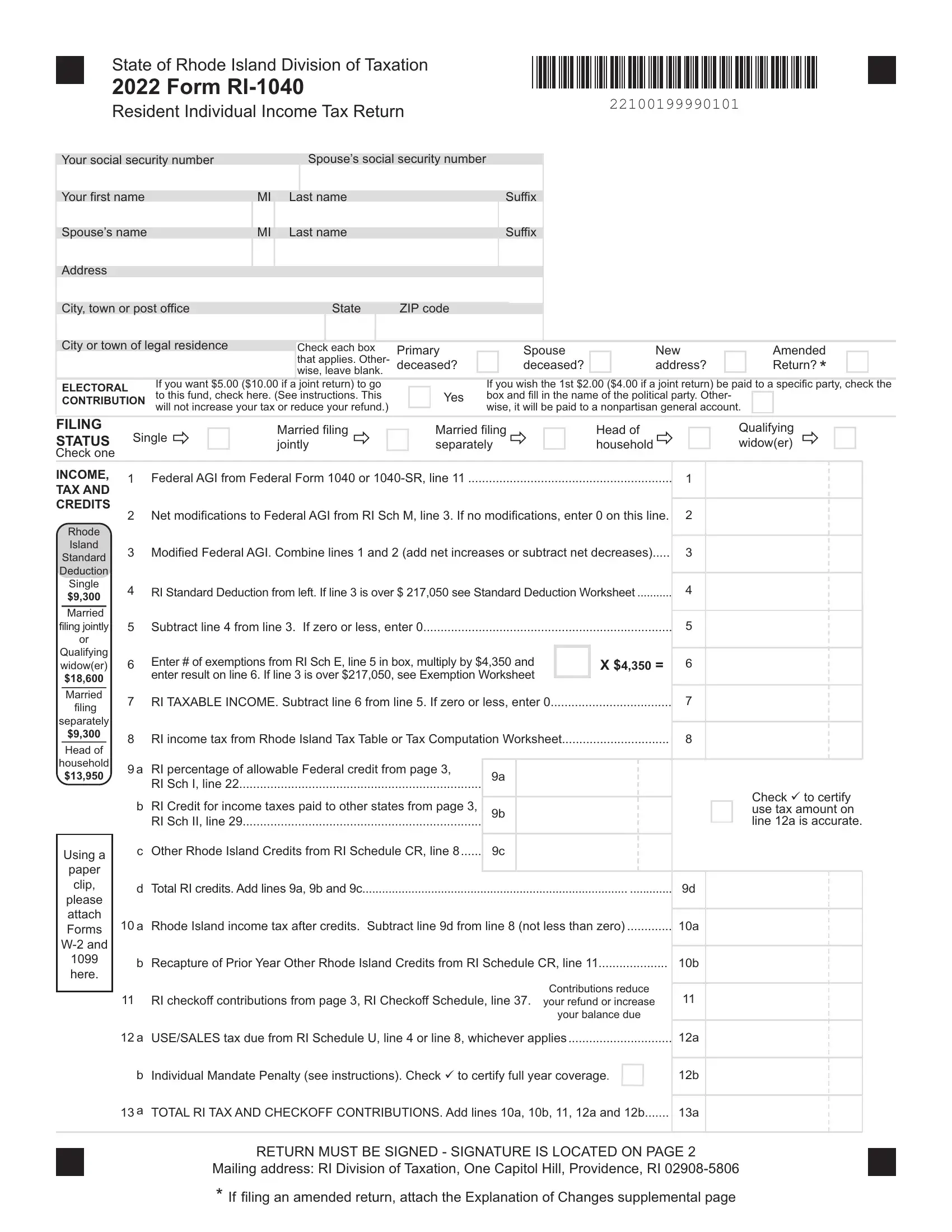

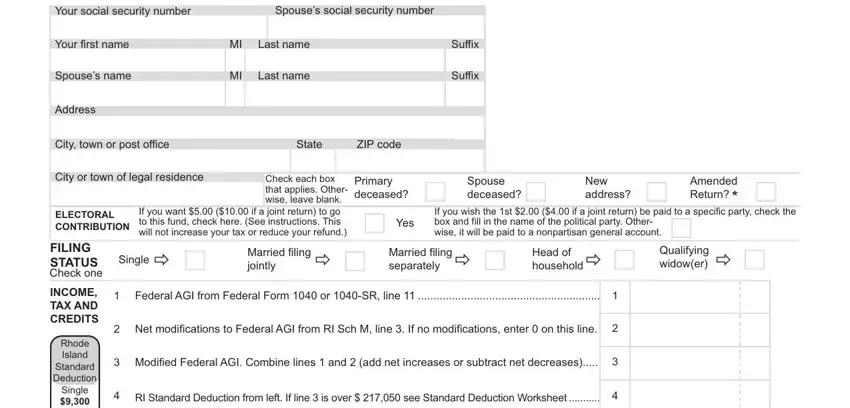

So as to complete this document, be certain to enter the necessary information in each blank field:

1. Whenever filling in the Ri 1040 Form, be certain to complete all of the necessary blank fields within the relevant form section. It will help facilitate the process, allowing for your details to be processed promptly and properly.

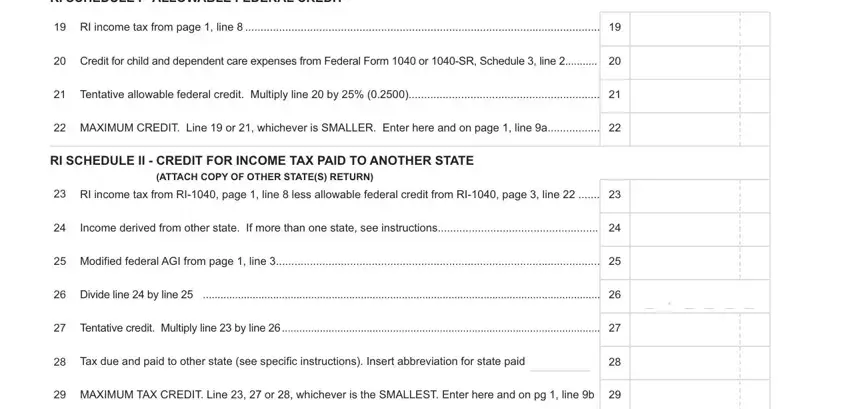

2. The third step would be to complete all of the following fields: .

Be extremely attentive while filling out this field and next field, since this is where most users make a few mistakes.

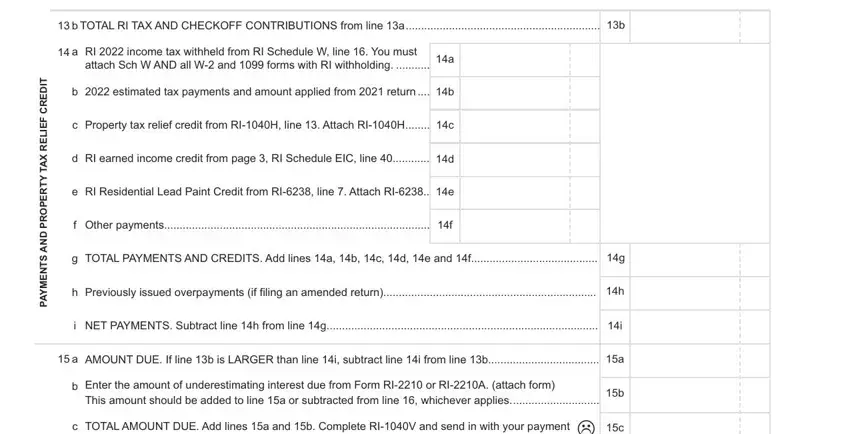

3. This next segment is fairly uncomplicated, - every one of these form fields must be filled out here.

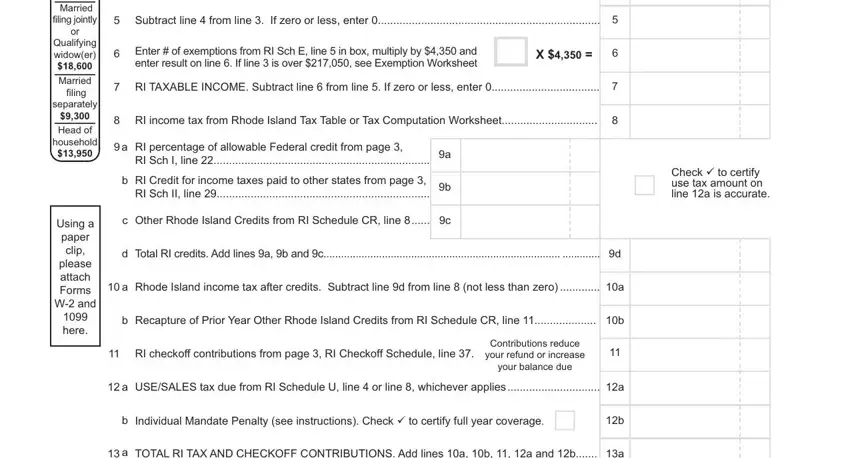

4. The subsequent part will require your attention in the subsequent places: . Just be sure you provide all of the required information to go onward.

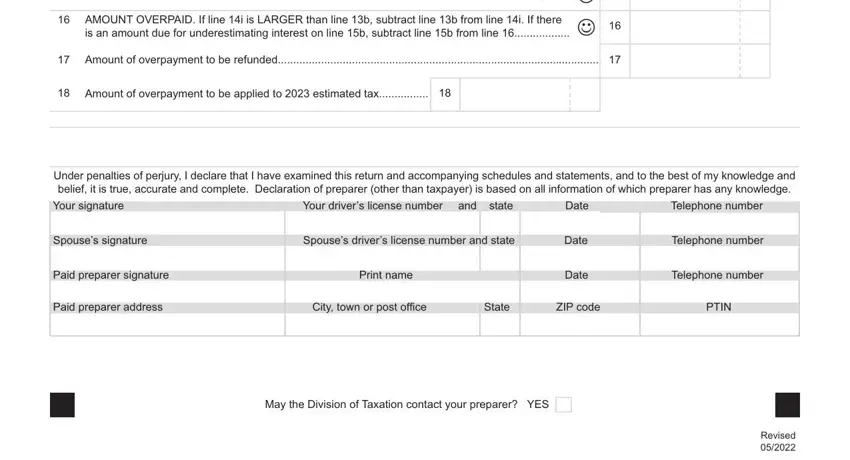

5. While you approach the end of your document, there are actually a couple extra points to do. Particularly, must all be done.

Step 3: Prior to submitting the document, double-check that form fields have been filled out the right way. The moment you determine that it is correct, click on “Done." Create a free trial account at FormsPal and gain instant access to Ri 1040 Form - download, email, or edit inside your personal account. At FormsPal.com, we do our utmost to be sure that all your details are stored protected.