Are you struggling to determine whether or not you should fill out Rita Form 37B? Don't worry, you're definitely not alone! Many businesses have encountered this issue and navigating the paperwork can seem daunting. This blog post will help explain why it's important to fill out this form and provide clear instructions of what needs to be done. Reading through the content ahead will allow for a greater understanding of the essential nature that Form 37B plays in the business world today.

| Question | Answer |

|---|---|

| Form Name | Rita Form 37B |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | rita ohio tax forms 37 for 2013, 2011, regional income tax agency form 37b, municipalities |

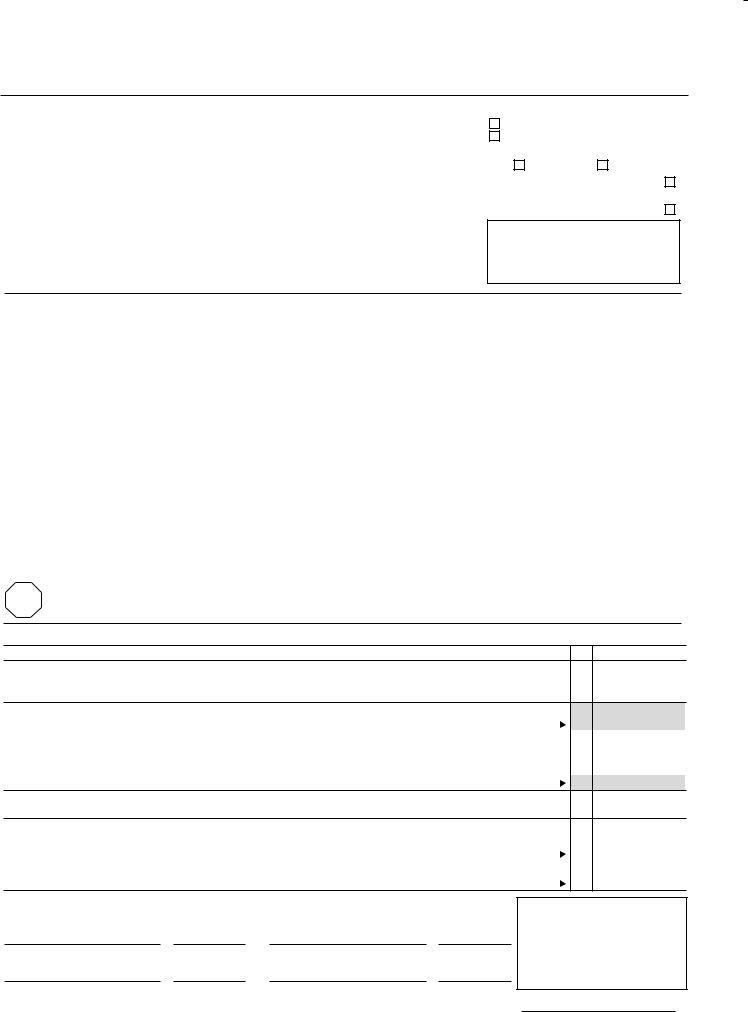

Form |

37B |

Regional Income Tax Agency |

2011 |

|||

RITA Individual Income Tax Return |

||||||

For use by taxpayers who did not move, have only |

||||||

|

||||||

|

||||||

|

|

|

|

|||

Your social security number |

Spouse’s social security number |

|

|

|||

|

|

|

|

|||

Your irst name and middle initial |

Last name |

|

|

|||

|

|

|

|

|||

If a joint return, spouse’s irst name and middle initial |

Last name |

|

|

|||

|

|

|

|

|||

Current home address (number and street) |

|

|

Apt # |

|||

|

|

|

|

|

||

City, state, and ZIP code |

|

|

|

|

||

|

|

|

|

|||

Daytime phone number |

|

Municipality you lived in for the tax year |

||||

|

|

|

|

|

|

|

Contact us toll free:

Cleveland 800.860.7482

Columbus 866.721.7482

Youngstown 866.750.7482

TDD 440.526.5332

Filing Status:

Single or Married Filing Separately 3

Joint 2 |

1 |

If you have overpaid, indicate your choice:

Refund 3 |

Credit 2 |

1 |

If this is an amended return, check here:

If you are exempt from iling, check this box and complete the back of this form:

RITA’s

Easy, Fast, Free & Secure

www.ritaohio.com

Section A

In Column A, put the actual name of the municipality (city or village) in which you and/or your spouse physically worked. If you did not work in a municipality, enter “None” in Column A. DO NOT enter school district tax in Column E.

Local/City copy of |

Column A |

Column B |

Column C |

Column D |

|

Column E |

Column F |

Workplace Municipality |

Wages |

Tax Rate |

Tax Due Before |

|

Local/City Tax |

Allowable Credit for |

|

Withholding |

|

Tax Withheld |

|||||

(Name of city or village where |

(Greater of Box 1, 5 or |

of resident |

|

Withheld |

|||

Multiply Column B times |

|

Lesser of |

|||||

you worked) |

18 from |

municipality |

|

By Employer |

|||

Column C |

|

Column D or Column E |

|||||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals |

|

Enter the total of Column B on Line 1 below, and enter |

|

|||

|

|

the total of Column F on Line 3 below. |

|

|

|||

If you have income other than wages reported on a

any) immediately. Both are available at www.ritaohio.com. Continue to Section B if you want to manually calculate your tax due.

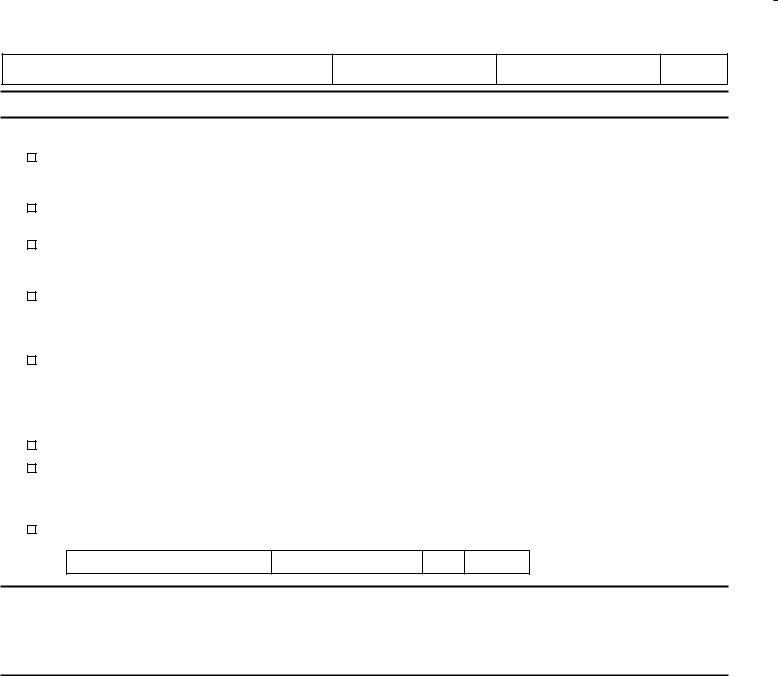

Section B

1 Total |

1 |

2Tax due before withholding. Multiply Line 1 by the tax rate of your resident municipality from the tax

table. Enter the tax rate of your resident municipality here: |

|

2 |

|

|

|

3 Total credit allowable for withholding from Section A, Column F |

3 |

|

4Tax due after withholding (Subtract Line 3 from Line 2). If less than zero, enter

|

instructions about iling a Form |

4 |

5 |

2011 estimated tax payments made to RITA by check, credit/debit card, or |

5 |

6 |

Credit carried forward from 2010 |

6 |

7 |

Total estimated tax payments and credit carryovers (add lines 5 & 6) |

7 |

8 |

Balance due. If Line 7 is less than Line 4, subtract Line 7 from Line 4 |

8 |

9Amount to be Credited. If Line 7 is greater than Line 4 and you want a credit, subtract Line 4 from

Line 7. You may not split an overpayment between a credit and a refund. |

9 |

10Amount to be Refunded. If Line 7 is greater than Line 4 and you want a refund, subtract Line 4 from

|

Line 7. You may not split an overpayment between a credit and a refund. Allow 90 days |

10 |

11 |

Enter 2012 estimated tax in full. If left blank, RITA will calculate for you. |

11 |

12 |

Enter full estimate from Line 11 or irst quarter estimate (1/4 of line 11) less credit, if any, from Line 9 |

12 |

13 |

TOTAL DUE by April 17, 2012. Add Lines 8 and 12. Make check payable to R.I.T.A. |

13 |

Under penalties of perjury, I declare that I have examined this return, and to the best of my knowledge and belief, it is true, correct, and accurately lists all amounts and sources of municipal taxable income I received during the tax year.

Your Signature |

Date |

Preparer’s Signature |

Date |

Spouse’s Signature if a joint return |

Date |

Preparer’s Address |

Id Number |

Mail with payment and W2s to: Regional Income Tax Agency PO Box 94652 Cleveland, OH

Mail with W2s & without payment to: Regional Income Tax Agency

PO Box 94653

Cleveland, OH

May RITA discuss this return with the preparer shown above?

Yes

No Preparer Phone #:

Form 37B (2011) |

Page 2 |

Name of taxpayer(s) shown on page 1

Your social security number

Spouse’s SSN if iling joint exemption Year

Declaration of Exemption

I am not reporting municipal (city or village) taxable income because:

1. I had no municipal taxable income for the year indicated above. Attach a copy of page 1 of your federal Form 1040, 1040A or 1040EZ. If you did not ile a federal return because you did not meet the federal minimum gross income requirements, check here: .

2. I was a member of the armed forces of the United States and had no income for the year indicated above other than military pay, military allowances, interest income, and/or dividend income.

3. |

I was under 18 years of age for the entire year (or the appropriate age for my resident |

||||||

|

municipality as indicated below in the Special Notes). Attach a copy of your birth |

||||||

|

certiicate or driver’s license. |

|

|

|

|

|

|

4. |

I am a retired individual and received only pension, social security, interest and/or |

||||||

|

dividend income for the year indicated above. Attach a copy of page 1 of your federal |

||||||

|

Form 1040, 1040A or 1040EZ. If you did not ile a federal return, attach a copy of your |

||||||

|

|

|

|

|

|||

5. |

Prior to the irst day of the year indicated above, I moved out of a RITA municipality, and I had no |

||||||

|

rental or |

||||||

|

|

Current Home Address (number and street) |

City |

|

State |

Zip |

|

|

|

|

|

|

|

|

|

|

|

Prior Home Address (number and street) |

City |

|

State |

Zip |

|

6. |

|

|

|

|

|

|

|

The taxpayer indicated above is deceased. Indicate the date of death to the right. |

|||||||

7. |

I am not exempt from tax. However, I iled and reported my taxable income to RITA on |

||||||

|

a joint return iled with my spouse. |

|

|

|

|

|

|

|

|

Spouse’s name |

|

Spouse’s social security number |

|

||

|

|

|

|

|

|

|

|

Date of Birth |

Mo |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

Retirement Date |

Mo |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

Date of Move |

Mo |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

Date of Death |

Mo |

Day |

Year |

|

|

|

|

|

|

|

|

8.I meet the requirements of the Military Spouse Residency Relief Act for the year indicated above. Attach copies of Form DD 2058, your valid military spouse ID card, and your spouse’s most recent LES.

Address of legal domicile (number and street) |

City |

State Zip

Taxpayer’s Signature

Under penalties of perjury, I declare that I have examined this declaration of exemption, and to the best of my knowledge and belief, it is true, correct and complete.

Your signature |

|

Date |

|

Spouse’s signature if joint exemption |

|

Date |

Special Notes

The under 18 years of age exemption does not apply to residents of the following municipalities:

• |

Addyston |

• |

Ripley |

• |

Belpre |

• |

Riverside |

• |

Campbell |

• |

Rossford |

• |

Fremont |

• |

Saint Paris |

• |

Girard |

• |

Tontogany |

• |

Harrison |

• |

Williamsburg |

• |

Lockland |

• |

Wintersville |

• |

Middleport |

• |

Youngstown |

•Oxford

•Powhatan Point

The following municipalities use an under 16 years of age exemption instead of an under 18 years of age exemption:

• |

Avon Lake |

• |

Jackson Center |

• |

Cedarville |

• |

Jewett |

• |

Fairborn |

• |

Yellow Springs |

For the under 18 years of age exemption to apply, the resident must be a

• Cardington

The following municipalities have additional special rules:

Bellevue

•State unemployment compensation is taxable Garield Hts.

•Residents of Garield Hts. who are 62 years of age and older are entitled to a wage exemption. Grove City

•Developmentally disabled employees earning less than the minimum hourly wage while employed at

Lockland

•Any Lockland taxpayer who is 65 yrs. of age or older on December 21 of the taxable year and has gross taxable income of $1200.00 or less is exempt. An exemption certiicate must be iled.

Loveland

•Loveland does not give credit for Kentucky county taxes withheld. Mogadore

•Taxpayer’s who are full time, post secondary education program students for at least 5 calendar months of the year may be eligible for a tax credit not to exceed $75.00.

Oakwood Village

•Personal earnings of any person who is a

Ottawa

•Students 18 years of age or under and earning less than $600.00/yr are exempt from paying municipal income tax.

Reynoldsburg & Worthington

•Income of the mentally retarded or developmentally disabled while working in a government funded workshop for less than minimum wage is exempt.

Sherwood

•The irst $10,000.00 of any salaries, wages, commissions and other compensation earned by any natural person

Yellow Springs

•Individuals under 18 years of age who are newspaper carriers are exempt from paying municipal income tax.